Equity Year End Wrap-up & Outlook 2025

Posted On Saturday, Jan 11, 2025

2024 was an eventful year with elections in domestic and dominant foreign countries, commencement of rate cutting cycles globally and slowdown in domestic economy. Sticky inflation didn’t grant any room for rate cuts in India. Despite slowdown in the domestic economy and muted earnings growth, equity markets had a reasonable performance supported by DII and retail flows. Reasonable market performance despite muted earnings growth has led to above average valuations in most pockets.

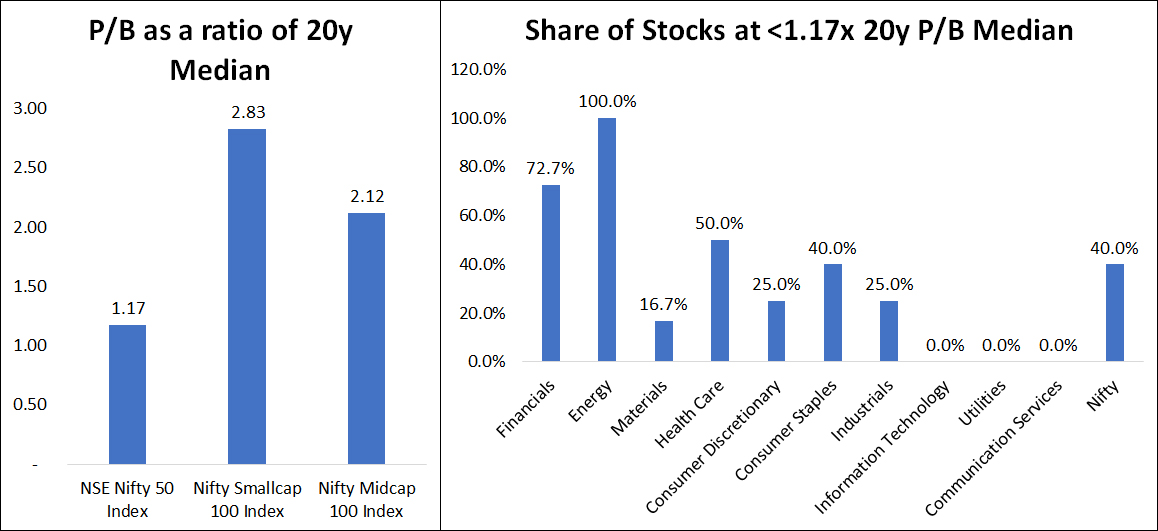

As shown in the following graph, market valuation across segments remains higher than historic median. Large cap universe as indicated by Nifty is relatively less expensive compared to small and mid-caps. The second chart shows the share of stocks within sectors where the ratio of current valuation relative to its historic median is lower than Nifty’s similar ratio.

Source: Bloomberg; Data as of 17-Dec-2024

If we were to anlayse the sector wise valuation of stocks within Nifty (Based on GICS classification), most sectors are trading at elevated valuations compared to Nifty. Financials and Energy are the segments where valuations indicate attractiveness. Financial sector is dominated by select private sector banks and certain insurance names. Energy sector majorly comprise of certain public sector names which generally tend to command relatively lower multiples due to the nature of its business.

Key Triggers to decide market direction in 2025:

- Revival in Corporate Earnings Trajectory

The recent earnings season witnessed steep earnings cuts in quite a few sectors. The key sectors which led the bulk of decline were in Energy, Cement, consumer discretionary and Insurance. The margin expansion witnessed last year, driven by lower input cost has moderated and EBITDA has recorded a marginal decline, highlighting margin concerns.

Large components within Energy sector reported poor earnings due to weak GRM (gross refining margins); infra focused themes were impacted due to lack of capex spends by government. Heightened competition coupled with slowdown in consumption continues to put pressure on sectors such as paints/cement/FMCG. Going forward, we expect a gradual recovery in earnings as we progress through the year driven by cyclical recovery in many of these sectors.

- Global Policies:

Policies by the newly elected government in the US could influence global trade and there could be few areas where India may benefit. Case in point is India IT services, which has borne the brunt of increased cost of doing business due to talent localisation during Trump’s previous tenure. Earnings trajectory of US corporates would be a key determinant of technology spends translating to opportunities for Indian IT firms. A potential tax cut could give a boost to earnings leading to higher discretionary spends for the IT firms. The weaker rupee/stronger dollar is a good tailwind for the IT sector as exports from India become lucrative.

Global manufacturing may see an accelerated move away from China if any incremental tariffs are placed on imports from China into US. India may be one of the beneficiaries. Pharma sector could be a key beneficiary in diversion of trade from China, especially generic drug and active pharmaceutical ingredient (API) suppliers.

- FPI flows

Global central banks have commenced the rate cutting cycle. Lower interest rates indicate lower opportunity cost for investment in equities. This could trigger a revival in FPI flows which form a predominant share of Indian equity holding. Lack of visible growth signs in China could also increase attractiveness of India as a credible emerging market with reasonably stable policy environment.

What should an investor do?

2024 was a year of one-offs with slowing government capex and extreme climate scenarios impacting the demand environment. 2025 is likely to see normalization on many fronts such as capex, demand normalization and interest rate moderation. Though valuations remain elevated in many pockets, investment processes which have valuation related guard rails are likely to outperform in this environment. Investors should maintain the right asset allocation at all points in time and may invest towards equity in a staggered manner.

|

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More -

Equity Monthly View for February 2025

Posted On Friday, Mar 07, 2025

Indian markets continued the down trend in the month of February 25 on the back of continued FPI

Read More -

Equity Monthly View for January 2025

Posted On Thursday, Feb 06, 2025

Indian markets witnessed sharp sell-off in the month of January on the back of continued FII selling (USD -8.6Bn in January 25 vs USD -755Mn for CY2024).

Read More