Akshaya Tritiya: Shubh Din Par Sone Mein SIP karo

Posted On Tuesday, May 07, 2024

As Indians, many of our behaviours, practices and choices are rooted in traditions. Such as when buying a new asset – a car, a house, gold, or investing in a new business venture or a financial asset – most of us still look for an auspicious time and day. There are several such days in the year, but Akshaya Tritiya carries a lot of significance.

On this day of the year, the Sun and the Moon are at the acme of their brightness during spring. In Sanskrit Akshaya means “never decreasing”, and since it is the third lunar day of the bright half of the spring season, it is called Tritiya. In other words, Akshaya Tritiya marks the significance of spring.

It is believed that investments made on this day shall bring unending or eternal prosperity and good fortune, springing up the financial stature. To invest in gold, Akshaya Tritiya particularly, is considered as the best muhurats.

But should you base your decision to invest in gold, on the lone astronomy and mythology only?

At present, the outlook for gold seems favourable supported by the following factors:

• There are some geopolitical tensions, whether it is the Russia-Ukraine war, conflict in West Asia--particularly the war between Israel and certain militant groups of the region, attacks in the Red Sea, offensive countermeasures taken by North Korea by firing long-range missiles and deepening ties with Russia and China, fraught relations between the U.S. and China (the two economic superpowers of the world), hostile relations between China and Taiwan, India’s military stand-off with China at the Line of Actual Control, and more.

• There is a risk to the inflation trajectory springing up from the perils of possible geopolitical tensions and geoeconomic fragmentation. The supply chain issues alongside climate events, could disrupt the ongoing disinflation process. Central banks, recognising this, are keeping are close watch on inflation for their monetary policy actions.

• Central banks have pushed back rate cuts for later this year, but not ruled out. They are hoping to see inflation move further down and do not want the ongoing disinflation process to de-anchor by reducing the policy interest rates prematurely. Other than inflation, central banks are also assessing the other incoming macroeconomic data, evolving outlook and balance of risks. If the risks diminish, policy interest rates may be cut later this year, which shall augur well for gold on account of the inverse correlation with interest rates.

• Public debt in several countries is burgeoning. Global debt (which includes borrowing of the government, corporates, and households) has touched a record-high of USD 307 trillion in 2023, with big increases across both, developed economies (U.S., Japan, France, and the U.K.) and emerging market economies (China, India, Brazil, and Mexico), as per the Institute of International Finance (IIF). The global debt-to-GDP ratio is roughly 330%, which means that world debt is around 3.3 times its annual economic growth. In some cases, the debt is higher than the pre-COVID pandemic levels. A higher level of debt amidst elevated interest rates rate is increasing the debt burden and adding to economic uncertainty.

• There is uncertainty around general elections. Several countries have their national elections scheduled this year, including India, the U.S. countries in Europe, Mexico, Indonesia, Thailand, North Korea, South Korea, and several others have elections scheduled in 2024. Nearly half of the world's population is heading to the polls in 2024. The outcome of the general elections is set to shape government policies and have an impact on geopolitics, macroeconomic conditions, and society at large. So, there is some element of political uncertainty. If the election results throw surprises, i.e. it is other than what was largely expected, volatility in high-risk asset classes such as equity would intensify, and the spotlight would be on gold. Note, that gold and equities, generally, have an inverse correlation.

In fact, recognising many of the aforementioned factors, gold has caught the attention of investors and scaled a new high of late (Crossed Rs 70,000 per 10-gram in domestic markets and is trading close to USD 2,300 per troy ounce in international markets).

In 2024, gold has thus far generated an absolute return of 13.6% in Indian Rupee (INR) terms as of April 30, 2024. The current uncertain times warrant a strategic allocation to gold for its trait of being a safe haven, an effective portfolio diversifier, and a store of value.

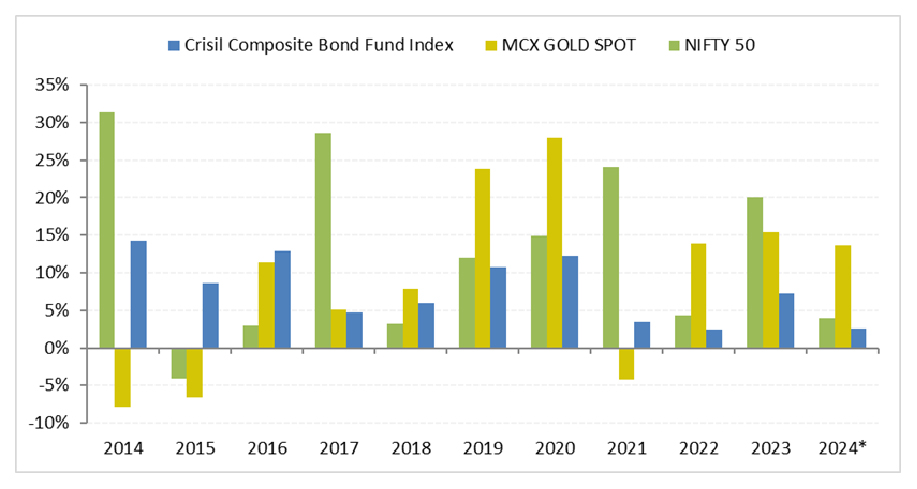

Graph 1: Gold Has proved to be a Hedge in the Investment Portfolio

*Data as of April 30, 2024, MCX spot price of gold used. Returns expressed are in absolute terms considering domestic currency. Past performance is not indicative of future returns. (Source: MCX, ACE MF)

The graph above shows that in times when equities disappointed investors -- like they did in 2016, 2018, and 2022 -- and when fear gripped the world during the Covid-19 outbreak or when geopolitical tensions intensified, it is gold that has exhibited sheen.

Last year, i.e. 2023, sensing the geopolitical and macroeconomic risks, gold even defied high interest rates, and rewarded investors with double-digit returns.

Note, that there is no winning asset class year-on-year. Hence, tactically holding some gold in your investment portfolio is worthwhile.

Graph 2: Gold Has Fared Well in the Long Run

Base = Rs 10,000, Data as of April 30, 2024. MCX spot price of gold used. Past performance is not indicative of future returns. (Source: MCX)

The graph above shows that gold has fared well in the last decade. The long-term uptrend exhibited by gold cannot be ignored and highlights the importance of owning it in the portfolio.

A fact is that, unlike financial assets, gold is a real asset – meaning gold does not carry credit or counterparty risk.

Thus, strategically allocate around 10% to 20% of your entire investment portfolio towards gold and hold with a long-term view (of over 8 to 10 years) considering risk-return ratio. Want to know, in general, what should be your asset allocation? Click here to use our online Asset Allocation tool that shall help you sensibly diversify your investment portfolio.

How to invest in gold currently?

Well, given that the price of gold has moved up, at present it makes sense to stagger your investment in gold (as against a lump sum purchase). Note that given the sharp run-up in prices, a pullback in the near term cannot be ruled out. So, use the declines to stagger your investment in gold over the next few months.

Staggered or systematic investments in gold with discipline would help you handle the price volatility in the interim (with rupee-cost averaging) and minimise emotional investing. And in the medium-to-long term, given the delicate macroeconomic and geopolitical situation, gold has potential to deliver good returns.

This Akshaya Tritiya instead of buying gold in a physical form - by way of bars, coins or jewellery - consider investing in gold the smart way - in the form of a Gold ETF and/or Gold Savings Fund. The latter is a fund-of-fund scheme investing in underlying Gold ETFs, which benchmarks the performance against the prices of physical gold. It strives to produce returns that closely resemble the underlying Gold ETF and price of gold.

The advantage of investing in a Gold Savings Fund is that it facilitates investing in a disciplined manner through the Systematic Investment Plan (SIP) mode with a sum of as little as Rs 500. It offers affordability, convenience, and potential for long-term wealth creation.

You can invest through the regular investment process without holding or opening a demat account.

The units of the Gold Savings Fund will be purchased at the NAV declared by the fund house, and the allotted units will be reflected in your mutual fund account statement.

Similarly, when you wish to sell your units in a Gold Savings Fund, you need to fill in and sign the redemption request slip, submit it to the Investor Service Centres of the fund, or redeem online from the AMC website.

Investing in a Gold Savings Fund clearly has benefits over holding physical gold, such that you do not have to worry about storage or holding costs, risk of loss, or theft, and there is better flexibility and liquidity. It is a hassle-free and smart way to invest in gold.

To learn more about Quantum Gold Saving Fund and to invest, click here.

So, be a thoughtful investor. Buy gold sensibly this Akshaya Tritiya.

Happy Investing!

|

|

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund |

|  Investors understand that their |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund www.QuantumAMC.com.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Akshaya Tritiya: Shubh Din Par Sone Mein SIP karo

Posted On Tuesday, May 07, 2024

As Indians, many of our behaviours, practices and choices are rooted in traditions. Such as when buying a new asset – a car, a house, gold, or

Read More