Debt monthly view for January 2023

Posted On Thursday, Feb 09, 2023

Indian fixed income market has had a dull start in 2023 so far. Bond yields had been in a narrow range with the 10-year G-sec trading between 7.25%-7.35% for the most part of the last two months before closing the January month at 7.33%. On February 8, 2023, the 10-year G-sec was at 7.34% In the money market, yields moved higher materially due to continued tightening in the liquidity condition. A sustained wide gap between credit and deposit growth in the banking system also contributed to a rise in short-term interest rates.

The 3 months treasury bill yield moved up from 6.34% on Dec’22 to 6.48% by January end. It rose further in the current month to 6.67% on February 8, 2023.

Certificate of deposit (CD) rates of AAA-rated PSU banks are currently around 7.20% for 3 months maturity and around 7.60% for 1-year maturity. These rates were at 6.66% and 7.59% respectively on December 30, 2022.

CPI inflation fell to 5.72% YoY in December 2022. This was the third consecutive monthly drop in inflation from its peak of 7.4% in September 2022.

A large part of this disinflation was contributed by a sharp decline in vegetables, which may dissipate with the summer season's uptick. However, inflation momentum measured by a month-on-month increase in index levels has come down significantly across many goods and services.

Services inflation overall has been muted and will likely remain benign due to weak employment conditions and a reduction in direct fiscal support for rural employment and farm incomes.

We expect headline CPI inflation to fall below the 5% mark by mid of this year and average around 5.3% in FY24.

In the Union budget for FY24, the government managed to strike a fine balance between boosting capital expenditure to stimulate growth and continuing with fiscal consolidation. The quality of government expenditure has improved consistently in the last three years with capex to total expenditure rising from 12% in FY21 to 22% in FY24. This should enhance the future growth potential of the economy and should lead to higher revenues for the government over the medium to long term.

The fiscal deficit for FY24 is set at 5.9% of GDP vs 6.4% in FY23. The Net and Gross market borrowing estimates were raised marginally to Rs. 11.8 trillion and Rs. 15.4 trillion respectively. However, this was slightly lower than the broader market expectation.

The government also reiterated its commitment to further consolidate its fiscal deficit to below 4.5% of GDP by FY 2025-26. Thus, market borrowings of the central government should decrease or remain the same for the next two years.

The monetary policy committee of the RBI hiked the policy repo rate by 25 basis points in the February meeting by a 4-2 vote and maintained the policy stance as “withdrawal of accommodation”.

The Repo rate now stands at 6.50%. Consequently, the Standing Deposit Facility (SDF) rate moved up to 6.25% and Marginal Standing Facility (MSF) rate moved up to 6.75%.

The policy was broadly in line with the market expectations though we were expecting a pause in the rate hiking cycle this time.

The RBI seems concerned about the sticky core Inflation while they are relatively more comfortable with the growth outlook. The RBI estimates the CPI inflation to average 5.3% and real GDP growth at 6.4% in FY24.

In the last 10 months, the repo rate has been hiked by cumulative 250 basis points and the short-term money market rates have moved up by over 300 basis points. The full impact of these measures is yet to be seen.

Based on the RBI’s 1 year ahead inflation estimate of 5.6%, the real repo rate is currently at 90 basis points and the real rate on a 1-year treasury bill is around 130 basis points. In our opinion, the current real rates are adequate for the current state of economic growth, and we would expect the RBI to pause the rate hiking cycle in the next MPC meeting in April. We would expect the repo rate to remain at 6.50% for the remainder of 2023.

Given the 25 basis points rate hike was widely expected, there was limited impact on the bond market. Bond yields moved up 3-5 basis points after the policy announcement. We continue to expect the bond yields to go down over the medium term with improvement in external and fiscal balances and falling inflation.

Given the fact that a sizable rate hike has already been delivered and the starting yields of bonds are between 7.0%-7.5%, bond funds are likely to do better over the coming 2-3 years. Investors with a 2-3 years investment horizon and some appetite for intermittent volatility, can continue to hold or add to dynamic bond funds.

Dynamic bond funds have the flexibility to change the portfolio positioning as per the evolving market conditions. This makes dynamic bond funds better suited for long-term investors in this volatile macro environment.

Investors with shorter investment horizons and low-risk appetite should stick with liquid funds. Rate hike and continued reduction in durable liquidity surplus is positive for short-term debt fund categories like the liquid fund. We would expect further improvement in the return potential of these categories as interest accrual on short-term debt instruments has risen meaningfully.

Since the interest rate on bank saving accounts are not likely to increase quickly while the returns from the liquid fund are already seeing an increase, investing in liquid funds looks more attractive for your surplus funds.

Investors with a short-term investment horizon and with little desire to take risks should invest in liquid funds which own government securities and do not invest in private sector companies which carry lower liquidity and higher risk of capital loss in case of default.

Source: RBI

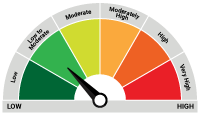

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Low to Moderate Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Debt Monthly View for January 2025

Posted On Friday, Feb 07, 2025

Bond markets witnessed increased volatility during the last month with the 10-year Government

Read More -

Debt Monthly View for December 2024

Posted On Tuesday, Jan 07, 2025

The year 2024 has proven to be a strong one for fixed-income investors, marked by India's inclusion in the JP Morgan GBI EM Index.

Read More -

Debt Monthly View for November 2024

Posted On Wednesday, Dec 04, 2024

In November the debt market was largely influenced by the US elections, which introduced considerable macroeconomic uncertainties.

Read More