Why Are Investors Coming Back To Equity Mutual Funds Through SIPs

Posted On Wednesday, Apr 28, 2021

The Power Of SIPs to Power your Goals

SIP or systematic investment plan is a mode of investing in mutual funds and investors are coming back to SIPs. It is widely preferred by investors as one can start investing as low as Rs.500 or even Rs. 100.

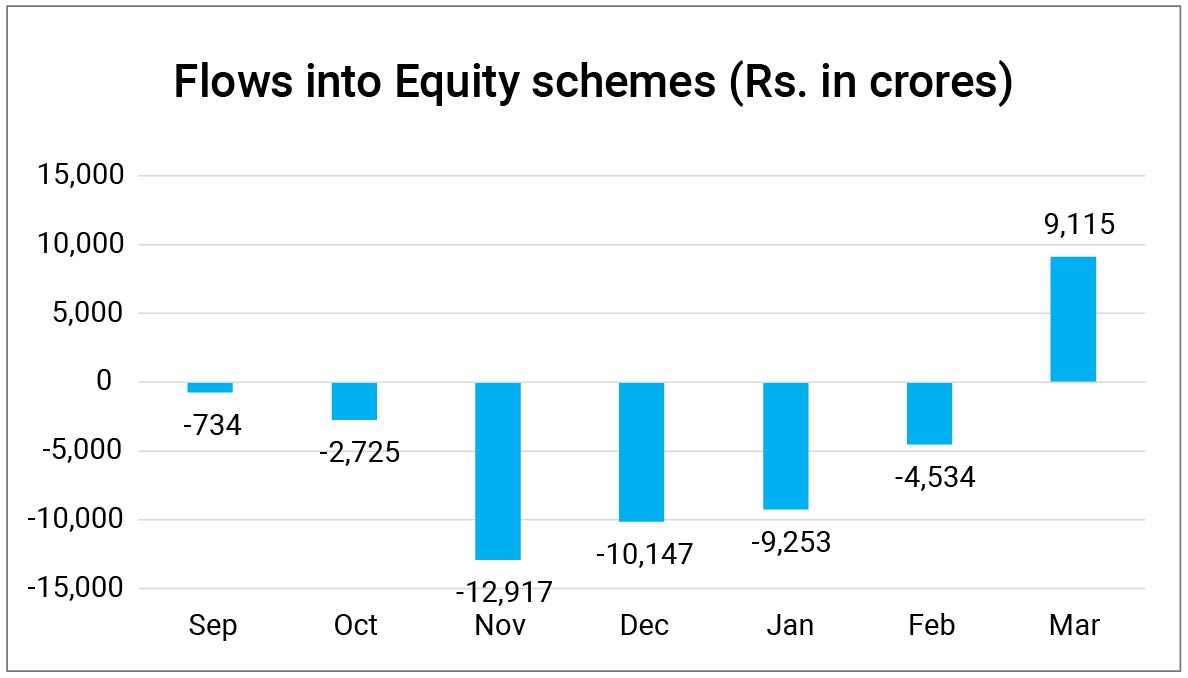

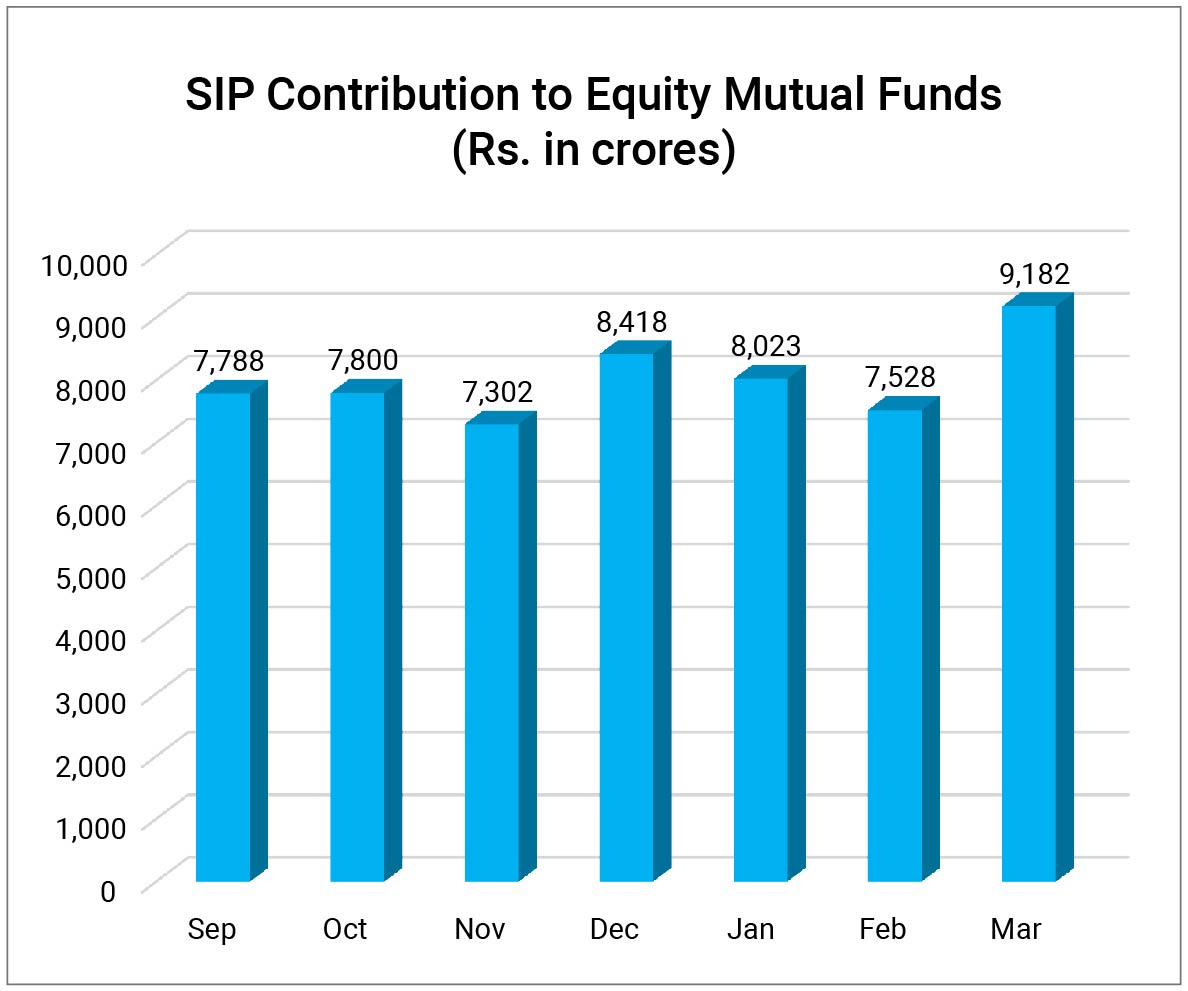

After a lull of eight months, equity funds saw a net inflow of Rs 9,115 crore. Inflows through Systematic Investment Plans (SIPs) also rose to Rs 9,182 crore (the highest amount ever) in March 2021 according to AMFI data.

Source: AMFI

Why is it that an SIP is the chosen way among investors?

Our CEO, Jimmy Patel talks about this trend reversal, “Clearly, timing the markets doesn’t work. Investors who thought of selling their investments when the markets recovered in the last quarter of 2020, could have lost out on the opportunity when Nifty made a new high in 2021.”

An SIP could have been an apt way to navigate the market uncertainty.

Well, the idea is to be patient and stay invested to reap the maximum benefits.

Industry experts believe that it is better to invest in a staggered manner using SIPs in diversified equity schemes.

In the present market scenario, with low interest rates and expectations of economic recovery, an SIP can help investors get the benefit of returns from riskier asset classes such as equity asset class. This could perhaps be the turning point for equity mutual funds.

This route is suitable especially for young or new investors who have just ventured into the unpredictable market.

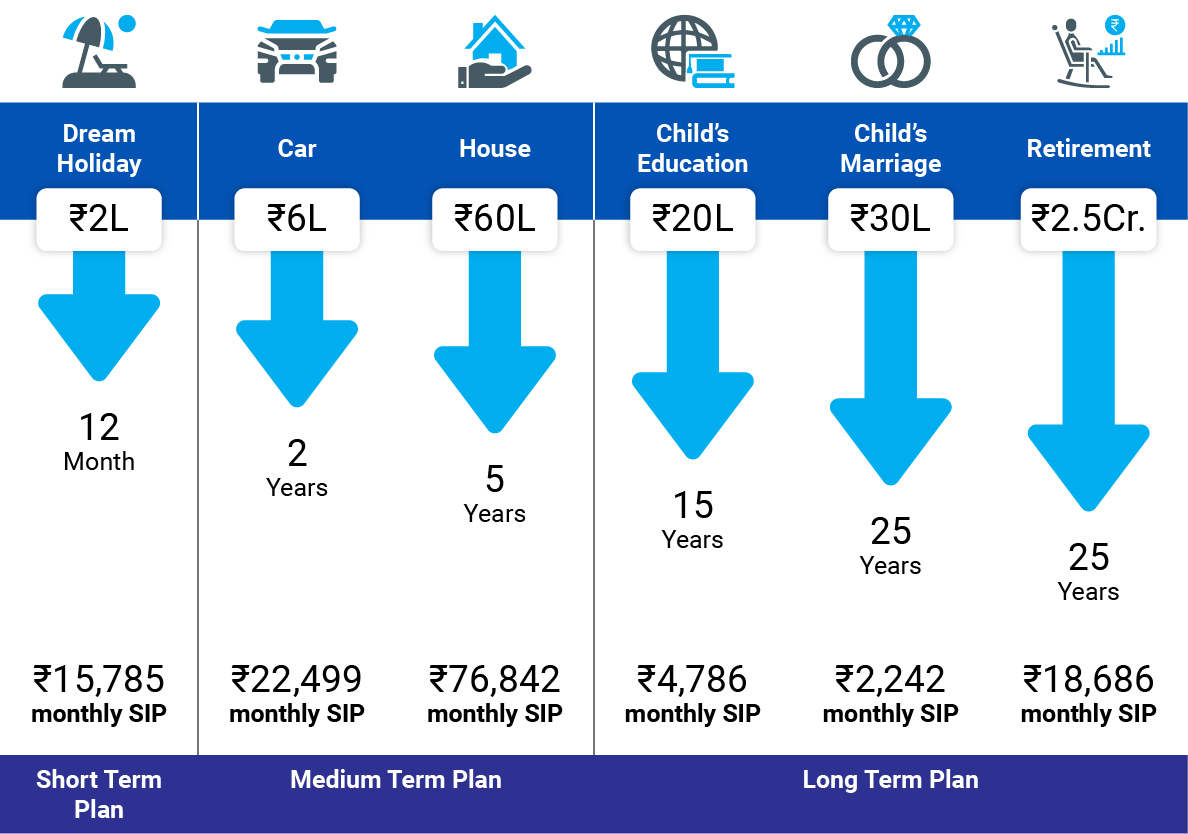

Let us understand how powerful an SIP amount is, when it is invested for.

a. short-term,

b. medium-term and

c. long-term goals

For the goals as illustrated below, the respective SIP amount is invested at the first of every month at an assumed rate of return of 10% to achieve the corpus amount.

SIP Goal Planner

The above chart is for illustration purposes only. Investments through SIP are subject to market risk and do not assure a profit or returns or protection against a loss in a downturn market.

Plus, it is easy to start SIP investments

You can activate an SIP, decide on an amount per month that you would want to invest in the mutual fund scheme of your choice.

The amount decided would be deducted from your bank account month on month and invested in your selected scheme.

All this can be done at your convenience online.

5 Benefits of Investing In A Systematic Investment Plan

If you ask us, every investor, irrespective of age or experience in investing, should invest using SIP’s.

You see, SIPs are based on the very simple but strong principle –

“Don’t Save What Is Left After Spending, Spend What Is Left After Saving”

Or simply put – Save First, Spend Later...

Here are your benefits of starting an SIP...

1. Low Monthly Investment: SIPs give you the freedom to start with as low as Rs 500 a month! You don’t even need to have a large lumpsum amount like many other investments need. And you could very well increase it as time passes and as you become more aware of the potential that Mutual Fund Investing holds.

2. Flexibility to pause, stop or redeem during Emergency: This is something we all want to avoid, but emergencies could strike any time, and we have no control over it. SIPs could come to your rescue. You have the flexibility to pause or stop investing anytime in the SIP and redeem your investment (Provided there is no lock-in period). However, it is suggested that you should pause or discontinue instead of redeeming from equities. The power is in your hands, and you can use it in case of emergencies.

3. Investment Discipline: If you are a young investor, the investment via an SIP will make you disciplined when it comes to managing your finances and investments. Thus, you will get into the habit of spending what is left after investing. And the automated investment every month takes away the hassle of paperwork and manual investing, which usually pushes people towards dropping the idea on the whole.

4. Rupee Cost Averaging: This is not as difficult as the name sounds. You see, the equity markets are volatile. When you invest via an SIP, you buy units for the amount you invest. So, you buy more units in a bear market and less during a bull market. In the long run, this results in a low cost per unit as you average it.

Last but not least and possibly the biggest reason to invest via SIP.

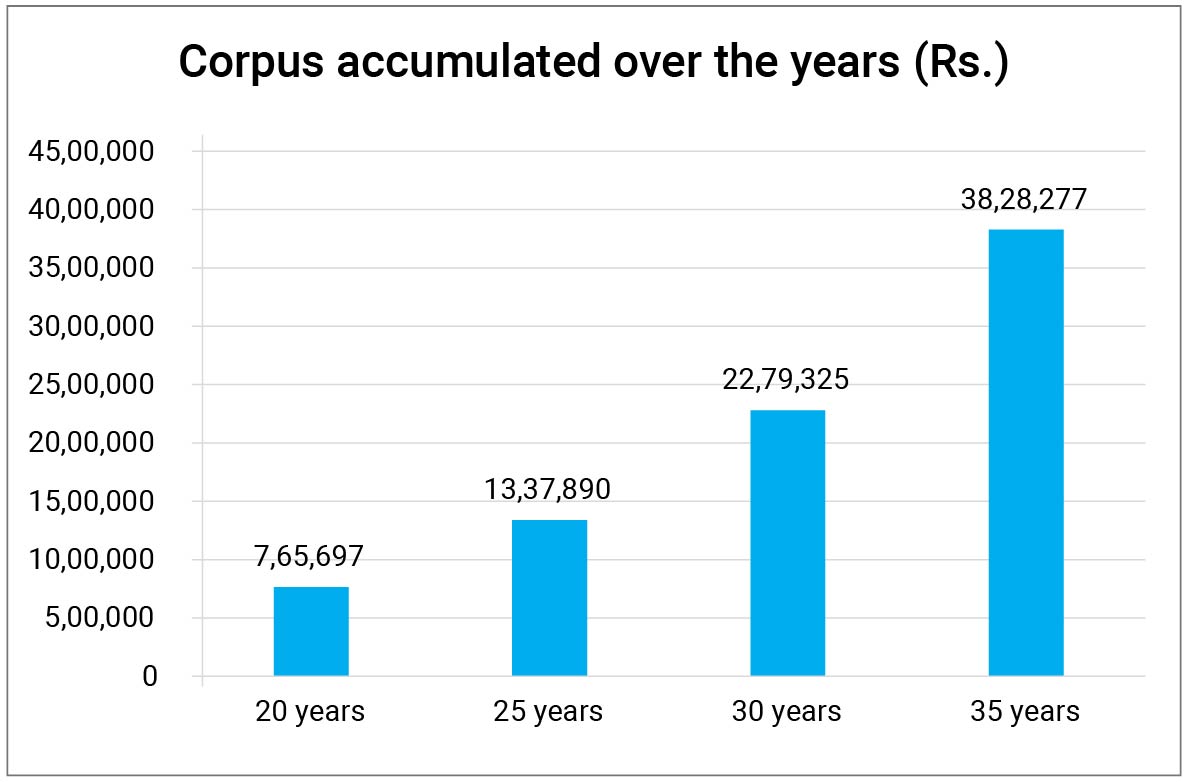

5. Grow your wealth with The Power of Compounding: Compounding is the ability of your investments to generate returns, which are then reinvested in order to generate their own returns.

In simpler words, the return you will earn from your invested amount will be re-invested, and thus increase your corpus amount.

It is a technique to make your money work harder for you...

Perhaps, power of compounding in SIP is the most powerful tool you can use to plan for many of the financial goals you plan to achieve.

And a Systematic Investment Plan (SIP) harnesses this power of compounding as you invest a set amount every month irrespective of the swings of the market.

The above illustration showcases corpus achieved at a monthly SIP of Rs. 1000 compounded @10% p.a. over a longer investment tenure. Investments through SIP are subject to market risk and do not assure a profit or returns or protection against a loss in a downturn market.

Thus, the mighty SIP is always a smart investor's choice to navigate market uncertainties and achieve their financial goals.

You now have all the information needed to make informed decisions.

Start investing right now and use the power of SIPs to achieve your financial goals.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

The SIP Investment Way To Build Wealth

Posted On Monday, Oct 25, 2021

If you are an investor – New or seasoned, there is no way you have not come across the term SIP Investment.

Read More -

Why Are Investors Coming Back To Equity Mutual Funds Through SIPs

Posted On Wednesday, Apr 28, 2021

SIP or systematic investment plan is a mode of investing in mutual funds and investors are coming back to SIPs.

Read More