Gold Monthly View for March 2023

Posted On Wednesday, Apr 05, 2023

March saw the Fed pivot narrative come back in a big way as a regional banking crisis in the United States made the economic impact of higher interest rates apparent. We had highlighted the possibility of such events in our October 2022 Gold outlook. Amid concerns of the crisis spilling over to other parts of the economy, investors rushed to the relative safety of gold, pushing the metal’s price to one-year highs above the $2000 level before consolidating gains as regulators intervened to calm markets down. Markets however continued to be on edge, and international gold prices settled close to $1980 per ounce ending the month ~9% higher in spite of another 25-basis point hike by the Fed. Domestic gold prices were up ~7% on account of the appreciation in the Indian Rupee.

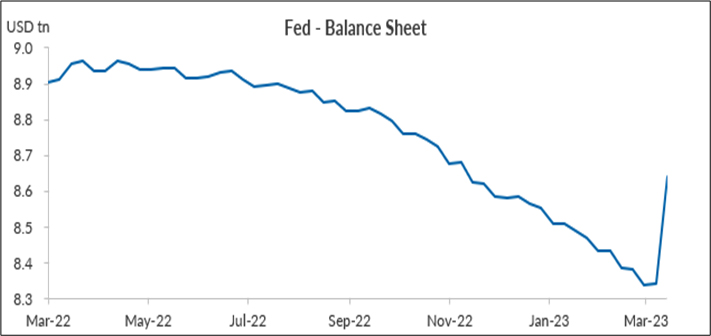

The Federal Reserve and other central banks responded to the banking crisis by extending emergency lines of liquidity. The Fed added nearly US$300 billion to its balance sheet in March, reversing almost half of the past year’s reduction in just a few days. This pressured the US Dollar Index lower and supported dollar-denominated assets like gold.

Source: Bloomberg

The regional banks in the United States could be the first of many things to break as a result of the most aggressive rate hiking cycle in decades. After a long period of excessively loose monetary policy, rates have been taken up from near-zero to 4.75% in a year’s time. It's likely that more damage to the financial system is yet to be revealed. Vulnerability in the financial system is expected to get further complicated if we see a recession in the United States. The probability of a recession in the next 12 months stands at 65% according to the latest Bloomberg monthly survey of economists. Policymakers have also cut US growth forecasts to 0.4%, down from the 0.5% they forecast in December 2022. And we know now how the central banks will respond in such a scenario. A fresh round of easing will undermine the Fed’s efforts to bring inflation down which continues to stay stubbornly high. Higher inflation bodes well for gold. Easing will also hurt the Federal Reserve’s credibility. This will be a positive environment for gold as investors realize that a real normalization of monetary policy looks unlikely for an economy hooked onto low interest rates and high liquidity.

In the run-up to the March 22nd FOMC meeting, expectations of a 50-basis point hike by the Fed were building up on account of the stronger than expected economic and inflation data in the US over the last couple of months. But the banking crisis seems to have limited the Fed’s ability to stay hawkish even though Powell said that the banking crisis has been successfully contained and downplayed fears of contagion. But if the Fed chooses to continue the rate hikes it risks further escalating the crisis or putting other financial institutions at risk or simply laying bare the various mal-investments that would have taken place in the easy money era. We thus saw only a 25-basis point hike in March which was largely perceived as moderately dovish as it was accompanied by an unchanged benchmark rate forecast of 5.1% for 2023 and a change of forward guidance from ‘ongoing increases in the target range will be appropriate’ to ‘some additional policy firming may be appropriate’ which signalled a potential policy shift. Thus, markets are now pricing in a less hawkish Fed and only one more rate hike this year. A pause in the Fed’s hiking cycle will be supportive of gold prices.

Powell in the post-FOMC press conference maintained that the inflation fight will continue and that there are no interest rate cuts on the table this year. However, markets are pricing in a rate cut this year which isn’t very unlikely given the current background of a slowing US economy and financial instability. Rate cuts will lead the way to higher gold prices. US Fed like always will be very sensitive to panic in financial markets which could lead them to pull the trigger on rates. But the timing of rate cuts could differ from market expectations which could result in some price volatility.

With financial system distress on the one hand and high inflation on the other, it is indeed a difficult job to be a central banker right now. The Federal Reserve will have to strike a very delicate balance with respect to its benchmark interest rate, which is spurring financial instability but is also the solution for high prices. With gold likely to benefit from the uncertainty, irrespective of how the macroeconomic situation pans out, investors could use pullbacks to add to their gold positions.

Data Source: World Gold Council

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Gold Monthly View for February 2025

Posted On Friday, Mar 07, 2025

The bullish momentum for gold carried on into February 2025, with spot prices maintaining

Read More -

Gold Monthly View for January 2025

Posted On Friday, Feb 07, 2025

In the calendar year 2024, gold demonstrated remarkable performance, yielding a return of ~ 27%.

Read More -

Gold Year End Wrap-up & Outlook 2025

Posted On Saturday, Jan 11, 2025

In 2024, the gold market experienced a remarkable surge, with prices increasing by approximately 29% through the year.

Read More