Equity monthly view for February 2021

Posted On Friday, Mar 05, 2021

March 05, 2021

S&P BSE Sensex increased by 6.2% on a total return basis in the month of February. On trailing twelve-month basis, the index has returned 29.9%. S&P BSE Sensex performance was much better than developed market indices such as S&P 500, which increased by 4.2% during the month. It was also better than the MSCI Emerging Market Index which rose by 2.2% during the month.

S&P BSE Mid-cap and S&P BSE Small-cap indices outperformed the S&P BSE Sensex in February; with the S&P BSE Midcap Index rising by 10.7% and the S&P BSE Small-cap Index rising 12.2%. Cyclicals did lot better in February with Power, Metals, Real Estate sector seeing a sharp increase, while technology and consumer staples stocks underperformed during the month.

| Table 1: Market Performance at a Glance | |

| Index | Trailing Twelve Months Returns %* |

| S&P BSE SENSEX | 29.9 |

| S&P BSE 200 | 33.6 |

| S&P BSE MID CAP | 38.4 |

| S&P BSE SMALL CAP | 48.9 |

| MSCI Emerging Market Index | 39.1 |

| S&P 500 | 33.9 |

* On Total Return Basis

Source-Bloomberg

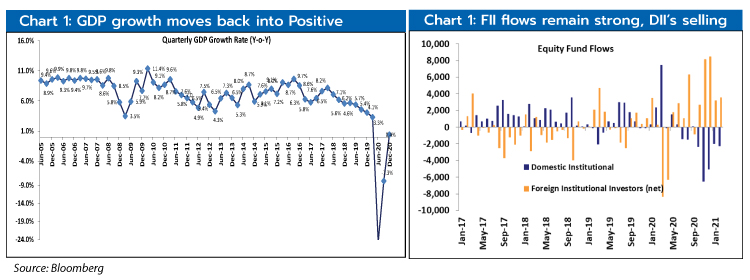

GDP moves out of recession

After two quarters of sharply negative growth, India’s GDP reported a marginally positive 0.4% growth in Q3FY21. GDP recovery continues to be led by Government spending, while private capex remains weak. High frequency indicators are also indicating economic activity is back to normal. Surprisingly expectations were slightly higher than the reported GDP, suggesting there is still some pain in the system especially in the unorganised sector. Feedback from corporate India remains strong and most companies have reported sharp jump in profitability in Q3FY21, driven by demand normalisation and cost efficiencies. Unless there is a significant increase in new Covid cases, its highly likely that the worst of the covid crisis is behind us. With Government spending expected to remain strong and liquidity to remain easy, GDP growth could surprise on the upside in coming quarters.

Flows Accelerate

FII’s continued to remain large net buyers of Indian equities, buying $3.5 bn worth in the month of February. FII’s have purchased $5.4 bln worth of equity stocks for this year till date, this on the back of US$ 23 bn of net buying in CY2020. DII’s have remained net sellers in February selling $2.3 bln worth of equities. Indian rupee marginally depreciated by 0.73% during the month. India will be reporting a very strong GDP growth in FY22 on a low base, making the India story very compelling for foreign investors and its likely FII flows will remain strong for the CY21.

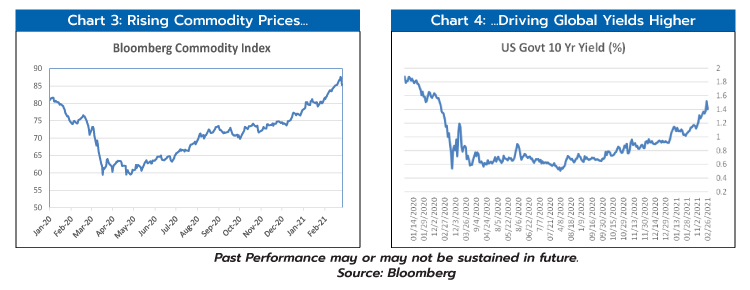

Rising Yields a worry

Bond markets have started showing nervousness about sharply rising commodity prices especially crude. The equity rally which started in April 2020 has broad underlying assumptions of easy liquidity plus large fiscal stimulus without significant uptick in inflation. Rising yields may queer the pitch and trigger a selloff in global equities. We continue to believe Central bankers will strive to keep yields low and continue to nurture the nascent recovery and drive employment in their respective economies. As of now we do not believe equities will sell off significantly fearing rising yields.

Domestically we have seen increase in covid cases in key states of Maharashtra and Kerala. The numbers still remain far below peak but remains a cause for concern. India so far has been lucky not to witness a second wave. Equity markets are factoring a normalisation of economic activity, any substantial increase in new Covid cases will derail the recovery and may trigger a sharp sell off

Table 2: New Covid cases sharply lower but has risen from the lows

| Apr-30 2020 | Jun-30 2020 | Sep-30 2020 | Dec-31 2020 | Jan-31 2021 | |

| Daily Tests | 72,453 | 217,931 | 1,426,052 | 1,127,244 | 795,723 |

| Daily new infections | 1,901 | 18,522 | 80,472 | 21,822 | 16,752 |

| Cumulative Cases | 33,610 | 566,840 | 6,225,763 | 10,266,674 | 11,096,731 |

| Of which -Recovered | 24,162 | 334,822 | 5,187,825 | 9,860,280 | 10,775,169 |

| Deaths - Cumulative | 1,075 | 16,893 | 97,497 | 148,738 | 157,051 |

| Vaccine Shots – Cumulative | 14,301,497 |

QLTEVF saw a 6.9% appreciation in its NAV in the month of February. This compares to 7.5% appreciation in its benchmark S&P BSE 200. Marginal underperformance for the month was driven by holdings in IT, Pharma and Auto. Cash in the scheme stood at approximately 6% at the end of February. Market valuations remain elevated and are factoring a robust recovery. Earning reported by corporate India have so far surprised positively and have led to slight upgrades. Rising earnings and excess liquidity is expected to keep valuations high. Any risks to the economic recovery can result in sharp correction. We remain constructive on Indian equities with longer-term view & suggest a neutral weight. Given the sharp run-up, we believe any fresh allocation toward equities should be staggered or through an SIP route.

Source: Bloomberg

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Long Term Equity Value Fund (An Open Ended Equity Scheme following a Value Investment Strategy) | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk-o-Meter is based on the portfolio of the scheme as on February 28, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly View for February 2025

Posted On Thursday, Feb 06, 2025

Indian markets witnessed sharp sell-off in the month of January on the back of continued FII selling (USD -8.6Bn in January 25 vs USD -755Mn for CY2024).

Read More -

Quantum ELSS Tax Saver Fund: Solid, Stable and works 30 hours a week for you

Posted On Friday, Jan 31, 2025

Investors seek stability, consistency, and reliability in their financial journey.

Read More -

Resilience in Rough Markets - Invest the Quantum Way

Posted On Friday, Jan 24, 2025

It’s been a jolly good ride for Indian equity investors since 2020 with 5-year annualized return of frontline indices Nifty 50 and Nifty 500 at 15.5% and 19% respectively as per NSE data as on December 2024.

Read More