Gold monthly view for July 2021

Posted On Thursday, Aug 05, 2021

Progress on the vaccination front and improving macroeconomic situation has favored risk assets and left gold sidelined despite favorable fundamentals. Talks of monetary tightening by the Federal Reserve in June knocked gold even lower to mid-$1700 levels. The sell-off was unwarranted as interest rates in the US are set to stay at near-zero levels till the end of 2022 and any stimulus tapering would depend on how the economy behaves. The metal struggled for most of July but regained those losses by the end of the month. Gold moved up by ~2% to $1815 levels with the backdrop of a dovish FOMC statement and weaker-than-expected US economic data taking a toll on the dollar. US GDP expanded at a 6.5% annual pace in the second quarter, well below market expectations.

Fed in no hurry to taper

In its latest monetary policy announcement in July, the central bank left its benchmark rate unchanged in the range of 0% to 0.25% as was expected and would continue its $120 billion monthly bond purchases. The Fed indicated that “substantial further progress” towards stable prices and maximum employment is warranted before they start tapering asset purchases. Thus, no concrete timeline for tapering was declared, but markets are pricing it to happen in the first quarter of 2022.

Referring to the millions still unemployed, Chairman Powell stressed that the economy still needs to cover more ground on the labour market. The unemployment rate, although improved, is still elevated at 5.9% (vs 3.5% in Feb’20). The labour force participation rate too is lower at 61.6% vs ~63% pre-pandemic.

Powell acknowledged that inflation is higher than expected but again insisted that price pressures are temporary. Although the Fed downplayed the impact of the Delta variant, it believes that it would be premature to declare victory on the pandemic as new mutants are emerging and the vaccination drive has slowed down in the US.

The takeaway for investors was that risks to the economic outlook remain and the US economy still needs the central bank's support, hurting the dollar and giving a boost to gold.

Delta could prompt central banks to loosen up

Amid growing fears of the next wave of infections, the ECB announced that it would keep its policy rates at ultra-low levels for longer than previously declared, as it does not want to tighten prematurely. The ECB has also decided to increase the pace of its asset purchases under the Pandemic Emergency Purchase Programme in the current quarter. So, the ECB has become even more accommodative.

The Reserve Bank of Australia had planned to begin asset tapering in September. But it is now expected to delay that. Extended lockdowns in the country's most populous city Sydney led by a fast-spreading COVID-19 outbreak of the highly transmissible Delta variant is expected to take a toll on the economic recovery.

The Center for Diseases Control and Prevention in the US changed its guidance to advise even vaccinated people to wear a mask in certain indoor settings. This is a step back in the trend of economic reopening and relaxing social distancing rules, which could have an impact on US economic recovery.

These developments have investors speculating that the Fed could also loosen its stance if the Delta variant spreads rapidly in the US. This is because protecting and reviving their economies is still central banks’ priority. This continued monetary support will prove to be conducive for gold.

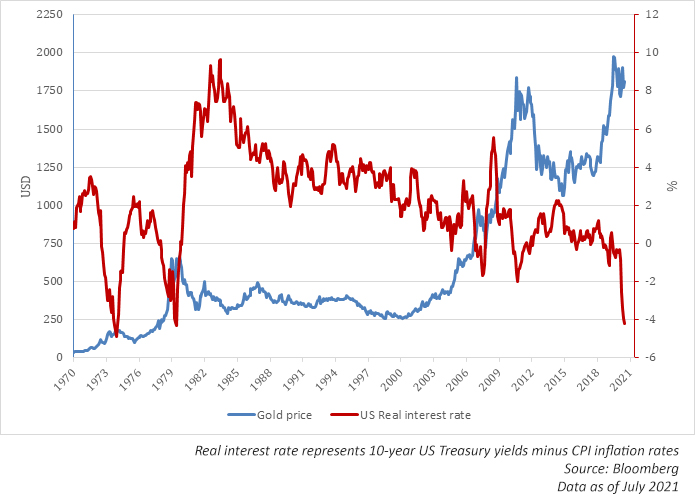

Real rates on the decline

Long-term bond yields in the US have been in a downward trend.10-year Treasury yields in the US have moved down from 1.5% to 1.25% in July despite rising inflation and talks of tapering, taking the 10-year real Treasury yield to -1.15%.

The price of gold has lagged in this drop in the real interest rates. So, gold seems undervalued from the fundamental point of view.

Lower bond yields may be suggesting that inflation will only be temporary. In that case, real yields will go up later in the year as inflation evaporates and the monetary tightening comes into play, hurting gold. If inflation is stickier than perceived, then the Fed and bond markets may simply be lagging, keeping real rates in the red till they catch up, benefitting gold. A decline in yields may also indicate expectations of slower economic growth as pent-up demand fizzles out and unemployment benefits in the US come to an end. Combined with high inflation, it could result in stagflation, a conducive environment for gold.

Effectiveness of vaccines in question again

Some research studies in the UK have recently claimed that antibody levels start to reduce six weeks after complete vaccination in the case of Pfizer and AstraZeneca vaccines and can reduce by more than 50% over 10 weeks. This has raised concerns that the protection provided by the vaccines may begin to wear off, particularly against new variants. The world thus remains susceptible to a prolonged health crisis, which could support investment demand for gold.

In an ideal scenario, the Fed would taper asset purchases and hike rates at the right time to keep inflation controlled while helping economic growth remain stable and robust. But that isn't going to be easy to achieve. It's more likely that the Fed will land up doing too much, too early, or too little, too late. In the first scenario, the economic recovery is negatively impacted. In the second, inflation worries come to the forefront. In both these scenarios, gold is set to benefit.

While fundamentals remain constructive, conflicting macroeconomic developments will keep gold prices range-bound in the near term. Investors should avoid going overboard and gradually build and maintain a 10-15% exposure to the strategic asset class.

Sources: Bloomberg, World Gold Council

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Gold Monthly View for February 2025

Posted On Friday, Mar 07, 2025

The bullish momentum for gold carried on into February 2025, with spot prices maintaining

Read More -

Gold Monthly View for January 2025

Posted On Friday, Feb 07, 2025

In the calendar year 2024, gold demonstrated remarkable performance, yielding a return of ~ 27%.

Read More -

Gold Year End Wrap-up & Outlook 2025

Posted On Saturday, Jan 11, 2025

In 2024, the gold market experienced a remarkable surge, with prices increasing by approximately 29% through the year.

Read More