Geopolitics, Oil and the Bond Market

Posted On Wednesday, Mar 16, 2022

The ongoing military conflict between Russia and Ukraine has become the centerpiece of all the economic and market discussions around the world. This has pushed commodity prices spiraling up at a fast pace and created a panic in the financial markets.

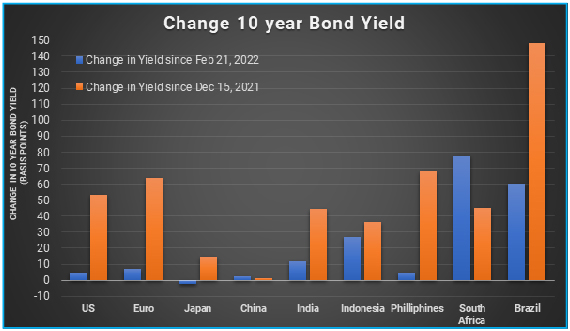

The risk-off sentiment is pulling down equities and weakening energy importing EM currencies, while the impact on EM bonds due to invasion has been mixed.

Since February 21, 2022, the Indian Rupee has lost ~ 2.4% against the US Dollar, the BSE-30 Sensex Index has fallen by 3.9% and the 10-year Indian government bond yield has moved up by 12 basis points (data as of March 10, 2022).

Chart – I: Bonds Showing Mixed Response; Remain Vulnerable to Oil Shock

Source – Refinitiv, Quantum Research, Data as of March 10, 2022.

Past Performance may or may not sustained in future.

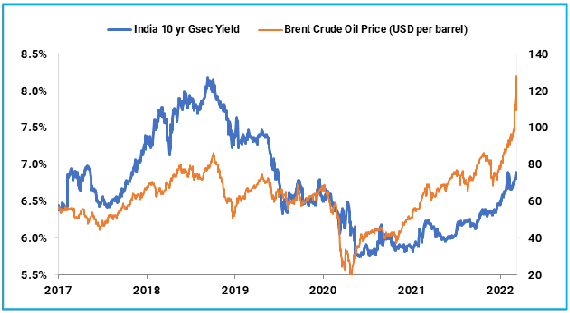

At the epicenter of all this is oil prices. Russia plays an outsized role in the global oil market. It is one of the largest producers of oil in the world accounting for more than 10% of the total world production of crude oil. Fear of supply disruption has pushed the crude oil prices surging above US$ 120 /barrel, the highest in more than a decade.

Now, a possibility of prolonged war and stricter economic sanctions raise risks of further supply disruptions and even higher oil prices.

Chart – II: India yields closely track crude oil prices

Source – Bloomberg, Quantum Research, Data as of March 10, 2022.

Past Performance may or may not sustained in future.

India Vulnerable to Oil Price Shock

For the Indian economy, it gives a feeling of déjà vu.

India faced its worst economic crisis in the aftermath of the Gulf war following the Iraqi invasion of Kuwait in 1990. Precipitated by the consequent spike in oil prices, India's oil import bill swelled, exports slumped, credit dried up, and investors took their money out leading to a balance of payment crisis.

It also reminds us of India’s ‘fragile five’ movement between 2011-2013. As the Arab spring took hold of much of the middle east, oil prices shot up leading to the widening of the current account deficit and high inflation. This ended with a ~20% fall in Indian Rupee against the US dollar and ~150 basis points jump in bond yields between July-September 2013 during the taper tantrum.

India imports more than 85% of its total crude oil consumption. This makes the Indian economy and the Indian bond markets vulnerable to an oil price shock.

For every US$ 10/barrel increase in the crude oil price, the import bill increases by US$ 20 billion, and the current account deficit widens by ~0.4% of GDP.

With full pass-through in diesel and petrol prices, a 10% rise in crude oil price would add about 25 basis points to the headline CPI directly. Its second round impact through increased transportation cost for other goods and services can add another 20-30 basis points in the headline inflation.

Table - I: Indian Economy Sensitive to Crude Oil

| Impact of US$ 10/bbl increase in Crude oil price... | |

| Import bill | (+) US$ 23 billion (0.7% of GDP) |

| Current Account Deficit (CAD) | (+) US$ 15 billion (0.4% of GDP) |

| Fiscal Deficit | (+) US$ 15 billion (0.4% of GDP) |

| GDP | (-) 20 basis Points |

| Inflation (for 10% rise in Crude oil prices) | (+) 45 basis Points |

Source: RBI, Quantum Research

Domestic petrol and diesel prices have not been changed since early November last year possibly due to ongoing state elections. The average brent crude oil price was ~US$ 80/barrel in November 2021. It is now trading above US$ 120/barrel.

As state elections get over this week, we may see a steep rise in domestic pump prices, or a major cut in fuel taxes or some combination of both.

We expect a combination of price hikes and a tax cut. This would push inflation higher and reduce the fiscal cushion.

Bond Market Impact

From the bond market’s perspective, this is a perfect storm. It was already grappling with rising inflationary pressures, large demand-supply imbalance, and less supportive global monetary policy. Now the geopolitical tensions have added another layer of uncertainty in the market.

For now, geopolitics remains the biggest driver of the bond market. Going ahead interest rate trajectory will be shaped by:

• how long the war goes on

• nature and scope of sanctions on Russia, and

• supply disruptions in the energy and other commodity markets

Table - II: Geopolitical Scenarios and their impact on the Bond Market

| Scenario | Market Impact |

| Russian Oil & Gas remains out of sanctions | Oil prices may come off somewhat, Market focus may shift to monetary policy Bond yields may continue to rise at a gradual pace; Yield curve to flatten with short term rates going up faster. |

| War goes on for long > stricter sanctions covering Oil & Gas | Oil prices may shoot up; Significant global Risk off bond yields move higher at a faster pace, INR depreciate |

Portfolio Positioning

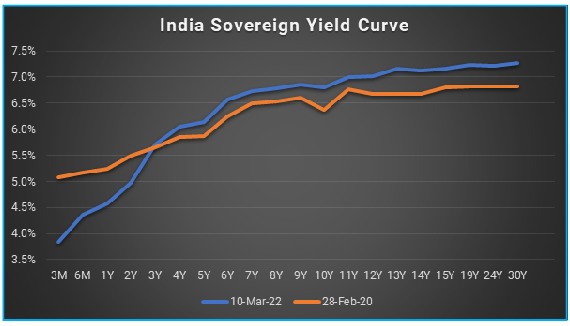

We expect the bond yield to move higher due to high oil prices and demand-supply imbalance. However, the yield curve is still very steep in the unto 5-year maturity segment.

With the overnight cash rate (Tri-party Repo) near 3.3%, 1yr Gsec trading around 4.6%, and 5-year Gsec trading around 6.1%, defensive portfolio positioning and cash holding comes with a substantial loss in interest accruals.

In this environment, the 2–5-year part of the Gsec curve offers the critical balance between the duration and accrual. It also offers a decent rolldown potential which can offset some of the rise in bond yields going forward.

Chart – III: Steep Yield Curve to Penalise Defensive Positioning

Source – Refinitiv, Quantum Research, Data as of March 10, 2022.

Past Performance may or may not sustained in future.

The Bulk of our holding in the Quantum Dynamic Bond Fund is in the 2-5 years maturity segment. Given the current geopolitical uncertainty, we are also holding a significant cash position in the fund to have a cushion against market sell-off.

We stand vigilant to react and change the portfolio positioning in case our view on the market changes.

What should Investors do?

In an environment of high uncertainty, it would be prudent for investors to avoid excessive credit and interest rate risk.

In our opinion, a combination of liquid to money market funds and short-term debt funds, and/or dynamic bond funds with low credit risks should remain as the core fixed income allocation.

We suggest bond fund investors to have a longer holding period to ride through any intermittent turbulence in the market.

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author – Pankaj Pathak, Fund Manager – Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian – Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Read our last few Debt Market Observer write-ups -

- The Fed Ultimatum

- The Great Divergence

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Low to Moderate Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on February 28, 2022.

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

The Pivot

Posted On Friday, Apr 21, 2023

The fiscal year 2022-23 has come to an end. The defining feature

Read More -

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Past, Present, and Future of Inflation

Posted On Friday, Feb 24, 2023

Inflation has been one of the biggest challenges in the post-pandemic world.

Read More