Equity monthly view for June 2020

Posted On Friday, Jul 10, 2020

July 10, 2020

Quantum Equity Team

June turned out to be another month of spectacular equity gains after the sharp pullback of April. S&P BSE Sensex inclined 7.7% during the month. India’s performance for the month was better than emerging market peers. MSCI Emerging market index gained 7.3% during the month (in same currency). On a year to date basis, BSE Sensex has declined 15.0%. This is on account of sell off in March following Covid-19 fears.

Small and mid-cap stocks fared better than the narrower index of BSE 30. S&P BSE Mid Cap index rose 10.4% during the month. S&P BSE Small Cap index has gain of 13.7% during the period. On YTD basis as well they have performed better. 12.2% and 9.1% is respective fall in Mid cap and Small cap index.

Cyclical sectors such as banks, auto and real estate were best performing for the month. Many data points suggested economic recovery. Bank and finance companies are indicating lesser borrowers taking moratorium benefit, helping stock performance. Telecom, FMCG and healthcare were among the sectors that didn’t participate in rally.

| Market Performance at a Glance | |

| Market Returns %* | |

| S&P BSE SENSEX YTD** | -15.0% |

| S&P BSE SENSEX MTD** | +7.7% |

| S&P BSE MID CAP MTD** | +10.4% |

| S&P BSE SMALL CAP MTD** | +13.7% |

| BEST PERFORMER SECTORS | Finance, Auto, Real estate |

| LAGGARD SECTORS | Telecom, FMCG, Healthcare |

| * On Total Return Basis | |

| ** Source-Bloomberg | |

YTD - Year To Date | MTD - Month To Date

FIIs pumped in USD 2.5 Bn in the month of June. On year to date basis, FIIs have pulled out USD 2.4 Bn from Indian stocks. Domestic institutions (DIIs) were net buyers of USD 0.3 Bn during the month. Within DII, mutual funds were sellers of USD 0.5 Bn stocks while insurers contributed the balance. DIIs have invested USD 11.8 Bn in equity market so far in 2020. Indian rupee gained 0.14% against US dollar during the month.

Covid 19 had led to global economies going through sharp deceleration. Economies across the world are expected to contract 5%-10% range in 2020. GDP witnessed in calendar 2019 (before the pandemic) could possibly return only in 2021 or 2022. To fight the virus, countries have used fiscal stimulus. The size of global stimulus announced is approx. 12% of world GDP. While developed countries could provide such support, developing countries such as India were constrained given limited manoeuvrability.

Fiscal policy has been supported by monetary policy to fight Covid-19. Here, emerging markets haven’t been much behind their developed counterparts. Interest rates in most developed countries have fallen closer to zero or in negative territory (Europe). US Fed has flooded the markets with cash and even taken measures to buy private sector bonds and give backstop so that companies don’t default. This is unprecedented in the history of country.

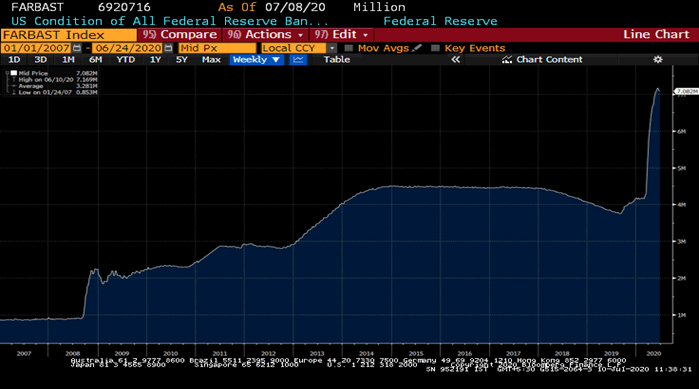

Federal Reserve Banks total assets (2007 Jan to 2020 Jun)

Source: Bloomberg

US Fed balance sheet has expanded from 4.2 Trn USD to 7.1 Trn USD in 4 months. The liquidity that was created in past 70 years by the central bank has been matched in last 4 months. The surge of liquidity has found its way in all asset classes including equities. Rally in equity markets has been much ahead of recovery in real economy.

Popular indices (non-sector specific) have risen 32-39% by June end (US dollar terms) since the bottom of 23rd March 2020. S&P BSE Sensex rise has been 34.7% in the same period (USD). Apart from central banks, there has been increased retail participation that has also helped stocks.

Retail investors across countries such as US and Australia have flocked to the stock markets. Many of these amateur investors are understood to be products of lockdown. People can no longer bet on sports events and go to casinos due to lockdown. Many have taken to betting on the stock markets as a result. They are called Robinhood investors in US, by name of the platform they do daily trades on.

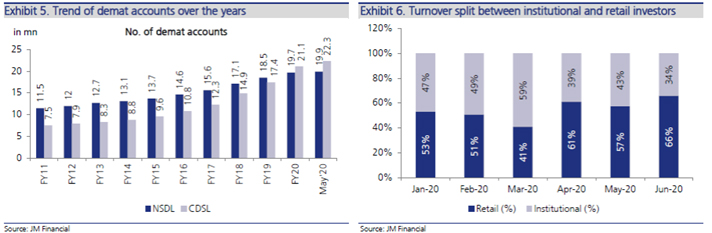

India is no different and has seen an increased participation from retail investors. Brokerage accounts opened by individuals in 2 months of FY21 have exceeded that of full year FY20.

Share of retail volumes in daily market turnover have far exceeded institutional investors (chart below).

On geopolitics, India’s tension with China in the Galwan valley of Ladakh region escalated. This was after 20 military personnel on Indian side were killed in hand combat. Both countries have engaged on mutual de-escalation. There have also been reports of cargo coming from China/Hong Kong being held at Indian ports which has led to supply chain delay for corporates and public.

In a revised forecast, IMF expects India’s GDP to contract by 4.5% during current year. This is the sharpest contraction by the agency of all countries. They expected GDP to decline 1.9% in April. Given lack of stimulus and a large unorganised sector, India’s GDP growth remains vulnerable in FY21.

India’s foreign exchange reserves overtook USD 500 Bn for the first time in history. Better portfolio flows helped. Trade deficit also narrowed for the country as imports contracted at fast pace.

Even as many parts of country are opening up, there have been others which are going into fresh lockdown. Rise in new cases of Covid-19 has led to this situation. Economic recovery is expected to be slow as India has become the 3rd largest country by number of covid positive cases.

BSE Sensex has risen from PE of 16 times in March month to 24 times currently. This has made it look slightly expensive. However, it is only a handful of stocks which have contributed to the overall rally. Earnings of most companies are likely to be disappointing in FY21 as lockdown has affected most.

Current economic scenario is challenging for many companies. Many companies may not survive and some will appear weaker after the current crisis. Few other companies, however will appear stronger and benefit from consolidation in respective industries. The scheme has chosen stocks which will hopefully be winners in the long term.

India is likely to grow faster than many nations. Economy is dependent on domestic consumption and thus insulated from any global problems over the long term. While economic growth faces pressure in near term, better monsoon and measures to ease liquidity are likely to stimulate growth. Opening up of most parts of economy is likely to lead to demand revival and employment creation. The risk being corona virus doesn’t see a resurgence.

QLTEVF saw a 6.0% appreciation in its NAV in June. In comparison its benchmark BSE 200 had 7.9% rise in the month. Financial stocks did quite well during the month. Scheme weight in financial stocks was lower than benchmark’s weight, leading to inferior performance. Not owning Reliance stock hurt during the month as it was up 16.4%. It alone contributed 28% of monthly BSE Sensex return.

Cash level in the scheme was 9% at month end. The scheme trimmed its holding in a power utility stock during the month. This was owing to change in view of the business

Data Source: Bloomberg

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Moderate Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – https://www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Debt Monthly View for January 2025

Posted On Friday, Feb 07, 2025

Bond markets witnessed increased volatility during the last month with the 10-year Government

Read More -

Gold Monthly View for January 2025

Posted On Friday, Feb 07, 2025

In the calendar year 2024, gold demonstrated remarkable performance, yielding a return of ~ 27%.

Read More -

Equity Monthly View for February 2025

Posted On Thursday, Feb 06, 2025

Indian markets witnessed sharp sell-off in the month of January on the back of continued FII selling (USD -8.6Bn in January 25 vs USD -755Mn for CY2024).

Read More