Looking Through the Noise

Posted On Thursday, Aug 24, 2023

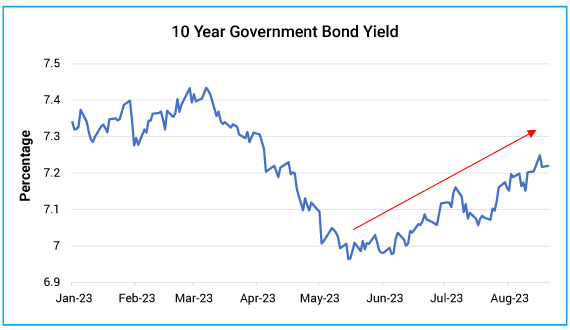

In the bond market, the sentiment pendulum has swung from one extreme to another over the last two months. Relentless rise in the US treasury yields and surprise jump in domestic inflation have rattled the investor sentiment in the Indian bond markets pushing bond yields higher and prices lower.

The 10-year Indian government bond (Gsec) yield which had fallen to lows of 6.95% in May, has jumped to the peak of 7.26%, before pulling back to the current levels of 7.22% on August 21, 2023.

Chart – I: Indian yields tracking UST, Crude and Inflation on way up

Source – Refinitiv, Quantum Research, Data as of Aug 21, 2023

Past Performance may or may not sustain in future

The underlying forces driving the bond yields over the last two months, continue to remain uncomforting -

- The US 10-year treasury yield, after rising sharply from levels of 3.5% during May 2023, is now holding above 4.2%

- The Crude oil price has risen more than 16% over the last two months and is still holding above the USD 85/barrel.

- The headline consumer price inflation in India jumped to 15 months high of 7.44% in July 2023 and expected to remain elevated for the next few months.

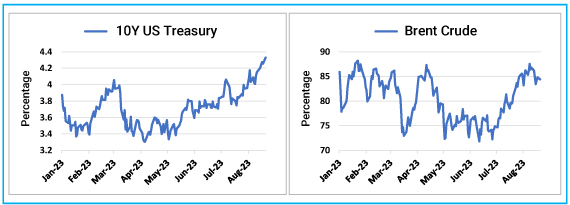

Chart – II: US treasury yields moving higher on resilient growth data and heavy supply

Source – Refinitiv, Quantum Research, Data as of Aug 21, 2023

Past Performance may or may not sustain in future

Tipping Point

The recent significant jump in the US treasury yields seems justified given - (1) the resilience shown by the US economy and the labour markets, and (2) sharp jump in treasury issuances.

However, for long term yields to go even higher and sustain there would require incremental strengthening of economic activity and serious worsening of future inflation trajectory. These conditions seem unlikely to hold given the synchronised global monetary policy tightening will continue to put restraint on demand.

We also note that interest rates in most of the developed world are at a level not seen in long time. The financial system in many places including the US is not accustomed to this high interest rates. This makes the financial system vulnerable to shock if the current level of US treasury rates sustains for long or move higher.

We have seen some short episodes of financial system vulnerabilities during September 2022 in the UK pension funds and during Mar 2023 in the US regional bank crisis. Once again, the financial condition in the US is tightening quickly. This is at a time when the corporate default rate is also showing an uptick.

In our opinion, the financial system risks should outweigh the supply risk in the US treasuries. We see higher probability of long-term US treasury yields coming down than moving higher.

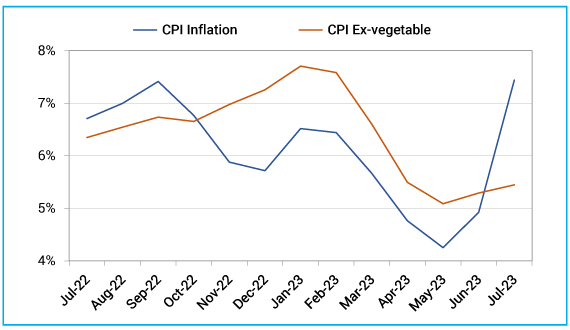

Inflation havoc

In India, the inflation momentum was falling since start of the year until May, when vegetable prices started to rise sharply. The CPI inflation spiked to 15 months high in July to 7.44% as against average inflation of 4.65% between April- June 2023.

However, the pickup in inflation was not broad-based. It was almost entirely contributed by the sharp surge in food prices especially that of cereals (11.02% yoy), Milk (8.02%), vegetables (33.96%), pulses (12.08%) and spices (20.09%).

These items constitute 27.2% of the CPI basket but contributed more than 65% to the total headline inflation in July. Rise in tomato prices alone contributed 114 basis points to the headline CPI.

CPI inflation excluding vegetable remained same as the previous month at 5.4% in July. The Core CPI which excludes the volatile food and fuel prices, dropped to 5.0%.

Chart – III: CPI Inflation spiked to 15 months high led by surge in food prices

Source – Mospi, Quantum Research, Data as of Aug 14, 2023

Past Performance may or may not sustain in future

Going by the history, impact of vegetable prices should be transitory. As the fresh produce come in September-October, vegetable prices should fall. We are already noticing some cooling off in the prices of tomatoes.

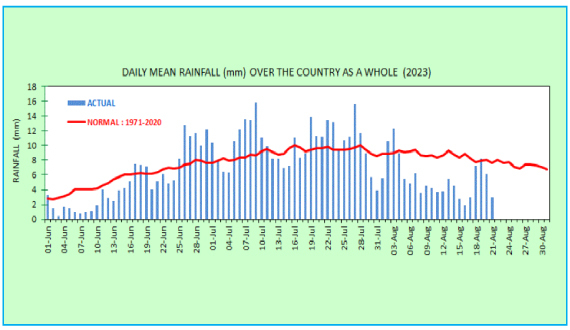

Although kharif sowing started late due to delayed monsoon, it picked up quickly during July and August as monsoon spread widened. As on August 18, 2023, overall area sown under Kharif crops stood at 102.3 million hectares which is 0.1% higher than previous year.

Chart – IV: Kharif sowing started late but recovering fast

| Sr. No. | Crops | Normal area | Area Sown (Million Hectare) 2023 | 2022 | % YOY | |

| 1 | Rice | 39.9 | 36.1 | 34.6 | 4.34% |

| 2 | Total Pulses | 14.0 | 11.5 | 12.7 | -9.16% |

| 3 | Total Oilseeds | 18.2 | 17.6 | 17.4 | 1.61% |

| 4 | Total Oilseeds | 18.6 | 18.6 | 18.9 | -1.68% |

| 5 | Sugarcane | 4.9 | 5.6 | 5.5 | 1.34% |

| 6 | Total Jute and Mesta | 0.7 | 0.7 | 0.7 | -5.61% |

| 7 | Cotton | 12.9 | 12.2 | 12.4 | -1.89% |

| Grand Total | 109.2 | 102.3 | 102.1 | 0.10% | |

Source – Agricoop, Data as of Aug 21, 2023

Nevertheless, there could be some more upside pressure on cereals due to rising international prices and on pulses due to lower sowing during the current Kharif season.

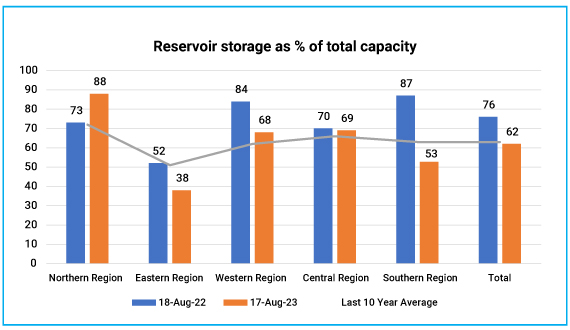

There is also a risk that lower rainfall in some areas could affect the quality of kharif production and the Rabi sowing later in the year which mostly depends on the accumulated water during the southwest monsoon.

Chart- V: Uneven Monsoon distribution poses risk to Rabi Crops

| Region | Actual | Normal | % Departure from Long Period Average |

| EAST AND NORTHEAST INDIA | 776.3 | 971.0 | -20% |

| NORTHWEST INDIA | 452.2 | 426.7 | 6% |

| CENTRAL INDIA | 688.7 | 703 | -2% |

| SOUTH PENNINSULA INDIA | 431.1 | 494.6 | -13% |

| COUNTRY AS WHOLE | 579.3 | 619.8 | -7% |

Source - IMD, Agricoop, Data as of Aug 21, 2023

The government has a decent history of keeping food prices under check by proactively managing the demand supply in the market. As food prices moved up, they have started to intervene actively through open market sale of many impacted food items like rice, pulses, tomatoes, and onions. We expect these supply side interventions to bring down the food inflation over coming months.

For the non-food inflation, we continue to expect the disinflationary momentum to continue (Past, Present and Future of Inflation) as the sluggish recovery of consumption demand and expanded corporate margins would keep prices stable at the consumers’ level. Slowing Chinese economy should also be helpful in keeping commodity prices under check.

To summarize, the headline CPI might remain elevated for the next 2-3 months due to vegetable prices. It could also push the average CPI for the FY24 to near or above 5.5%. However, much of it is due to a transitory price shock in vegetable price in the last two months and have no impact on the underlying inflation momentum.

We expect the headline CPI inflation to converge towards the Core CPI Inflation of 5% by the early 2024.

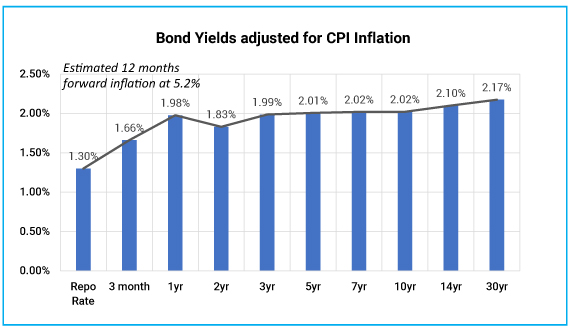

Bond Outlook

The near-term uncertainty about the global interest rates and domestic inflation might keep bond yields elevated in near term. However, looking through all the near-term noises, the medium-term outlook for bonds looks favourable supported by peaked policy rates, comfortable liquidity condition and strong external position.

After recent rise in bond yields, valuations have also improved. We see limited upside in yields from current levels as the overall macro backdrop is favourable.

In line with this view, we would use every rise in yield to extend the portfolio duration by accumulating long term bonds in a staggered manner.

What should Investors do?

With most of the government bond yield curve above 7.2%, there is decent accrual available at current levels. Even in the real term (adjusted for inflation), government bonds are offering meaningful positive real yield. With expected CPI inflation of 5.2% (RBI’s Q1FY25 inflation estimate) and a 1-year Gsec yield at 7%, the real yield is around 180 basis points.

Chart- VI: Real yields are positive and reasonably high

Source – Refinitiv, Quantum Research, Data as of Aug 21, 2023

Investors with 2-3 years holding period can consider Dynamic bond funds which have flexibility to change the portfolio positioning as per the evolving market conditions.

Investors with shorter investment horizons and low-risk appetites should stick with liquid funds.

Portfolio Positioning

Scheme Name | Strategy |

The scheme invests in debt securities of up to 91 days of maturity issued by the government and selected public sector companies. | |

The scheme to invest in debt securities issued by the government and selected public sector companies. The scheme follows an active duration management strategy and increases/decreases the portfolio duration (sensitivity to interest rates changes) in accordance with the Interest Rate Outlook. Given our favourable medium-term view and reasonable valuation in long term bonds, we have extended the portfolio maturity of the scheme. However, we are ready to act quickly to market developments and upcoming data points. |

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author – Pankaj Pathak, Fund Manager – Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian – Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Read our last few Debt Market Observer write-ups -

- The Last Lap

- Are Long Bonds Overvalued?

Portfolio Information Scheme Name: Quantum Liquid Fund | |

| Description (if any) | |

Annualised Portfolio YTM*: | 6.67% |

Macaulay Duration | 28 days |

Residual Maturity | 28 days |

As on (Date) | 31-07-2023 |

*in case of semi annual YTM, it will be annualised

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. |

|  Investors understand that their principal will be at Low Risk |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. |

|  Investors understand that their principal will be at Low to Moderate Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

The Pivot

Posted On Friday, Apr 21, 2023

The fiscal year 2022-23 has come to an end. The defining feature

Read More -

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Past, Present, and Future of Inflation

Posted On Friday, Feb 24, 2023

Inflation has been one of the biggest challenges in the post-pandemic world.

Read More