XIRR & CAGR - Use These Measures to Calculate Your Mutual Fund Returns

Posted On Tuesday, Jun 08, 2021

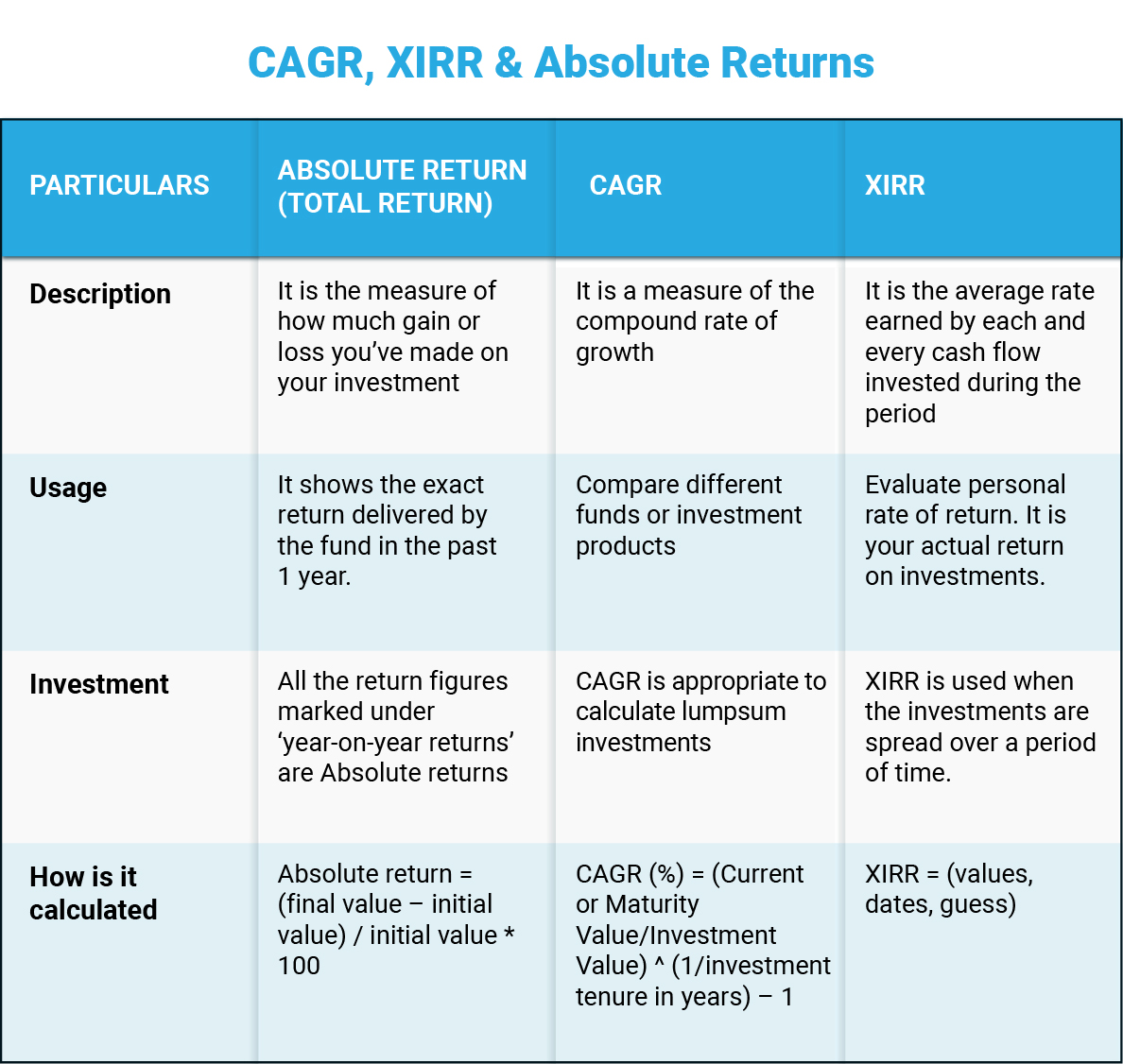

One key aspect of assessing mutual fund performance is to check their returns. This helps you, as investors, to monitor how much a particular mutual fund has lost or gained during a specific investment period. You may come across multiple terms such as Absolute Return, CAGR, or XIRR. Let’s understand the difference between them and their relevance to your mutual fund portfolio.

ABSOLUTE RETURN

What is Absolute Return?

Absolute Returns or Total Returns help you in calculating how much gain or loss you have made on your investment. It is the simplest measure of calculating returns.

When do we use absolute return?

We use absolute returns when we want to showcase a simple point-to-point return where the holding time is generally less than a year.

How do we calculate absolute return?

To calculate, you only need to know the initial and the current or the ending value of the investment scheme

Suppose Sanjay invests Rs. 1,00,000. And after ten months, his investment matures to Rs. 1,20,000. His absolute returns will be:

Absolute Returns = (Ending Value – Initial Value) / Initial Value * 100 = (1,20,000 - 1,00,000 / 1,00,000) * 100 = 20% |

Thus, Sanjay has made an absolute return of 20% over a 10-month period.

COMPOUNDED ANNUAL GROWTH RATE (CAGR)

What is Compounded Annual Growth Rate (CAGR)?

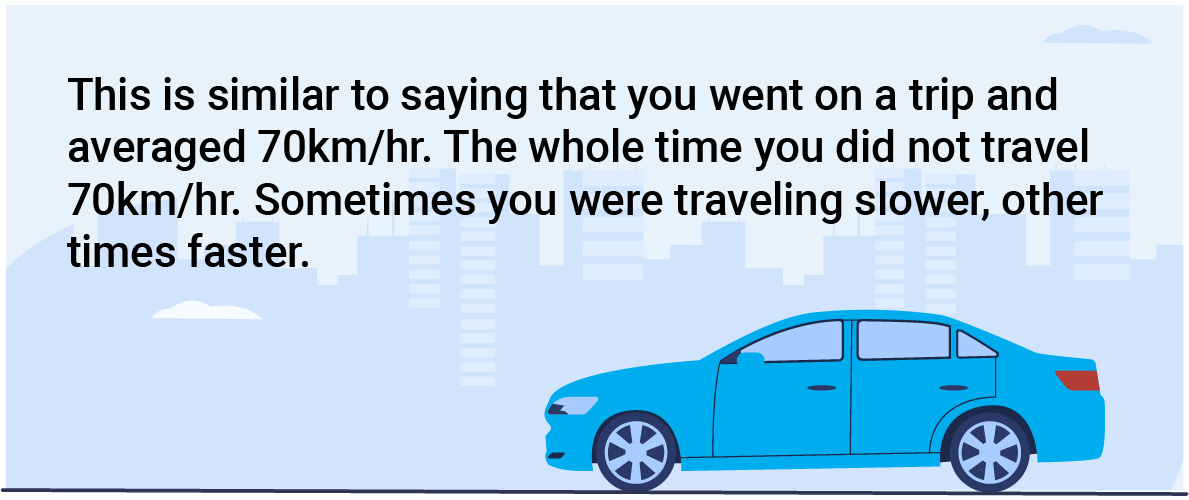

CAGR or Compound Annual Growth Rate helps you gauge the average yearly growth of your investments over a specific time period. It contains the assumption that investment is compounded over time.

When do we use CAGR?

CAGR is a relevant ratio to assess a lumpsum investment. You can use these returns to evaluate how your mutual fund investment is performing among parity schemes, against benchmark or other avenues such as bank deposits.

How do we calculate CAGR?

It just requires three inputs; an investment’s beginning value, ending value and the period.

The formula to calculate CAGR is:

CAGR (%) = (Ending investment value / Beginning Investment Amount) ^ (1/investment tenure in years) – 1 |

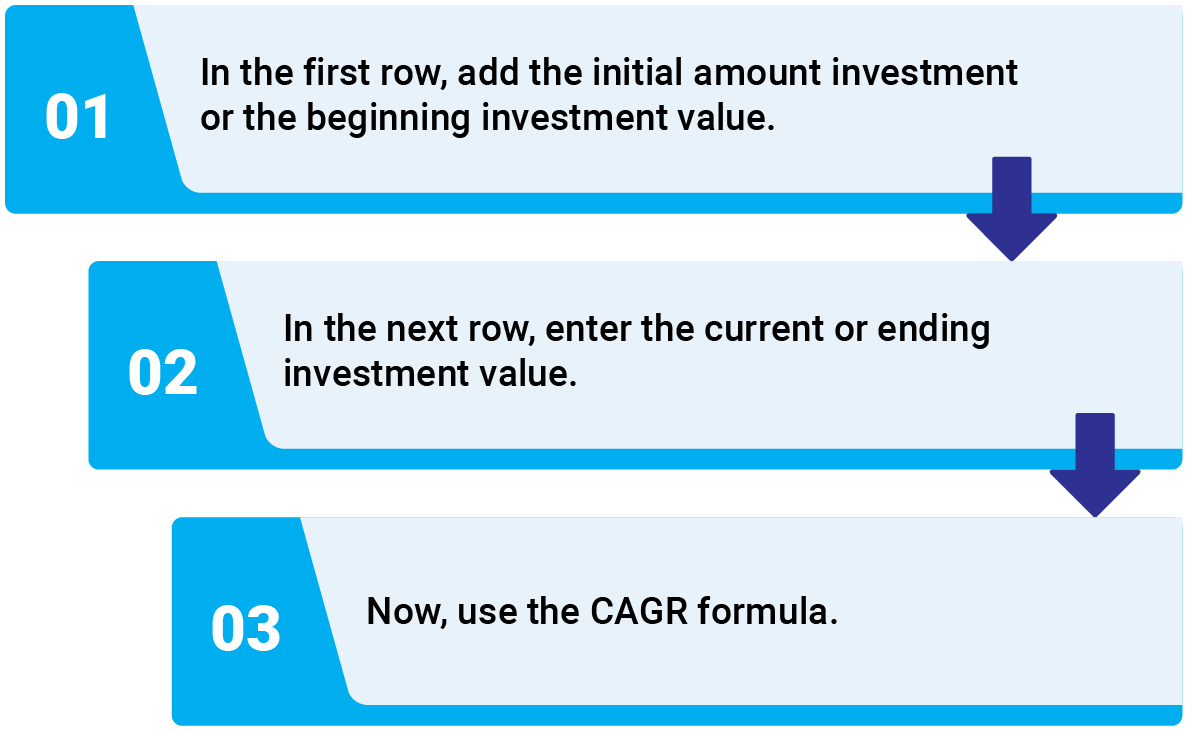

Step-by-Step Process to Calculate in Excel

Suppose you have invested Rs.1,00,000 in scheme A for 3 years and you want to compare with another scheme B for a lesser investment period of 2 years. So here, absolute returns may not give a whole picture since the period is different. Hence, it would help if you used CAGR. See the gif below to see which mutual fund scheme would give you better returns.

The above table is for illustration purposes only.

Having compared both the options, you can see that scheme B is earning better returns than Scheme A. While the absolute returns on Scheme A is higher than the second one, however, the earning potential for the second option is greater as determined by the CAGR.

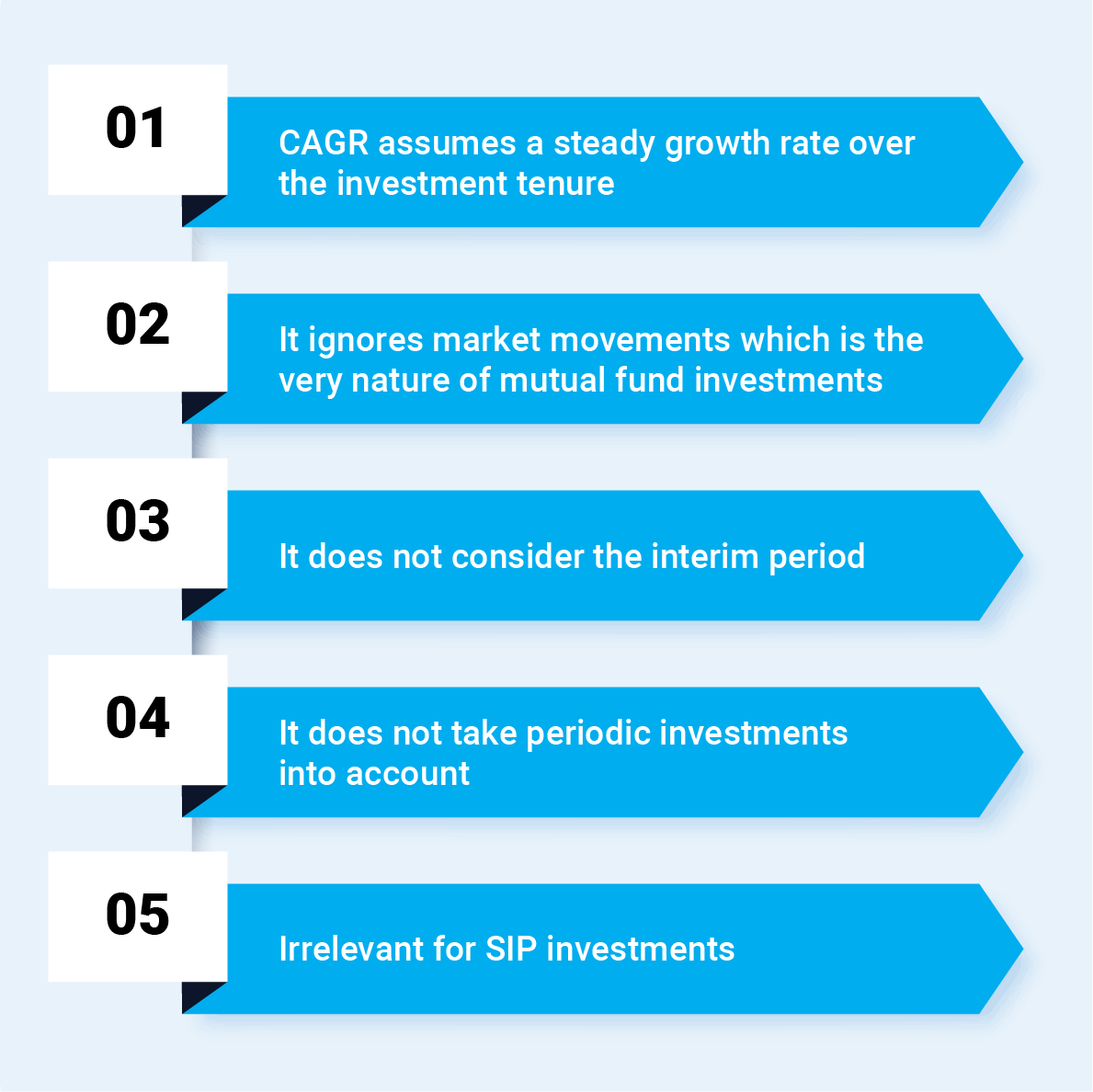

Limitations with CAGR:

Here is where IRR (Internal Rate of Return) or XIRR (Extended Internal Rate of Return) comes into the picture.

EXTENDED INTERNAL RATE OF RETURN (XIRR)

What is the Extended Internal Rate of Return (XIRR)?

XIRR stands for Extended Internal Rate of Return, a method used to calculate returns on investments. XIRR is that single rate of return, which would give the current value of investment when applied to every installment (and redemptions if any). XIRR is your personal rate of return. It is your actual return on investments.

When do we use XIRR?

In real life, the investments & redemptions happen over a different period, and in such a scenario, CAGR may not be applicable to calculate the returns. If you are investing through SIP or lumpsum or redeeming through SWP or lumpsum, XIRR is the appropriate way to measure returns.

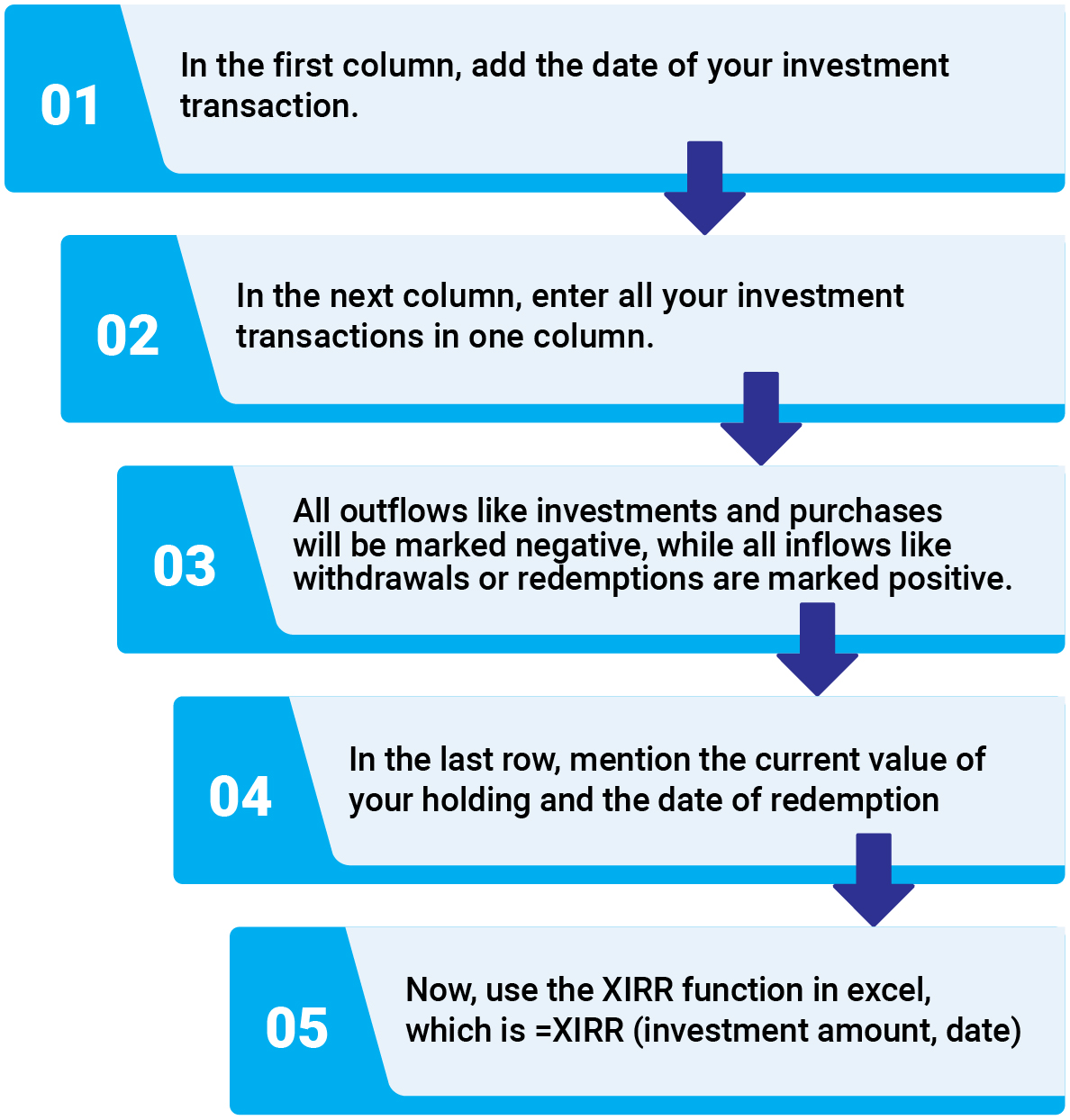

How do we calculate XIRR?

You can think of XIRR as nothing but an aggregation of multiple CAGRs. If you make multiple investments in a fund, you can use the XIRR formula to calculate your overall CAGR for all those investments taken together.

XIRR can be easily calculated using Microsoft Excel. Excel provides an inbuilt function to calculate XIRR. XIRR formula in excel is:= XIRR (value, dates, guess) |

Step-by-Step Process to Calculate in Excel

Let us understand with an example. Suppose you made a SIP of Rs.10,000 every month for eight months into Scheme A starting from April 01, 2020 to Nov 01, 2020. And you wish to redeem on Nov 24, 2020. Assuming NAV on the date of redemption is Rs.39.48.

Thus, the value of your investment = Total No. of units X NAV at the date of redemption = 2508.02 X 39.48 = Rs.99,017.

See the GIF below to see how XIRR formula is used

| Approach using Absolute Return | Approach using CAGR | Approach using XIRR |

| (Final Value – Initial Value) / Initial Value * 100 | Time period = 8 months = 6/12 = 0.67 years | XIRR = XIRR (value, dates, guess) |

| (₹99,017 – ₹80,000)/ ₹80,000 | (99017 / 80000) ^ (1/0.67) -1 | |

| = 23.17% | = 37.67% | 79% |

The above is for illustrative purposes only.

Let’s recap the different ways to evaluate mutual fund returns.

The Takeaway?

We select mutual funds to grow our money and earn better returns.

However, all of these terms, such as Absolute return, CAGR & XIRR, signify historical returns of the funds. This year‘s mutual fund that gives you good returns may not be a top performer tomorrow. It would help if you dug a little deeper to understand the qualitative aspects too that go into a mutual fund.

These could include factors like

Thereby, take into consideration the qualitative and quantitative aspects before you make a final decision on your mutual fund.

When you invest with Quantum Mutual Fund, you can rely on our 14 years of experience of the sound investment process backed by meticulous research.

Start investing with Quantum Mutual Fund today.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Do You Need to Update Your KYC/Modify KYC?

Posted On Friday, Apr 26, 2024

New KYC Regulation Effective April 1st 2024

Read More -

Are You Stuck in the Past or Ready for a Secure Future?

Posted On Wednesday, Jun 29, 2022

The ever-growing number of mutual fund schemes on offer has made it challenging for investors to select the best and most suitable one.

Read More -

Received an Increment? Step-up Your SIPs

Posted On Wednesday, Jun 01, 2022

For instance, let’s assume that you have registered for a monthly SIP of Rs 5,000 for a 10-year period and later on try to step-up the SIP at an annual frequency, say by Rs 500. In the first year...

Read More