Getting Better

Posted On Wednesday, Aug 21, 2024

Indian bonds have maintained a robust position, bolstered by increasing domestic demand and their inclusion in global indices (refer Optimism and Resilience). Recent developments, both domestic and global, have added further strength to the medium-term positive outlook.

Union Budget - Prudent Fiscal Policy with Achievable Goals

The Union budget was positive for the bond markets on three counts – (1) focus on fiscal consolidation and debt reduction, (2) conservative growth and tax collection assumptions, and (3) quality of expenditure.

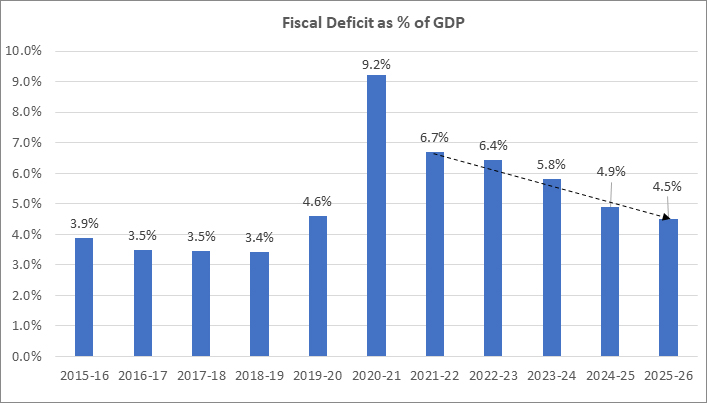

With some extra revenue in its kitty from the RBI’s Rs. 2.1 trillion dividend, the government reduced the fiscal deficit target for FY25 to 4.9% of GDP as against 5.1% set in the interim budget and 5.6% in FY24. It also reiterated the aim to reduce the fiscal deficit below 4.5% in FY2025-26. From 2026-27, the government aims to set the fiscal deficit each year such that the central government debt as % of GDP will be on a declining path.

Chart I – Fiscal deficit on a declining path

Source: indiabudget.gov.in

The government adopted a fairly conservative approach in its revenue growth projections. The gross tax collection is expected to increase by 10.8% year-on-year in FY25. According to the latest monthly data, gross tax collection in Q1FY25 (April-June 2024) has risen by 23.7%. Despite a potential slowdown in tax collections, there is a reasonable chance that the government will surpass its fiscal targets. Additionally, there is a possibility of reducing the market borrowing program towards the end of the year.

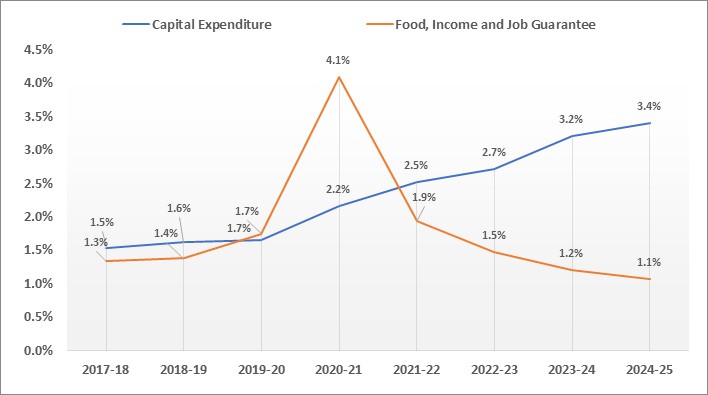

Another significant aspect of the budget was its emphasis on capital expenditure, while decreasing the proportion of welfare programs in the total expenditure. The net reduction in the fiscal deficit, along with a shift in spending patterns away from revenue expenditure, is expected to be disinflationary in nature.

Chart II – Government’s Capex on rise while welfare spending declining

Source: indiabudget.gov.in, Internal Research; Data as of July 2024

#Allocation towards Food subsidy, PM Kisan and MGNAREGA are used to show the expenditure on Food, Income and Job guarantee respectively

Softening US inflation and Rate cut bets

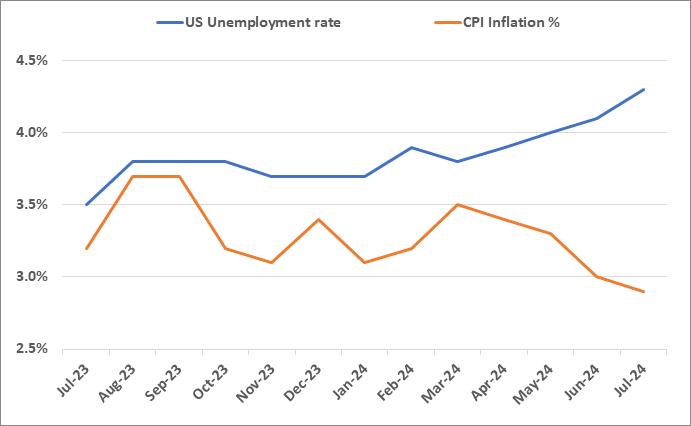

In the Federal Open Market Committee (FOMC) meeting held on July 30-31, 2024, the US Federal Reserve (Fed) left the interest rates unchanged at 5.25%-5.50%. However, it hinted at potential rate cuts in September acknowledging easing inflation pressures and rising unemployment.

Rate cut bets increased further after weaker than expected employment numbers for July. The non-farm payroll rose by 114,000 in July, falling short of the market expectation of 175,000. This led to a sharp decline in the US treasury yields, heightened fears of sharp economic slowdown and a potential recession in the US. However, many close observers of the US economy believe that this was due to disruptions caused by adverse weather conditions in July and will likely correct in coming months.

Nevertheless, a broader trend indicates moderating inflation and gradually rising unemployment rate. In July, the unemployment rate in the US jumped to three years high in at 4.3% vs 4.1% in June while the CPI inflation fell to 2.9% yoy vs 3.0% in June.

The CME Fed Watch tool is now showing 75% probability of 50 basis points rate cut in September Fed meeting and 74% probability of 100 basis points before the end of this year. A faster rate cutting cycle in the US would be supportive for the Indian bond market as well.

Chart III – Moderating Inflation and rising Unemployment rate have prepared the ground for rate cuts

Source: US Bureau of Labor Statistics

Good Monsoon and healthy sowing to ease food prices going

Cumulative rainfall in the current monsoon season now stands at 103% of the long period average (as of August 19, 2024). Although the spatial distribution of rainfall has varied widely across different regions, it has not impacted the sowing activity. As per the latest available data of August 9, 2024, 89% of total Kharif sowing has already completed and the total area sown under the Kharif crops is 1.4% higher than the corresponding period last year.

| Seasonal Rainfall (in mm) as on 19th August 2024 | |||

| Region | Actual | Normal | % Departure from LPA |

| East & Northeast India | 837.3 | 960.0 | -13% |

| Northwest India | 419.5 | 420.9 | 0% |

| Central India | 757.7 | 693.1 | 9% |

| South Peninsula India | 585.3 | 488.6 | 20% |

| Country as a whole | 632.5 | 611.8 | 3% |

Source: mausam.imd.gov.in

| Crop | Area Sown up to 13th August 2024 | YOY Change | |

| 2024-25 | 2023-24 | ||

| Paddy | 331.78 | 318.16 | 4.3% |

| Pulses | 117.43 | 110.08 | 6.7% |

| Millets & Coarse Cereals | 173.13 | 171.36 | 1% |

| Oilseeds | 183.69 | 182.17 | 0.8% |

| Sugarcane | 57.68 | 57.11 | 1% |

| Cotton | 110.49 | 121.24 | -8.9% |

| All Crops | 979.89 | 966.4 | 1.4% |

Source: agriwelfare.gov.in

Favourable monsoon progress and increased sowing are expected to boost Kharif food production and help ease food prices in the future. This should bring overall inflation closer to the RBI’s 4% target by early next year.

RBI’s draft Liquidity Coverage Ratio (LCR) norms to boost bonds’ demand

With an aim to enhance the liquidity resilience of banks, the RBI has proposed changes to the liquidity coverage ratio (LCR) norms for banks which will come into effect from April 1, 2025 (RBI Draft Guidelines). Under the new guidelines, banks will have to apply higher run-off factor for deposits that are enabled with internet and mobile banking facilities.

Once the new LCR norms come into effect from April 1, 2025, the LCR position of banks are expected to decline by 10%-20%. Thus, demand for high quality liquid assets (HQLA) like government bonds and State development loans will rise. Market estimates for such incremental demand is between Rs. 3 to 6 trillion. To put this in perspective, the incremental demand will account for 25%-50% of the net government borrowing for FY25.

We would expect some dilution in the implementation of these guidelines. However, it will surely add to the overall demand for government bonds.

Outlook

We continue to hold our medium term positive outlook on Indian bonds (refer The Bull Case) which is supported by a structural shift in demand supply balance, and a cyclical turn in inflation and monetary policy.

However, we have turned little cautious on near term given the sharp decline in yields over the last few months and rich valuations at most parts of the yield curve.

What should Investors do?

Considering a strong case for long term yields to decline over the next 1-2 years backed by the reasons described above, we believe long term government bonds offer a rewarding opportunity.

Dynamic Bond Funds are well-positioned to capitalize on this opportunity, offering the flexibility to adjust if circumstances change. However, investors should be prepared for a holding period of at least 2-3 years to navigate through potential volatility.

Investors with shorter investment horizons and low-risk appetites should stick with liquid funds.

Portfolio Positioning

Scheme Name | Investment Approach |

The scheme invests in debt securities of up to 91 days of maturity issued by the government and selected public sector companies. | |

The scheme to invest in debt securities issued by the government and selected public sector companies. The scheme follows an active duration management strategy and increases/decreases the portfolio duration (sensitivity to interest rates changes) in accordance with the Interest Rate Outlook. Given our near-term cautious view, we are reduced the portfolio duration in the recent rally in the bond market. Nonetheless, the scheme still holds a reasonably high allocation in long term bonds of 10 years and above maturity. |

Source - IndiaBudget.gov.in, Internal Research, RBI, MOSPI

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author – Pankaj Pathak, Fund Manager – Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian – Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Read our last few Debt Market Observer write-ups -

- Market Mood – Optimism and Resilience

- Balancing Priorities: The Need for Fiscal Reallocation

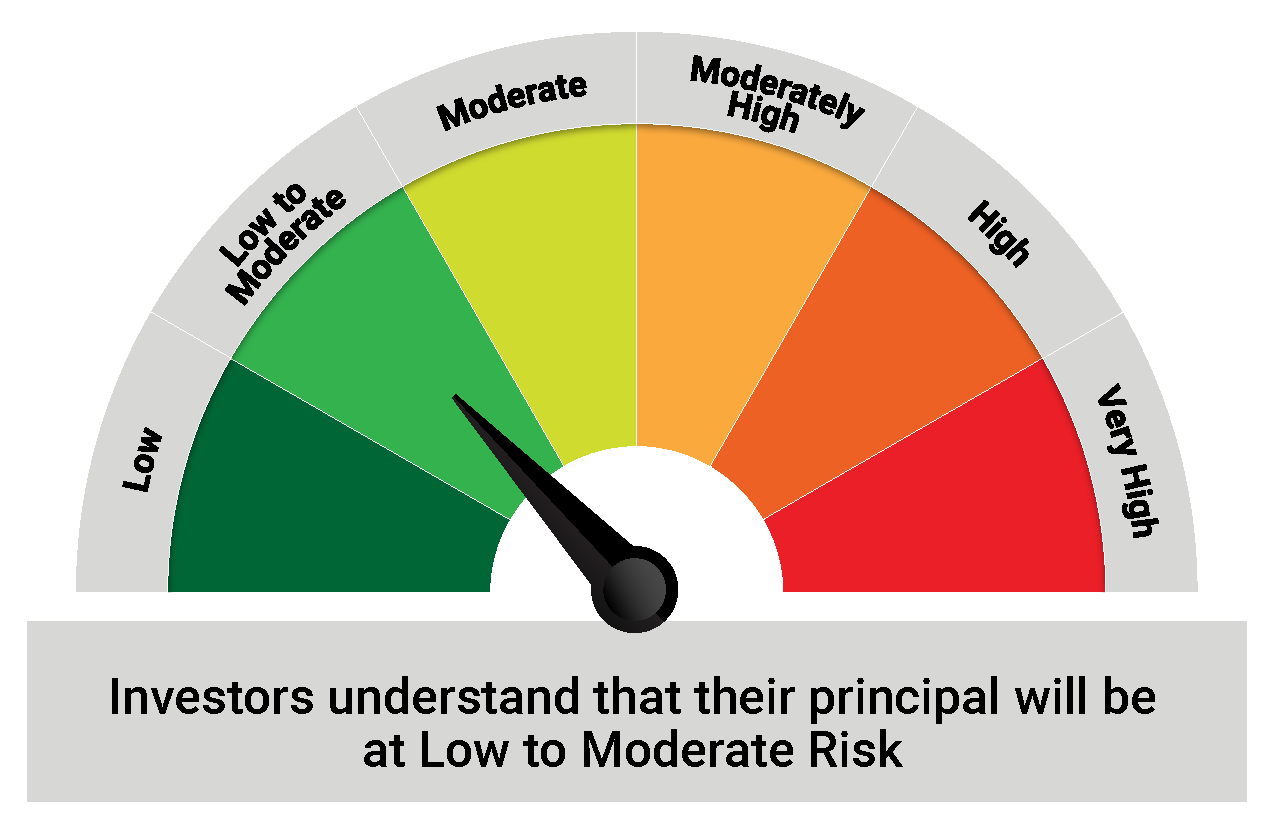

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of Scheme | Riskometer of Tier I Benchmark |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. |

|  |  |

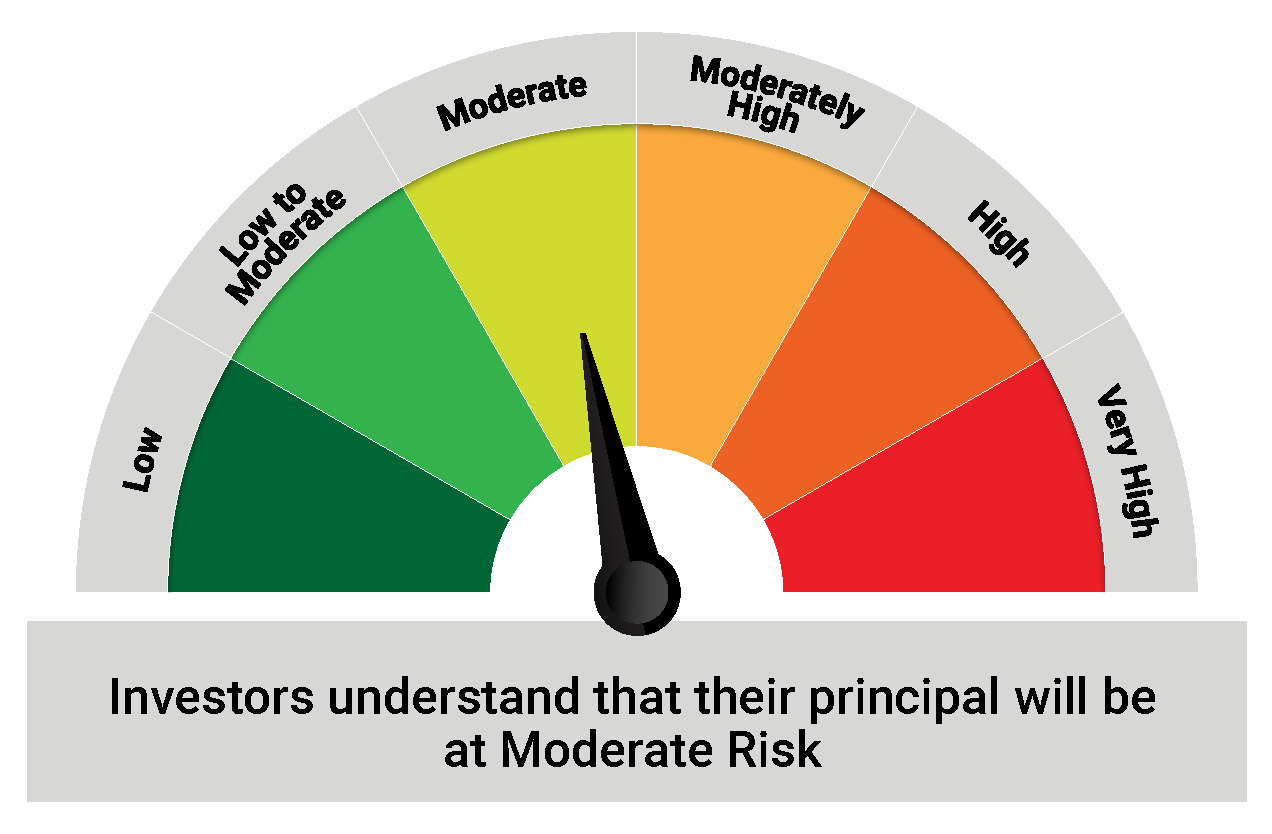

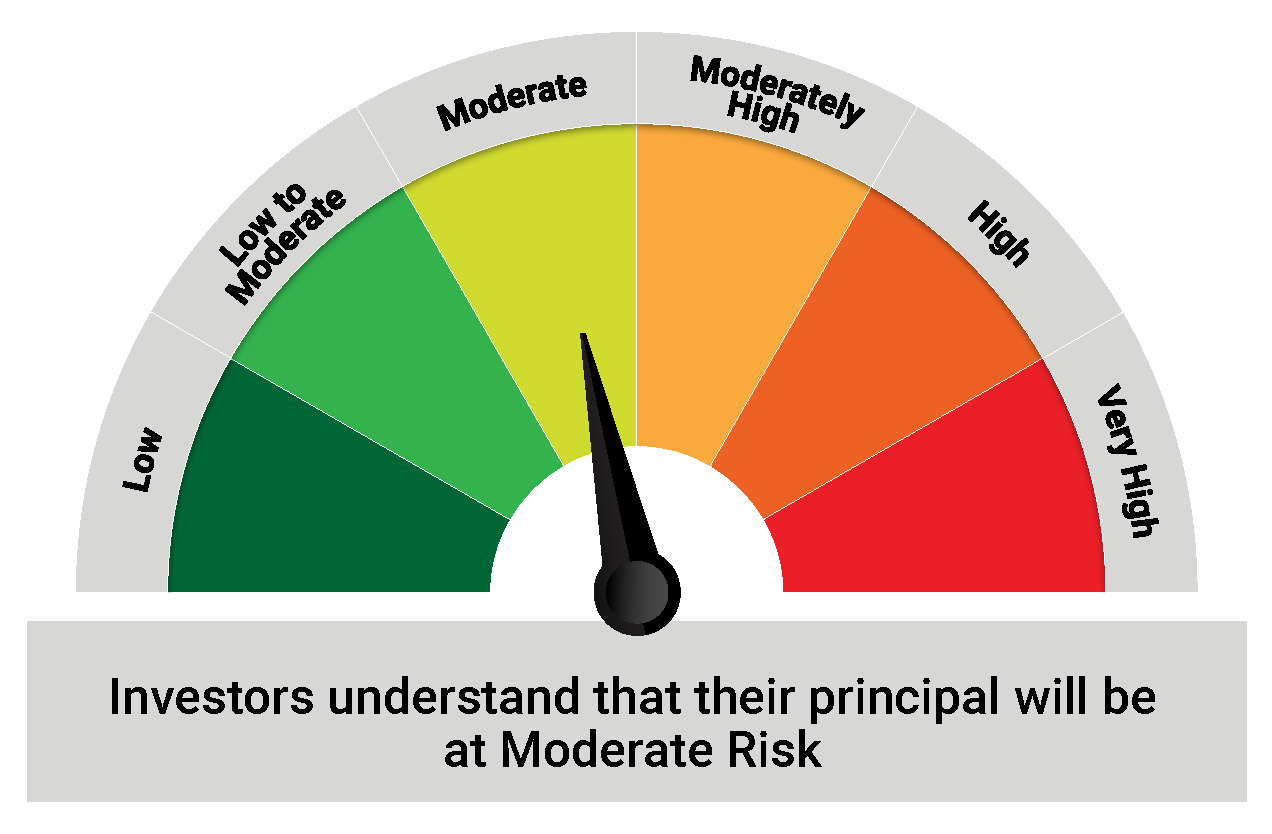

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. |

|  |  |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

The Pivot

Posted On Friday, Apr 21, 2023

The fiscal year 2022-23 has come to an end. The defining feature

Read More -

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Past, Present, and Future of Inflation

Posted On Friday, Feb 24, 2023

Inflation has been one of the biggest challenges in the post-pandemic world.

Read More