Resilience in Rough Markets - Invest the Quantum Way

Posted On Friday, Jan 24, 2025

It’s been a jolly good ride for Indian equity investors since 2020 with 5-year annualized return of frontline indices Nifty 50 and Nifty 500 at 15.5% and 19% respectively as per NSE data as on December 2024. This multi-year equity rally has ensured that risk sentiment remains high and has required very little risk mitigation on the part of the investor.

But the recent downfall since their September 2024 highs, have seen these indices fall into correction territory - a more than 10% fall, making investors uneasy.

Looking ahead, we’ve arrived into 2025 showing slowing economic growth, declining earnings-growth expectations and still-elevated valuations on the domestic front. Recent political transitions, geopolitical upheavals and an increasing preference for US assets may influence domestic inflation, the Indian Rupee and foreign flows to India.

Thus, while India’s long term growth story remains intact, investors would do well to remain cautiously optimistic and prioritize downside protection for the foreseeable future. The reason is twofold.

First, is simple math. A 20% market correction would result in a Rs 100 portfolio becoming Rs 80. But for that Rs 80 to get back to Rs 100, one would require a larger gain of 25%. Instead, if the fall in portfolio value can be limited to 10% using adequate risk mitigation measures even as the market falls 20%, the portfolio would require only 11% return to recover from the loss, utilizing the rest of the market upside to grow. This means, in the process of wealth creation, limiting fall in portfolio value is as essential as chasing returns.

The second reason has got to do with human emotions. It’s easy to hop on the equity market train when the going is good - investors fall prey to recency bias and herd behaviour when the markets are on a roll, doubling down on their investments in expectation of similar or higher future returns potential. But the real mettle of the investor is tested when markets begin to wobble – seeing their portfolios in red, panic and fear make investors exit, hurting the compounding process of their long-term investments. Even if they don’t exit, the volatility can be an unnerving experience.

As such, investors owning investments with robust risk management practices and downside protection will not only be more comfortable in the short run but also be better off in the long run. Downside protection refers to the portfolio strategies that are employed to minimize or mitigate a fall in the value of investments. Downside protection ensures that instead of growing aggressively only to later recover from losses, your portfolio steadily compounds wealth.

At Quantum, we have always prioritized downside protection and risk adjusted returns by using the following risk management strategies:

1. Integrity screen

The integrity screen is at the core of portfolio construction across all of Quantum’s equity schemes. This proprietary framework helps filter out companies with bad governance practices as a risk management strategy. We believe that businesses that are high on ethical and integrity parameters face fewer risks related to stakeholders or regulations and thus turn out to be steady and sustainable sources of financial gains.

2. Liquidity filter

Reduced liquidity in the secondary market may have an adverse impact on market price and the Scheme’s ability to dispose of particular securities during a market downturn. To address this risk, we invest only in companies with average trading volumes of over US $1 million/day (Quantum Long Term Value Fund & Quantum ELSS Tax)

3. Value investing

Our flagship fund the Quantum Long Term Equity Value Fund (QLTEVF) is a value-oriented strategy where investments are made in companies whose shares are undervalued when compared to long term valuation expectations. Investments are sold when the Investment Manager believes the market price of the shares has exceeded its assessment of the long-term value of that company. This provides a margin of safety when prices revert to fundamentals - allowing for some losses to be incurred without major negative effects.

Currently, the QLTEVF Portfolio is 11% less expensive than the BSE Sensex Index providing a cushion in case of a potential market downturn.

QLTEVF | As % Of BSE Sensex Index | BSE Sensex Index** | |

| Weighted PER: March 2025E | 15.4 | 90% | 17.0 |

| Weighted EPS Growth: March 2025E | 15.2% | 102% | 15.0% |

| PEG Ratio (excludes cash) 2026E | 1.01 | 89% | 1.14 |

| T12M PE | 22.2 | 94% | 23.7 |

“The above table depicts value characterise of QLETVF Portfolio and not the indicative returns.”

Source: Internal Research; As of December 31st, 2024, | cash weight excluded | **BSE Sensex Index weight is based on free-float. % BSE Sensex Index column depicts the Fund fundamentals as a percentage of BSE Sensex Index fundamentals. The figures mentioned in WTD PER, WTD EPS and PEG ratio are calculated on the basis of Bloomberg consensus estimates for companies owned by the Fund as well as the companies in the BSE Sensex Index as of the reporting date i.e. December 31st, 2024. Past Performance may or may not be sustained in the Future. This table is to be read with complete performance provided in the article below.

4. Cash holding

To shield the portfolio from sharp losses during elevated markets, Quantum generally holds higher cash levels which can then be deployed when a good opportunity arises. (mainly in QLTEVF & QETSF).

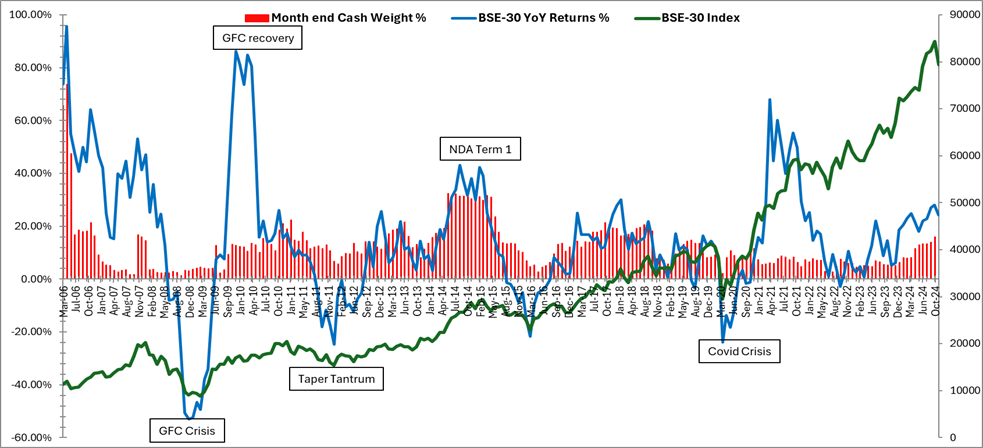

Typically, the cash levels of the QLTEVF have built up during the bull phases of the market such as pre GFC crisis, post Modi victory in 2014 or more recently in the current rally and cash gets deployed post corrections when valuations are attractive such as during GFC crisis, taper tantrums in 2012-13 and Covid crisis.

Given the current dynamics in equity markets, the QLTEVF cash levels are at 15.64%.

Data Compilation: Quantum; Data as on December 2024.

5. Diversification

The investments are made in stocks across a number of sectors to ensure adequate diversification. Generally, there is stock wise limit such that maximum weight to a stock is capped at 6% on cost basis and 10% at market value basis. (QLTEVF & QETSF).

Quantum’s approach, centered around integrity, liquidity filters, value investing, cash holding, and diversification, prioritizes risk-adjusted returns, providing a strong foundation for navigating the challenges and future market fluctuations. Quantum has demonstrated the ability to deliver consistent risk adjusted returns over market cycles. As such, investors would do well to remain prudently optimistic, with a clear focus on safeguarding their portfolios while positioning for long-term success. In the current market environment, Quantum can help you strike a balance between growth and safety by using sensible downside protection and not chasing aggressive return maximization.

|

Mr. George Thomas is the Fund Manager effective from April 01, 2022. & Mr. Christy Mathai is the Fund Manager effective from November 23, 2022.

| Performance of the Scheme | Direct Plan | |||||||

| Quantum Long Term Equity Value Fund - Direct Plan - Growth Option | Current Value ₹10,000 Invested at the beginning of a given period | |||||||

| Period | Scheme Returns (%) | Tier I - Benchmark# Returns (%) | Tier II - Benchmark## Returns (%) | Additional Benchmark Returns (%)### | Scheme Returns (₹) | Tier I - Benchmark# Returns (₹) | Tier II - Benchmark## Returns (₹) | Additional Benchmark Returns (₹)### |

| Since Inception (13th Mar 2006) | 14.51% | 13.23% | 13.20% | 12.60% | 1,28,050 | 1,03,639 | 1,03,048 | 93,217 |

| 10 years | 12.88% | 14.03% | 13.75% | 12.40% | 33,627 | 37,219 | 36,293 | 32,224 |

| 7 years | 13.14% | 14.35% | 14.33% | 13.93% | 23,766 | 25,608 | 25,566 | 24,956 |

| 5 years | 18.95% | 19.04% | 18.08% | 14.99% | 23,837 | 23,931 | 22,975 | 20,123 |

| 3 years | 18.79% | 15.35% | 14.69% | 11.69% | 16,771 | 15,354 | 15,090 | 13,939 |

| 1 year | 22.51% | 15.67% | 14.59% | 9.41% | 12,271 | 11,581 | 11,472 | 10,949 |

#BSE 500 TRI, ##BSE 200 TRI, ###BSE Sensex TRI. Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). #with effect from December 01, 2021 Tier I benchmark has been updated as BSE 500 TRI. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite. CAGR BSE 500 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006. ##TRI data is not available since inception of the scheme, Tier II benchmark performance is calculated using composite CAGR BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value. since August 1, 2006. Regular Plan was launched on 1st April 2017. Click here for other schemes managed by Fund Manager.

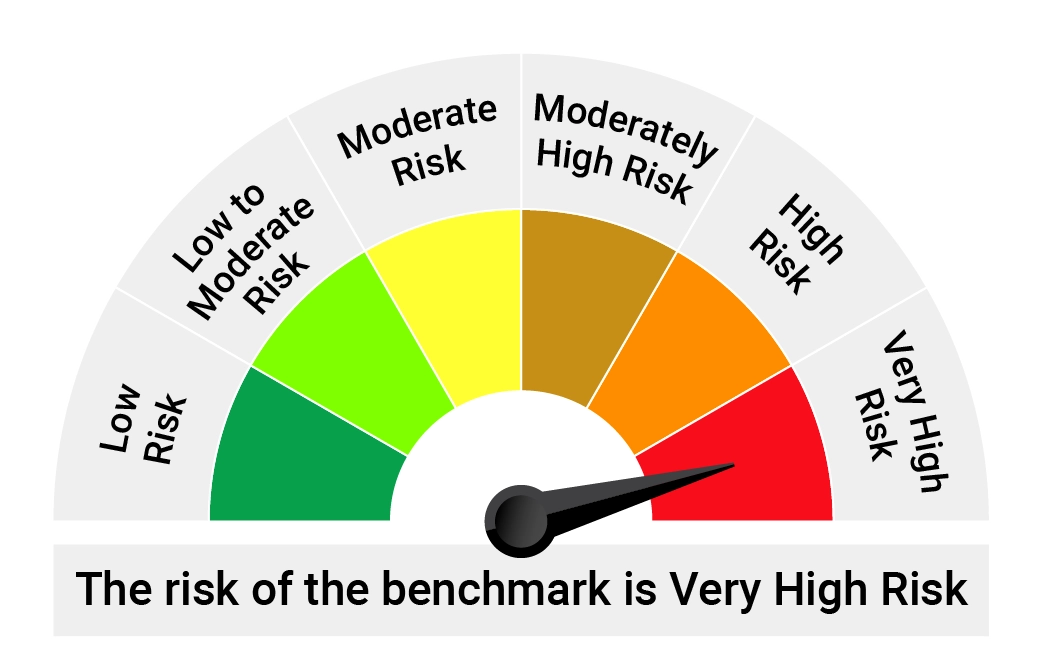

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Risk-o-meter of Tier I & II Benchmark |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. Tier I Benchmark : BSE 500 TRI | Tier II Benchmark : BSE 200 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in BSE 200 index. |  |  |

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

Quantum ELSS Tax Saver Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit. Tier I Benchmark : BSE 500 TRI | Tier II Benchmark : BSE 200 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More -

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More