Why Soaring Oil Prices Couldn't Dampen Market Mood

Posted On Thursday, Sep 21, 2023

From inflation and monetary policy, market’s attention has now shifted to rising crude oil prices and a possibility of global bond index inclusion. The push-pull effect of these opposing forces has added volatility in the bond market and made the future look more uncertain.

Oil on rise; but the link is broken

Crude oil prices have jumped more than 30% in the last three months due to supply cuts by the OPEC+ alliance which includes 23 oil producing countries and account for over 40% of world crude oil production. The brent oil prices began to soar from the lows of ~USD 72/barrel in June 2023 to near USD 95/barrel as of September 19, 2023.

India imports more than 85% of its total crude oil demand. Rising oil prices, citrus paribus, will increase the import bill, expand current account deficit, lower growth, and push up inflation.

Chart – I: Indian Economy Sensitive to Crude Oil

Impact of US$ 10/bbl increase in Crude oil price... | |

Import bill | (+) US$ 25 billion (0.6% of GDP) |

Current Account Deficit (CAD) | (+) US$ 14 billion (0.3% of GDP) |

GDP | (-) 20 basis Points |

Inflation (for 10% rise in Crude oil prices) | (+) 45 basis Points |

Source – RBI, Quantum Research

Increase of 10% in crude oil price can add about 25 basis points to the headline CPI directly through increase in domestic fuel prices. Its second-round impact through increased transportation cost for other goods and services can add another 20-30 basis points in the headline inflation.

On face of it, it seems like a big negative for the inflation outlook. However, we argue that the actual impact on inflation will not be that significant this time around. The link between the global crude oil price and domestic fuel prices is broken.

Prices of diesel and petrol are kept constant for the last 14 months. LPG prices have been cut recently for both the retail consumers and commercial users. We do not see a reversal in this trend anytime soon. Atleast not till the general elections in May 2024.

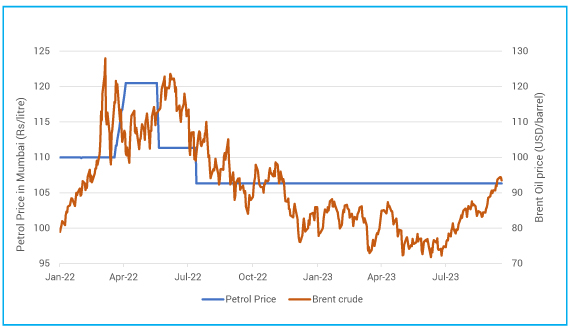

Chart –II: Petrol prices remained flat for more than 14 months despite sharp fall and rise in crude oil price

Source – Bloomberg, Quantum Research; data upto September 18, 2023

Taming inflation through supply side measures is one of the stated priorities of the government. In words of the finance minister Nirmala Sitharaman "Obsession to use interest rates as the only tool to deal with inflation and not manage the supply side factors will not give a complete solution".

In line with this thought, the government has announced various supply side measures to control food inflation over the last few months. We expect that the government will adopt a similar stance for the fuel prices given its impact on the consumer sentiment and inflation expectation.

In case global crude oil prices remain elevated for an extended period, we would expect a cut in fuel taxes to keep pump prices under check. Reduction of excise duty on petrol and diesel by Rs. 5/ltr could lead to revenue loss of around Rs. 750 billion for the Central government. Given robust direct tax collections (23.5% y-o-y growth in H1 FY24), this can be absorbed in the government’s budget without any significant widening of fiscal deficit and market borrowings.

Also, as the chart above shows, oil marketing companies did not pass on the benefit of lower crude oil price in the first half of the year, they might be asked to share the burden of higher crude oil prices in the later half.

All in all, we do not expect any material impact on inflation outlook and monetary policy due to crude oil prices. Nevertheless, rising crude oil price will continue to have a significant impact on the market sentiment. Thus, an upward bias in yield, in case of further rise in crude oil price, cannot be ruled out.

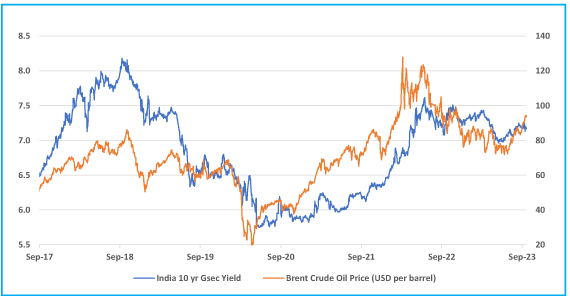

Chart –III: Despite limited inflation impact this time, market sentiment remains sensitive to crude oil prices

Source – Bloomberg, Quantum Research; data upto September 18, 2023

Past Performance may or may not sustain in future

Index Inclusion Buzz is back

Like an annual ritual, market buzz about index inclusion is back. We too discussed this issue in past - India Bonds Going Global (September 2022) and Will Foreigners ‘Bond’ with India (September 2021).

India is on the watchlist for inclusion into the FTSE Emerging Markets Government Bond Index (EMGBI) and JP Morgan GBI-EM Index. Review of these indices are due at this month end and early next month respectively.

This time, the buzz was triggered by a media report that the RBI has been making informal inquiries with select bond market participants about the impact of allowing settlement of domestic sovereign debt on the Euroclear platform.

This move is believed to ease Indian bond market access for foreigners. Though it is not a pre-condition for index inclusion, inability to access the market through an international central security depository (e.g. Euroclear) was raised as one of the hurdles by index participants in addition to seeking clarity of taxation.

There is no progress on these two remaining issues since last index review. However, ouster of Russia from the index last year has left the index more concentrated among few countries. Now, 7 countries in the JP Morgan GBI-EM Index account for ~70% of the total allocation, while the remaining 13 countries have a combined weight of near 30%.

India’s index inclusion would add diversification to the index, enhance the yield and expand the market opportunities for global debt investors. So, the benefits might outweigh the concerns.

From India’s perspective, index inclusion could attract a large pool of foreign capital into Indian bond market. As per estimates by some global investment banks, India’s inclusion in the JP Morgan’s GBI-EM Index could attract around USD 25-40 billion (passive and active) foreign inflows in the first year. Inclusion into Bloomberg’s Global Aggregate Index could attract another USD 7-10 billion.

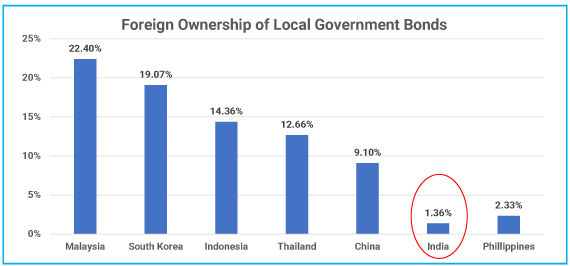

This could be big boost for the Indian bond market as foreigners hold less than 2% of Indian bonds; while the government is excessively relying on commercial banks and the RBI to fund its large borrowing program.

Chart -IV: Indian Bonds are under-owned by foreigners

Source – www.asianbondsonline.adb.org, RBI, Quantum Research,

Data for India as of March 2023 and all others are as of March 2022

More importantly, index inclusion will open a source of consistent demand for Indian bonds from investors who track the index, particularly from the exchange-traded funds or ETFs. Even active investors will be more comfortable investing in India when it becomes part of the index.

Apart from the direct impact of additional demand, there are other benefits as well.

- The new demand source for government bonds might also help in deepening the corporate bond market in India.

- Potential foreign inflows into Indian debt will expand the source of foreign capital which in turn will strengthen India’s balance of payment situation and deepen the market for the Indian Rupee.

- Foreign holding of bonds would enforce much stricter discipline on the fiscal and monetary policy.

- Increased participation by foreign investors, would enhance the credibility of the Indian bond market and will make it easier for the government and the corporate sector to raise debt capital from global investors.

Clearly, India has a lot to gain from Index inclusion. However, there are downsides as well. High foreign holding of debt might expose Indian markets to external shocks. Large inflows-outflows linked to developments in the global markets can have an outsized impact on the domestic bond and currency markets. Thus, additional safeguard measures will have to be deployed to deal with any such external shocks.

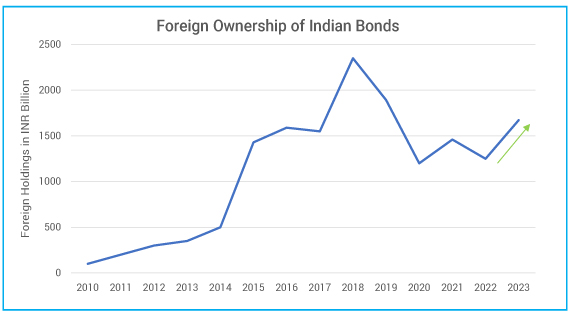

So far in 2023, foreigner investors (FPI) have been consistent buyer in the bond market with net purchase of Rs. 219 billion (USD 2.7 billion) of government bonds.

Chart – V: Foreigners turned buyer in Indian bonds in 2023

Source – RBI, Quantum Research, Data up to September 2023

Market Outlook

Despite increased volatility, Indian bond yields are stuck in a tight range. The 10-year government bond yield has been trading between 7.10% and 7.25% for the last two months.

Notwithstanding the rise in US treasury yields and crude oil prices, prospects of index inclusion should keep the bond market sentiment upbeat in the near term. A positive outcome could drive down yields substantially due to foreigners under exposure to Indian bonds. However, a setback on index inclusion should push up yields only marginally.

From medium-term perspective, outlook for bonds looks favourable supported by peaked policy rates, comfortable liquidity condition and strong external position.

At current levels, valuations look reasonable for medium to long duration bonds. The 10-year government bond is currently trading at 65 basis points above the policy repo rate. Given the policy repo rate is near cycle peak, this spread looks significantly higher than its historical average during peak rate environment.

In line with this view, we would use every rise in yield to extend the portfolio duration by accumulating long term bonds in a staggered manner.

What should Investors do?

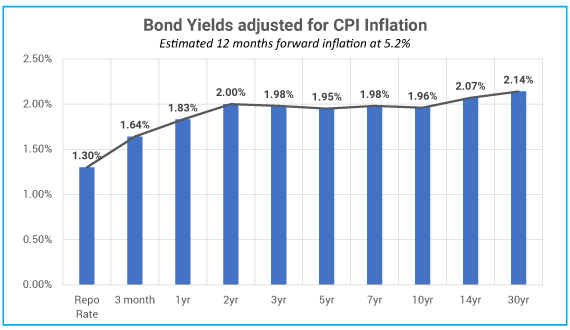

With most of the government bond yield curve above 7.0%, there is decent accrual available at current levels. Even in the real term (adjusted for inflation), government bonds are offering meaningful positive real yield. With expected CPI inflation of 5.2% (RBI’s Q1FY25 inflation estimate) and a 1-year Gsec yield at 7%, the real yield is around 180 basis points.

Chart – VI: Real yields are positive and reasonably high

Source – Refinitiv, Quantum Research, Data as of September 18, 2023

Investors with 2-3 years holding period can consider Dynamic bond funds which have flexibility to change the portfolio positioning as per the evolving market conditions.

Investors with shorter investment horizons and low-risk appetites should stick with liquid funds.

Portfolio Positioning

Scheme Name | Strategy |

The scheme invests in debt securities of up to 91 days of maturity issued by the government and selected public sector companies. | |

The scheme to invest in debt securities issued by the government and selected public sector companies. The scheme follows an active duration management strategy and increases/decreases the portfolio duration (sensitivity to interest rates changes) in accordance with the Interest Rate Outlook. Given sharp drop in yield last week, we reduced the portfolio duration tactically. However, we maintain our favourable medium-term view and will look to add duration at every rise in bond yields. |

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author – Pankaj Pathak, Fund Manager – Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian – Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Read our last few Debt Market Observer write-ups -

- Looking Through the Noise

- FED, Liquidity and Rain

Portfolio Information Scheme Name: Quantum Liquid Fund | |

| Description (if any) | |

Annualised Portfolio YTM*: | 6.85% |

Macaulay Duration | 49 days |

Residual Maturity | 49 days |

As on (Date) | 31-08-2023 |

*in case of semi annual YTM, it will be annualised

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. |

|  Investors understand that their principal will be at Low Risk |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. |

|  Investors understand that their principal will be at Moderate Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

The Pivot

Posted On Friday, Apr 21, 2023

The fiscal year 2022-23 has come to an end. The defining feature

Read More -

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Past, Present, and Future of Inflation

Posted On Friday, Feb 24, 2023

Inflation has been one of the biggest challenges in the post-pandemic world.

Read More