The Bull Case

Posted On Friday, Nov 24, 2023

Over the last two years, bond markets endured a historic jump in global inflation, fastest ever rate hikes by central banks across the globe, wild swings in commodity prices and intense geopolitical stress unseen in decades. The US treasuries, which are widely perceived to be risk-free asset, have been behaving like a penny stock with sharp moves in yields.

Amidst all the chaos, the Indian bond market has shown an unshakable resilience. Indian bond yields remained relatively stable trading between 7.0%-7.5% for most of this period. Credit spreads remained tight, and demand for bonds remained robust. Even foreign investors were buying Indian government bonds despite elevated interest rates around the globe.

There are still many reasons to be positive on the Indian bond market going forward.

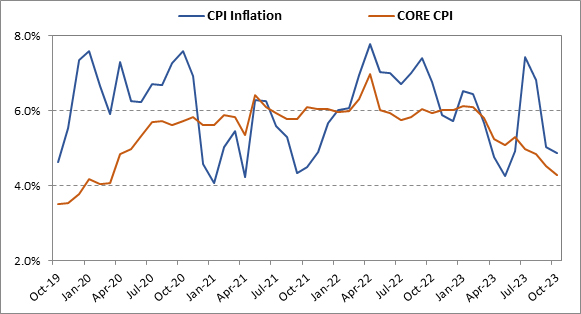

The Core Disinflation

The headline CPI inflation has been all over the place lately due to volatile food prices, mainly due to vegetables. From its peak of 7.44% in July 2023, it has now come down to a more comfortable level of 4.9% in October 2023.

However, a more significant disinflation has been witnessed in the Core CPI Inflation which excludes the volatile food and fuel index. Historically, the Core CPI have been more durable in nature – often showing the underlying inflation trend in the economy.

The Core-CPI has come down consistently since start of the year from over 6% in January 2023 to 4.27% in October 2023. Based on the current trend and general weakness in the broader demand outlook, the core CPI might fall further towards 3.8% by mid of next year. This should offset any potential upside move in food prices due to fall in agricultural production – keeping overall consumer inflation under check.

Chart – I: Falling Core Inflation (ex-Food and Fuel) to ease pressure from the RBI

Source – MOSPI, Quantum Research, Data upto October 2023

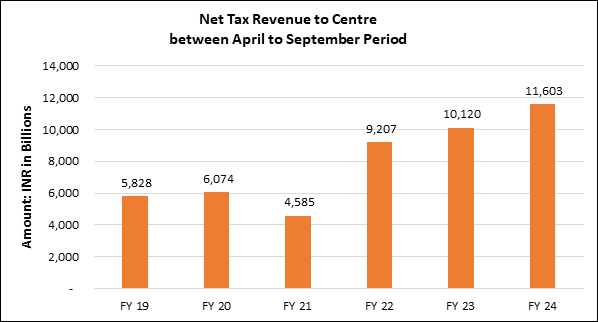

Fiscal Flexibility

Government’s tax collections have shown a healthy growth in the first half of the fiscal year 2023-24. As per the government’s press release, direct tax collections for FY24 up to October 9, 2023 have grown by 21.8% compared to same period last year. This is significantly higher than the government’s budgeted direct tax growth target of 10.5% YoY.

Chart – II: Tax Revenues continue to grow at a faster pace than budget estimates

Source – cga.nic.in, Quantum Research, Data upto September 30, 2023

Non-tax revenues have also shown a remarkable jump over the last year owing to the large dividend of Rs. 874 billion from the RBI. We expect other public sector companies particularly public sector banks to also deliver reasonable growth in dividend payouts to the government this year.

In our estimate, combination of tax and non-tax collections could provide government around Rs. 1.5 trillion extra revenues than their budget estimates. Even after adjusting for some shortfall in the disinvestment target, the government will likely have more than Rs. 1.2 trillion of extra cash this year. This can be used to reduce taxes on fuel or increasing welfare spending without stretching the government’s fiscal position. This also opens a possibility of reduction in government borrowing later in the year.

Collections under various small saving schemes of the government have also shown a robust 50% increase during April-August 2023 compared to the same period last year. This further boosts the chances for reduction in government borrowing.

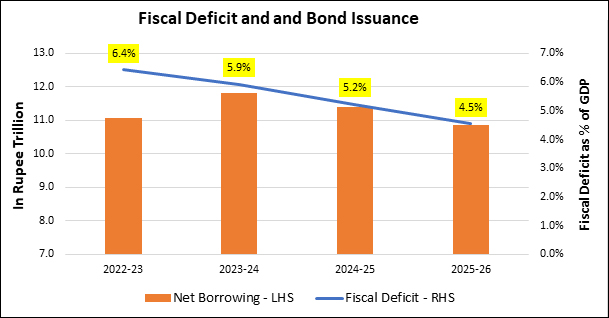

Demand Supply Balance

Demand supply balance in the bond market in likely to change significantly over the next two years. After expanding the fiscal deficit to 9.2% of GDP during pandemic shock in FY2020-21, the government has been on a path of fiscal consolidation.

The fiscal deficit for the current financial year 2023-24 is pegged at 5.9% of GDP. The government has set a target to bring down the fiscal deficit to under 4.5% of GDP by FY2025-26.

This implies that the net issuance of government bonds could also fall. We estimate reduction in net government bond supply by around Rs. 1.6 trillion over the next 2 years bringing it down to around Rs. 10.2 trillion in FY26 from current Rs. 11.8 trillion.

Chart – III: Fiscal consolidation will lead to significant reduction in bond supply over coming years

Source – IndianBudget.gov.in, Quantum Research, Data for FY25 and FY26 is based on Quantum Research team’s estimates

On the demand side, a healthy demand growth from long term investors like insurance, pensions, provident funds etc. is expected to continue in line with the growth in the nominal GDP. India’s inclusion in the global bond indices will also be supportive for demand in the bond market.

India will be included in the JP Morgan GBI EM Index starting June 2024 with an eventual 10% index weight to be reached in March 2025. This is expected to attract USD 25-40 billion of foreign inflows into Indian bonds over the next 12-15 months.

Read more about the potential impact of bond index inclusion - {Why Soaring Oil Prices Couldn't Dampen Market Mood}

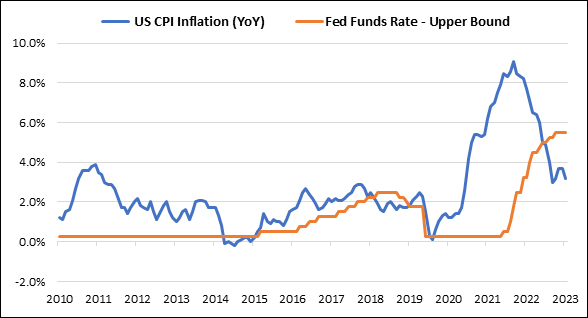

Global Tailwinds

Although the sharp rate hikes in the advanced economies did not move the Indian bond yields much, it did dampen the investor sentiment during the last two years.

The rate hiking cycle in the US and in many other advanced economies is now expected to have come to an end. There’s also an expectation that the US Fed will start cutting rate by mid-next year. This could turn the investors’ sentiment for the emerging market bonds too.

Chart – IV: Falling US inflation and high positive real rates – case for rate cuts in 2024

Source – Bloomberg, Quantum research, Data Upto November 20, 2023

Given the India’s inclusion in the global bond index, Indian bond stands to benefit significantly from the turn in global monetary policy cycle.

Monetary policy easing in the US and other developed economies might also take off some pressure from the RBI - giving way to a shallow rate cutting by the end of 2024.

Market Outlook

As discussed above, we expect falling inflation, favorable demand supply mix and an expectation of a reversal in the global monetary policy cycle shall be favorable for Indian bonds over the medium term.

Despite some cooling in bond yields relative to their peak in last month, bond valuations still look reasonable for medium to long duration bonds. The 10-year government bond is currently trading near 85 basis points above the policy repo rate. Given the policy repo rate is near cycle peak, this spread looks significantly higher than its historical average during peak rate environment.

In line with this view, we would use every rise in yield to extend the portfolio duration by accumulating long term bonds in a staggered manner.

What should Investors do?

With most of the government bond yield curve above 7.20%, there is decent accrual available at current levels. There is also a strong case for yields to decline over the next 1-2 years based on the reasons described above.

Investors with 2-3 years holding period can consider Dynamic bond funds which have flexibility to change the portfolio positioning as per the evolving market conditions.

Investors with shorter investment horizons and low-risk appetites should stick with liquid funds.

Portfolio Positioning

Scheme Name | Strategy |

The scheme invests in debt securities of up to 91 days of maturity issued by the government and selected public sector companies. | |

The scheme to invest in debt securities issued by the government and selected public sector companies. The scheme follows an active duration management strategy and increases/decreases the portfolio duration (sensitivity to interest rates changes) in accordance with the Interest Rate Outlook. Given sharp jump in yields last month, we have increased the portfolio duration of the fund in line with our positive medium-term outlook. We intend to keep portfolio duration high to benefit from potential fall in yields as per our view. |

Source – RBI, Quantum Mutual Fund

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author – Pankaj Pathak, Fund Manager – Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian – Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Read our last few Debt Market Observer write-ups -

- Geopolitics and Shifting Demand-Supply Balance

- Why Soaring Oil Prices Couldn't Dampen Market Mood

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. |

|  Investors understand that their principal will be at Low Risk |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. |

|  Investors understand that their principal will be at Moderate Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

The Pivot

Posted On Friday, Apr 21, 2023

The fiscal year 2022-23 has come to an end. The defining feature

Read More -

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Past, Present, and Future of Inflation

Posted On Friday, Feb 24, 2023

Inflation has been one of the biggest challenges in the post-pandemic world.

Read More