Investors Continue to Pour Money into This (Hint: It's Not Gold)

Posted On Friday, Sep 04, 2020

What would you say if we told you that even something as bad as the Covid-19 pandemic, has a silver lining?

You see, the pandemic has given a boost to one specific type of investing.

According to UN PRI, the value of global assets signing up for this investment opportunity has tripled over 8 years in 2020 to a $40.5 trillion...

Post the pandemic impact, the attractiveness of the opportunity has increased even further.

Yes, this is one of the fastest growing investment opportunities globally.

And the best part is, you could benefit from this high potential opportunity right here in India.

What are we talking about?

ESG Investing.

Or Environmental Social Governance Investing.

In case you are wondering whether anyone in India is interested in this...read this...

For a recent event organized by us, to discuss this opportunity, over 20,000 investors signed up!

And ever since we hosted it, we are receiving many queries on this opportunity.

Given this interest, today we are sharing with you the key takeaways from this event...

ESG - one of the Fastest growing investment approach globally

All it takes to change the world is an idea.

And here a spark of an idea became mainstream.

"We seek to promote the long-term economic performance of our investments and reduce financial risks associated with the environmental and social practices of companies that we are invested in,"

said Thomas Sevang of Norges Bank Investment Management (Norway) of this idea.

Asset managers around the globe are not satisfied with just profits...

They want their companies to go beyond and follow a very high level of corporate governance.

Why?

Because they found a clear positive correlation between sustainability and economic profitability.

This is looks like a clear winner

We told you earlier how the pandemic resilience has boosted the potential of ESG investing.

Like always, Quantum AMC spotted this opportunity early on.

"We believe that in the long term ESG funds can deliver good long term risk-adjusted returns." Says Chirag who manages our ESG Fund.

You must read his views on why there is a positive correlation between sustainability and economic profitability.

This is the reason all of us at Quantum are fired up about this idea of sustainable investing.

Identifying good investee companies that satisfy the ESG criteria is tricky though...

The criteria is tough, but there are still companies that meet it.

Chirag, who hosted the event, shared some examples of companies that satisfy the ESG criteria and showed how they performed over time.

Here are 2 examples...

Marico is an example of a business managed by a professional CEO despite promoter holding of ~60%. 37% of the material used in production at Marico is from renewable sources.

About 93% of packaging material is recyclable. They implemented responsible sourcing guidelines in 2017.

At Berger, training is provided to 20,000 unskilled and semi-skilled workers. The company manufactures environmentally friendly products.

Both these companies, which are a part of the Quantum ESG fund portfolio.

Now of course, you could do all the hard work and find ESG compliant companies yourself.

Or you could simply opt for the Quantum India ESG Fund.

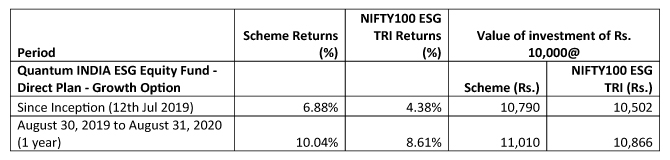

Here's how our fund has performed since inception...

Quantum India ESG Equity Fund in particular has outperformed benchmarks since its inception.

Past performance may or may not be sustained in the future.

Load is not taken into consideration in scheme returns calculation. Data as of August 31 2020.

Different Plans shall have different expense structure. Returns are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

The Schemes has been in existence for more than 1 year but has not yet completed 3 and 5 years period. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

Need we say more?

Editor's Note: Go ahead and watch the full recording of the ESG webinar here. Or if you have already made up your mind, get in touch with us at 1800-22-3863 or drop us a line at [email protected] Or request a call back by simply giving us a missed call on +91-22-68293807

#Stocks referred above are illustrative and not recommendation of Quantum Mutual Fund/AMC. The Fund may or may not have any present or future positions in these Stocks. The above information of stocks which is already available in publically access media for information and illustrative purpose only and not an endorsement / views / opinion of Quantum Mutual Fund /AMC. The above information should not be constructed as research report or recommendation to buy or sell of any stocks.

**Other Schemes managed by Mr. Chirag Mehta

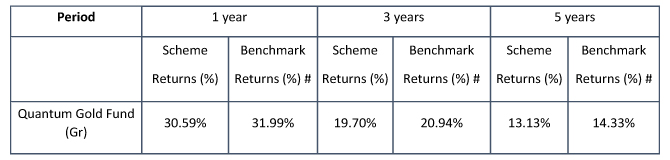

Quantum Gold Fund

Mr. Chirag Mehta effective from May 1, 2009.Co-managing with Ms. Ghazal Jain effective from June 2, 2020

Past performance may or may not be sustained in the future. Data as of 31st August 2020.

#Domestic Price of Gold. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Mr. Chirag Mehta manages 5 Schemes. The Scheme being Exchange Traded Fund has one plan to invest through stock exchange and having a single expense structure.

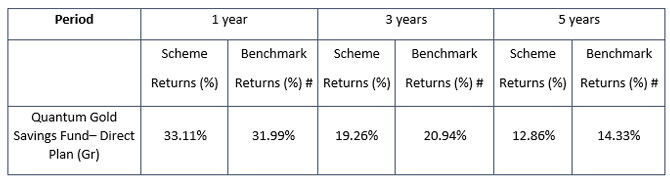

Quantum Gold Savings Fund

Mr. Chirag Mehta effective from May 19, 2011.Co-managing with Ms. Ghazal Jain effective from June 2, 2020

Past performance may or may not be sustained in the future. Data as of 31st August, 2020.

#Domestic Price of Gold. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Different Plans shall have different expense structure. Mr. Chirag Mehta manages 5 Schemes.

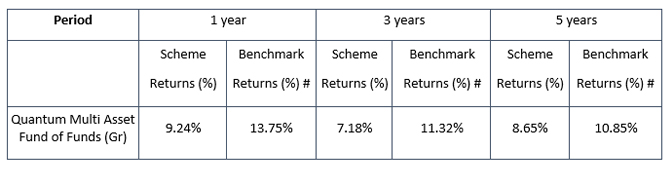

Quantum Multi Asset Fund of Funds

Mr. Chirag Mehta Co-managing along with Mr. Nilesh Shetty effective from July 11, 2012

Past performance may or may not be sustained in the future.

Data as of 31st August, 2020

Load is not taken into consideration in Scheme Return Calculation. # Indicates CRISIL Composite Bond Fund Index (40%) + S&P BSE SENSEX Total Return Index (40%) + Domestic price of Gold (20%). It is a customized index and it is rebalanced daily Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Different Plans shall have different expense structure. Mr. Chirag Mehta manages 5 schemes of the Quantum Mutual Fund.

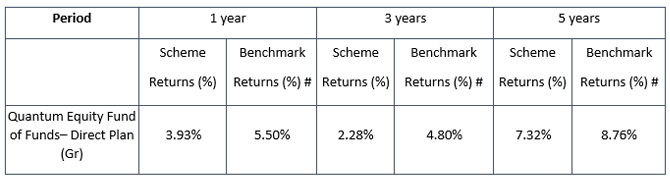

Quantum Equity Fund of Funds

Mr. Chirag Mehta effective from November 01, 2013

Past performance may or may not be sustained in the future. Data as of 31st August, 2020.

Load is not taken into consideration in Scheme Return Calculation. # S&P BSE 200 TRI Return. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Different Plans shall have different expense structure. Mr. Chirag Mehta manages 5 schemes of the Quantum Mutual Fund.

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Multi Asset Fund of Funds (An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund) | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  Investors understand that their principal will be at Moderately High Risk< |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns •Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Debt Monthly View for January 2025

Posted On Friday, Feb 07, 2025

Bond markets witnessed increased volatility during the last month with the 10-year Government

Read More -

Gold Monthly View for January 2025

Posted On Friday, Feb 07, 2025

In the calendar year 2024, gold demonstrated remarkable performance, yielding a return of ~ 27%.

Read More -

Equity Monthly View for February 2025

Posted On Thursday, Feb 06, 2025

Indian markets witnessed sharp sell-off in the month of January on the back of continued FII selling (USD -8.6Bn in January 25 vs USD -755Mn for CY2024).

Read More