Will Central Banks sell their Gold to fund Pandemic deficits? Seems unlikely

Posted On Thursday, Apr 23, 2020

Lately, there has been a lot of talk about global central banks liquidating their flight-to-safety assets - gold reserves - in order to generate cash and save their economies from the upcoming recession. Understandably, gold investors are concerned that this large scale gold-selling will push the asset's price down.

Although central bank policies have been prone to error, we believe that this is the "misstep" they would want to avoid. So, we rightly discount this possibility. Till the latest central bank reserve statistics are not out to confirm or deny this, let's examine the factors that could limit the possibility and scale of this phenomenon for the benefit of wary investors.

First and foremost, central bankers don't need cash!

After witnessing the massive bond-buying programs unleashed by global central banks as a response to the current crisis, you should be convinced that central banks can print money when they please, hence eliminating the need to sell anything for cash.

They appreciate gold post-2008

In the decade since the financial crisis, global central banks have been net purchasers of gold. This change in behavior is a clear acknowledgment of the benefits that holding gold can bring to a reserve portfolio, especially in times of economic crisis. In a 2019 survey by the WGC, over three-quarters of central banks saw gold's role as a long term store of value as relevant, while 63% highlighted its effectiveness as a portfolio diversifier as highly relevant.

The pandemic has thrown up unprecedented systemic risks

The COVID-19 pandemic has heightened economic and political uncertainty and led to an increase in systemic risk. Gold, unlike the other reserve asset - US dollar, bears no political or credit risk.

They are keen on de-dollarization

Central bank portfolios are typically US dollar centric. There are concerns about the outlook for the US dollar as it faces the threat of being devalued by the extraordinary monetary policies being announced to battle the current crisis. It thus makes sense for central banks to reduce their exposure to the dollar by holding gold, which cannot be devalued or manipulated. In fact, as per a 2019 WGC survey, 13% of central banks said de-dollarization was highly or somewhat relevant to their decision to invest in the shiny metal.

They don't really "sell" gold, they just lend or swap it

Central banks manage funding strains during times of crisis without liquidating their gold reserves. They use gold swaps and gold deposits as ways to create foreign exchange liquidity.

They don't hold enough gold

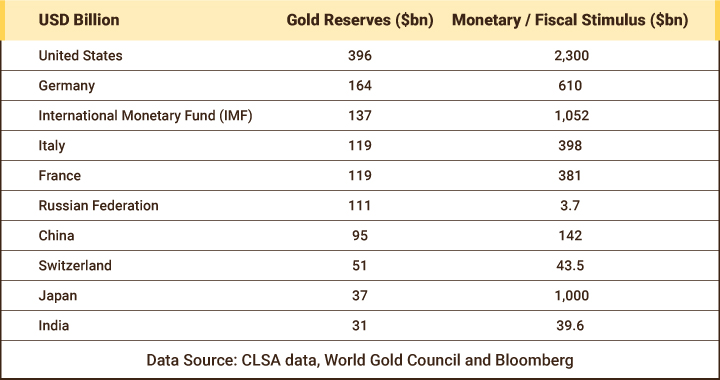

The value of gold holdings that these central banks own is little as compared to the huge liquidity being doled out by them.

As you can see, Gold reserves are paltry in comparison to the monetary/fiscal measures committed by the country. They are expected to further keep pushing billions of dollars to support their beleaguered economies. In effect, selling gold reserves would be of no help.

Now since we've pretty much established that these speculations about central banks dumping their gold have little or no basis, let's quickly map out what would happen even if they turned out to be true. You don't know what Trump would really do, right?

For instance, the Federal Reserve decides to sell all, yes all of its 8133 tons of gold reserves to fund its current rescue package of $2.2 trillion (the gold, by the way, is valued at ~$400 billion at current prices and will fund barely 20% of the stimulus).

Of course, there will be a knee-jerk reaction in gold markets as the supply suddenly shoots up. But let's not forget that there will also be buyers to absorb the new supply and stabilize prices. Buyers with large appetites for gold,like the central banks of Russia, China or large holders of US treasuries who as we mentioned before, will be really keen to diversify their reserves away from the US dollar. This would indeed be true when the US removes one of the important pillars of strength for the US dollar that emanates from its large gold holdings. Remember, gold at the end of the day is a monetary asset and was used as money for a significantly longer time period than any other reserve currency.

Fundamentally, they have a good reason to diversify. Ballooning deficits and unsustainable debt levels of the USA are increasingly threatening the stability, reliability, and reserve currency status of the dollar making it imperative for central banks to reduce their large exposures to the currency. There will also be buyers with smaller appetites - institutions and investors which will devour the metal for its increasingly conducive fundamental and situational attributes.

To sum it up, whether these speculations are true or not, either way, the future looks bright for gold. Brace for some price volatility along the way as central banks continue to intervene in financial markets.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at Moderately High Risk |

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumMF.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Gold Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After experiencing a surge of approximately 9% in 2025 through the end of February, gold prices further increased by an additional 9% in March, bringing year-to-date returns to around 19%.

Read More -

Gold Monthly View for February 2025

Posted On Friday, Mar 07, 2025

The bullish momentum for gold carried on into February 2025, with spot prices maintaining

Read More -

Gold Monthly View for January 2025

Posted On Friday, Feb 07, 2025

In the calendar year 2024, gold demonstrated remarkable performance, yielding a return of ~ 27%.

Read More