Mutual Fund Riskometer- Types and Risk Levels

Posted On Sunday, Feb 16, 2025

Investing in mutual funds has become one of the most preferred ways for Indians to build wealth, with over ₹66.93 trillion in Assets Under Management (AUM) as of December, 2024, according to AMFI (Association of Mutual Funds in India), which is more than a 6-fold increase in the last decade. However, with better potential for returns comes an equally important factor-risk.

Despite the growing popularity of mutual funds, many retail investors believe they don’t fully understand the risks associated with their investments. This lack of clarity sometimes keeps potential investors on the sidelines. Funds with high returns often come with equally high / very high risk, and balancing these elements requires informed decision-making.

This is where the Mutual Fund Riskometer becomes an essential tool. By visually representing the risk levels of different mutual fund schemes, the Riskometer simplifies complex financial data into an easy-to-understand format. Whether you're a seasoned investor or someone just looking to begin, the Riskometer helps you to understand scheme risk category.

What is a Mutual Fund Riskometer?

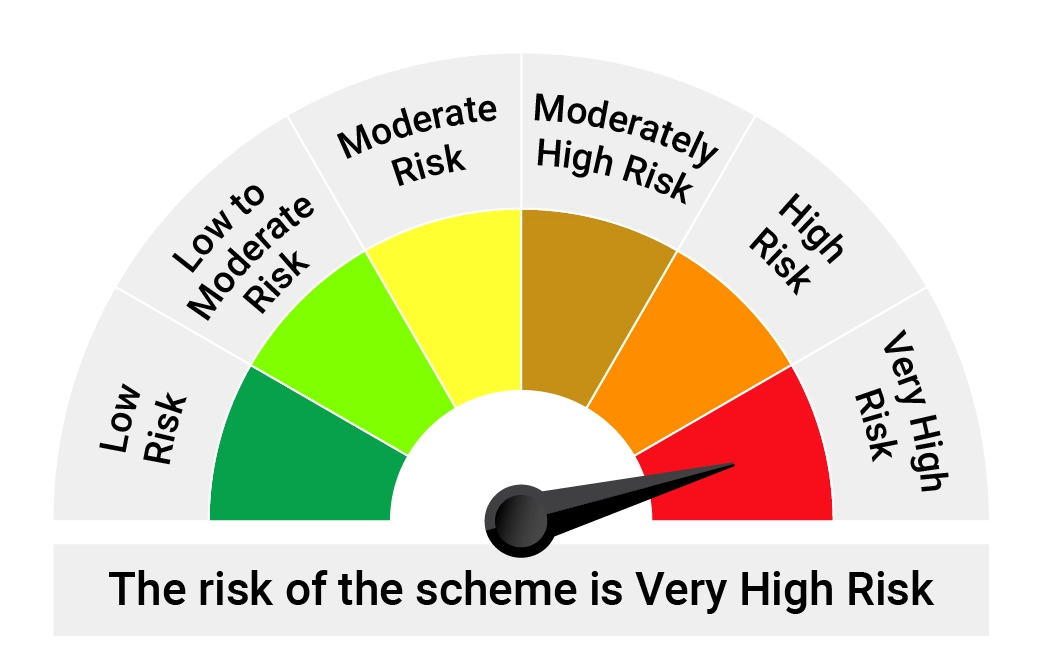

To enable investors to make an informed decision regarding their investments, a pictorial representation of the risk to the principal invested in a mutual fund product is depicted using a ‘Riskometer’. The pictometer will categorize the risk in the scheme at one of six levels of risk, as shown in the picture below.

Think of it as a speedometer on your car dashboard but for risk levels. It ranges from Low to Very High and helps investors understand how much risk they are taking by investing in a specific mutual fund.

Risk-o-meter shall have the following six levels of risk for mutual fund schemes -

- Low risk

- Low to Moderate risk

- Moderate risk

- Moderately High risk

- High risk

- Very High risk

The mutual fund has to calculate the risk value of each scheme based on the parameters as prescribed in the SEBI Regulations. This must be depicted on the risk-o-meter. If there is any change in the risk level, then this has to be conveyed through a Notice cum addendum and email or SMS to the unitholders. The risk-o-meter has to be evaluated on a monthly basis.

This simple tool ensures transparency and helps investors match their risk appetite with suitable mutual fund options.

Understanding the Six Risk Levels in the Riskometer

The Mutual Fund Riskometer categorizes funds into six distinct risk levels, providing investors with a clear understanding of the scheme risk. Each category serves as a means to understand and evaluate whether a fund aligns with an investor's financial goals and risk appetite.

1. Low Risk

Funds in this category are considered the least risky due to their underlying securities, making them suitable for individuals seeking a degree of capital protection.

2. Low to Moderate Risk

Designed for investors open to taking limited risks for moderate returns over a medium to long time horizon.

3. Moderate Risk

Suitable for investors aiming to diversify their portfolio while taking on some risk.

4. Moderately High Risk

These funds involve a higher level of risk and are suited for investors with a moderately aggressive risk profile, willing to accept greater volatility for the prospect of achieving returns.

5. High Risk

These funds are best suited for those willing to undertake high risks in pursuit of returns.

6. Very High Risk

These are the very high-risk funds. While they have the potential for high risk adjusted returns, they are suited only for investors who can tolerate market fluctuations.

Riskometer: Your Investment Compass

Whether you’re a conservative investor or an aggressive risk-taker, the Riskometer explains you the risks before investing. Before investing in any mutual fund scheme, always check its Riskometer category. Understanding where your fund stands on the risk scale will help you make informed decisions. Invest wisely, stay informed, and let the Riskometer guide you toward your financial goals!

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this Article / Video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The Article / Video has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of the Article / Video should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. None of the Quantum Advisors, Quantum AMC, Quantum Trustee or Quantum Mutual Fund, their Affiliates or Representative shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary losses or damages including lost profits arising in any way on account of any action taken basis the data / information / views provided in the Article / video. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Understanding AMC: The Asset Management Company to Mutual Funds

Posted On Friday, Sep 06, 2024

In the world of mutual funds, the term "AMC" might appear frequently. AMC stands for Asset Management Company, and it manages the operation and management of mutual funds.

Read More -

IDCW Option in Mutual Funds: A Simple Guide for Investors

Posted On Thursday, Aug 29, 2024

The Indian mutual fund industry has grown incredibly fast over the past 10 years.

Read More -

How to Calculate Returns From an ELSS And Its Tax Implications

Posted On Friday, Feb 10, 2023

As you may know, there are multiple tax-saving options in India to save taxes under Section 80C of the Income Tax Act

Read More