Debt Monthly View for November 2024

Posted On Wednesday, Dec 04, 2024

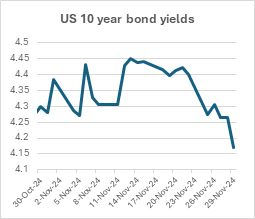

In November the debt market was largely influenced by the US elections, which introduced considerable macroeconomic uncertainties. President elect Donald Trump’s inclinations towards higher trade tariffs and lower taxes have pushed inflation expectation higher and raised fiscal risk in the US. This sparked what became known as the "Trump trade", marking a sharp rise in long term US treasury yields and stronger Dollar.

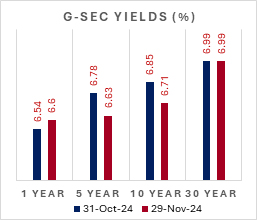

During the month, the 10 US treasury yield surged from approximately 3.6% in mid-September to a high of 4.45%, before easing by 20 basis points as concerns related to the election began to fade. The Indian 10-year benchmark government bond yield also moved up to 6.87% during the month. However, the trump trade fizzled out somewhat towards the end of the months pulling down bond yields from their monthly peak. At monthly closing both the US treasury and the Indian bond yields ended lower compared to the previous month.

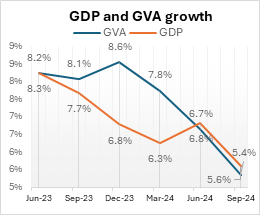

Decline in Indian bond yields at the month end was also influenced by the Q2 GDP number which came at 5.4%, significantly lower than broader market expectation of 6.7%. The weak GDP performance has heightened speculation of a policy rate cut and liquidity easing from the RBI, potentially shifting focus from inflation control to growth support in the coming quarters.

Corporate bond yields saw a slight uptick, but the spread between G-sec and corporate bonds of corresponding maturities widened significantly by the month-end, on account of easing G-sec yields.

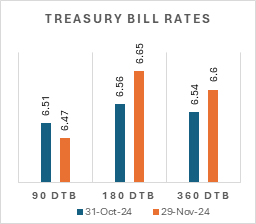

In the money market, T-bill rates for the 6-month and longer segments edged up, closing the month at 6.65%, while rates for the 3-month segment declined to 6.47% due to the prevailing liquidity conditions and lower T-bill supply. Meanwhile, the 3-month AAA PSU CP/CD rates remained in the range of 7.17%-7.20%.

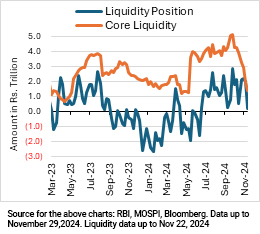

Although banking system liquidity stayed in surplus through most of November (averaging Rs1.38 lakh crore), much of that was due to pick up in government spending. While the core liquidity declined significantly from surplus of ~Rs5 lakh crore in October,2024 to Rs1.39 lakh crore by November 22, 2024. The decline in core liquidity surplus was primarily due to the RBI’s sales of foreign exchange and seasonal pick up in cash withdrawals.

Liquidity condition is expected to tighten further in coming months as cash withdrawals tend to pick up during the January to March quarter. FPI selling could further tighten the liquidity condition.

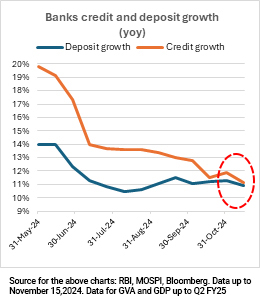

With moderation in credit growth, the gap between bank credit and deposits is narrowing. This trend suggests that the pressure for CD issuances by banks could ease in the coming months, potentially narrowing spreads between CPs/CDs and T-bills, provided liquidity remains favorable.

Outlook

The RBI's shift to a "neutral" stance in the last monetary policy can be seen as a step towards eventual rate cuts. With GDP growth showing signs of sluggishness, bets on potential rate cuts have increased further. The RBI might wait for the recent spike in food prices to cool-off, before start cutting rates. We would expect rate cuts to start from February 2025. Nevertheless, the RBI may announce some liquidity easing measures including a potential CRR cut in the December monetary policy.

Globally, focus will be on the US payrolls report, with a weak print potentially boosting December rate cut expectations. Leadership changes in the US and CPI data from the US and India will also shape market sentiment.

Globally, focus will be on the US payrolls report, with a weak print potentially boosting December rate cut expectations. Leadership changes in the US and CPI data from the US and India will also shape market sentiment.

We maintain our medium-term positive outlook (refer Bull Case Revisited) on long-term bonds considering -

- Continued strengthening in demand from insurances companies, pension and provident funds

- India’s inclusion in the global bond indices to continue to add to the demand

- Potential Increase in demand from banks owing to RBI’s proposed LCR norms (Liquidity Coverage Ratio)

- Government’s focus on fiscal consolidation and debt reduction

- Declining domestic inflation and anticipated rate cuts by the RBI

- Global Synchronized Rate Cutting Cycle

- Strong External Balances

Intensifying geopolitical tensions, however, could be a risk. This could lead to a surge in crude oil prices and prolonged disruptions in global supply chains.

Given the above factors, we expect the bond yields to go down (prices to go up). In this declining interest rate environment, investors with medium to long investment horizon, should consider dynamic bond funds. These funds can allocate to long-duration bonds while keeping flexibility to adjust portfolio position if market conditions change. This adaptability allows investors to remain invested for a longer period.

Investors with a short-term investment horizon and with little desire to take risks can invest in liquid funds which invest in government securities and do not invest in private sector companies which carry lower liquidity and higher risk of capital loss in case of default.

Source: RBI, MOSPI, Bloomberg

|

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Debt Monthly View for February 2025

Posted On Friday, Mar 07, 2025

February 2025 kicked off with two key events in Indian bond markets: the Union Budget and RBI's Monetary Policy.

Read More -

Debt Monthly View for January 2025

Posted On Friday, Feb 07, 2025

Bond markets witnessed increased volatility during the last month with the 10-year Government

Read More -

Debt Monthly View for December 2024

Posted On Tuesday, Jan 07, 2025

The year 2024 has proven to be a strong one for fixed-income investors, marked by India's inclusion in the JP Morgan GBI EM Index.

Read More