How We Tackle Downside Risk So You Don’t Have To! #InvestWithoutStress

Posted On Friday, Feb 07, 2025

During periods of market euphoria, when stock prices are soaring and investor sentiment is overwhelmingly optimistic, many investors focus solely on returns while disregarding the risks involved. They often fail to recognize that the impressive gains seen in bullish markets may stem from heightened risk exposure—risks that can lead to losses when market conditions shift. However, ignoring downside protection in such times can be costly. It is crucial to assess the level of risk a fund assumes to generate returns, as factors like liquidity constraints, corporate governance issues within invested companies, and elevated stock valuations can erode long-term gains when markets correct.

Safeguarding Wealth: The Importance of Downside Protection in Euphoric Markets

The Quantum Long Term Equity Value Fund has always prioritized risk management in its equity portfolio, aiming to deliver stable, long-term returns.

Quantum AMC’s investment philosophy is based on a strategy that considers long-term stability and growth potential of its investors’ wealth. Liquidity, prudent valuations, strong governance, and sustainable growth are among the basic principles that Quantum focuses on to ensure its portfolios are well-positioned to help weather market swings.

This careful but strategic method helps protect Quantum’s downside risk while at the same time allowing it to capture upside potential. Know more

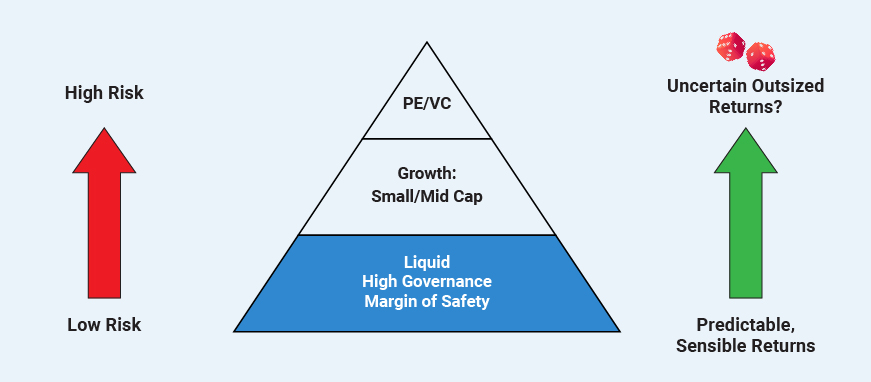

For any investor, equity allocation should have a higher portion at the base of the pyramid, invested in fund that prioritises liquidity, governance and valuations based on investor’s risk appetite. As you move up the pyramid, return expectations may increase, but so do the associated risks.

Watch this video, where our fund managers, George Thomas and Christy Mathai, share insights into how the fund has historically managed downside risk and why it outperformed during periods of market turbulence.

The video highlights our disciplined investment approach covering:

Valuation Sensitivity: How our focus on purchasing stocks below intrinsic value protecting against market downturns.

Cash Holding Strategy: Why higher cash levels during bull markets allow us to deploy funds effectively when opportunities arise.

Long-Term Focus: How we focus on delivering long-term returns through disciplined, strategic investing.

Watch the full video here:

|

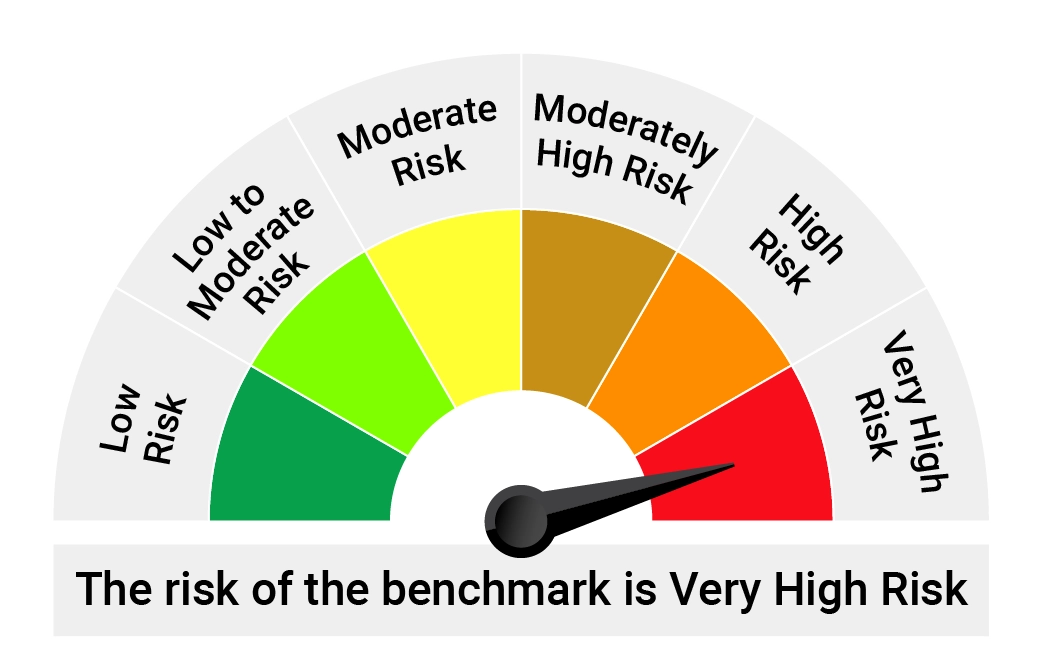

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Risk-o-meter of Tier I & II Benchmark |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. Tier I Benchmark : BSE 500 TRI | Tier II Benchmark : BSE 200 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in BSE 200 index. |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More -

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More