Strategies to Grow Your Mutual Fund Distribution Business

Posted On Monday, Apr 08, 2024

In the last decade, the Indian mutual fund industry has seen phenomenal growth. The net AUM has nearly quadrupled from Rs 10.11 trillion in May 2014 (since the Modi-led-NDA government was voted to power) to Rs 50.77 trillion as of Dec 2023.

MF Industry Growth

India’s mutual fund industry AUM-to-GDP ratio - which represents the penetration of mutual funds in the economy - today is around 15% compared to 7-8% a decade back. Although this ratio is low compared to the global average of around 75%, a remarkable increase in AUM is quite evident.

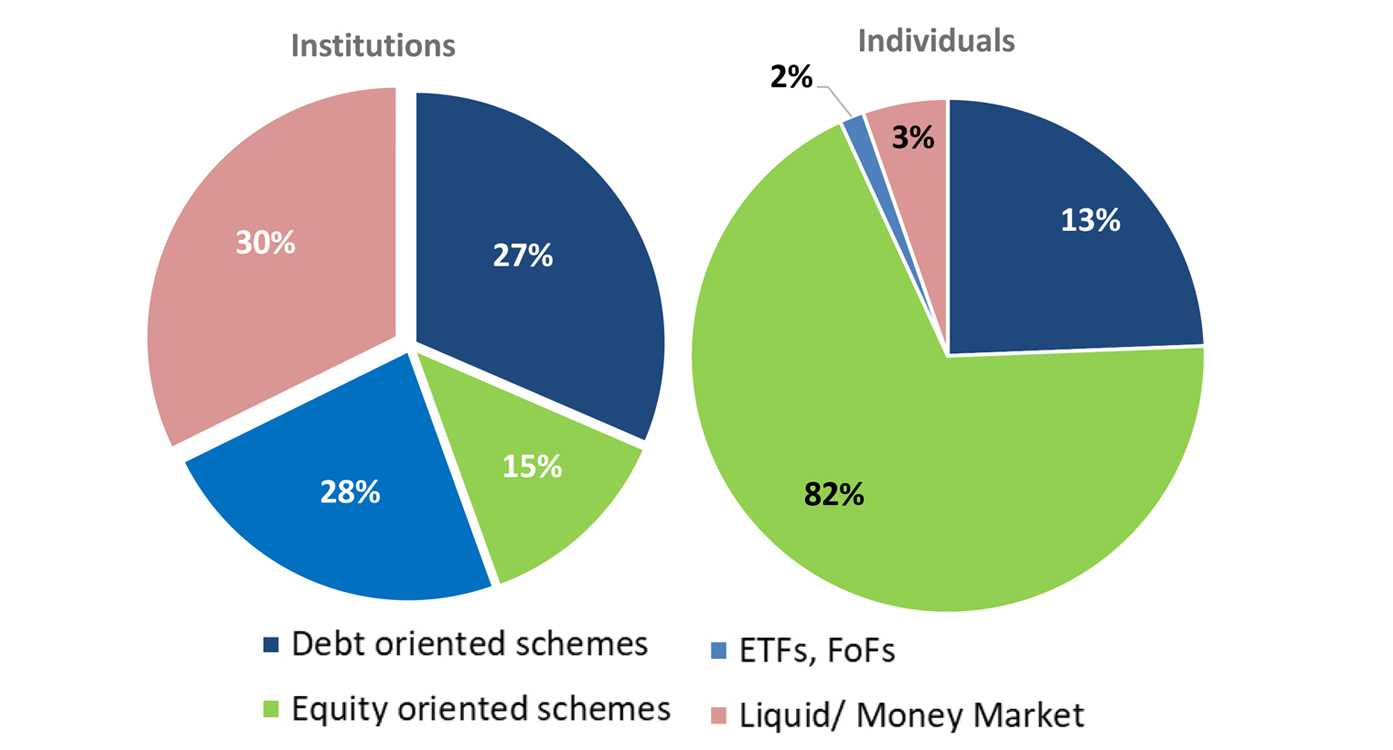

Today, interestingly, individual investors (retail and High Net worth Individuals) hold a relatively higher share of the industry’s assets (59.2% as of November 2023).

Moreover, individual investors are holding a dominant portion (82%) of their hard-earned money in equity-oriented mutual fund schemes – in other words taking risks -- to better returns than parking money in some of the traditional investment avenues.

Pie Charts: Investor Categories Across Scheme Types

Data as of October 31, 2023

(Source: AMFI)

The B30 locations, (i.e. beyond the top 30 geographical locations) are also driving inflows into mutual funds. As of November, 2023, 26% of the individual assets are coming from B30 locations.

Investors, as you know, are investing via the Systematic Investment Plan (SIP) and lump sum mode. SIPs particularly have become a popular choice for making regular and systematic investments in mutual fund schemes.

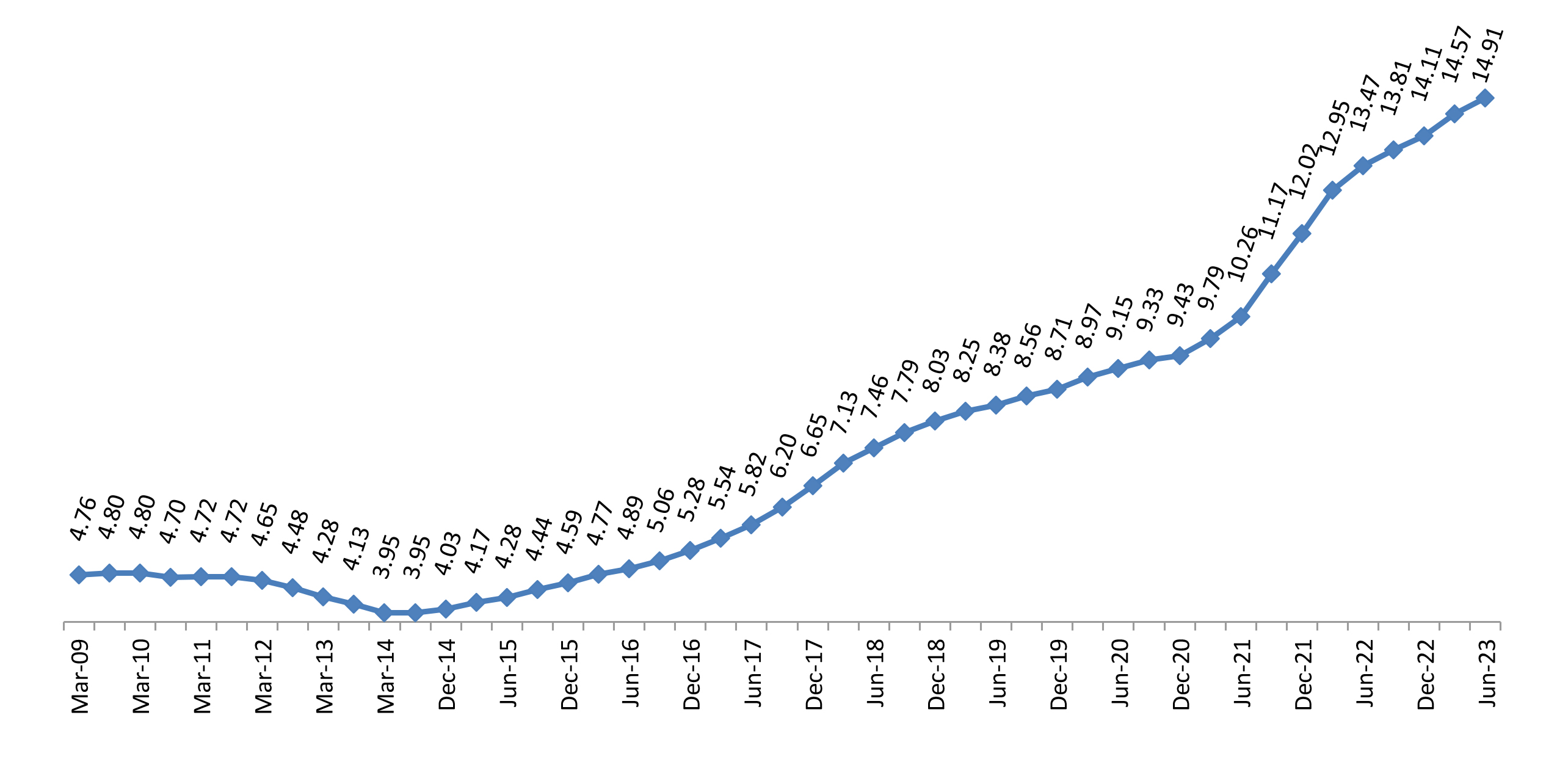

The folio count (also known as the mutual fund accounts) thus has increased from around 4 crores in May 2014 to approximately 15 crores in 2023.

Graph 1: Increase in mutual folio counts over the years

Data as of June 30, 2023

(Source: AMFI)

How MFDs add value to an investors’ lifecycle?

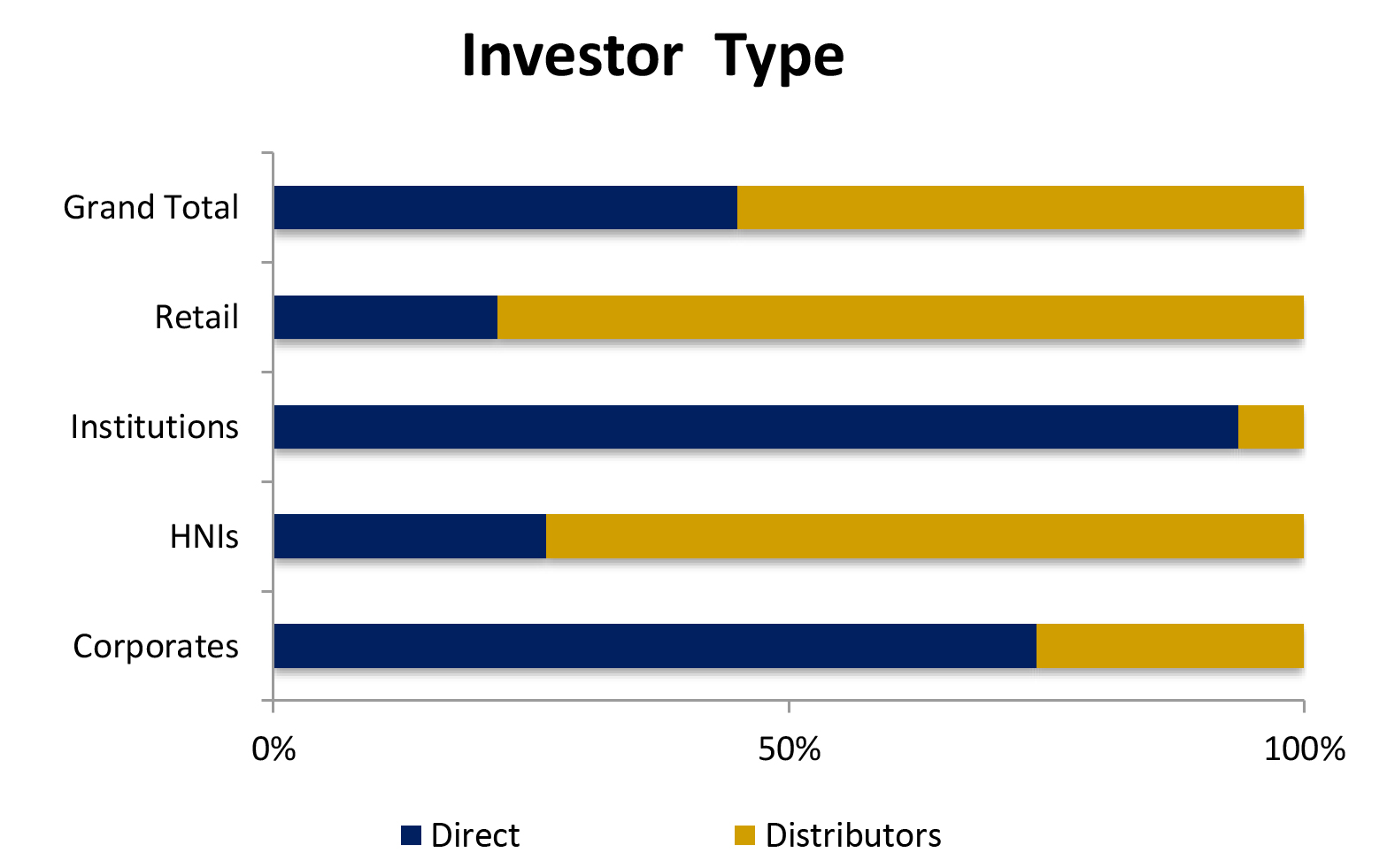

An intriguing fact is that many retail and HNI investors still depend on mutual fund distributors (MFDs) or Independent Financial Advisors (IFAs) to make investments. Distributors (including banks) account for 57% of the Indian mutual fund industry’s assets as of October 2023. This goes to say that MFDs and IFAs have an important role to play.

Graph 2: Distributor v/s Direct

Data as of Nov 30, 2023

(Source: AMFI)

Trail commissions are ongoing payments made to distributors as long as the investor remains invested in the mutual fund. So mutual fund distributor commission structure varies across AMCs and schemes. Assuming a distributor successfully gets an investor to invest in an equity mutual fund investment with growth of 12.64% CAGR (compounded annualized growth rate) using SIP investment of Rs.10,000 per month for 15 years.

| No of Years | Opening Balance | Investment | Investment Value | CAGR @12.64% | Fund Value | Normal Commission @0.50% |

| 1 | Nil | 1,20,000 | 1,20,000 | 15168 | 1,35,168 | 675.84 |

| 2 | 1,34,400 | 1,20,000 | 2,54,400 | 32156 | 2,86,556 | 1432.78 |

| 3 | 2,86,556 | 1,20,000 | 4,06,556 | 51389 | 4,57,945 | 2289.72 |

| 4 | 4,57,945 | 1,20,000 | 5,77,945 | 73052 | 6,50,997 | 3254.99 |

| 5 | 6,50,997 | 1,20,000 | 7,70,997 | 97454 | 8,68,451 | 4342.26 |

| 6 | 8,68,451 | 1,20,000 | 9,88,451 | 124940 | 11,13,391 | 5566.96 |

| 7 | 11,13,391 | 1,20,000 | 12,33,391 | 155901 | 13,89,292 | 6946.46 |

| 8 | 13,89,292 | 1,20,000 | 15,09,292 | 190775 | 17,00,067 | 8500.33 |

| 9 | 17,00,067 | 1,20,000 | 18,20,067 | 230056 | 20,50,123 | 10250.61 |

| 10 | 20,50,123 | 1,20,000 | 21,70,123 | 274304 | 24,44,426 | 12222.13 |

| 11 | 24,44,426 | 1,20,000 | 25,64,426 | 324144 | 28,88,570 | 14442.85 |

| 12 | 28,88,570 | 1,20,000 | 30,08,570 | 380283 | 33,88,853 | 16944.27 |

| 13 | 33,88,853 | 1,20,000 | 35,08,853 | 443519 | 39,52,372 | 19761.86 |

| 14 | 39,52,372 | 1,20,000 | 40,72,372 | 514748 | 45,87,120 | 22935.60 |

| 15 | 45,87,120 | 1,20,000 | 47,07,120 | 594980 | 53,02,100 | 26510.50 |

The above table is for illustration purposes only. Returns calculated by taking mean of 10-year rolling returns between 01/06/13 and 30/05/23 for Equity Funds (Sensex). Past performance may or may not be sustained in the future and is not a guarantee of any future returns.

What MFDs and IFAs need to do?

⮚ Earn the Trust and Confidence of Investors/Clients

This is paramount. In general, investors are fed up with the rampant mis-selling tactics going on, particularly by banks who place their interest at the fore. Sadly, quite a few banks push or sell mutual fund schemes that earn them better commissions and seldom care about what is appropriate for the investor.

Independent Financial Advisors (IFAs) and Mutual Fund Distributors (MFDs) need to distinguish themselves from the crowd by standing for honest, ethical advice, putting their client’s interests at the fore and handhold them in the journey of wealth creation and accomplishing the envisioned financial goals.

As Douglas Adams (an English writer and humourist) once said, “To give real service you must add something which cannot be bought or measured with money, and that is sincerity and integrity.”

Unfortunately, unlike in the medical profession where doctors take the oath to practice the profession with integrity, honesty, humility, and compassion to serve their patients first, there is no such oath for investment professionals. But the truth is, investment professionals have fiduciary responsibilities to fulfil, and therefore, must follow ethics and integrity during their service to clients. In a sense, IFAs and distributors must act as ‘Financial Guardians’ to investors/clients.

Investors expect transparency, the best disclosure norms and the hope for confidentiality from IFAs and mutual fund distributors. While, of course, the regulator has regulations in place for this, much of it must come consciously from IFAs and distributors from within.

Furthermore, as you know there is no one-size-fits-all approach, IFAs and distributors need to ensure investors/clients receive ‘personalised’ prudent advice. Imagine going to a doctor who gives you a prescription without taking cognizance of your physiology and medical history – the results would be disastrous, isn’t it?

Hence, earning the trust, respect and confidence of the clients is essential, whereby the value of your advice, as an IFA or distributor, is well-recognised and well-respected.

⮚ Provide Need-Based and Research-backed Financial Products

Investing is an individualistic exercise. Therefore, IFAs and distributors must make a conscious effort to offer products that align with the investors' risk-taking ability, broader investment objective, the envisioned financial goals and time in hand to achieve those envisioned goals. In this respect, online risk profiling and asset allocation tools may be used.

Besides, it would be sensible to back the recommendations with access to thorough and unbiased research reports, as opposed to past returns and/or mutual star ratings given on historical performance, which are in no way indicative of future returns.

Broadly here are some parameters to give weightage to select mutual funds for the client’s portfolio:

• Systems & Processes

• Market cycle Performance (bull and bear phases)

• Asset Management Style (wherein the investment mandate and strategy are considered)

• Risk-Reward Ratios (because for every level of return, the fund generates, there is a certain level of risk)

• Performance Track Record

Returns or performance track record should be the last thing to be considered.

"The essence of investment management is the management of risks, not the management of returns," said Benjamin Graham, the father of value investing.

Further, given that the world of finance and investments is ever-changing, IFAs and mutual fund distributors must keep abreast with the latest developments.

⮚ Technology Adoption

The lockdowns of the COVID-19 pandemic introduced us to a new way of practice. To communicate with investors/clients, many of us used WhatsApp, Telegram, emails, and even conducted client meetings over Zoom, and Webex, among many such tools. Even now while there isn’t any pandemic or restrictions, IFAs and distributors must continue to use these tools, especially when offline meetings aren’t possible.

Other than apps for meetings, to execute or perform transactions for investors/clients, go green to reduce paper and cost of servicing clients. In this day and age of fintech, many platforms exist to execute transactions online. However, MF Utility (MFU) and BSE StAR MF, are among the popular ones offering convenience to investment advisors and mutual fund distributors. These platforms are integrated with Registrar and Transfer Agents (RTAs), viz. CAMs and Karvy, plus power-packed with features that potentially help improve the service capabilities of IFAs and distributors with 24x7 universal online access.

Apart from using the aforementioned transaction platforms, IFAs and distributors could consider using worthy practice management software and Customer Relationship Management (CRM) tools to serve investors/clients efficiently.

Note, adopting technology shall make client onboarding easy and faster, increase service accessibility almost 24x7, help have better control, eliminate human biases, enhance transparency and efficiency, plus the reduced cost of servicing. Simply put, the use of technology would be a win-win for you, the IFA or distributor, and the investor/client.

⮚ Effectively Use Social Media

Social media, if used correctly, could help in reaching a wider targeted audience and grow business exponentially. Today a lot of individuals - across age groups - are spending time online. Thanks to smartphones and affordable data plans.

IFA and distributors can leverage this by devising a sensible digital market strategy to reap dividends. Social media platforms or channels, such as WhatsApp, Telegram, Facebook, and X (earlier known as Twitter), may help reach out to new prospects. The decision to choose a suitable promotional platform must be based on the demographics, i.e., the target audience using that social media channel.

Propagate a sensible idea rather than pushing products or asking investors to invest through you. In this respect, as an IFA or mutual distributor you could share simple explainers in an infographic form, or articles or guides around prudent investing that would arouse the interest of investors.

LinkedIn, for example, could be used to share case studies of investors/clients with fellow IFAs and distributors.

With valuable views articulated on social media, brand equity for self could be built, which could entice investors to seek your services.

Why Consider Becoming a Mutual Fund Distributor with Quantum Mutual Fund?

Quantum Mutual Fund helps investors achieve their financial goals with simple solutions across three key asset classes-equity, debt, and gold. Plus, we have ELSS for tax saving and ESG Fund for socially responsible investors.

For mutual fund distributors, Quantum Mutual Fund provides all the marketing collateral, access to our DIT (Distributor Initiated Transaction) platform, fund manager insights (through webinars and articles), and facilitates learning and educating your customer on the concepts of investing.

To know more visit- https://www.quantumamc.com/partner-corner

Quantum Mutual Fund has consistently delivered risk adjusted returns relative to the risk associated in the long term with robust investment processes and systems with an investor-first approach.

Empanel with us today and act as a ‘Financial Guardian’ to your investors while you aim to grow your mutual fund distribution business.

|

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Choosing the Right Mutual Fund for your Client?

Posted On Thursday, Jan 30, 2025

Choosing the right mutual fund can be a pivotal step towards building a secure financial future for your clients.

Read More -

The Importance of Regular Portfolio Reviews

Posted On Thursday, Jan 30, 2025

While managing a portfolio involves what one thinks will be suitable investments...

Read More