Why It Makes Sense to Add Gold to Your Investment Portfolio Now?

Posted On Monday, Jun 01, 2020

Gold, the precious yellow metal, commands a store of value, i.e. it is looked up to a lender of last resort during economic uncertainties. Over the years it has continued to display its sheen and still remains the most lucrative precious metal to invest in.

Particularly now that the world is battling with Coronavirus or COVID-19 and there is no evident containment from its spread yet, the spotlights will continue to remain on gold.

Gold is an essential asset that is treated differently because...

? The ability to act as an effective tool

? An effective portfolio diversifier

? Potential to generate good risk-adjusted returns over the long-term

? Can counter inflation over the long run

? Highly liquid

? And can help deal with systemic risk, during stressful, uncertain times

Gold as an asset generally shares negative correlation with other assets (such as equity, debt, real estate etc.), and tends to perform better during risk-off periods.

The current times of Coronavirus global pandemic, where many countries (India included) have ordered lockdowns, it is bound to hit the economies real hard. For this very reason, global growth has been reduced sharply by the International Monetary Fund (IMF), the World Bank, and several rating agencies.

The World Gold Council (WGC) expects the market risk and economic growth interaction to impact gold prices this year. Mainly, the following factors will keep the focus on gold as per the WGC:

? Financial uncertainty and lower interest rates

? Weakening in global economic growth

? Gold price volatility

The WGC has also stated that the uncertainty brought about by the novel Coronavirus and its potential impact on public safety and economic growth could be added to the list.

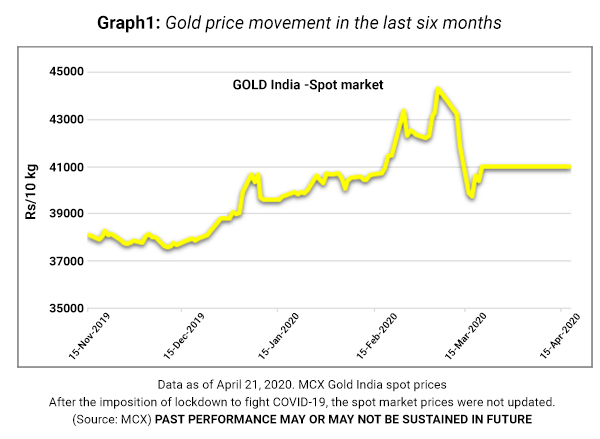

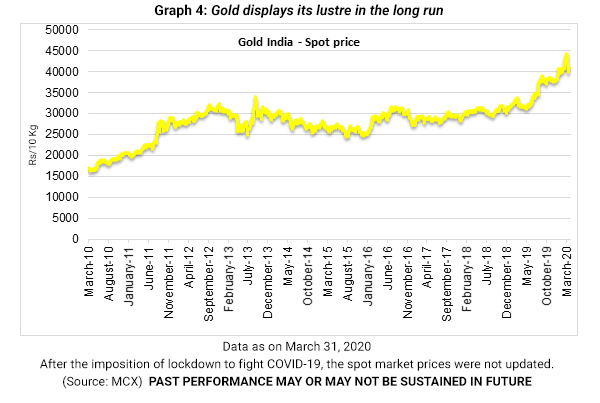

The COVID-19 lockdown has, of course, clogged the activity in gold markets including India’s. In Indian rupee terms price per 10 gram of gold corrected by -3.2% in March 2020, nonetheless remained over Rs 40,000/10 gram. During the January to March 2020 quarter, gold gained nearly +5.0%.

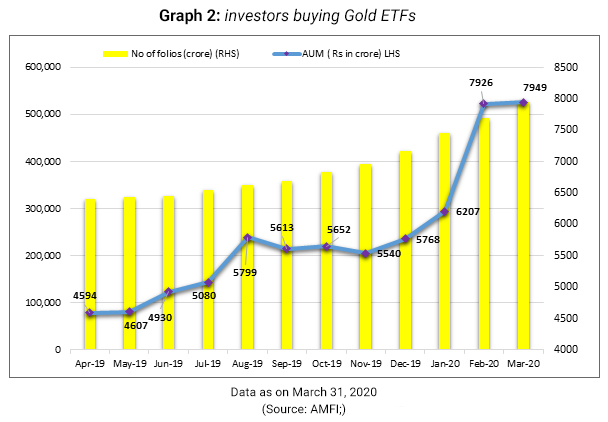

The Association of Mutual Funds in India (AMFI) recent data sheds light on the precious yellow metal being favoured for investment through the rise in the number of folios and the increase in Average Asset under Management (AAUM) of the Gold ETFs (see Graph 2).

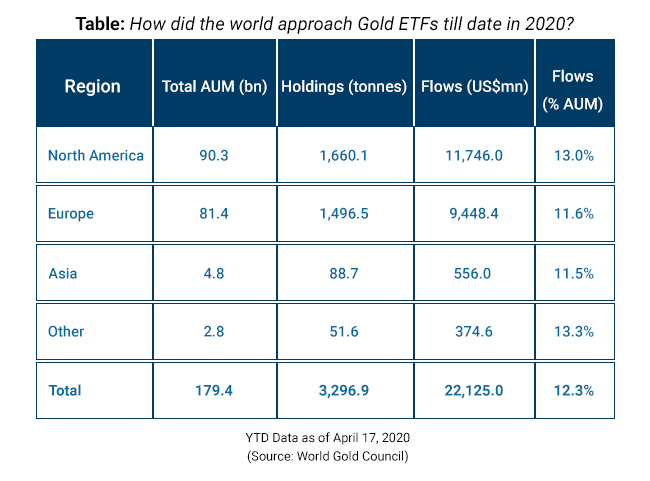

In many parts of the world as well, gold ETFs have witnessed positive participation as central banks continued to lower interest rates and adopt an accommodative monetary policy stance to support growth. Global gold-backed ETFs (gold ETFs) and similar products added 298 tonnes(t), or net inflows of US $23bn, across all regions in the first quarter of 2020 – the highest quarterly amount ever in absolute US dollar terms and the largest tonnage additions since 2016, as per the WGC.

This shows that investors are rightly buying gold, recognising it to be a store of value during uncertainty. While demand for jewellery and physical gold has taken a hit, the focus currently is on the investment forms of gold.

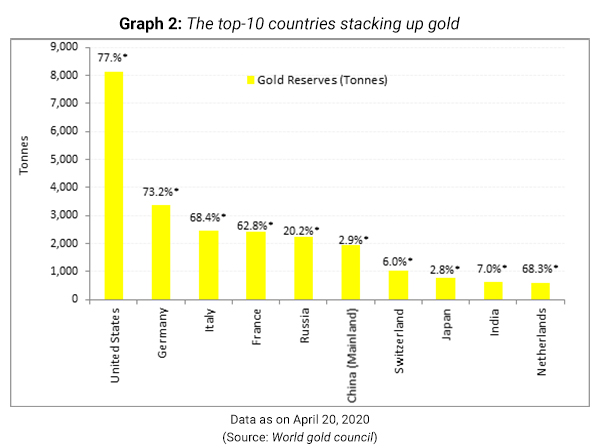

Even with the central banks of the world recognising the risk involved are adding to their gold reserves (see Graph 3). Gold, as you may know, plays an important role in central bank’s reserve management.

Currently, the following factors would prove supportive for gold...

• The outbreak of COVID-19 with no evident containment yet

• Economic uncertainty and fears of a virus-led global recession

• Global GDP growth revised downwards and for across regions

• A record-high global debt-to-GDP of nearly US$ 255 trillion (over 322% of global GDP) - 40 percentage points higher than at the onset of 2008 global financial crisis according to the Institute of International Finance (IIF), as the world is fighting the COVID-19 pandemic

• The easy monetary policy action and accommodative stance followed by central banks of the world and stimulus packages to boost growth.

• Depreciation of the Indian rupee against the dollar

• The crash in oil market prices

• Trade war tensions due to protectionist policies followed

• Geopolitical tensions

• The US Presidential elections later this year, in November 2020

• Potential risk to the inflation trajectory

• And the Increased stock market volatility

Given the on-going extreme turbulence in the equities, gold holds the potential to provide risk- adjusted returns. Last year, i.e. in 2019, the precious yellow metal posted an absolute return of nearly +25% when other asset classes witnessed high volatility and posted not so good returns.

The road ahead for Gold...

Until the COVID-19 pandemic is contained and economic uncertainty prevails, the spotlights will continue to remain on gold.

It makes good sense to invest in gold strategically.. The long-term secular uptrend exhibited by gold is something that invites attention and highlights the importance of owning gold in the portfolio with a longer investment horizon.

Plus, if the southwest monsoon indeed turns out to be normal as expected by the Indian Meteorological Department (IMD), demand for gold may rise and it will shine further.

In the current situation, consider allocating some portion of the investment portfolio to gold. Allocate around 10-15% of the entire investment portfolio to gold and hold it with a long-term investment horizon. Invest in gold the smart way through gold Exchange Traded Funds (ETFs) or gold savings funds.

Gold will continue to play its role as an effective portfolio diversifier and a store of value during economic uncertainty.

Happy Investing!

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumMF.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Do You Need to Update Your KYC/Modify KYC?

Posted On Friday, Apr 26, 2024

New KYC Regulation Effective April 1st 2024

Read More -

Are You Stuck in the Past or Ready for a Secure Future?

Posted On Wednesday, Jun 29, 2022

The ever-growing number of mutual fund schemes on offer has made it challenging for investors to select the best and most suitable one.

Read More -

Received an Increment? Step-up Your SIPs

Posted On Wednesday, Jun 01, 2022

For instance, let’s assume that you have registered for a monthly SIP of Rs 5,000 for a 10-year period and later on try to step-up the SIP at an annual frequency, say by Rs 500. In the first year...

Read More