Investing in India: High GDP and Fast Growth Potential

Posted On Wednesday, Oct 19, 2016

Investing money in an appropriate investment option at the right time is said to be a more difficult task than earning the money itself! Every investor is interested in earning the highest possible return on his/her investment. The rate of return on investment depends on many factors such as type of asset class, risk, economic and political scenario, etc.

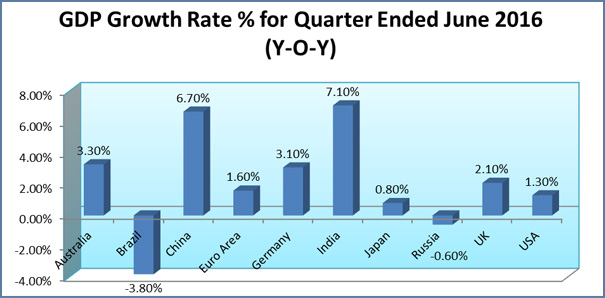

This article attempts to take a closer look at the macroeconomic view of India as an investment destination. At this point, India is one of the highest and fastest growing economies in the world: the country’s GDP (gross domestic product) is above 7 percent, as against the global economic growth rate of 3-3.5 percent.

Why is India one of the best investment destinations?

India has been the beneficiary of significant foreign inflows of late. In the 12-month period ending March 2016, Foreign Direct Investment (FDI) increased 29 per cent to US$ 40 billion, as compared to US$ 31 billion the year prior. What is it that has made the country so attractive to investors? Many things have contributed, but a few of the most important:

India is the fastest growing economy in the world with GDP growth of ~7 percent. Continued high growth is projected by many experts including the International Monetary Fund (IMF), which expects the Indian economy to expand 7.6% in 2016-17.

The policy of inflation-targeting by former RBI chief Raghuram Rajan has brought inflation down to more stable levels. Rajan’s successor Dr. Urjit Patel is expected to pursue a similar policy approach, especially considering he was one of its main architects in the first place.

While it has been slow going, no doubt, the central government has been charting the past for investment as well. A primary example of this is the recent passage of GST, which is set to be implemented in April 2017 and is expected to bring more transparency and growth in tax revenue. Results of various studies indicate that GST could boost India's GDP growth by 0.9-2 per cent.

Against the backdrop of weak global growth, the bright prospects of the Indian economy – along with elements that give a reasonable expectation for continued growth – have the capacity to attract significant foreign investment going forward.

Across the world, investors are willing to invest money in India. In the last two weeks alone, two large Canadian funds - Brookfield Asset Management and Caisse de Dépôt et Placement du Québec (CDPQ) - have announced investments worth about $2 billion in the country. Russia is looking forward to collaborate with India in manufacturing fighter planes and spare parts for aircraft, as is Rafale of France. Another French company, Schneider Electric, is also bullish on India, as the French major sees big opportunities from the government's 'Make in India' and digitisation programmes. The list does not end here. With a positive outlook for the year to come from the ratings agencies, it should not surprise anyone if more and more companies join that list.

Goods and Services Tax (GST) - one of the key tax reforms in independent India

GST is one of the most important tax reforms in independent India. It's a comprehensive tax levy on the manufacture, sale and consumption of goods and services at a national level. Generally, GST ranges between 15-20% in most countries. Today, the effective tax rate on manufactured goods works out to 20%, while services are taxed at 14%+. The GST rate has not been decided yet, but it is likely to be around 18%, meaning the tax on manufactured goods could go down.

The crucial three-day meeting of the all-powerful GST Council, which started Tuesday, 18 October, will decide the tax rate and sort out issues like the compensation formula for rollout of the new indirect tax regime beginning April 1, 2017.

The implementation of GST will boost the growth prospects of the Indian economy. "India's GST passage gives us additional conviction around our 8% GDP growth forecast over the next few years", says S&P Global Ratings. Separately, the IMF in its latest Asia-Pacific regional economic update said "India's strong reform push in 2016 is welcome and should continue apace. Adoption of the goods and services tax is poised to boost India's medium-term growth."

At Quantum we are not cheering GST that loudly just yet. We believe that there will be a 2-3 year gestation period after which we will be able to better judge if GST is the panacea that it is claimed to be. It will also be interesting to note whether companies that benefit and increase their savings multi-fold as a result of a proper tax structure, hoard these savings or pass them on to the consumer.

The real verdict on GST will emerge after a few years, but as we are EXTREMELY bullish on the long term India growth story, we believe that the GST is a massive step in the right direction.

Be a part of India's growth story

As an individual investor, you may find it difficult to read and understand all economic and political events and their impact on your investments. This is where professional mutual fund managers can help you. A SIP (systematic investment plan) via a mutual fund will assist you in joining India’s growth story. Don’t forget, the stock market is a mirror of the macroeconomic performance of the country. Today’s domestic scenario is positive and investment-friendly which has the capacity to generate higher returns on stock market investments. A professionally-managed fund that has a direct linkage to the equity market would be a great channel of investment at this time.

If you haven’t been a part of India’s growth story to date, it’s never a bad time to start thinking responsibly about planning your financial future. As a fund house, we are very bullish on India for the long term because of the reasons stated above. To harness the potential of this growing tiger, we launched the Quantum Long Term Equity Fund in 2006. We built a strong investment philosophy and the proof that the philosophy and strict adherence to the principles of value investing works, lies in the track record that the Quantum Long term Equity fund has garnered after 10 years of serving as an honest, viable, low cost option for our investors.

India’s stock markets in these last 10 years have seen the highs of the Modi wave and the lows of the Lehman crisis. Despite all that, the Quantum Long Term Equity fund has given a 15 % CAGR return since its inception.

| Quantum Long Term Equity Fund Performance as on September 30, 2016 | ||||||

| Discrete 12 month returns (%) | ||||||

| Period | Scheme ^ | S&P BSE- 30 TRI Returns # | S&P BSE Sensex Returns ## | Value of investment of Rs. 10,000@ | ||

| Scheme (RS.) | S&P BSE- 30 TRI (RS.) # | S&P BSE Sensex (RS.) ## | ||||

| September 30, 2015 to September 30, 2016 | 23.32% | 8.16% | 6.54% | 12,332 | 10,816 | 10,654 |

| September 30, 2014 to September 30, 2015 | -0.30% | -0.43% | -1.79% | 9,970 | 9,957 | 9,821 |

| September 30, 2013 to September 30, 2014 | 50.72% | 39.53% | 37.41% | 15,072 | 13,953 | 13,741 |

| Since Inception ** | 15.32% | 11.01% | 9.39% | 45,050 | 30,124 | 25,793 |

| ^ Past performance may or may not be sustained in the future. Load is not taken into consideration and Returns are for Growth Option | ||||||

| Returns up to 1 year period are Absolute Returns. Returns greater than 1 year period are compounded annualized (CAGR). | ||||||

| # S&P BSE 30 TRI ## S&P BSE Sensex @ shows the current value of Rs 10,000/- invested at the beginning of a given period | ||||||

| ** Inception Date: March 13, 2006. Since inception returns are calculated on NAV of Rs 10 invested at inception. | ||||||

| For other Schemes Performance by Mr. Atul Kumar please refer at end of the article. | ||||||

For other Schemes Performance by Mr. Atul Kumar please refer at end of the article.

So let the Quantum Long Term Equity Fund, with its enviable track record, be the engine of growth of your savings as India as a nation is the real crouching tiger – ready and waiting to take a quantum leap into the future.

| Quantum Tax Saving Fund Performance as on September 30, 2016 | ||||||

| Discrete 12 month returns (%) | ||||||

| Period | Scheme^ | S&P BSE- 30 TRI Returns # | S&P BSE Sensex Returns ## | Value of investment of Rs. 10,000@ | ||

| Scheme (RS.) | S&P BSE- 30 TRI (RS.) # | S&P BSE Sensex (RS.) ## | ||||

| September 30, 2015 to September 30, 2016 | 23.63% | 8.16% | 6.54% | 12,363 | 10,816 | 10,654 |

| September 30, 2014 to September 30, 2015 | -0.99% | -0.43% | -1.79% | 9,901 | 9,957 | 9,821 |

| September 30, 2013 to September 30, 2014 | 50.70% | 39.53% | 37.41% | 15,070 | 13,953 | 13,741 |

| Since Inception ** | 21.17% | 16.28% | 14.55% | 44,530 | 32,315 | 28,767 |

| ^ Past performance may or may not be sustained in the future. Load is not taken into consideration and Returns are for Growth Option. | ||||||

| Returns up to 1 year period are Absolute Returns. Returns greater than 1 year period are compounded annualized (CAGR). | ||||||

| # S&P BSE 30 TRI ## S&P BSE Sensex @ shows the current value of Rs 10,000/- invested at the beginning of a given period | ||||||

| ** Inception Date: Dec 23, 2008. Since inception returns are calculated on NAV of Rs 10 invested at inception. | ||||||

Product Labeling

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Moderate Risk |

| Quantum Tax Saving Fund (An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit) | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  Investors understand that their principal will be at Moderately High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Debt Monthly View for January 2025

Posted On Friday, Feb 07, 2025

Bond markets witnessed increased volatility during the last month with the 10-year Government

Read More -

Gold Monthly View for January 2025

Posted On Friday, Feb 07, 2025

In the calendar year 2024, gold demonstrated remarkable performance, yielding a return of ~ 27%.

Read More -

Equity Monthly View for February 2025

Posted On Thursday, Feb 06, 2025

Indian markets witnessed sharp sell-off in the month of January on the back of continued FII selling (USD -8.6Bn in January 25 vs USD -755Mn for CY2024).

Read More