Target Equity Growth with a more Predictable Approach

Posted On Thursday, Dec 28, 2023

While markets will always remain uncertain and unpredictable, what if we told you could rely on a fund that follows Predictable Approach?

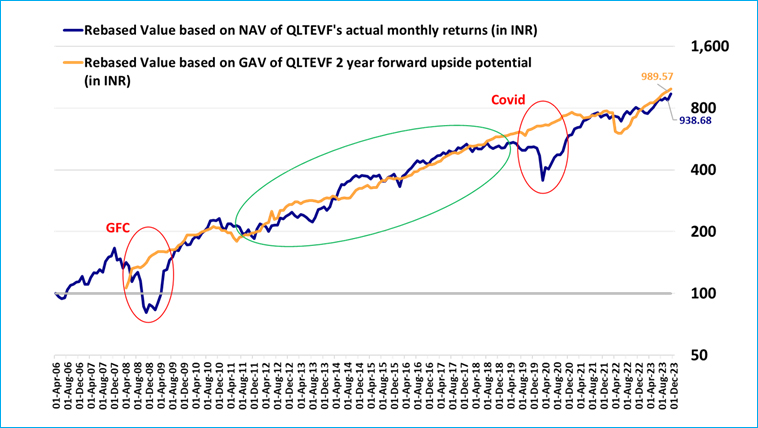

The Quantum Long Term Equity Value Fund’s track record is an indicator of the fund’s upside potential with a reasonable degree of certainty. Barring black swan events, the estimated NAV of Quantum Long Term Equity Value Fund based on upside potential of underlying stocks over the years has closely tracked the actual fund performance over the long-term. This helps illuminate the path to upside potential and ride the market movements with confidence.

Upside Potential, Gross and with Actual NAV Returns Delivered

The above graph shows the estimate of rebased GAV of Quantum Long Term Equity Value Fund – Direct Plan – Growth Option on the basis of Upside Potential of the portfolio (equal to the sum total of weight of each stock (multiplied by) the percentage difference between the current market price and the sell limits assigned to each stock in the portfolio by the in-house research teams). The performance returns are net of fees and expenses, and assuming reinvestment of all dividends and other earnings. Past performance may or may not be sustained in the future. The value axis for graph 2 has been plotted based on logarithmic scale of 2. Source: Internal Research, Bloomberg Finance L.P., As of Nov 30, 2023.

The fund is focused on buying companies that are undervalued relative to its historical average. When you invest with a fund that invests with companies trading at a discount to its intrinsic value, you lower the downside risks that arise due to uncertainties.

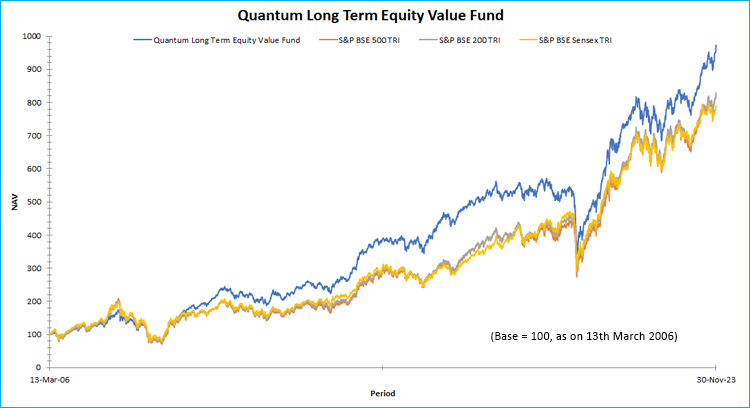

QLTEVF Outperformance across Market Cycles (Mar 2006 – Nov 2023)

Data as on 30th November 2023 Past performance may or may not be sustained in future. This graph should be reviewed in conjunction with detailed performance of the scheme provided below.

Quantum has demonstrated the ability to predict upside potential and deliver consistent risk adjusted returns over market cycles.

Looking ahead, we believe that there is a good room for upside potential due to broad-based economic growth and sustained earnings.

✔ Stable Policy Environment: The election results were as per expectations and investors anticipate the policy environment is likely to be stable for a longer period.

✔ Sustained Corporate Earnings: Earnings growth remains resilient, supportive of broad-based earnings recovery.

✔ Robust Balance Sheets: Balance sheets have been deleveraged which means that companies are in their best position to take risks in terms of expansion of capacity.

✔ Pickup in Domestic Demand: Rural consumption especially 2-Wheeler volumes is picking up.

✔ FII Flows Return: After the large outflow during October, FIIs turned buyers with inflow of USD 2.3bn in the month of November. DIIs were net buyers with $1.7bn inflows.

✔ Moderating Inflation: Equities across the globe rallied in November, as corporate earnings benefited due to moderation in inflation and energy prices.

✔ China+1: Exports of Goods & Services have seen a steady rise as India is featuring more and more in China+1 and global supply chain discussions.

When compared with other equity investments, Quantum Long Term Equity Value Fund (Long Term Value with ‘Values’) falls at the lower end of the risk-reward spectrum, acting as an anchor to your equity portfolio, delivering commensurate returns for the risk it takes. Quantum Long Term Equity Value Fund is the foundation and crucial component (45%) of your diversified equity portfolio, as part of Quantum’s 12| 20:80 Asset Allocation Strategy.

Quantum Long Term Equity Value Fund – USP’s

A lumpsum investment of Rs. 10,000 since inception in this fund (Mar 13, 2006) would have grown to Rs.97,280 as of Nov 30, 2023 with a return of 13.69% CAGR versus its benchmark Tier- 1 S&P BSE 500 TRI (12.63%) and S&P BSE 200 TRI (12.65%).

The unique upside potential chart provides predictable outcomes and has proven to generate returns over the long term. As we step into 2024, let Quantum illuminate your path to a year filled with stability and success!

Choose Predictable Investing

|

Your Investment of ₹10,000 would have performed as below table with respect to benchmarks.

| Performance of the Scheme | Direct Plan | |||||||

| Quantum Long Term Equity Value Fund - Growth Option | ||||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark# Returns (%) | Tier 2 - Benchmark## Returns (%) | Additional Benchmark Returns (%)## | Scheme (₹) | Tier 1 - Benchmark# Returns (₹) | Tier 2 - Benchmark## Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (13th Mar 2006) | 13.69% | 12.66% | 12.67% | 12.36% | 97,280 | 82,835 | 82,964 | 78,949 |

| November 29, 2013 to November 30, 2023 (10 years) | 13.76% | 15.58% | 15.22% | 13.86% | 36,353 | 42,600 | 41,268 | 36,667 |

| November 30, 2016 to November 30, 2023 (7 years) | 11.83% | 15.70% | 15.49% | 15.46% | 21,885 | 27,766 | 27,414 | 27,359 |

| November 30, 2018 to November 30, 2023 (5 years) | 12.76% | 16.00% | 15.48% | 14.46% | 18,234 | 21,015 | 20,546 | 19,649 |

| November 27, 2020 to November 30, 2023 (3 years) | 19.00% | 20.21% | 19.08% | 16.27% | 16,874 | 17,397 | 16,909 | 15,738 |

| November 30, 2022 to November 30, 2023 (1 year) | 16.16% | 13.44% | 11.21% | 7.59% | 11,616 | 11,344 | 11,121 | 10,759 |

#S&P BSE 500 TRI, ##S&P BSE 200 TRI, ###S&P BSE Sensex.

Past performance may or may not be sustained in the future.

Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#with effect from December 01, 2021 Tier I benchmark has been updated as S&P BSE 500 TRI. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR S&P BSE 500 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

##TRI data is not available since inception of the scheme, Tier II benchmark performance is calculated using composite CAGR S&P BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

The Scheme is co-managed by Mr. George Thomas & Mr. Christy Mathai. Mr. George Thomas is the Fund Manager managing the scheme since April 1, 2022. Mr. Christy Mathai is the Fund Manager managing the scheme since November 23, 2022.

For other Schemes Managed by Mr. George Thomas & Mr. Christy Mathai, please Click here.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Riskometer of Tier I Benchmark and Tier II Benchmark |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy Tier I Benchmark : S&P BSE 500 TRI Tier II Benchmark : S&P BSE 200 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund www.QuantumAMC.com.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Target Equity Growth with a more Predictable Approach

Posted On Thursday, Dec 28, 2023

While markets will always remain uncertain and unpredictable, what if we told you could rely on a fund that offers you more predictability?

Read More