Balancing Priorities: The Need for Fiscal Reallocation

Posted On Monday, Jun 24, 2024

With the formation of the new coalition government, media and market circles have started speculating about the upcoming budget which is expected to be announced by the third week of July. Whispers of an increase in income tax exemption limit and boost to welfare spending have been making rounds for the few days.

Despite the noise, the bond markets remain tranquil with bond yields contained in a tight range near the 7% mark. Yet, there is a close eye on the first budget of the new coalition government to gauge the direction of fiscal policy over the next 5 years.

In Retrospect

Over the last 4 years, the fiscal policy has been focusing on –

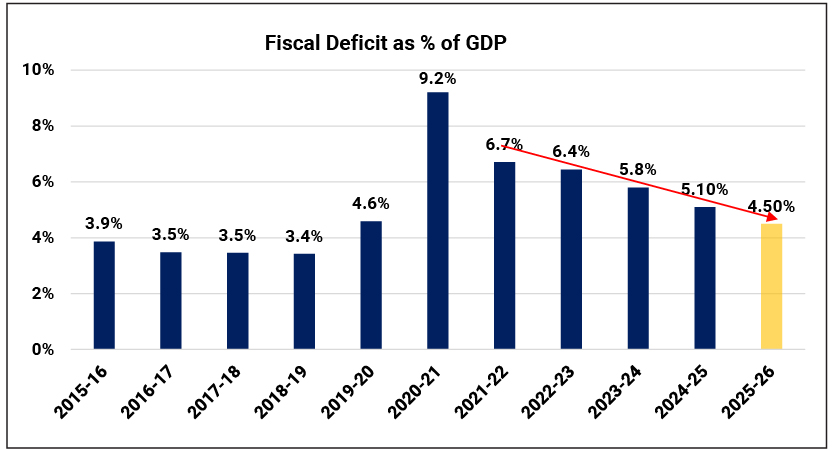

(1) gradually reducing the fiscal deficit from 6.8% in FY22 to 4.5% of GDP by FY26

(2) boosting capital formation by investing in public infrastructure

Chart – I: Government on path to reduce Fiscal Deficit to 4.5% of GDP by FY 26

Source – IndiaBudget.gov.in, Quantum Research, data as per Interim Budget Estimate of February 2024.

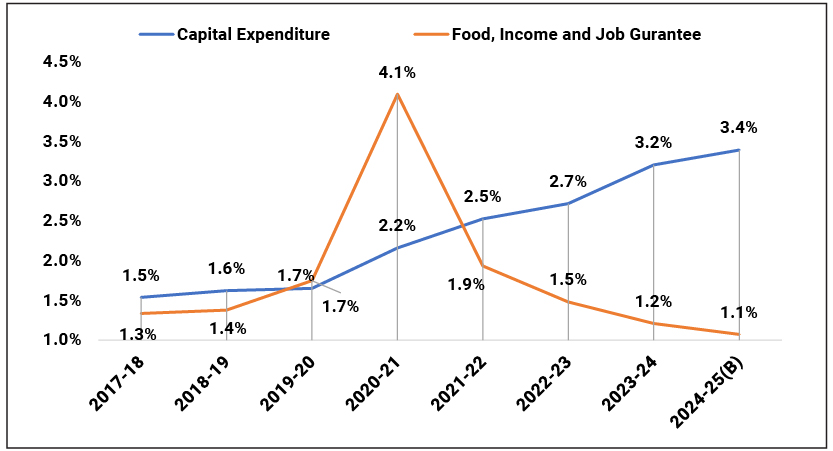

While the government kept the total expenditure in check, it significantly adjusted its spending pattern by allocating more funds to capital expenditure (capex) & reduced welfare spending. Consequently, the proportion of capex in the total budget inched up from approximately 12% pre-pandemic to 23% currently.

The capex to GDP ratio improved consistently from 1.7% in FY20 to 3.2% in FY24. At the same time, spending on some of the direct welfare schemes like food subsidy, MGNAREGA (Rural Job Guarantee) and PM Kisan (Farm Income Guarantee) declined from 1.7% of GDP in FY20 to near 1.2% of GDP by FY24.

Chart – II: Government Expenditure shifted towards boosting Capex while welfare spending declined

Source – IndiaBudget.gov.in; CMIE, Quantum Research; data upto FY25 based on Interim Budget Estimates of February 2024.

From the bond market’s perspective, this fiscal policy approach has been supportive in two ways:

(1) Reducing fiscal deficit kept bond supply under check leading to favorable demand supply balance for long term bonds.

(2) Reduced welfare spending translated into weaker demand conditions and put downward pressure on inflation particularly the Core CPI.

The Flip Side

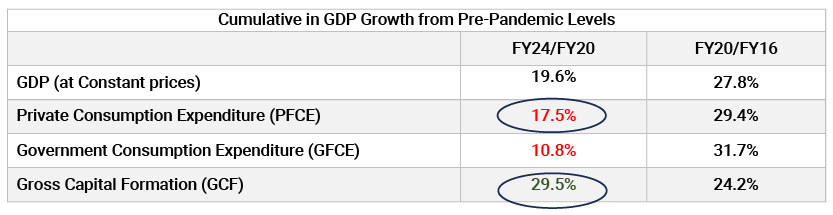

On the flip side, this fiscal approach fueled a stark divergence between different growth drivers. The GDP growth in the last 4 years was led by a sharp pickup in capital formation which grew by cumulative 29.5% between FY20-FY24. While consumption, which accounts for nearly 60% of the economy, grew at a more sluggish pace posting only 17.5% cumulative growth in the same period.

There is also evidence of severe contrast between the consumption demands from different sections of the economy. The economically stronger section has shown strong demand for various premium goods and services while the demand from the economically weaker section is yet to recover from the covid shock.

Chart – III: India’s Growth recovery has been uneven

Source – MOSPI, Quantum Research; data upto March 31, 2024

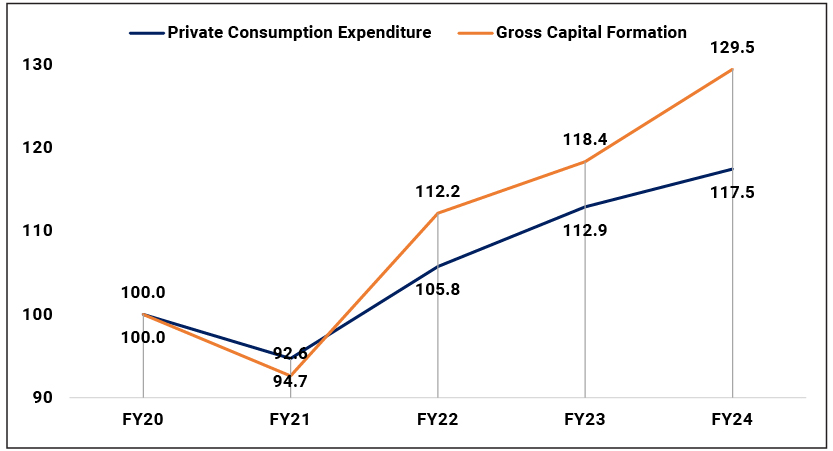

Chart – IV: Government’s Capex push helped capital formation, while Consumption growth remained tepid due to uneven economic recovery and lack of fiscal support

Source – MOSPI, Quantum Research; data upto March 31, 2024

What to Expect

Although overall capital formation and construction activity have been growing at a solid pace, it is proving to be more capital and technology intensive and lesser of a job generator. Thus, the trickle-down effect (capital investments boosting incomes and consumption demand) is not coming as expected.

Also, the sluggish consumption demand is turning out to be a hurdle for a pick-up in private investments.

This presents a case for reallocation of government expenditure to boost demand. We might see increasing allocation towards schemes like housing, rural roads, livelihood promotion etc. in the upcoming budget.

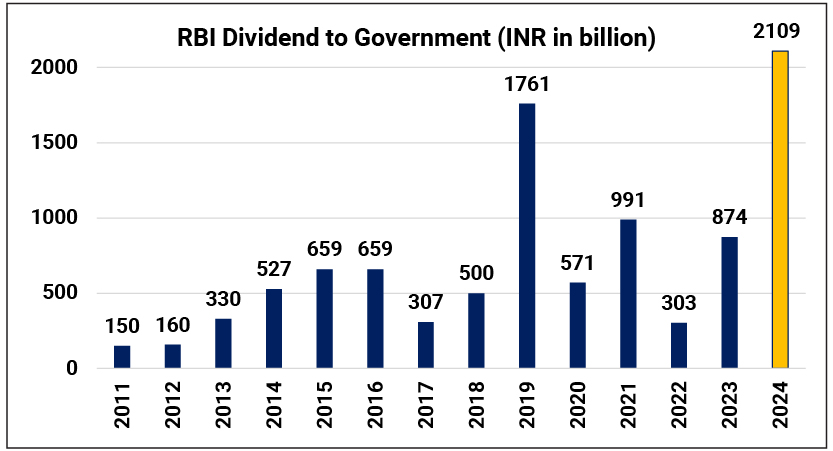

This can be comfortably achieved without compromising on the fiscal consolidation goals in FY25, thanks to the RBI’s surprise large dividend of Rs. 2.11 trillion to the government.

Chart – V: RBI’s Dividend Bonanza offers flexibility to spend more without fiscal compromise

Source: RBI, Quantum Research; data upto May 31, 2024

All in all, we expect fiscal consolidation to continue along with the broader capex push, while there could be some increase in spending to boost demand from the additional resources in form of the RBI dividend.

What should Investors do?

Bond market’s focus will remain on the fiscal consolidation path and the resultant demand supply balance in the bond market. To that extent, we do not expect any material shift in the fiscal policy.

We continue to hold our positive outlook on Indian bonds (refer The Bull Case) supported by a structural shift in demand supply balance, and a cyclical turn in inflation and monetary policy.

India’s inclusion in the global bond indices and rapidly growing domestic financial savings will continue to boost demand in the bond market. At the same time, government’s fiscal consolidation is reducing supply of bonds making demand supply balance in favour of long-term duration bonds.

Considering a strong case for long term yields to decline over the next 1-2 years backed by the reasons described above, we believe long term government bonds offer a rewarding opportunity.

Dynamic Bond Funds are probably best placed to capture this opportunity with a flexibility to change if things don’t pan out as expected. However, investors need to have a longer holding period of at-least 2-3 years to ride through the intermittent volatility.

Investors with shorter investment horizons and low-risk appetites should stick with liquid funds.

Portfolio Positioning

Scheme Name | Investment Approach |

The scheme invests in debt securities of up to 91 days of maturity issued by the government and selected public sector companies. | |

The scheme to invest in debt securities issued by the government and selected public sector companies. The scheme follows an active duration management strategy and increases/decreases the portfolio duration (sensitivity to interest rates changes) in accordance with the Interest Rate Outlook. Given our positive view on the bond market, we are maintaining reasonably high duration in the scheme with bulk of portfolio invested in above 10-year maturity segment. |

Source – IndiaBudget.gov.in, Quantum Research, RBI, MOSPI

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author – Pankaj Pathak, Fund Manager – Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian – Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Read our last few Debt Market Observer write-ups -

- Index Inclusion: How will it Unfold

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. |

|  Investors understand that their principal will be at Low Risk |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. |

|  Investors understand that their principal will be at Moderate Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

The Pivot

Posted On Friday, Apr 21, 2023

The fiscal year 2022-23 has come to an end. The defining feature

Read More -

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Past, Present, and Future of Inflation

Posted On Friday, Feb 24, 2023

Inflation has been one of the biggest challenges in the post-pandemic world.

Read More