Debt Monthly View for October 2024

Posted On Wednesday, Nov 06, 2024

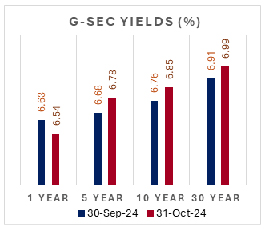

Indian bond yields moved up in October following sharp rise in the US treasury yields and spike in domestic CPI Inflation. The 10 year government bond (IGB) yield rose 9 basis points from 6.76% to 6.85%. However, because of the easy liquidity situation and reduced supply of Treasury bills, the 1-year IGB yield fell from 6.63% to 6.54%.

In the October Monetary policy Review, the RBI shifted its policy stance from "withdrawal of accommodation" to "neutral", citing a notable improvement in the growth-inflation balance. At first, this improved market sentiment. However, the atmosphere was soured by Governor Das's remarks that a "rate cut at this stage will be premature."

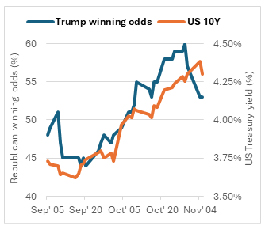

The 10 year US treasury yield increased from 3.74% to 4.28%, driven by strong jobs data and positive economic signals, reducing the likelihood of aggressive Federal Reserve rate cuts. Uncertainty around the US elections also contributed to the rise in UST yields. The bond market seemed particularly concerned about the US fiscal policy as both the presidential candidates are favoring increasing spending.

On a positive side, FTSE Russell announced to include Indian government bonds under FAR (fully accessible route) into its FTSE Emerging Markets Government Bond Index (EMGBI), marking the third major index inclusion. Indian bonds will be added to the FTSE indices over a six month-period, commencing with September 2025. At full inclusion, India will have 9.35% weight in the EMGBI index. Global index inclusion will enhance the visibility of India's bond market and will attract more international investment – opening a new demand source for Indian bonds.

Banking system liquidity eased during the month due to pick up in government spending. The average daily surplus increased to around Rs. 1.5 trillion in October against an average of Rs. 1 trillion in September. While the Core liquidity (Banking liquidity + Government cash balance) declined from near Rs. 5 trillion at September end to below 4 trillion by the October end due to increased cash withdrawals and forex sales by the RBI in October.

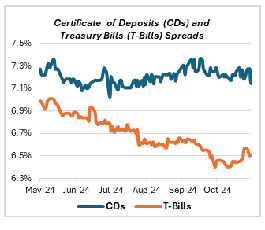

As the core liquidity surplus decreased, money market rates inched up. The 3-month treasury bill (T-bill) rates rose to 6.51% at October end from 6.40% a month ago. Yields on Certificate of Deposit (CD) and Commercial papers remained relatively flat between 7.1%-7.2% for AAA rated PSUs. Given the Tbill supply has gone down while CD issuances have picked up, there is still a wide gap between the CP/CD rates and Tbills

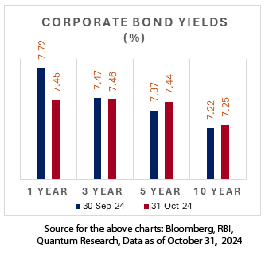

Corporate bond yields rose for longer maturities and fell for shorter maturities. The gap between the 10-year and one-year AAA bonds shrank in October, but the yield curve is still inverted.

Positive long-term inflation outlook amid near term volatility: The headline CPI inflation rose to 5.49% YoY in September, mainly driven by a 36% YoY spike in the vegetable index. While the CPI inflation excluding vegetables, which represents 94% of the CPI basket, remained benign at 3.36% YoY.

The recent surge in vegetable inflation is mostly the result of excessive rainfall in several vegetable-producing regions, which briefly caused a shortage of some important vegetables. We expect vegetable inflation to decline once the new crops arrive by late December, lowering the headline CPI overall.

Strong kharif sowing and favorable conditions for Rabi season (good soil moisture and full reservoirs) should bode well for food production and inflation next year.

We would expect the headline CPI inflation to average below 4% mark in FY26. Any fuel price cuts by the government could further soften the headline inflation in FY26. We see a possibility of 50-100 basis points reduction in the Repo rate during CY 2025.

In near term, markets will closely watch the US Presidential elections, US labor and CPI data, and domestic October CPI data.

OUTLOOK: We maintain our medium-term positive outlook (refer Bull Case Revisited) on long-term bonds considering -

- Continued strengthening in demand from insurances companies, pension and provident funds

- India’s inclusion in the global bond indices to continue to add to the demand

- Potential Increase in demand from banks owing to RBI’s proposed LCR norms (Liquidity Coverage Ratio)

- Government’s fiscal consolidation

- Declining domestic inflation and anticipated rate cuts by the RBI

- Global Synchronized Rate Cutting Cycle

- Strong External Balances

Intensifying geopolitical tensions however could be a risk. This could lead to a surge in crude oil prices and prolonged disruptions in global supply chains.

Given the above factors, we expect the bond yields to go down (prices to go up). In this declining interest rate environment, investors with medium to long investment horizon, should consider dynamic bond funds. These funds can allocate to long-duration bonds while keeping flexibility to adjust portfolio position if market conditions change. This adaptability allows investors to remain invested for a longer period.

Investors with a short-term investment horizon and with little desire to take risks, can invest in liquid funds which invest in government securities and do not invest in private sector companies which carry lower liquidity and higher risk of capital loss in case of default.

Source: RBI, MOSPI, Bloomberg

|

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Debt Monthly View for December 2024

Posted On Tuesday, Jan 07, 2025

The year 2024 has proven to be a strong one for fixed-income investors, marked by India's inclusion in the JP Morgan GBI EM Index.

Read More -

Debt Monthly View for November 2024

Posted On Wednesday, Dec 04, 2024

In November the debt market was largely influenced by the US elections, which introduced considerable macroeconomic uncertainties.

Read More -

Debt Monthly View for October 2024

Posted On Wednesday, Nov 06, 2024

Indian bond yields moved up in October following sharp rise in the US treasury yields and spike in domestic CPI Inflation.

Read More