Gold - The new Currency?

Posted On Sunday, Mar 01, 2009

Last Sunday, I was sitting next to my 82 year old grand father, as he read the Sunday edition of the news paper. This has been his Sunday morning routine for the last 25 years since he had retired from a public sector bank. He came across an article on the current financial crisis and how the central bankers are trying to combat the crisis.

After reading he asked me, "Do you know, we hear about these bailouts and stimulus packages coming out of U.S."

I replied: Yes.

Grandfather: "Hundreds of billions, even trillions of dollars, right?"

I: "That's right."

Grandfather: "They don't really have the money, though, do they?"

I: "No, they don't."

Grandfather: "And so they are just going to print it, aren't they?"

I: "Yes, the central bank would print the currency and allow the government's to borrow money."

Grandfather: "Out of nothing??? Is there any real backing, like Gold in earlier days?"

I: "NO."

Grandfather: "But that's not right, is it?"

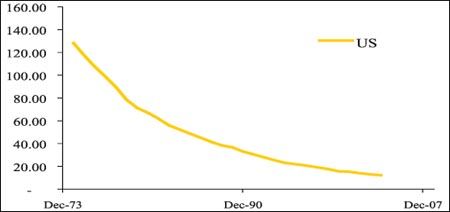

Chart: Less Gold underlying per unit of currency in circulation*

Source: Bloomberg, World Gold Council

*Ratio of Gold (in tonnes) to currency (in bn dollars) in circulation

i.e. tonnes of gold per bn dollars in circulation I was stunned and replied "But, do they have any choice?"

He replied that "central bankers are making a grave mistake of taking on an aggressive loose (lower) interest rate policy and flooding the economy with more and more paper money in order to revive the economic activity."

He further added "But, that is not going to work as it would not lead to real economic growth. Let me explain this in more detail ". The trapped banker in him was coming to the fore. He asked: Have you heard about "The Gold Standard?"

Not very long ago paper receipts with gold in storage were used as currencies. This era was known as "The Gold standard". People exchanged these paper notes for good or services they required as it was more convenient to carry them rather than carrying a lot of physical gold. So every paper receipt issued had equal amount of gold backing it. Over time, those who held the gold and issued the receipts noticed that physical gold was seldom claimed even though the receipts changed hands several times.

The temptation to issue more receipts than the gold in storage became too large to resist, and fractional banking was invented. This allowed the issuers to charge interest and increase the amount of currency or paper in circulation many times more than the underlying Gold.

The scheme would work as long as everyone did not claim his or her gold at the "same time" Those issuers who abused the system suffered from bank-runs, in which receipt holders came in to claim their gold in large sizes. Since there was not enough gold to cover all the outstanding receipts, only the claimants that entered the door first, would get any gold.

The scheme would work as long as everyone did not claim his or her gold at the "same time" Those issuers who abused the system suffered from bank-runs, in which receipt holders came in to claim their gold in large sizes. Since there was not enough gold to cover all the outstanding receipts, only the claimants that entered the door first, would get any gold.

The system was based on the faith the public had in the gold receipts, with all issuers not being equal. The Federal Reserve Bank (RBI of USA) was therefore created to regulate the system and stand ready to bail out any bank that could not meet its obligations. Fractional banking was allowed to continue subject to additional regulation and scrutiny, but the system is still based purely on the faith and confidence that people have in pieces of paper.

A monetary system based on fiat money amounts to no more than a confidence game. The value of fiat money is determined solely by our confidence in the issuers of that money. The confidence is that the country's currency is "valuable" because of the country's economic and military strength. This is what we have been made to believe in. Actually speaking, fiat currency is simply the printing of a currency out of thin air with no intrinsic value. If too much money is created the public will lose confidence in its purchasing power and the perceived value of the money can collapse. Remember, fiat money has no intrinsic value; it only has perceived value. This is why most of the fiat currencies met with disaster if you look back in history.

The current regime

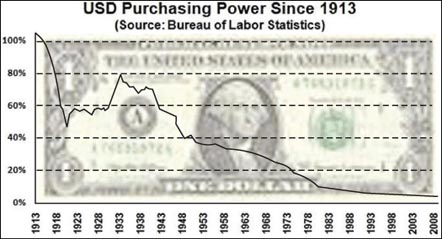

The Federal Reserve has been printing currencies at will over some time now causing devaluation of the U.S dollar. The current financial crisis is unprecedented and the Fed is committed to solving it by insertion of unlimited amounts of money whenever required. As a result, we regularly hear about bailouts, stimulus packages and similar measures amounting to trillions of dollars. In the process, the US Fed balance sheet is testing whether it can grow a tree to the sky. This will all lead to devaluation of dollar. Just like stock in a company is diluted when more stock is issued. Our Government calls this 'inflation', when in reality it's devaluation. This devaluation will eventually lead to a loss of faith in the dollar and people will no more want to hold the paper. As a result, people will want to convert their cash / wealth to something that they believe in, something that has intrinsic value and that has proved its worth over decades.

Chart: Loss of Purchasing Power (Devaluation)

Source: www.dollardaze.com

Gold is the only thing available on earth that suits the requirements because of the sheer fact that it cannot be created at will by the central bankers. It possesses an intrinsic value and is free from any counter party risk. It has decade's long history of being used as a form of currency.

The Process has begun in America: "The Honest Money Bill"

We have been hearing about many advocates proposing to move to a gold standard. It's not only words; it is more action this time around. There is a flurry of activity nation-wide in USA regarding the reinstitution of Gold backed currency.

The Honest Money Bill first saw the light of the day in the eastern state of USA, known as New Hampshire, 5 years ago. Then its spread to other states in USA such as Indiana, Missouri and lately the Ohio. The Honest money bill enables citizens of these states to again use Gold and Silver as a currency, realizing once again the benefits and value of a sound, inflation proof currency. As proposed, gold and silver would be exchanged for fiat currency at their free market 'bullion' prices and weights. The basis for value of this 'new' currency - silver and gold in specified coinage forms, and by the gram in digital forms, would be free to use as an 'alternate' currency to the dollar. This act provides the ability for direct payment to and from the State for fines, fees, taxes, licenses, land and business transactions in gold or silver coins, or digital gold currency. However, The Honest Money Act works in parallel with the Federal Reserve Notes, competing with it.

Gold is the obvious choice, if the world were to move away from a fiat currency standard. The movement process has begun. If things continue, as they are and the central bankers continue with their currency printing spree, will we see the return of "The Gold Standard's of 1970s".

At the end of this conversation, I was perspiring. If Gold becomes the new currency, where will its price be?

Related Posts

-

QLTEVF – Your Partner in Both Good Times and Bad

Posted On Friday, Mar 28, 2025

A good life partner is one who not only is with us to celebrate the good times but who also has our back during the bad times.

Read More -

Wealth Creation + Tax Saving + Value Investing with Downside Protection – Who Said You Can't Have It All?

Posted On Friday, Mar 21, 2025

As the financial year draws to a close, many investors are focused on optimizing their tax liabilities.

Read More -

Debt Monthly View for February 2025

Posted On Friday, Mar 07, 2025

February 2025 kicked off with two key events in Indian bond markets: the Union Budget and RBI's Monetary Policy.

Read More