Gold monthly view for April 2022

Posted On Monday, May 09, 2022

A cocktail of geo-economic and geopolitical factors kept international gold prices volatile, as they moved in a wide range between $1890 and $1990 per ounce in April. Prices ended the month 0.45% down close to $1915 per ounce as the May 3-4 Fed meeting and a 50-bps interest rate hike, the largest in two decades, came closer. The rupee depreciated by 0.81%, pushing domestic gold prices up by 0.38% for the month.

US inflation print in March came in at 8.5% and further intensified the Federal Reserve’s fight against rampant inflation. Bankers upped their hawkish rhetoric, pushing the dollar up and taking a toll on gold. The dollar was further supported by a war-troubled, weaker euro and widening interest-rate differential with the yen. India’s CPI and WPI inflation spiked to 6.95% and 14.55% respectively in March. With global supply chains under stress, and energy prices firming, imported inflation will continue to persist for the foreseeable future. With interest rates on fixed instruments still low, gold’s appeal as a store of value strengthens.

Questions on the resilience of the US economy came up again with GDP contracting by 1.4% on an annualized basis in the first quarter of 2022, the first contraction since 2020. While Consumer spending and other lagging indicators suggest the economy is doing well, leading indicators like yield curves are flattening fast and new home sales tumbled 8.6% in March. According to the Goldman Sachs economics team, there is now a 35% chance of a US recession over the next two years. And there’s a real possibility that Fed may accelerate the slowdown with their aggression. Given the fact that Fed can only do so much to bring supply-constrained inflation down, we can be staring at a stagflationary scenario.

As the Fed begins to rip the easy money band-aid off, global as well as domestic equities tumbled in April. Expansion of the Fed's balance sheet has been a huge driver of gains in global risk assets in recent years. Thus, a reduction is likely to have the opposite effect. Equity investors also battled other headwinds like worsening inflation, lockdowns in China, and the ongoing war in Europe. The Nifty index saw big gyrations and was down 2% for the month.

Given these underlying vulnerabilities, the Fed may succeed in front-loading some tightening to combat the inflation monster of its own making, but it is likely that it will have to reconsider its super hawkish stance going forward. Since the Global Financial Crisis, the Fed has repeatedly ended up being less hawkish than it promised in order to maintain financial stability.

Amid market expectations that the RBI, in response to higher inflation and in line with global central banks, will tighten monetary policy this year, the Crisil Composite Bond Fund Index gave a return of 0.5% in the first quarter of 2022. Domestic equity markets gave a return of 0.7% in the same period. This has raised concerns that monetary tightening could result in a positive correlation to equities and dampen bonds’ utility as a portfolio diversifier. Demand for gold, which gave a return of 8% in the 3 months and is negatively correlated to equities, could in turn get a boost.

As the military war between Russia and Ukraine continues, Vladimir Putin has initiated an energy war by cutting off gas supplies to Poland and Bulgaria, threatening to do the same for other "unfriendly nations" that refuse to pay in rubles. This will further fire up inflation in the Eurozone which hit a record high of 7.5% in April and drag down growth in the continent with Frances’ economy stagnating and Italy’s contracting in the first quarter. On its part, Europe is increasingly trying to reduce its dependence on Russian energy. In addition to stagflation, fears of a nuclear confrontation still linger over Europe and the world at large. China’s strict Covid management is threatening to hurt demand, pressure global supply chains and risk the global growth trajectory. Growth weaknesses in Europe, China, and Russia won’t take long to spill over into the rest of the world.

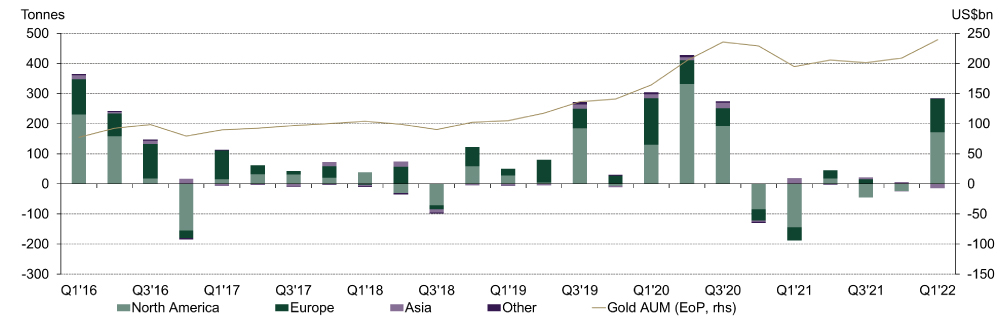

With this background, data from World Gold Council indicates that global gold demand in the first quarter was 1234 tonnes, 34% above Q1 2021, and 19% above the five-year average of 1039 tonnes. The demand was driven by Gold ETFs which had their strongest quarterly inflows since Q3 2020. Holdings jumped by 269 tonnes, more than reversing the 174 tonnes annual net outflow in 2021.

For as long as the geopolitical uncertainties and the high inflation environment continue, investment demand is expected to stay robust.

Quarterly global gold ETF holdings, tonnes, and end-of-period AUM value

Source: Bloomberg, Company Filings, ICE Benchmark Administration, World Gold Council

Indian Gold ETFs on the other hand saw outflows of over 700 crores in January and February as per AMFI data. However, the Russia- Ukraine war and further firming of inflation in March led to inflows of 200 crores in the month, re-establishing gold’s relevance. In the quarter, 10 lakh new folios were added, which shows a sustained interest in gold and growing acceptance of Gold ETFs as investment vehicles. Given the current environment, this trend can be expected to continue.

Central banks continue to value gold’s utility in these uncertain times and thus added 84 tonnes to global official gold reserves during the first quarter. We expect central banks to continue to diversify away from dollar assets into gold.

The Fed’s tightening cycle will continue to put downward pressure on gold for the next couple of months. On the other hand, worries about growth, geopolitics, and inflation will keep demand supported. The result will be volatility and rangebound prices which can be a good entry point for long-term investors. With so many moving parts, the likelihood of the Fed achieving a soft landing for the economy is low. A growth slowdown, high debt levels, and financial market instability will ensure that the Fed’s tightening is short-lived, making conditions conducive for gold again. Investors should be guided by their asset allocation and keep anywhere between 10-15% of their portfolio in gold. This is best achieved by staggering investments in gold ETFs and gold fund of funds.

Sources: Bloomberg, World Gold Council

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Gold Monthly View for February 2025

Posted On Friday, Mar 07, 2025

The bullish momentum for gold carried on into February 2025, with spot prices maintaining

Read More -

Gold Monthly View for January 2025

Posted On Friday, Feb 07, 2025

In the calendar year 2024, gold demonstrated remarkable performance, yielding a return of ~ 27%.

Read More -

Gold Year End Wrap-up & Outlook 2025

Posted On Saturday, Jan 11, 2025

In 2024, the gold market experienced a remarkable surge, with prices increasing by approximately 29% through the year.

Read More