Gold monthly view for May 2021

Posted On Thursday, Jun 03, 2021

In May, gold prices rose above the key psychological level of $1,900 per ounce, ending the month roughly 8% higher and turning positive for the year to date.

Much of May’s action in gold was a result of evidence showing a rise in prices in the United States and the weakening of its key rivals - the 10-year Treasury yield, the Dollar Index and Bitcoin.

Higher inflation coupled with Fed’s dovish stance helped gold regain its footing.

With trillions of dollars of stimulus trickling down to the real economy, accelerating vaccination rollouts and unfixed supply chains, higher inflation has become the central market-moving theme so far in 2021.

In the U.S., Personal Consumption Expenditure — which is the Federal Reserve’s preferred gauge for inflation, jumped 3.6% in the year to April. The Consumer Price Index registered a 4.2% growth in April - its largest increase in almost 13 years.

With discussions to increase the minimum wage to $15 from the existing $7.5 underway in the US, we might see wage inflation add to the already spiraling commodity price inflation. This and President Biden seeking to run $1.3 trillion deficits every year throughout the next decade will make inflation more structural and sticky.

A higher inflationary environment is good for gold, which is seen as a reliable store of value especially when rates are anchored at zero levels in much of the developed world.

Earlier this year, the dollar and U.S. bond yields rallied on signs of a swift turnaround of the U.S. economy, as investors speculated the Fed will hike rates faster than anticipated. This triggered selling in gold as a strengthening dollar tends to make gold more expensive to foreign buyers while rising bond yields reduce its attractiveness as it offers no yield. But starting April, inflation expectations and related concerns over the purchasing power of the dollar instigated a retreat in real yields and the dollar and helped the yellow metal claw its way back up.

The Federal Reserve has downplayed the impact of rising inflation terming it as “transitory” and pledged to keep a dovish monetary policy for the foreseeable future. The U.S. central bank has the tricky job of curbing any possible outbreak of inflation without throwing economic recovery off track. With the Fed stretching its inflation tolerance through its Flexible Average Inflation Targeting framework and committing to keep rates low till 2023, it's likely that real rates will be on the decline as inflation picks up, benefitting gold.

The economic bounce from stimulus earlier in the year begins to fade

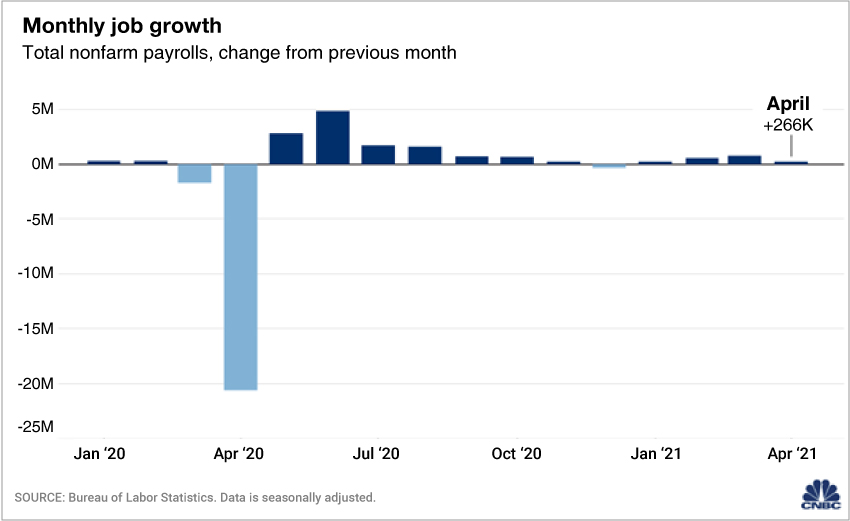

Even as U.S. GDP growth for the first quarter of 2021 came in at an annual rate of 6.40%, other economic indicators are slowing, a sign that the country’s recovery from the pandemic still faces challenges. U.S. non-farm payrolls increased by a modest 266,000 jobs in April, far short of the one million that economists had forecast and left total employment down by 8.2 million from its pre-pandemic level. Similarly, retail sales in the U.S. did not grow month-on-month in April as the effect of stimulus checks distributed earlier in the year faded. The housing market too is showing signs of fatigue, with new home sales dropping in April by 5.9%. Consumer confidence also slipped to a reading of 117.2 vs a market expectation of 119.2 and durable goods sales were down 1.3%.

Confidence about the economic outlook thus seems to be fading now nudging investors to increase their allocation to gold. Risk assets riding on easy money, however, continue to do well, raising concerns of frothiness and limiting a rally in gold prices for now. But going forward, markets might get a reality check as the timing of recovery gets pushed further down the road and the disconnect between the economy and financial markets become evident. Gold will then yet again prove to be a relevant portfolio asset.

Volatility in crypto sends investors fleeing to gold

The sheer price performance of cryptocurrencies or the fear of missing out lured many investors to chase this well-marketed promise of an alternative form of digital currency and helped push Bitcoin to a record near $65,000. But this journey upward has been one of extreme volatility given that it is a relatively new asset class with fewer participants and a debatable intrinsic value, which makes it susceptible to large price fluctuations and speculation. Most recently, the cryptocurrency saw a massive 37% correction in May. Maybe that's why, after chasing higher returns and enduring big swings over the last few months, funds seem to be now reversing from cryptocurrencies like Bitcoin to gold as investors appreciate the reliability and stability of the precious metal.

Inflation concerns keep stocks in check

Global equities markets have been supported by a coordinated effort from major central banks, which have pumped trillions of dollars into financial markets since last year while committing to lower-for-longer interest rates. But higher inflation could mean a scaling back of central banks' easy money policy. This prospect has led to global markets losing growth momentum as investors see central banks slowly but surely moving towards a tightening policy.

Higher interest rates increase the cost of capital, hurting corporate profitability. Higher commodity prices too will lead to higher input costs, impacting margins. This can spook markets and trigger volatility.

Gold's negative correlation to equities can increase its attractiveness for investors in these times of jittery equity markets.

Appreciating rupee hurts INR gold returns

Despite the second wave of Covid-19 and resulting restrictions raising concerns on the growth outlook, the Indian rupee strengthened in May on account of foreign inflows and the weakening of the U.S. dollar. Higher prices and local lockdowns adversely impacted local gold demand. Gold prices thus ended the month only 5% higher in INR terms.

What lies ahead

After a healthy correction due to rising confidence about the economic outlook, gold’s return to $1,900 levels seems logical and overdue as prices were stretched to the downside given the fundamentals.

Just how much gold prices will rise and how strong its move will depend on how sustainable the economic recovery is, and the resulting policy action which can either be status quo or tightening. Also, at any first signs of dwindling economic momentum, central banks and governments can be expected to intervene with their usual prescription which entails higher deficit spending. On the other hand, it will also depend on whether or not this higher inflation is transitory and in reaction, whether or not the U.S. dollar and real yields trend down further.

Gold is also expected to reflect investor concerns over record debt and deficit levels, frothy financial markets and the emergence of inflation, thus strengthening going forward.

Sources: Bloomberg, World Gold Council

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Gold Monthly View for February 2025

Posted On Friday, Mar 07, 2025

The bullish momentum for gold carried on into February 2025, with spot prices maintaining

Read More -

Gold Monthly View for January 2025

Posted On Friday, Feb 07, 2025

In the calendar year 2024, gold demonstrated remarkable performance, yielding a return of ~ 27%.

Read More -

Gold Year End Wrap-up & Outlook 2025

Posted On Saturday, Jan 11, 2025

In 2024, the gold market experienced a remarkable surge, with prices increasing by approximately 29% through the year.

Read More