The ugly twin of taxation - inflation

Posted On Monday, Sep 16, 2019

Don’t find paying taxes fun? You’re not alone. In fact, searching for ways to legally pay less tax is a favorite Indian pastime.

We are so passionate about tax saving that for many of us investments start and end at Section 80 C!

But what is it about taxes that make them so undesirable? It’s obviously because taxes leave us with lesser money to take home, and hence lesser money to buy things.

But then how come no one seems to complain about the silent, ruthless tax twin that eats into our money’s ability to buy things year after year? Inflation.

Yes, inflation is a tax – silent because it slowly creeps into our lives without us noticing and ruthless because it can really turn our finances upside down if it catches us unprepared. It is a tax we pay every year, not in rupees and not to the government, but in an indirect way with our reduced purchasing power.

Now, purchasing power is the amount of goods and services that can be purchased with a unit of currency. So reducing purchasing power simply means the same money buys us fewer things over the years.

This happens because currencies suffer from financial repression. They can be printed and created by governments and central banks without any restrictions which results in them losing their value/ purchasing power as their supply increases.

This is why the first goal of investing is to grow our money at a rate faster than inflation. This is called inflation proofing. Inflation proofing is an investment strategy that insulates our money against inflation’s eroding effects in order to either grow, or keep our purchasing power intact. Because if you’re not doing that, you’re getting poorer, not richer - beating the very purpose of investing.

So it only makes sense for us to prepare/plan for inflation as, if not more, proactively and enthusiastically as we go about doing tax planning every year, right?

But in spite of there being so many resources and discussions about the inflation-beating abilities of Equity as an asset class, it is far from holding a core position in an average Indian investment portfolio today. Instead we Indians love our fixed deposits. As per RBI, 51% of household financial assets are held in currency and deposit form, compared to only 8% in equities as of FY18. Of course, fixed deposits could be considered ideal for safety and stability of returns required in the short term for immediate expenses and emergency needs. But do they serve the purpose of long term wealth creation?

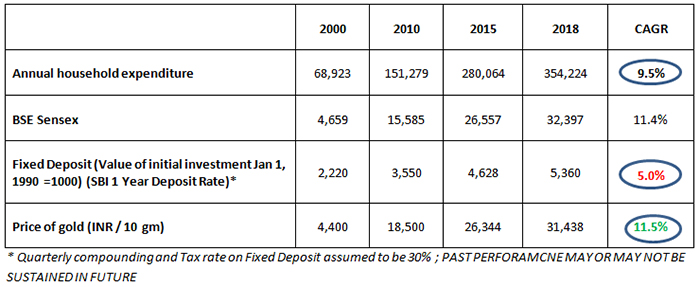

We decided to run some numbers. We analyzed the annual household expenditure numbers of a consumer basket in India from the year 2000 to 2018. The basket included food and beverages, transportation and communication, clothes, shoes, recreation, education and cultural activities, rent / accommodation cost, fuel / electricity, medical expenses, and other miscellaneous costs. We constructed this basket as we believe it’s more indicative of the inflation levels than the general CPI index which tends to give a heavy weightage to food prices in its calculation, making it less relevant for the middle class and upper class which have higher education, recreation and lifestyle expenses.

So anyway, this annual household expenditure has increased at a rate of 9.5% per annum from 2000 to 2018.Over the same time, the BSE Sensex has moved up by 11.4% per annum. And surprise, surprise – fixed deposits have yielded a post-tax return of only 5% per annum, and price of gold has grown at 11.5% per annum!

These numbers thrash two misconceptions. First, that fixed deposits are “risk-free”. True, they give fixed and assured returns and have the backing of a bank, but they haven’t even helped investors outpace inflation, forget growing their wealth, which as discussed above is the biggest investment risk there is!!

And second that gold is a dead investment because it doesn't accrue interest or generate earnings. With returns as good as Indian equity indices, gold has not only preserved purchasing power but done much more.

But how did gold manage to do this? Well, unlike currencies, gold cannot be inflated or printed; it is thus far less susceptible to government manipulation. For this reason, gold has historically remained a relatively stable purchasing power, whereas practically all currencies have lost purchasing power in the long run.

As always, gold shines. Pun intended.

Equipped with these statistics, we hope you pay attention to post-inflation returns as much as you do to post-tax returns, and prudently use gold for your investments. Because in this case, ignorance will not be bliss.

Data Source: CMIE

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Gold Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After experiencing a surge of approximately 9% in 2025 through the end of February, gold prices further increased by an additional 9% in March, bringing year-to-date returns to around 19%.

Read More -

Gold Monthly View for February 2025

Posted On Friday, Mar 07, 2025

The bullish momentum for gold carried on into February 2025, with spot prices maintaining

Read More -

Gold Monthly View for January 2025

Posted On Friday, Feb 07, 2025

In the calendar year 2024, gold demonstrated remarkable performance, yielding a return of ~ 27%.

Read More