Polls to Portfolios: A Robust Portfolio with Quantum in Post-Election India

Posted On Wednesday, Jun 05, 2024

The election season may be over, but the journey for your investments is ongoing. With Quantum Mutual Fund, you have a trusted ally by your side, ready to help you seize the opportunities that come with the post-election market outlook. With a steadfast commitment to fostering financial security and growth, Quantum Mutual Fund stands out as a beacon for strategic investments. Leveraging deep market insights and a robust framework for investing, Quantum Mutual Fund offers investors a comprehensive approach to navigating the post-election environment.

As India embarks on a new chapter of development and progress, aligning your investments, provides the clarity and confidence you need to safeguard your financial future.

Post Elections

With a coalition government after a decisive election, India is poised for a wave of new policies and economic initiatives. Quantum Mutual Fund is here to help navigate this market landscape with ease and confidence. Our unique Upside Potential and ability to deliver predicable outcomes, can benefit you, as an investor Our investment team understands the nuances of a coalition-led administration and is ready to provide insights for investment opportunities.

What History Says

Historically, most of the times, the markets have shown positive trends following election results, often rallying as investor sentiment turns optimistic about the future economic policies and reforms. This time around, the market sentiment is not as hopeful.

When considering the post-election market outlook, it's important to note the potential impact of the upcoming monsoon season as well. A good monsoon rains can boost agricultural output, improve rural incomes, and positively affect various sectors, thereby enhancing overall market performance.

Why Stability Matters

Stability in the government can translate to stability in markets. When investors have confidence in the government's ability to implement and sustain economic policies, they are more likely to invest, driving market growth. A government focused on economic development can initiate and support large-scale infrastructure projects, which not only stimulates economic activity but also create jobs and improves the overall business environment.

Adding Stability in Your Investments

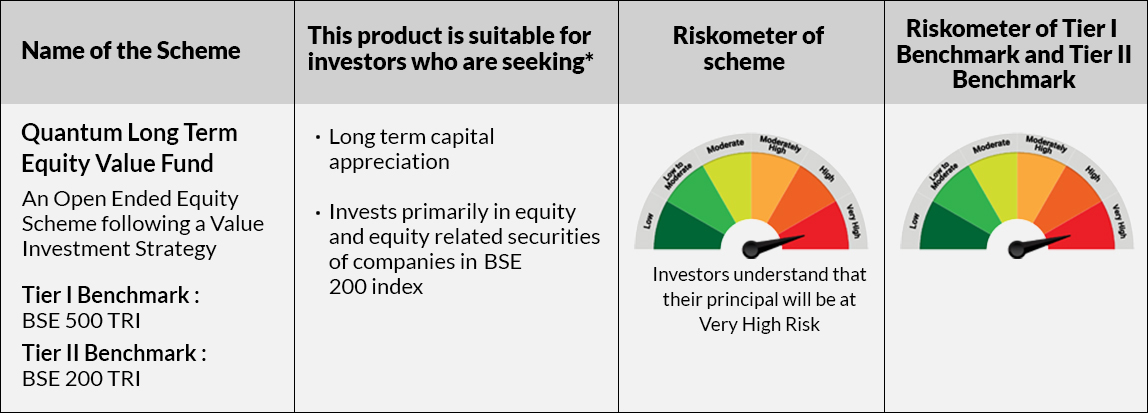

Investing in Quantum's Long-Term Equity Value Fund provides a avenue to infuse stability into your investment portfolio, fostering a sense of clarity and confidence for investors. This fund is designed to focus on long-term growth, capitalising on a diversified mix of high-quality equities. The fund's robust research framework and disciplined approach helps mitigate market volatility, offering a resilient investment option.

Key Sectors to Watch

- Infrastructure: Is expected to be a significant focus. Investments in roads, railways, ports, and urban development can lead to a multiplier effect, boosting various related industries.

- Technology: Continued support for digital India initiatives and technological advancements can position India as a global tech hub, attracting both domestic and international investments.

- Renewable Energy: Government incentives and policies promoting renewable energy can lead to sustainable growth and attract investments in solar, wind, and other renewable projects.

What to look out for?

Investors are advised to keep an eye on sectors likely to benefit from government policies, such as infrastructure, technology, and renewable energy. Additionally, monitoring the progress of monsoon rains will be crucial, as it plays a significant role in the overall economic health of the country. Investors are also hopeful that the government will prioritise economic stability and growth, leading to a favourable investment climate.

Also Consider

During election season, market valuations tend to become expensive, reflecting the heightened anticipation and speculative sentiment among investors. Much of the prospective earnings growth and government policy continuity is already priced into current market levels, creating an environment where investors might find it challenging to identify undervalued opportunities. The market's optimism is built on the expectation of stable and favourable government policies post-election, but this also means that any deviation from these expectations can lead to significant market fluctuations. For thoughtful investors, it’s crucial to consider these factors and maintain a strategic, long-term perspective in their investment decisions.

Navigating the Market with Quantum Mutual Fund

For investors looking to capitalise on the post-election market conditions, Quantum Mutual Fund offers a strategic approach to asset allocation. By focusing on a diversified portfolio, like the Quantum Long Term Equity Value Fund offers, we help mitigate risks and use growth opportunities.

The key takeaway is that,

Quantum Mutual Fund can help navigate this evolving landscape with time-tested asset allocation strategies designed to mitigate risks and capitalise on growth opportunities. By focusing on a diversified portfolio, investors can remain resilient through both political and seasonal changes, ensuring a stable and financial future.

|

|

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More -

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More