Emergency Funds as an Indicator of your Risk Appetite

Posted On Monday, Oct 17, 2022

Everyone thinks of investments, especially in equity markets as ‘risky’. Undoubtedly, equity mutual funds tend to be riskier than fixed income funds. Generally, greater the risk, greater is the reward (or potential for higher returns). As you begin your journey as an investor in Mutual Funds, you will realize that financial planning websites and tools will ask you numerous and often hard to answer questions to define your risk taking ability. It is important that you understand your risk appetite before investing.

If you don’t know risk – how can you gauge whether the investments you make justify the returns? Your risk appetite changes depending on the time you want to stay invested, your age, and your financial goals etc.

Emergency Funds as an Indicator of your Risk Appetite

At Quantum, we look at Emergency Funds as the amount you need to keep aside so that in the event of an adverse situation, such as COVID, loss of job, illness etc, your financial planning and day to day life do not get negatively impacted.

An easy way to calculate this:

Emergency Funds = X times your Monthly Expenses

Emergency Funds can serve as an indicator of your risk appetite. Depending on your risk appetite, the multiple changes and hence the size of the emergency corpus.In other words, risk appetite is the amount of risk you are willing to accept to achieve returns for your financial goals. If you are young and have no significant financial obligations and dependents yet, you may set aside an emergency corpus equivalent to 6 months. On the other hand, if you are older or nearing retirement, or have an EMI to pay off, you will need a large reserve for a rainy day, equivalent to 24 months of monthly expenses or more.

In short, the lower the risk appetite, the higher the emergency reserves, and vice versa.

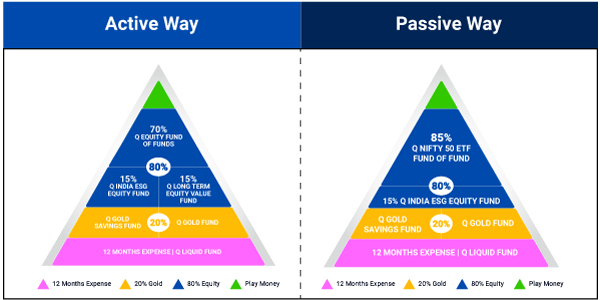

Quantum’s 12:20:80 Asset Allocation Strategy

As per our tried and tested 12:20:80 Asset Allocation Strategy, we suggest that an investor, keep aside an emergency fund equivalent to your consumption pattern for 12 months.

For example, if your monthly expenses are Rs 100,000 then your emergency fund could be 100,000x12 = Rs.12,00,000. However, as mentioned above, depending on your risk appetite, you can personalize your emergency reserves from a range of 6 months to 36 months of monthly expenses.

Try our easy-to-use12:20:80 Asset Allocation (Baarah, Bees aur Assi) calculator on our website to help you determine how much you need to set aside for your emergency reserves.

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation

Your investable surplus can be allocated to the other building blocks – portfolio diversifying block and growth block using gold and equity funds respectively. Click here to know more

Irrespective of which style of investing you prefer, be it active or passive, Quantum Liquid Funds offer form the core building block upon which the other investments are added.

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation

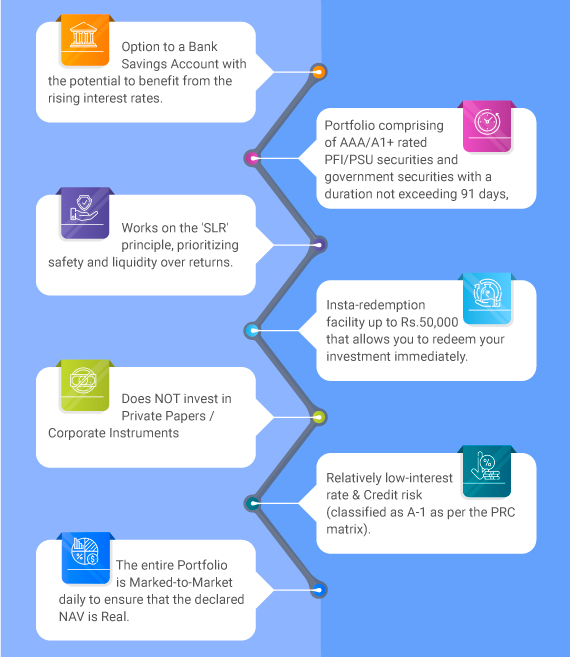

Park your Emergency Funds in Quantum’s Liquid Fund for these Reasons:

Get Started on the Financial Journey

Most employees receive their bonus around this time. If you are one of them, this may be a good opportunity to use a part of your bonus to create or enhance your emergency fund depending on your risk appetite. If you are beginning to save, you can start with one month and then gradually build it up from there.

When the basics are in shape, one can strategize and quickly embark on a financial journey that helps focus on larger goals for life. The contingencies in life cannot be avoided but reactions to the contingencies can be planned. Being prepared helps to reduce stress and anxiety and allows managing uncertainties in a better manner.

It matters being well-acquainted with the level of risk you’re comfortable with taking on before you embark on strengthening your financial health.

So, go ahead and invest in the Quantum Liquid Fund to have a fall-back option for emergencies and enjoy the festivities ahead.

|

|

Product Labeling

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Nifty 50 ETF Fund of Fund An Open-ended fund of fund investing in units of Quantum Nifty 50 ETF | • Long term capital appreciation • Investments in units of Quantum Nifty 50 ETF – Exchange Traded Fund |  Investors understand that their principal will be at Very High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on September 30, 2022

Investors of Quantum Nifty 50 ETF Fund of Fund (Scheme) will bear the recurring expenses of the scheme in addition to the expenses of Quantum Nifty 50 ETF.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.quantumamc.com toread scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Akshaya Tritiya: Shubh Din Par Sone Mein SIP karo

Posted On Tuesday, May 07, 2024

As Indians, many of our behaviours, practices and choices are rooted in traditions. Such as when buying a new asset – a car, a house, gold, or

Read More -

Emergency Funds as an Indicator of your Risk Appetite

Posted On Monday, Oct 17, 2022

Everyone thinks of investments, especially in equity markets as ‘risky’. Undoubtedly, equity mutual funds tend to be riskier than fixed income funds.

Read More -

Now, A Diversified Portfolio at your FingerTips

Posted On Wednesday, Jul 20, 2022

In the interest of continuing our investor first approach, we have made the Asset Allocation Approach easy and simple for you to adopt, either using an active or a passive approach.

Read More