Portfolio Released: A Sneak Peek into Our Small Cap Portfolio!

Posted On Wednesday, Dec 13, 2023

We believe that within the realm of small caps lie opportunities that can generate good returns, and we are excited to present a firsthand look at our carefully curated portfolio. Our team has been hard at work scouting for quality companies – small-cap stocks with good growth potential. As per our investment methodology, we are sector agnostic and are open to all bottom-up stories that show growth potential. It is a portfolio where every sector plays a unique value addition. The small cap index is more diversified as compared to large cap index offering exposure to new & emerging themes like Green Energy, EV penetration, Niche services. The Quantum Small Cap Fund is a curated collection that doesn't just follow trends but sets them, capturing the essence of the small cap market's untapped potential.

Small Caps more diverse than large caps

As you can see, the S&P BSE Small Cap Index offers exposure to niche sectors and emerging themes which are not generally covered by large caps.

| Sector | S&P BSE Small Cap Index | BSE Sensex Index |

| Finance | 18.33 | 38.90 |

| Capital Goods | 15.26 | 4.99 |

| Healthcare | 10.8 | 1.71 |

| Information Technology | 7.27 | 15.30 |

| Housing Related | 5.16 | 1.34 |

| Chemical & Petrochemical | 5.03 | 1.89 |

| Miscellaneous | 4.86 | 0.00 |

| FMCG | 4.15 | 9.31 |

| Consumer Durables | 3.88 | 1.86 |

| Agriculture | 3.42 | 0.00 |

| Metal, Metal Products & Mining | 3.39 | 2.30 |

| Transport Equipment | 3.18 | 5.48 |

| Power | 2.96 | 2.87 |

| Tourism | 2.53 | 0.00 |

| Telecom | 1.96 | 3.23 |

| Oil & Gas | 1.81 | 10.83 |

| Transport Services | 1.66 | 0.00 |

| Media & Publishing | 1.43 | 0.00 |

| Diversified | 1.4 | 0.00 |

| Textile | 1.37 | 0.00 |

| Other | 0.15 | 0.00 |

| Total | 100 | 100 |

Data As on: October 31, 2023 Source: BSE, Compiled By: Quantum AMC

We are happy to announce that our Small Cap Fund has completed its portfolio construction & here’s an overview of the major sectors we have allocated to.

| Top 5 Sectors QSCF | Weight |

| Finance | 13.66% |

| IT | 5.12% |

| Consumer Durables | 3.87% |

| Commercial Services & Supplies | 3.82% |

| Gas | 2.11% |

As you can see, the portfolio has good weightage towards finance sector with exposure to banks & financial services. We believe that the future of financial sector is bright on the back of robust credit growth and strengthened balance sheets. Corporates now have more appetite to borrow money with the deleveraging of balance sheets. Indian banking system has opportunity to lend further offering scope for upside potential.

With rural consumption picking up, the portfolio offers allocation to consumer durables and auto sector, particularly in the auto ancillary segment with exposure to the burgeoning EV space. The portfolio also has some companies in the IT sector where we feel the worst is behind us and Indian companies have a long run-way in terms of increasing market share in global services.

The portfolio has exposure to stocks which are financing renewable energy projects. We have meticulously selected each company based on their disruptive potential, innovation, and robust fundamentals.

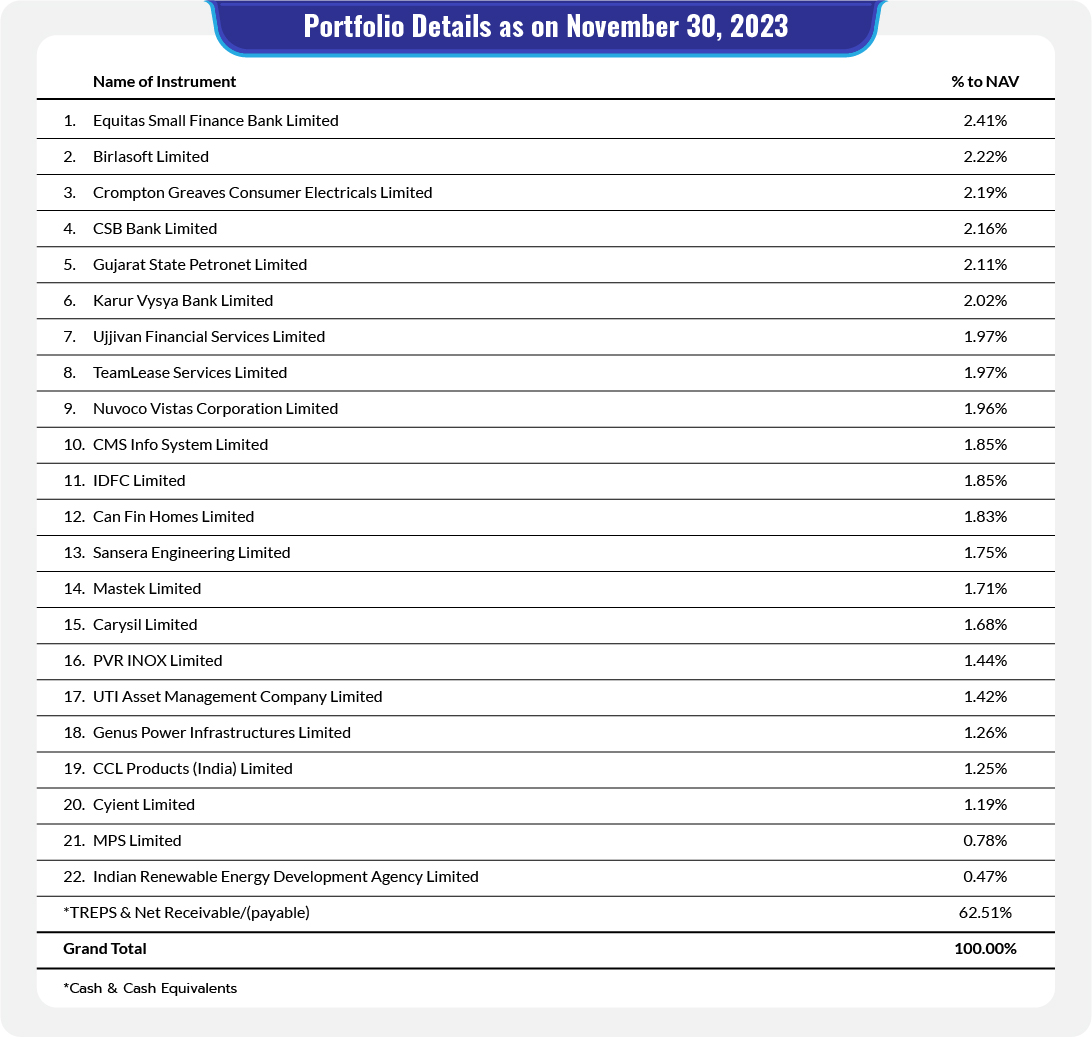

Here’s an overview of the Portfolio Details:

For complete portfolio view latest factsheet.

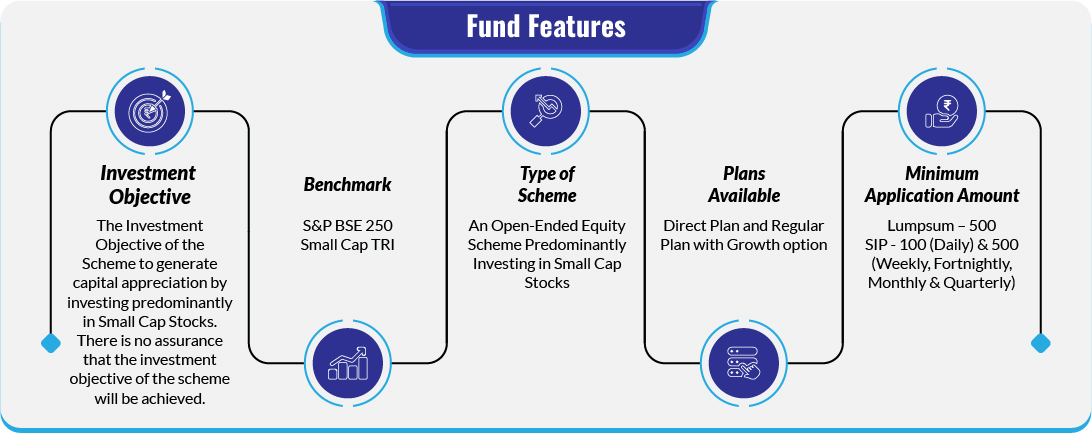

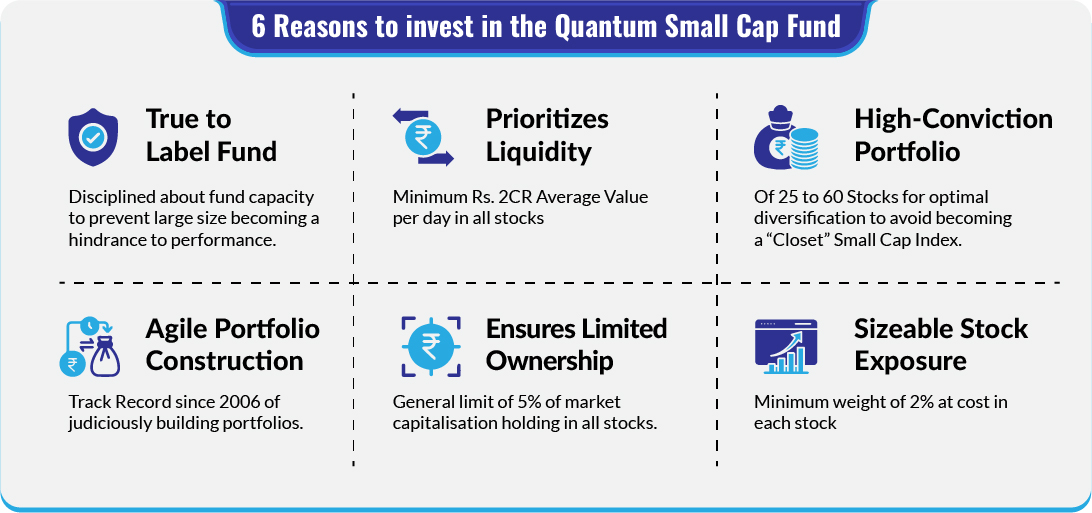

We do as we say and say as we do. Liquidity, Strong fundamentals, integrity & valuations have been the underlying parameters that we use to filter our equity portfolio. Our Quantum Small Cap Fund is built on the back of this robust investment process that screens out a high conviction portfolio of 25-60 stocks after using intensive fundamental analysis (both quantitative and qualitative).

Please refer Scheme Information Document of the Scheme for complete Investment Strategy

These are companies based on sustainable business model, high standards of corporate governance and does not compromise on growth while being mindful of valuations through its GARP based screening (Growth at Reasonable Valuation).

If you are looking to open doors to new opportunities for wealth creation in your equity investments, small caps offer you that possibility. The fund has potential to deliver long term risk adjusted returns. Explore opportunities in the small-cap space with Quantum Small Cap Fund. For more details as to how much to allocate in this fund, you can make use of our handy asset allocation calculator.

Watch this space as we will be sharing insights on Small Cap Fund Portfolio as it evolves & matures. In essence, scheme portfolio is not just an investment; it's the potential to shine brighter in your equity investing journey.

|

|

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Riskometer of Tier I Benchmark and Tier II Benchmark |

Quantum Small Cap Fund An Open Ended-Equity Scheme Predominantly Investing in Small Cap Stocks Tier I Benchmark: S&P BSE 250 Small Cap TRI | • Long term capital appreciation • Investment in Small Cap Stock |  Investors understand that their principal will be at Moderately High Risk |  Investors understand that their principal will be at Very High Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund www.QuantumAMC.com.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Portfolio Released: A Sneak Peek into Our Small Cap Portfolio!

Posted On Wednesday, Dec 13, 2023

We believe that within the realm of small caps lie opportunities that can generate remarkable returns

Read More