KEEP CALM & INVEST ON

Posted On Monday, Jun 20, 2022

According to an old Wall Street saying, the market is primarily driven by just two emotions: fear and greed. While no one can predict the future, investing wisdom calls us to be fearful when markets are greedy and greedy when markets are fearful. But when we allow ourselves to be ruled by overriding emotions, we most often do the opposite – buy high and sell low. Today on the occasion of International Yoga Day, find out how do you keep emotions under control to help how you achieve your long-term goals, even when markets have been experiencing widespread losses?

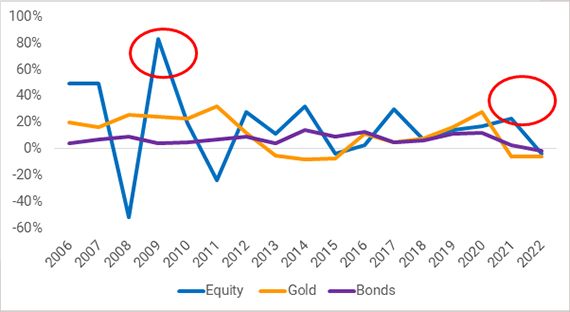

1. Avoid turning a notional loss into a real loss: One way of controlling emotions is to control our actions. The equity market is undoubtedly experiencing a tough phase. Equity mutual funds across categories have been deep in the red, registering widespread losses. However, as we have witnessed in the past, equity markets have bounced back after several such or worse downcycles. For instance, imagine someone holding an all-equity portfolio in the downmarket of 2008 or 2020, or holding none in the equity rally that followed?

Equity market is cyclical

Source: Bloomberg. Data as on May 31, 2022. Past performance may or may not be sustained in the future

During such a time, if you would have redeemed during the equity market crashes of 2008 and 2020, you would have transferred the notional loss to a real loss.

2. Stay committed to your goals: The best way to avoid getting swept by emotions is to spell out your long-term financial goals and make goal-based investment decisions. Set your goal, attach a number or a value and a timeframe for it, and finally research the right investment avenue to achieve it. Then use the help of an asset allocation strategy – divide your investment into equities, debt and gold. Then stay invested using the goal as a roadmap. This saves you from the need to constantly monitor the market.

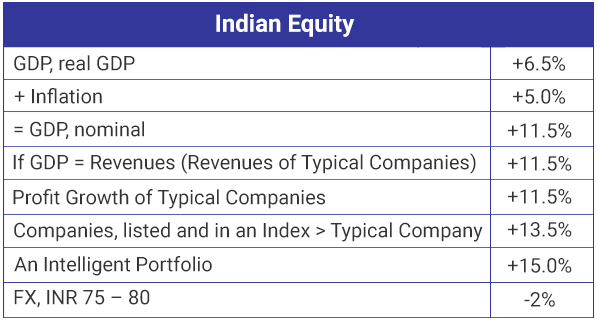

3. Set reasonable expectations: In the short term, equity markets can go through fluctuations and it’s difficult to assess returns. Over a longer duration, you are better able to assess return expectations. To anchor your expectations from an equity standpoint, assess how India has grown from a longer term perspective.

India’s GDP growth in the last few decades has averaged close to 6-6.5% real GDP growth. If you add our average inflation which has been close to 5-5.5%, the nominal GDP that India has is close to 11-12%. From a longer-term perspective, larger listed companies can grow a bit faster at 13%, and a smart portfolio with the ability to pick good businesses at good valuations can give you a return of close to 15%. Assuming rupee depreciation at 2%, this basic math is the key for anchoring your return expectations from equity mutual funds from a longer-term perspective in India.

Anchoring return expectations

4. Understand your risk tolerance: Avoid taking more risk than necessary. Sometimes FOMO (Fear of Missing Out) might lead to a speculative behaviour leading you to chase riskier assets such as cryptocurrency. It’s important to remember that not all asset classes move in one direction. Diversification will help you reduce portfolio risk.

You can diversify your investments across asset classes using the 12:20:80 asset allocation strategy that works well in respect of the market conditions - be it the global financial crisis, Covid crisis, or the market fluctuations we have seen post-Covid.

According to this strategy, 12 months of your money should be kept safe in avenues like a Liquid fund scheme because it does not take any credit risk and the rest of the money should be split between equity at 80% and gold at 20%. Finally, not more than 5% should be allocated to riskier asset classes such as Cryptocurrencies. Within each of the buckets, you need to diversify. For example, in the equity bucket, you need to diversify across different styles and market caps.

You can use the 70:15:15 ratio as part of the overarching Asset Allocation Strategy to rebalance and strengthen your largest block – the growth block consisting of a diversified equity basket.

It makes sense to add the Quantum Long Term Equity Value Fund which comprises of stocks at reasonable valuations and a lower leverage that will be less sensitive to the increases in the cost of capital and rate hikes than a portfolio with high PE multiples. You can additionally diversify with Quantum India ESG Equity Fund positioned for sustainable growth over the long term. Finally, diversify across different market cap and styles using Quantum Equity Fund of Funds.

Building Your Growth Block - Diversified Equity Basket

| Mr. No | Fund | Allocation | Benefit |

|---|---|---|---|

| Equity Fund 1 | Quantum Equity Fund of Funds | 70% | 1 Fund = 5-10 well researched diversified Equity schemes |

| Equity Fund 2 | Quantum India ESG Equity Fund | 15% | Shortlists funds based on environmental, social and governance parameters |

| Equity Fund 3 | Quantum Tax Saving Fund or Quantum Long Term Equity Value Fund | 15% | Follows value style lowering downside risks and helps achieve long term goals |

5. Finally, exercise discipline and patience by starting an SIP (Systematic Investment Plan): An SIP can often be the simplest way to help you resist the urge to pull out of the markets and stay on track on your financial journey.

Believe in the Indian growth story and the long-term growth prospects of the equity market and keep your emotions controlled by making your investments relevant to your goals using a staggered and diversified approach.

| Related Articles | ||

| Is Your Portfolio in a Free fall? Or Are You on Your Dream Vacation | ||

| Why Market Crashes Don't Rattle Thoughtful Investors | ||

| 4 Ways to Protect Yourself from Yourself |

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation •Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation •Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  Investors understand that their principal will be at Very High Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on May 31, 2022.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Tax Planning Season is Coming - Don’t Wait Till the Last Moment

Posted On Tuesday, Nov 15, 2022

It is around the time when companies start requesting investment proofs for tax planning.

Read More -

How Can ESG Investing Safeguard Your Future?

Posted On Thursday, Aug 11, 2022

Three waves of the pandemic, the Russia-Ukraine war, record-high inflation - the last three years have been challenging...

Read More -

Balancing Emotions While Investing

Posted On Monday, Jun 20, 2022

Emotions are an essential part of what makes us human but when it comes to investing, emotions can either make or break your goals.

Read More