Gold - Dus Reasons to Buy on Dussehra

Posted On Friday, Oct 11, 2024

Lord Rama defeated the 10-headed Ravana on the day that we fondly celebrate as Dusshera. Beginning new ventures on this occasion has historically been considered to bring success. In the present too, gold bought on this auspicious day can be rewarding investments in the long run. Given the face of the following 10 market developments.

Escalating tensions in the Middle East have caused uncertainty in the markets with October 7th marking one year of the conflict. No resolution seems to be in sight, the risk of the conflict is looming over global markets. Gold generally tends to attract flows in times of such risk aversion.

The geopolitical situation in the oil-exporting regions may threaten to disrupt oil infrastructure and oil supplies, pushing oil prices higher. This could have an inflationary impact on goods and services as raw materials and transportation cost more. Gold generally tends to do well in inflationary environments.

Following Beijing’s recent stimulus measures, foreign investors seem to be expecting a comeback for Chinese economy and equity markets. Some tactical foreign money can thus move out of Indian stocks – which is among the expensively valued markets in the world – and move to reasonably valued Chinese stocks. This makes Indian equities prone to volatility. Gold with its generally low correlation to equity markets, can have a stabilising role in investment portfolios.

With the Federal Reserve having ended its restrictive monetary policy stance with a larger than expected 50 basis point cut in September and signaling an additional 150 basis points of rate cuts by end of 2025*, the investment case for non-yielding gold has improved.

The outsized interest rate cut by the Fed, which has historically been deployed only at times of crisis, when seen against the backdrop of weakening US labor markets may hint at the possible risk of a US recession. Unstable economic conditions in the world’s largest economy usually have spill-over effects for the rest of the world, diverting capital to comparatively lower risk assets like the US Dollar and gold.

The November Presidential elections in the USA are consequential for the rest of the world, including India, as they determine US policy on everything from trade tariffs to geopolitics. Any unfavourable outcomes could result in a risk-off market sentiment, benefitting gold.

With the Indian central bank keeping interest rates high, domestic growth has begun to moderate with GDP growth, Manufacturing PMI, core sector output, GST collections, auto sales showing signs of slowing. Q2FY2025 earnings are expected to reflect this slowdown in momentum. Any resulting correction in equity markets could be balanced by holding gold.

While domestic growth is stable, Indian equity markets are richly valued - trading above long-term averages, making them vulnerable to pull-backs. As such, a gold allocation can help diversify the risk.

The Reserve Bank of India is expected to follow its US counterpart and cut interest rates by end of the year given that domestic inflation is now benign. This may result in gradual depreciation of the Indian Rupee as some foreign money moves out in search of higher interest rates. A weaker currency is usually positive for domestic gold prices.

With weddings season set to take place in the 2024 Indian season, demand for gold is expected to be robust in the coming quarters, keeping domestic prices well supported.

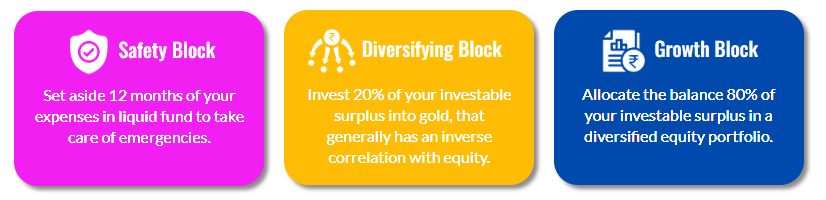

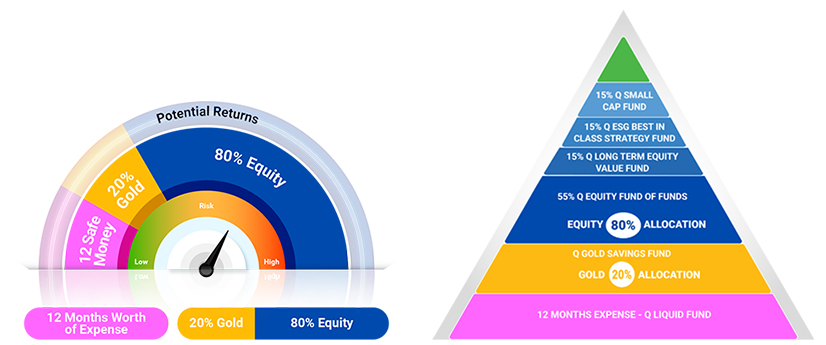

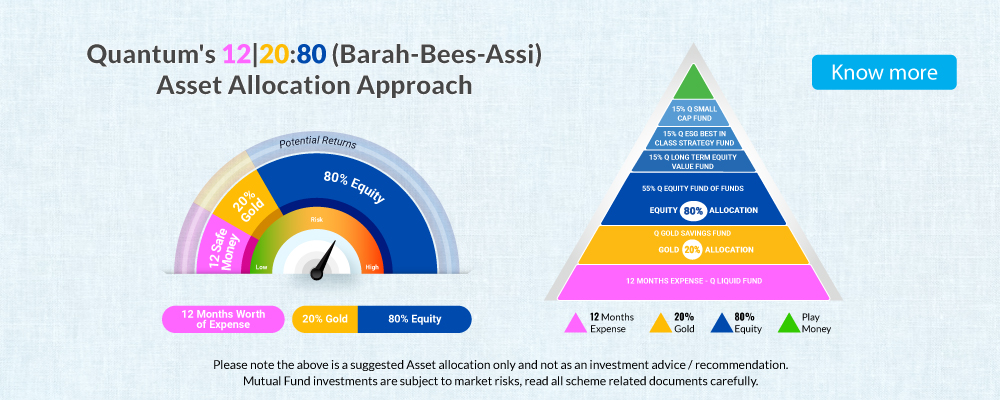

At Quantum too, we believe that gold is one of the important building blocks of a well-diversified portfolio.

As part of our 12|20:80 Asset Allocation Approach*, we suggest a 20% allocation to gold to complement an 80% equity allocation, after keeping 12 months of expenses for emergency use in a liquid avenue. This gold allocation can be taken through the Quantum Gold Savings Fund, which is a Fund of Fund that invests in the physical gold-backed Quantum Gold Fund – ETF. This fund has all the benefits of the Quantum Gold ETF, namely purity, price-efficiency, liquidity and convenience but also enables investors to invest using the SIP mode and without a demat account.

Please note the above is a suggested Asset allocation only and not as an investment advice / recommendation.

Despite the recent run up in prices, the long-term outlook for the precious metal looks constructive as the geopolitical situation remains uncertain and global monetary policy turns conducive. As such, buying gold in a staggered manner this festive season will not only honour tradition, but also make investments valuable.

|

*https://www.jpmorgan.com/insights/outlook/economic-outlook/fed-meeting-september-2024

If you prefer a DIY (Do-It-Yourself) approach:

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Small Cap Fund An Open Ended-Equity Scheme Predominantly Investing in Small Cap Stocks Tier I Benchmark: BSE 250 SmallCap TRI | • Long term capital appreciation • Investment in Small Cap Stock |  Investors understand that their principal will be at Very High Risk |

Quantum ESG Best In Class Strategy Fund An Open-ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme assessed through a Best In Class Strategy Tier I Benchmark : NIFTY100 ESG TRI | • Long term capital appreciation • Invests in shares of companies following Environment, Social and Governance (ESG) theme assessed through a Best In Class Strategy |  Investors understand that their principal will be at Very High Risk |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy Tier I Benchmark : BSE 500 TRI | Tier II Benchmark : BSE 200 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds Tier I Benchmark : BSE 200 TRI | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold Tier I Benchmark : Domestic Price of physical gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund Tier I Benchmark : Domestic Price of Physical Gold | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Nifty 50 ETF Fund of Fund An Open-ended fund of fund investing in units of Quantum Nifty 50 ETF Tier I Benchmark : Nifty 50 TRI | • Long term capital appreciation • Investments in units of Quantum Nifty 50 ETF – Exchange Traded Fund |  Investors understand that their principal will be at Very High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk Tier I Benchmark : CRISIL Liquid Debt A-I Index | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on September 30, 2024

Investors may please note that they will be bearing the recurring expenses of this Scheme in addition to the expenses of the underlying Schemes.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Gold - Dus Reasons to Buy on Dussehra

Posted On Friday, Oct 11, 2024

Lord Rama defeated the 10-headed Ravana on the day that we fondly celebrate as Dusshera.

Read More -

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More