The Road Ahead for Indian Bonds

Posted On Monday, Feb 24, 2025

With Donald Trump back in the White House, trade tariffs and anti-immigration policies are back in focus. The disinflation trend from 2023 and 2024 has stalled, and the US Federal Reserve has scaled back future rate cuts.

US Treasury yields remain elevated near 4.5%, and the US dollar continues to rise, exerting pressure on emerging market currencies, including the Indian Rupee. Domestically, liquidity conditions have tightened, and foreign exchange reserves have significantly dropped as the RBI steps in to defend the INR. (Refer Indian Bonds in a Volatile Global Landscape)

Amidst these developments, the Union Budget for FY 2025-2026 and the first monetary policy announcement by the new MPC and RBI Governor set the stage. In this edition of our DMO, we will assess the potential impact of these policies on the fixed income market, and our outlook moving forward.

India’s FY26 Budget: A Path to Fiscal Prudence and Inclusive Growth

The Budget reaffirms the Government's commitment to fiscal discipline while promoting inclusive, long-term economic growth aligned with the vision of 'Viksit Bharat'. With a strategic emphasis on four key growth drivers - Agriculture, MSMEs, Investment, and Exports - the Budget strikes a balance between immediate consumption support and long-term structural reforms.

The fiscal policy continues to prioritize reducing the fiscal deficit and overall public debt as a share of GDP, while directing limited resources towards measures that boost discretionary consumption, such as personal income tax cuts and incentives for employment-generating sectors like toys and footwear.

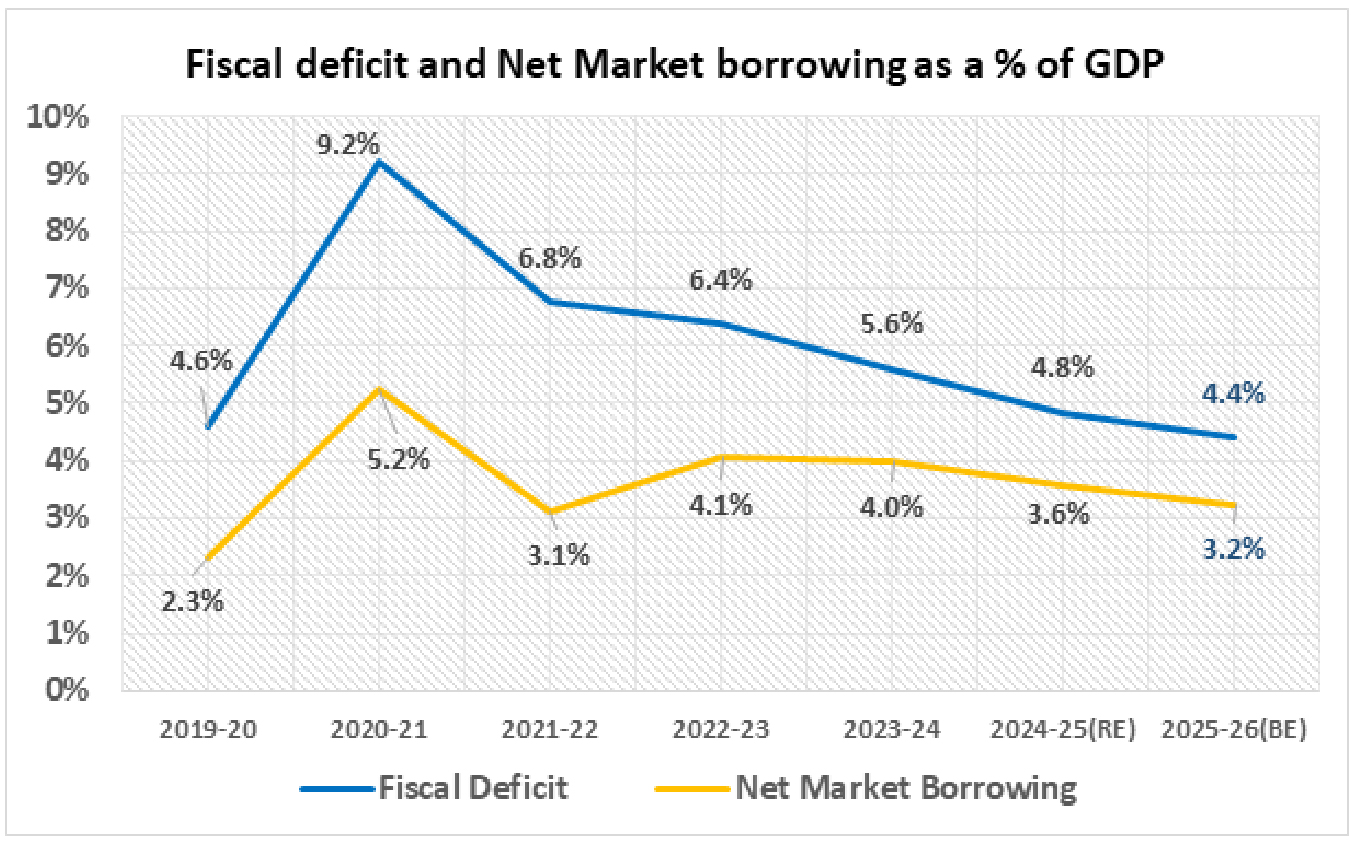

Chart – I: Strengthening Fiscal Health with Deficit Reduction and Lower Borrowing

Source: RBI, Union Budget documents for FY25-26, Quantum Research Graphics

With overall government expenditure and the fiscal deficit set to decline further in FY26, we view this Budget as non-inflationary, despite the consumption boost from income tax cuts.

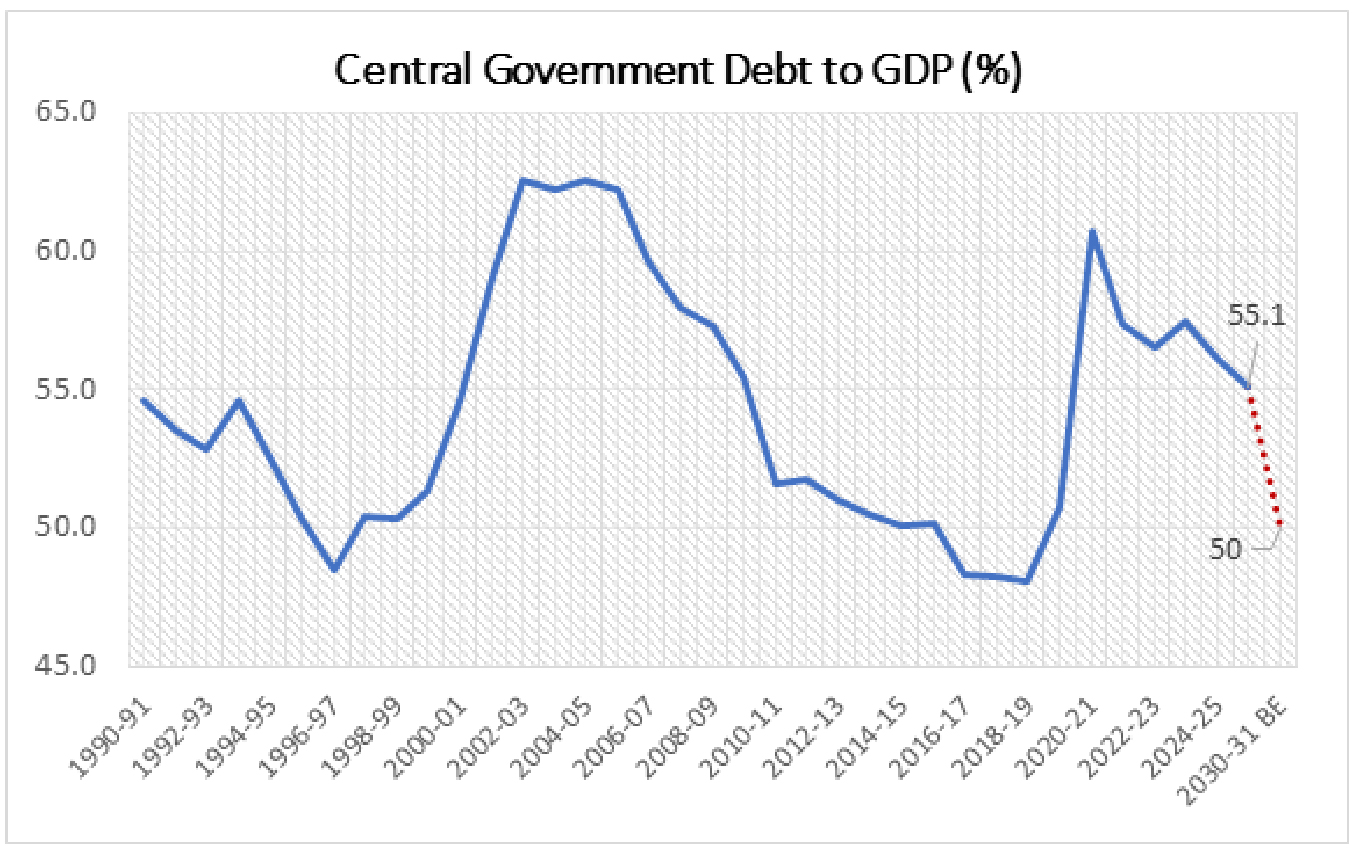

From the bond market's perspective, the government's fiscal policy is fundamentally positive, as the central government's debt-to-GDP ratio is projected to steadily decrease from the current 57.1% to below 50% by FY31. This suggests an annual fiscal deficit reduction of at least 0.2% of GDP after FY26.

Chart – II: Government borrowing as a % of GDP set to decline steadily over the years aiding sustainable economic growth

Source: RBI, CMIE, Union Budget documents for FY25-26, Quantum Research Graphics.

In FY 2025-26, the net government borrowing is pegged at Rs. 11.53 trillion, almost same as last year. However, as a percentage of GDP, net government bond issuance is projected to decrease from 3.6% in FY25 to 3.2% in FY26.

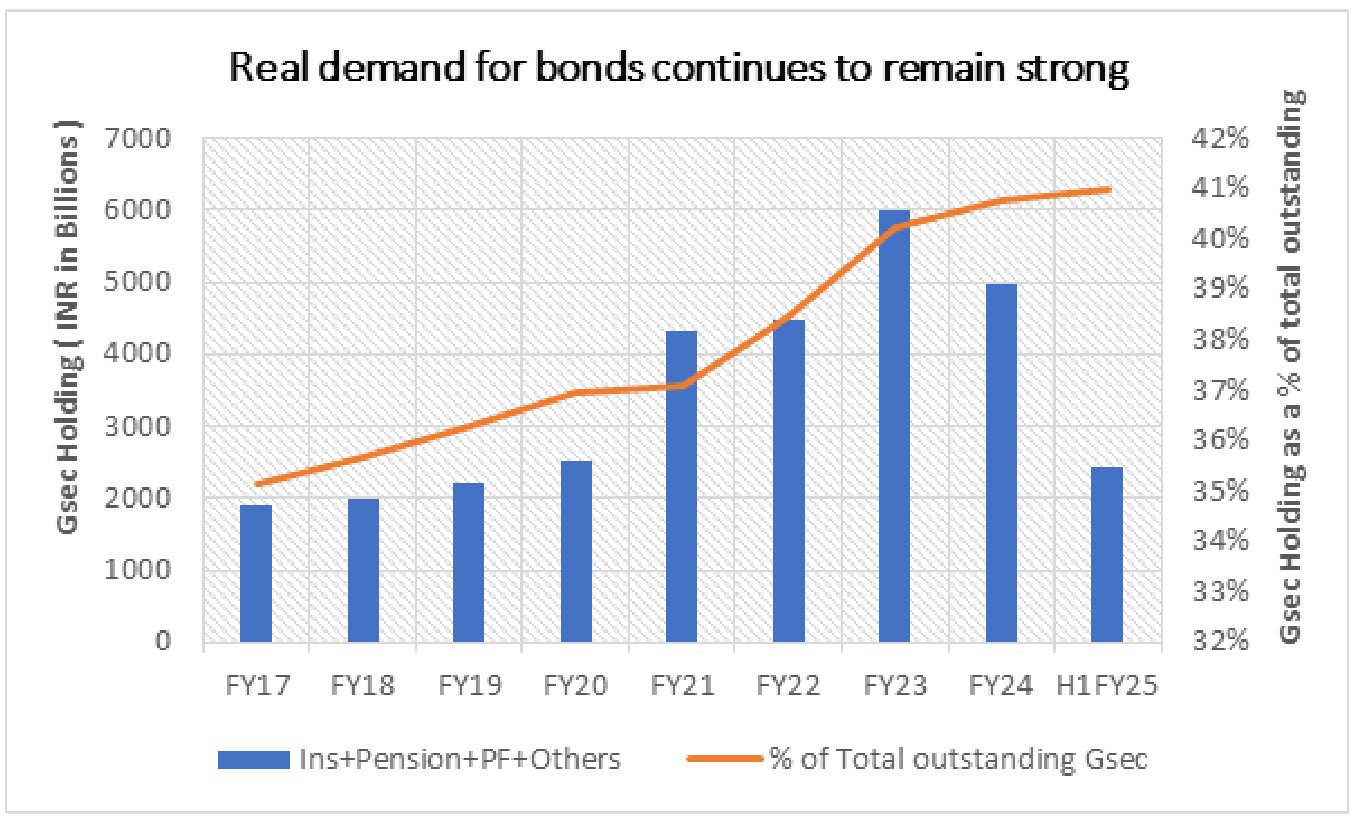

Chart III: Real demand for bonds from continued to show strengthen

Source: RBI, CMIE, Quantum Research Graphics. Data till September 30, 2024

To put this into perspective, if demand for government bonds from domestic banks, insurance companies, pension funds, and others grows in line with nominal GDP, we could face a supply shortage in the government bond market. Additionally, with potential RBI purchases (to ensure durable liquidity) and increasing foreign demand (driven by India’s inclusion in global bond indices), the demand-supply gap is likely to widen, with demand surpassing supply.

Inward focused monetary policy

Turning our focus to monetary policy, the global economic environment emerged as a significant challenge. However, the Monetary Policy Committee (MPC) of the RBI chose to prioritize domestic growth and inflation dynamics, initiating a rate-cutting cycle with a 25-basis point reduction in the repo rate. Given the prevailing global uncertainties, most market participants anticipate this to be a gradual rate-cut cycle, with cumulative cuts likely to range between 50 to 75 basis points. This cautious approach reflects the RBI's careful balancing act between fostering domestic growth and managing inflationary pressures.

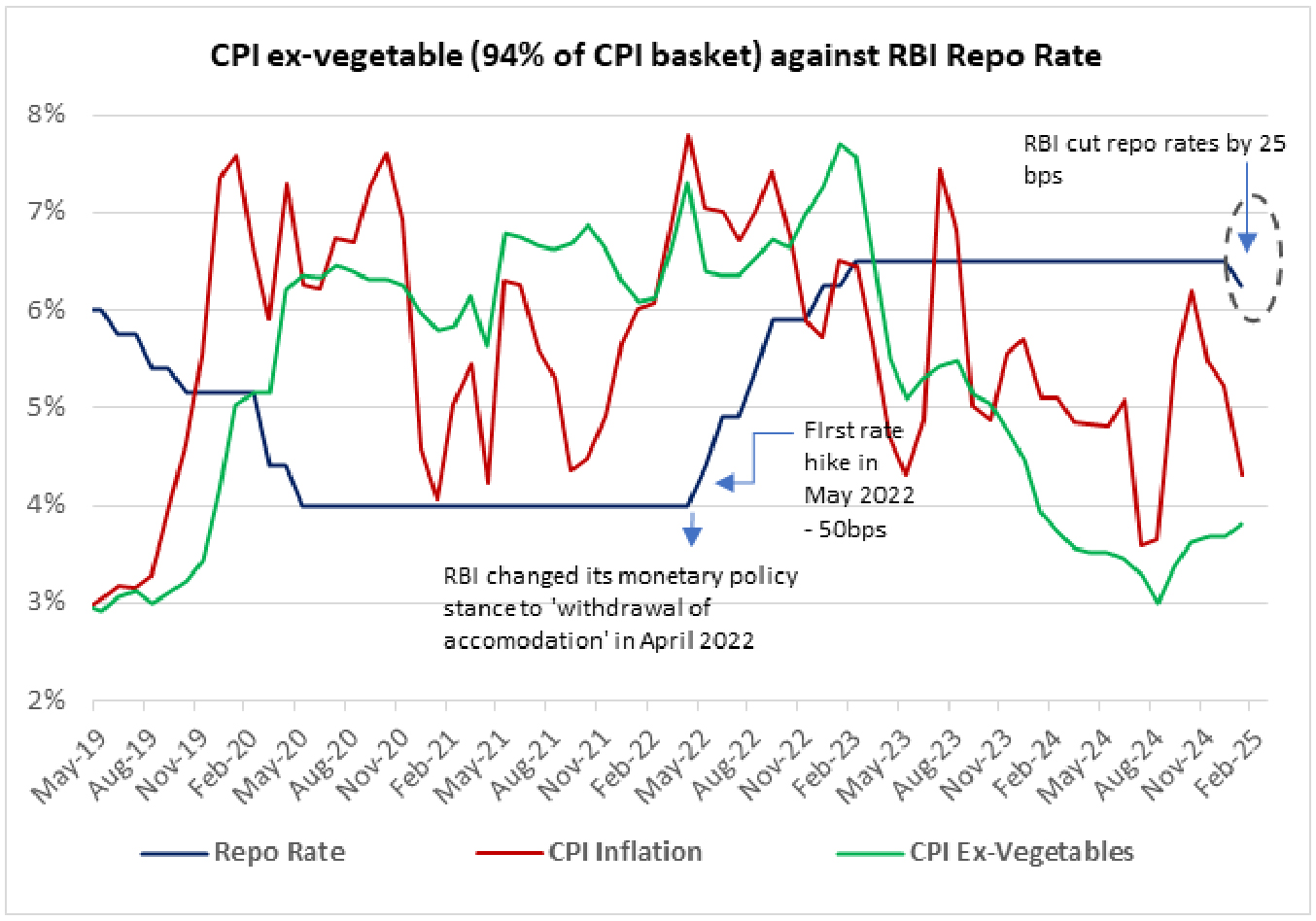

Chart – IV: With inflation trends moderating, the RBI slashed rates by 25 bps in February.

Source: MOSPI, RBI, Quantum Research Graphics. Data for CPI inflation and CPI ex-vegetables up to January 31, 2025. Data for Repo rate is as of February 07, 2025

Following the rate cut and a carefully balanced communication regarding the growth-inflation trade-off, there has been a clear dovish shift in the monetary policy. The policy stressed staying focused on inflation projections and enhancing its forecasts and nowcasts, indicating that the MPC will remain at ease with inflationary shocks as long as their estimates do not show a significant uptick.

However, despite this, the bond market reacted negatively, with bond prices falling and yields rising after the policy announcement. In our view, the market's disappointment stemmed from overly optimistic expectations about a shift to an "accommodative" policy stance and the anticipation of OMO (Open Market Operations) purchases being announced directly in the policy statement.

We believe the RBI has made a prudent decision in maintaining its 'neutral' policy stance, given the heightened global uncertainties and currency volatility. Looking ahead, we expect at least one more rate cut in April. If the current growth slowdown persists, further rate cuts could follow beyond April.

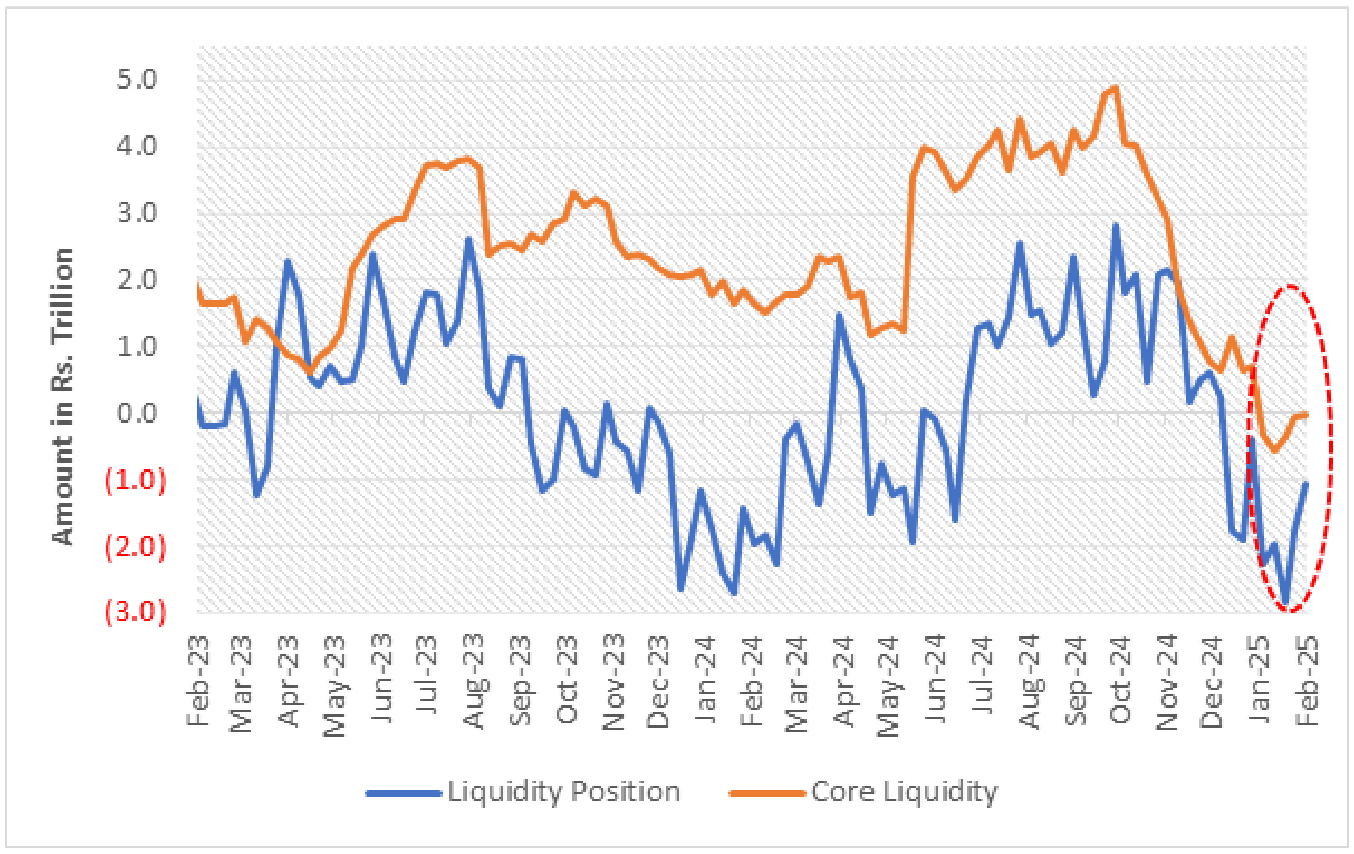

Chart – V: Banking system liquidity continues to remain tight; Core liquidity in deficit

Source: RBI, Quantum Research internal Calculations. Data up to Feb 07, 2025

While the RBI did not introduce immediate liquidity-boosting measures, it reiterated its commitment to ensuring sufficient system liquidity on an ongoing basis. Additionally, the RBI has already outlined an OMO purchase schedule through February 20, 2025.

Given the seasonal increase in cash demand and the RBI's short position of approximately USD 24 billion in the foreign exchange forward market, set to mature between February and March, durable liquidity is likely to tighten in the coming months. To mitigate the impact on banking system liquidity, the RBI may conduct additional open market operations (OMOs) of government bonds during March and April.

OUTLOOK:

Amidst global volatility, the Indian bond market has demonstrated remarkable resilience, with yields remaining within a narrow range. This stability is particularly evident when comparing the performance of the Indian and US bond markets: between September 24 and January 2025, the 10-year US Treasury yields have risen by more than 70 basis points, while the Indian 10-year government bond yield has declined by 6 basis points.

This contrast underscores the strength of the Indian bond market in the face of global market fluctuations.

With fiscal balances improving and monetary policy easing, the Indian bond market's resilience is likely to persist throughout 2025. The favourable demand-supply dynamics, along with potential rate cuts and continued central bank support through open market operations (OMOs), should help drive Indian bond yields lower. (Refer Indian Bonds in a Volatile Global Landscape)

Given these factors, we maintain a positive outlook for medium to long-duration bonds, expecting further declines in bond yields over the next 12 to 24 months (refer to "Bull Case Revisited"). However, we will remain vigilant to emerging risks and are prepared to adjust our outlook if circumstances require it.

What should Investors do?

In our view, dynamic bond funds are the ideal choice for long-term investors who can tolerate occasional market volatility.

These funds offer the flexibility to adjust portfolio positioning in response to changing market conditions.

For investors with shorter investment horizons and a low risk tolerance, liquid funds remain the more suitable option.

Portfolio Positioning

Scheme Name | Investment Approach |

The scheme invests in debt securities of up to 91 days of maturity issued by the government and selected public sector companies. | |

The scheme to invest in debt securities issued by the government and selected public sector companies. The scheme follows an active duration management strategy and increases/decreases the portfolio duration (sensitivity to interest rates changes) in accordance with the Interest Rate Outlook. Given our positive view on the bond market, we are maintaining reasonably high duration in the scheme with bulk of the assets in 10–40-year maturity bucket. |

Source - RBI, Blomberg, Refinitiv, MOSPI, CCIL, Quantum Internal Research

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author - Pankaj Pathak, Fund Manager - Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian - Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Read our last few Debt Market Observer write-ups -

- Indian Bonds in a Volatile Global Landscape

- Remain Positive but Turning Cautious

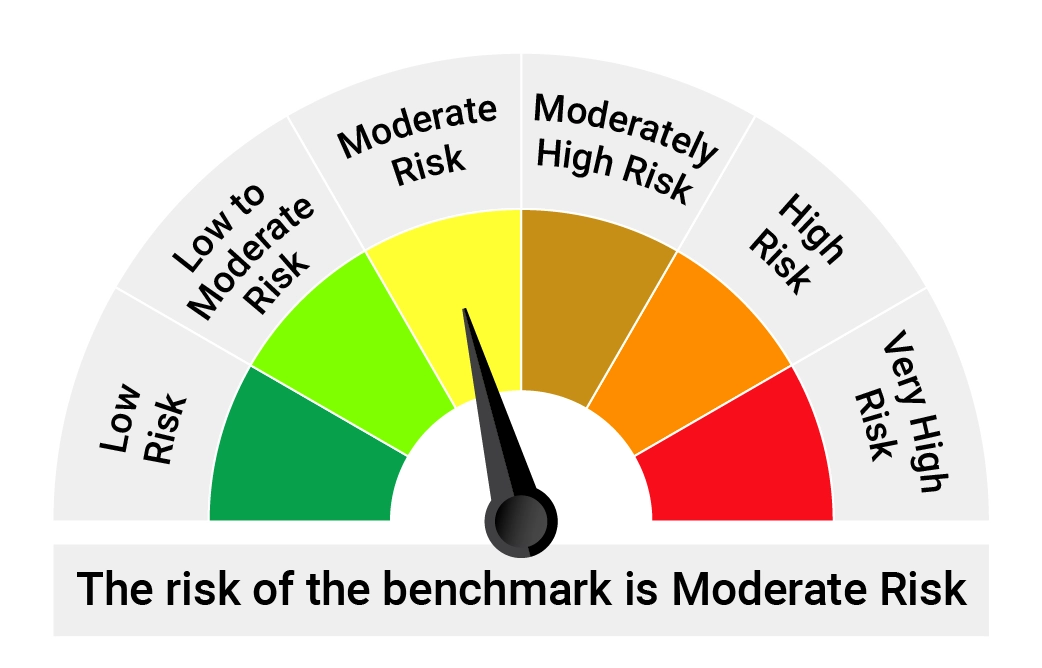

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of Scheme | Riskometer of Tier I Benchmark |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. Tier I Benchmark : CRISIL Liquid Debt A-I Index |

|  |  |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. Tier I Benchmark : CRISIL Dynamic Bond A-III Index |

|  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

The Pivot

Posted On Friday, Apr 21, 2023

The fiscal year 2022-23 has come to an end. The defining feature

Read More -

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Past, Present, and Future of Inflation

Posted On Friday, Feb 24, 2023

Inflation has been one of the biggest challenges in the post-pandemic world.

Read More