Equity Year End Wrap-up & Outlook 2024

Posted On Friday, Dec 22, 2023

2023 defied the consensus view of moderate equity returns given the background of rising global interest rates, limited scope for valuation expansion and elevated crude prices amid geo-political tensions. The Sensex delivered a total return of 19.1%, majorly supported by earnings growth. BSE Mid cap and BSE Small cap indices delivered returns of 44.7% and 46.7% respectively. Returns in large and mid-cap indices were majorly driven by earnings growth with flattish earnings multiple. This is indicative of the strengthening of the earnings upcycle which commenced in FY22. (Note: YTD Return figures as of Dec 15, 2023 are considered)

Key Triggers to decide market direction in 2024:

- Demand Pickup in mass segment: Demand in mass market and rural segments remain muted since the pandemic due to inflationary pressures. A moderation in inflation could support a recovery in the mass market segment, further strengthening the ongoing economic upcycle. While the earnings growth in recent quarters was driven by margin expansion, volume growth driven by broad-based demand could support earnings growth in 2024. Volume recovery in rural focussed two-wheeler sales indicate green shoots in rural consumption.

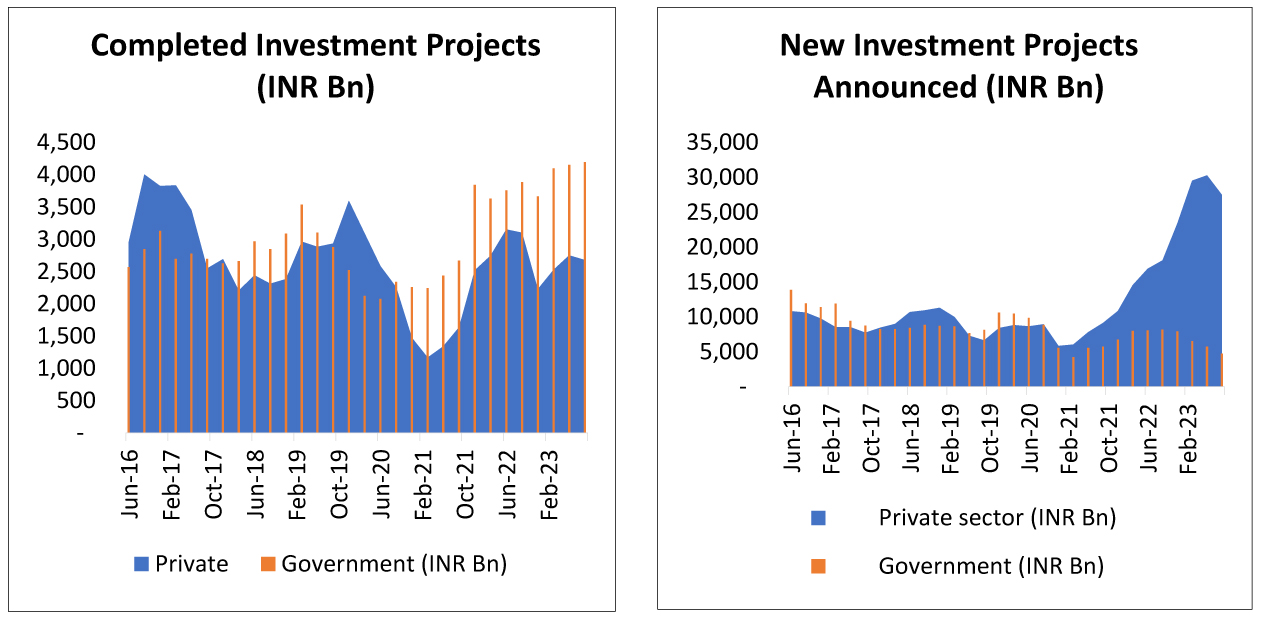

- Private Capex Revival: Most of the recent capex was driven by government sector. As per RBI survey, capacity utilisation in manufacturing sector is near a healthy level of 74-75%. Buoyant demand environment along with a pickup in utilisation could strengthen the private capex trajectory. Private capex is showing early signs of revival. As indicated in the below graphs, share of private sector in new project announcements has meaningfully improved.

Private Sector Leads in New Project Announcements:

Source: CMIE; TTM (Trailing Twelve Month) figures are considered

- Foreign Flows: While DII flows have been robust for the past few years, rising global interest rates have kept FPI flows under check. DIIs have invested $ 20.2 bn in 2023 on top of $ 35.8 bn in 2022. FPI flows have been tepid at $ 12.8 bn this year, but better than the outflow of $ 16.5 bn in 2022(Data as of Nov-2023). This has resulted in decadal low FPI ownership in Indian equities. As global inflation and interest rates moderate, India’s stable policy environment and resilient economy could attract meaningful foreign flows.

Segments that could drive Markets in 2024:

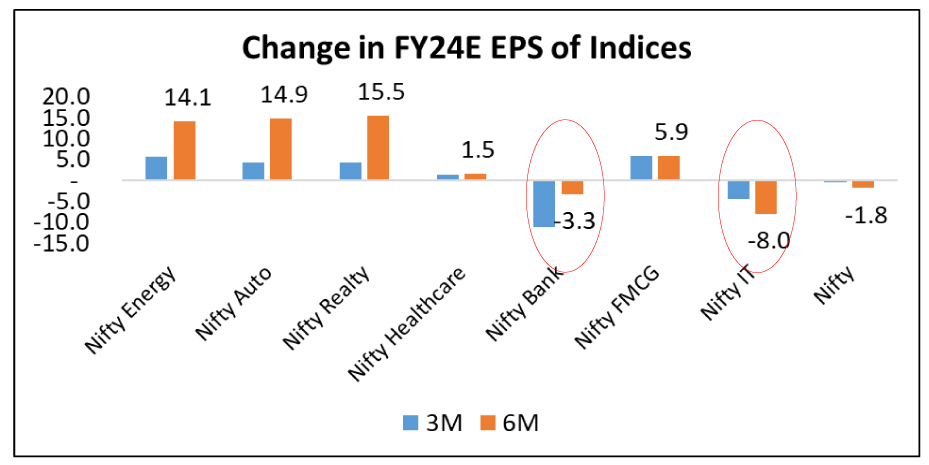

Investors need to be selective as most sectors have seen a favourable earnings cycle along with stellar returns. The trajectory of consensus earnings estimates of a sector along with recent return profile can provide insights to identify the next set of market drivers. Two promising sectors which have delivered relatively muted returns along with a potential improvement in earnings trajectory are Banks and IT. Favourable credit cycle coupled with a revival in corporate credit offtake can drive earnings of banks. A likely soft landing in the US can trigger a faster conversion of deal wins to revenue in IT sector.

Apart from fundamental reasons, these two sectors could be major beneficiaries of a reversal in FPI flows.

IT and Banks: Muted Earnings Expectation and reasonable valuation

Source: Bloomberg; Data as of Dec 14, 2023

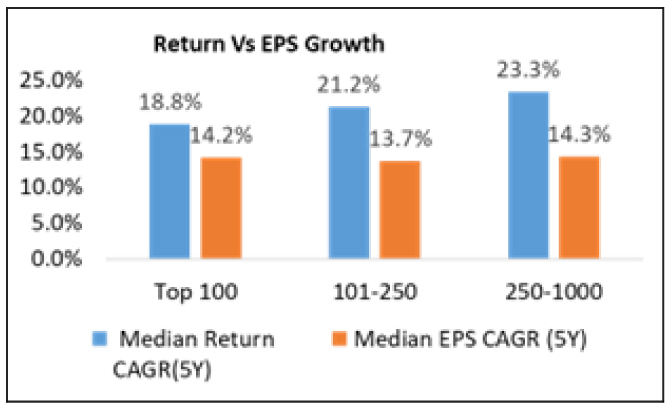

As indicated in the below graph, small and mid-cap stocks have recorded relatively better returns compared to their earnings growth. Apart from normalisation in earnings, higher flows into these categories have contributed to the superior returns in the segment. Cumulative share of flows into small and mid-cap categories over the past 3 years stands at 28.3% Vs AUM share of 19% (Source: AMFI, Data as of Nov-23). On the back of relatively lower historic returns compared to earnings growth, large caps appear favourable on a risk-reward basis.

Median Return and EPS CAGR across market cap categories:

Source: Bloomberg; Data as of 30-Nov-2023

Note:

- Companies with a listing history of at least 5 years is sorted by market cap (Highest to Lowest)

- Median EPS CAGR is computed for stocks with meaningful EPS growth values within the category

What should an investor do?

Notwithstanding the above average valuations, the favourable earnings cycle and policy stability makes us positive on equities over the medium term. The reasonable earnings growth in the medium term could make valuations seem rational over time. Domestic economy is in fine fettle while global economy could stabilise as interest rates start their downward journey. Unlike prior election years, the base case of policy continuity could limit the volatility around election period. While the current setting doesn’t indicate chances of a material correction, staggered investment may be considered for fresh investments to benefit from any near-term volatility.

Data source: Bloomberg

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More -

Equity Monthly View for February 2025

Posted On Friday, Mar 07, 2025

Indian markets continued the down trend in the month of February 25 on the back of continued FPI

Read More -

Equity Monthly View for January 2025

Posted On Thursday, Feb 06, 2025

Indian markets witnessed sharp sell-off in the month of January on the back of continued FII selling (USD -8.6Bn in January 25 vs USD -755Mn for CY2024).

Read More