Small Cap, Big Difference: Staying Ahead with Liquidity & other Risk Controls

Posted On Friday, Mar 01, 2024

Amid surging inflows and resulting rising valuations in the small-cap and midcap space, SEBI - the Securities and Exchange Board of India has directed Mutual Funds to put in place a policy to protect the interest of investors. This includes steps like moderating inflows, portfolio rebalancing & to ensure investors are protected from the first mover advantage of redeeming investors. AMCs have to share monthly disclosure of risk parameters including result of stress test & liquidity, valuation & portfolio turnover in the Small & Mid Cap Schemes.

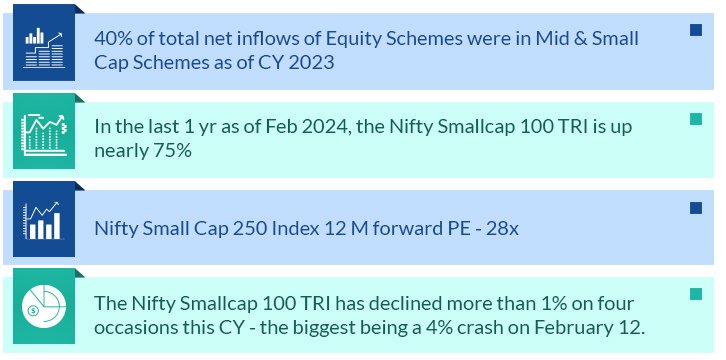

Small Cap Mutual Fund Industry - An Overview

Source: Bloomberg, AMFI

The proposed measures makes one think about the challenges this could put on Small cap and Midcap schemes with large Assets Under management (AUM) because managing such a scheme becomes more complex. During a market downturn, when many investors redeem their money, if a mutual fund runs out of cash and liquid stocks then such investors will get first mover advantage compared to the investors who remain invested in the scheme.

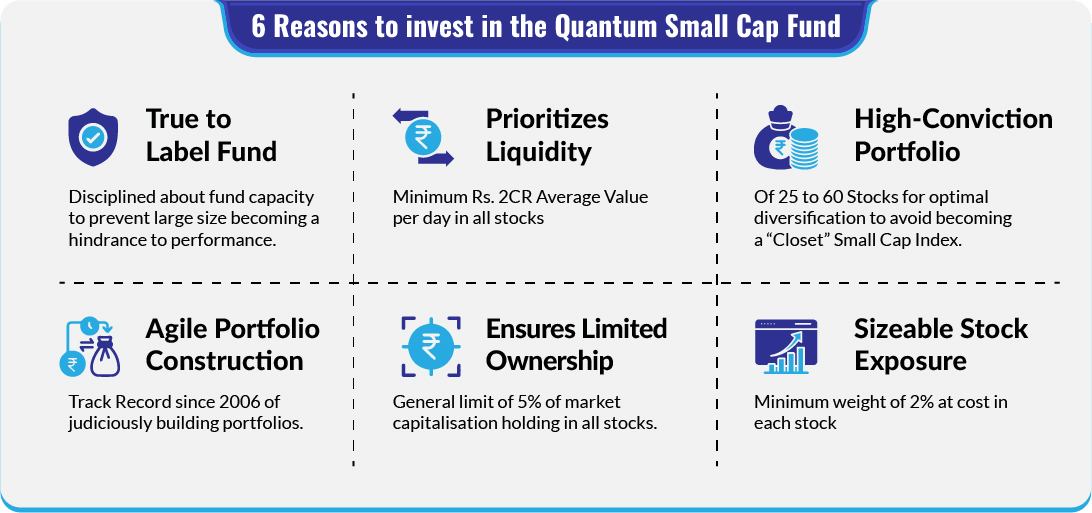

However, for Quantum Mutual Fund, we have a high and well-defined process with emphasis on liquidity. Even before SEBI issued this directive, the Quantum Small Cap Fund was launched with a robust investment framework with guardrails around liquidity and market cap ownership. These guardrails defines the capacity to which the fund can scale without compromising the portfolio characteristics and liquidity traits.

Risk Mitigation Measures

1. Fund Capacity:

We monitor how easily we can buy and sell the stocks we invest in ensuring liquidity concerns are addressed. Assuming not more than 1/3rd investor participation and the current portfolio weights, we arrive at a threshold fund capacity which is a limit on how much money the fund can accept. Without any compromise, we will be mindful of accepting new investments once we reach this limit to make sure we can still buy and sell stocks easily. Right now, there's plenty of room for new investments in the fund before the limit is reached.

2. Mindful of Liquidity:

We have a liquidity filter of Rs. 2 crores average liquidity over last 12 months. Our aim is to be able to enter or liquidate the portfolio stock within 66 trading days with 1/3rd participation on any given day. As per the investment process, we want the entire portfolio or most of the portfolio i.e. 90% to be liquidated within 66 trading days. We monitor portfolio liquidity on a monthly basis.

With the above liquidity criteria, the fund is scalable to a reasonable capacity without significantly altering the liquidity profile of the fund. The SEBI directive has prescribed a stress test liquidity evaluation which we have been running internally for the entire portfolio to understand the overall liquidity of the fund every month.

While over 65% of the holding is in good quality small cap stocks, we also hold some of the fund holdings opportunistically in large and mid-caps which look good from an upside potential perspective and also add value for being relatively more liquid, thereby adding to a better liquidity profile of the fund.

3. High-Conviction Portfolio:

Our approach is to keep the portfolio well diversified comprising of 25-60 quality small cap stocks. These are companies selected based on a sustainable business model, high standards of corporate governance. The portfolio is chosen so as to not compromise on growth while being mindful of valuations. If the increasing fund size compels a significant increase in number of stocks, it could lead to excessive diversification or overdiversification - having a long tail of stocks with suboptimal weights. This is what we would like to avoid as holdings are with insignificant weights below 1%, where any positive performance in an individual stock may not significantly contribute to the overall returns of the Fund.

4. Limited Ownership:

To avoid being a dominant shareholder in the company, we ensure that our portfolio holding does not exceed 5% of the market capitalization of the company in the small cap fund. This reduces the risk of trying to exit a large position in the company.

5. Investment guardrails:

We cap our holding in our investee company at 4% of the portfolio. This helps reduce the risk of a large position being stuck in a company if the liquidity reduces and also helps build enough diversification within the portfolio.

6. Portfolio Action / Rebalancing:

Portfolio action is taken based on potential upside in a stock. As the stock reaches our target and if there is no scope to upgrade our earnings, we will gradually exit the position. If the stocks have upside, we don’t want to reduce our holding and let our profits run until it reaches the regulatory cap of 10% at market value or if we find other alternatives that offer greater upsides. So portfolio action / rebalancing happens when the stocks reaches its optimal target. Even in case of large redemptions, our view of upside in stocks drives the stocks we would generally exit and not what we can sell easily, reducing the concern of remaining investors.

7. Integrity Filter:

Over and above, we evaluate the integrity and quality of the management teams within smaller companies. Smaller companies often struggle to attract strong management, which can lead to governance problems. Quantum Small Cap Fund prioritizes good management and safeguarding your investments over short-term gains. We prefer to avoid opportunities with poor integrity than risk your investment, even if a particular stock has a significant weight in the benchmark index.

In addition to the above checks to safeguard investor interest we are also mindful of Valuations using GARP based - screening approach (Growth at Reasonable Valuations):

The small cap universe is large & diverse with pockets of opportunities that appear reasonable on a PEG (Price to Earnings Growth) basis. Our endeavor is to stay invested in good quality small cap companies that offer at least reasonable upside.

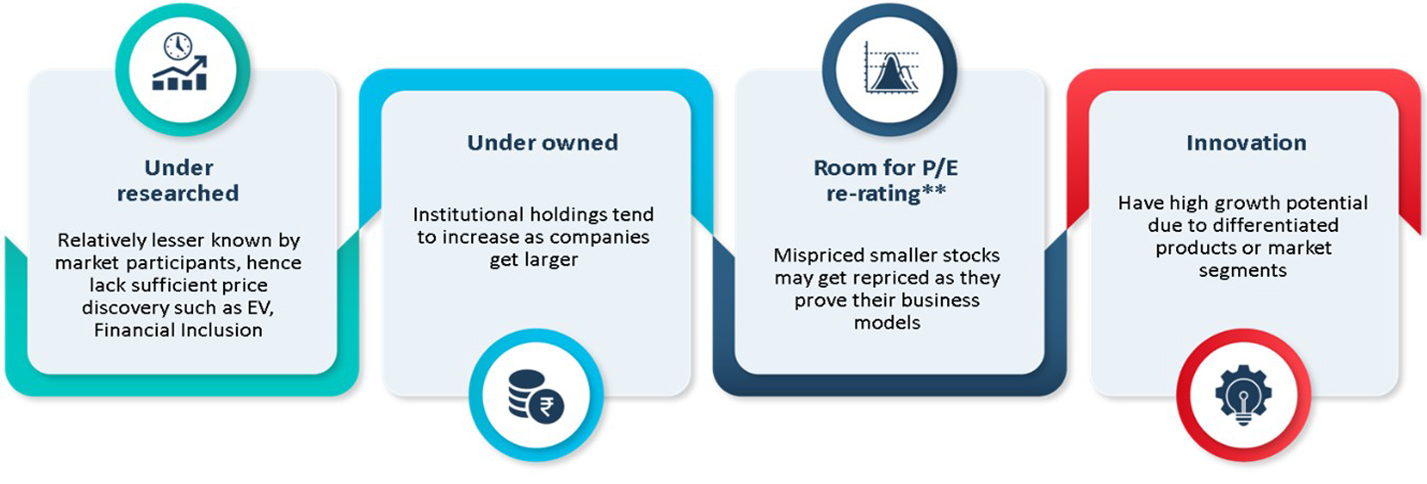

Opportunities in Small Caps

** Re-Rating of a stock indicates that Investors are willing to pay more or less for the stock.

Open the doors to new opportunities in small caps by being cognizant of liquidity, governance and fund capacity with Quantum Small Cap Fund - Big Difference to your Portfolio.

|

|

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Small Cap Fund An Open Ended-Equity Scheme Predominantly Investing in Small Cap Stocks |

|  Investors understand that their principal will be at Very High Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund www.QuantumAMC.com.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More -

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More