Equity Monthly View for January 2024

Posted On Tuesday, Feb 06, 2024

S&P BSE Sensex declined by -0.6% in the month of January. S&P BSE Midcap Index & S&P BSE Small cap Index increased by 5.2% and 7.1% respectively. Mid & Small continue to outperform the large cap indices. Equities across the globe (expect China) did well in January. S&P 500 was up 1.3%, tech heavy Nasdaq Composite Index was up 1.04%; MSCI Emerging Markets Index was down by -4.6% driven by China in January.

Broader economic activity continues to track well in India, with core inflation moderating. Recent CPI inflation print at 5.7% was high driven by volatile food inflation. The result season so far has been mixed, Banks in general are witnessing margin pressure with high loan to deposit ratio driven by deposit trailing credit growth. Domestic Auto volumes continues to be strong in most sub-segments. Management outlook in IT continues to weak, though most companies are reporting better margin driven by cost control. Pharma companies have witnessed margin expansion driven by better pricing trends in key markets. In terms of flows, FIIs were sellers to the tune of USD 3.1bn in the month of January and DIIs were net buyers with $3.2bn inflows.

Quantum Long Term Equity Value Fund (QLTEVF) saw an increase of 2.8% in its NAV in the month of January 2024; Tier-I benchmark S&P BSE 500 and Tier-II Benchmark S&P BSE 200 increased by 1.9% and 1.4% respectively. Our portfolio stocks within Consumer Discretionary (Auto), utilities and IT did well. Financials driven by banks were a key drag in our portfolio mainly due to NIM pressures.

Fiscally Prudent Interim Budget: Key Takeaways

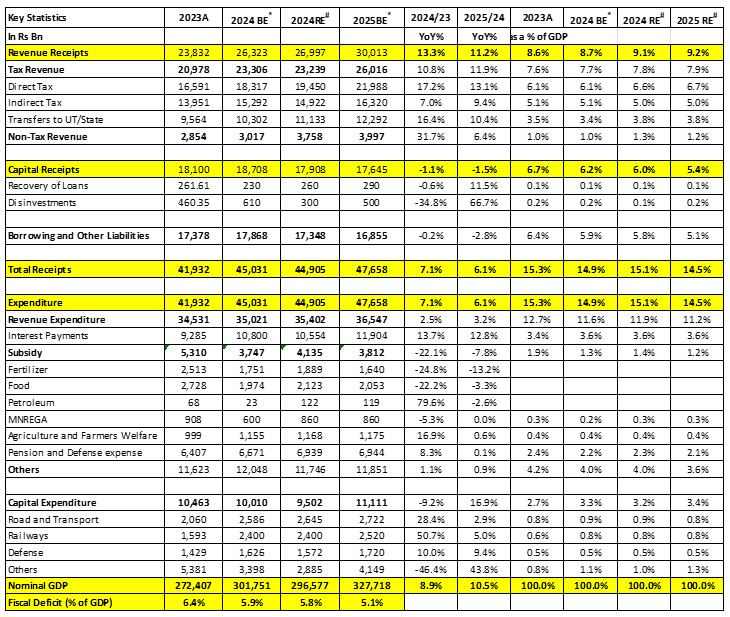

- Fiscal prudence was the key takeaway from the budget with the fiscal deficit projected to be 5.1% of GDP for fiscal year ending March 2025 down from 5.8% in fiscal year ending March 2024. Market expectations were in the region of 5.3%-5.5%. 10-year G-sec yield declined to 7.06% from yesterday’s level of 7.14%.

- Government continues to focus on infrastructure development with a 17% increase in capital expenditure for fiscal year ending March 2025 compared to revised estimates for fiscal year ending March 2024. Revised estimates for fiscal year ending March 2024 are 5% lower than budgeted numbers. There is a 11% increase in capital expenditure if one compares with budgeted estimate of previous year.

- Cut in Food subsidy (-3.3% YoY), Fertilizer subsidy (-13.2% YoY) and flat outlay on MNREGA could have implications on rural economy.

Source: Budget Documents *: Budget Estimates; #: Revised Estimates

Near term risks in our view are negative surprises on inflation trajectory, global slowdown, lack of pickup in rural demand and political uncertainty as the country heads into elections next year. To conclude, our portfolio is well positioned to benefit from cyclical economic upcycle over the medium term with major overweight being Financials and Autos. While there could be uncertainty emerging globally or in India; investors should not be unnerved by the near-term volatility and focus on allocating prudently to equities based on their financial goals. Any sharp correction due to near-term headwinds can offer additional valuation comfort and should be used to allocate more to equities with a long-term perspective.

Data source: Bloomberg

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Riskometer of Tier I & Tier II Benchmark |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. Tier I Benchmark: S&P BSE 500 TRI Tier II Benchmark: S&P BSE 200 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More -

Equity Monthly View for February 2025

Posted On Friday, Mar 07, 2025

Indian markets continued the down trend in the month of February 25 on the back of continued FPI

Read More -

Equity Monthly View for January 2025

Posted On Thursday, Feb 06, 2025

Indian markets witnessed sharp sell-off in the month of January on the back of continued FII selling (USD -8.6Bn in January 25 vs USD -755Mn for CY2024).

Read More