Your Answer to Simplifying Equity Investing in 2022 - Quantum Mutual Fund

Posted On Thursday, Jan 06, 2022

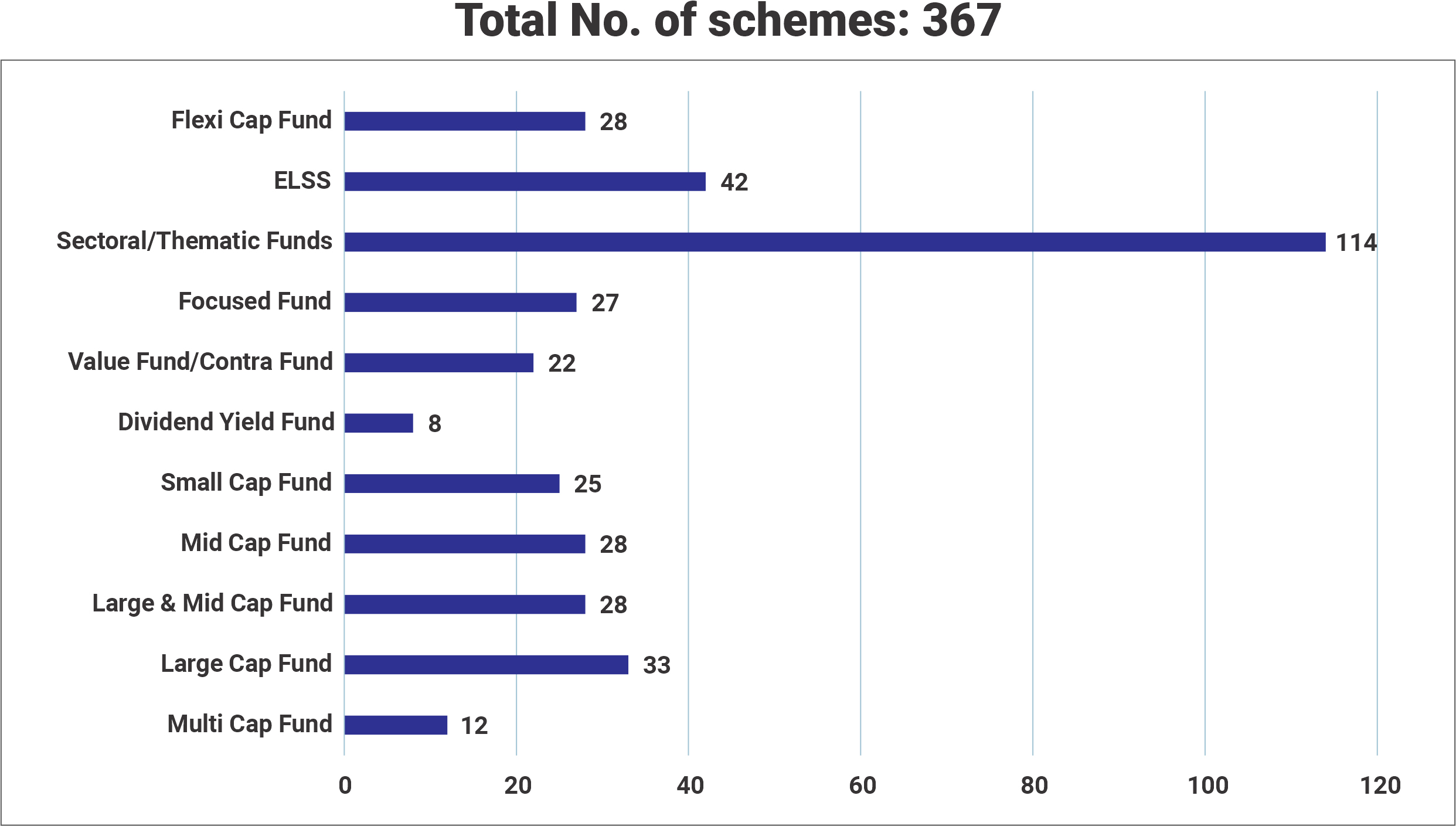

With the equity markets facing sharp swings, it is important to select a diversified equity mutual fund that can capture market opportunities while minimizing downside risk. However, searching for a suitable equity mutual fund among the 350+ equity mutual funds in the market can be a confusing and cumbersome job.

A few key questions that may come to mind:

1. How many funds should you have in your equity basket?

2. Should you be investing in large caps, mid or small caps?

3. Should you assess funds based on their ranking on mutual fund rating sites?

The simple answer to these questions is that you should focus on building a diversified portfolio that is not biased to any market cap or investment style. It should give your portfolio the potential to grow, at the same time, minimize downside risks.

Building this portfolio, however, may be more complex. With more and more schemes added to the industry every year, you need to go beyond mutual fund returns to research a suitable equity mutual fund.

Source: AMFI Data as of Nov 30, 2021

A Simple Solution - Equity Fund of Funds

If you are unable to decide or don’t have the time to research and select from the numerous Equity Funds out there in the market, an Equity Fund of Funds can be the right solution for you. This fund comprises of a well-researched diversified investment portfolio of other equity mutual funds.

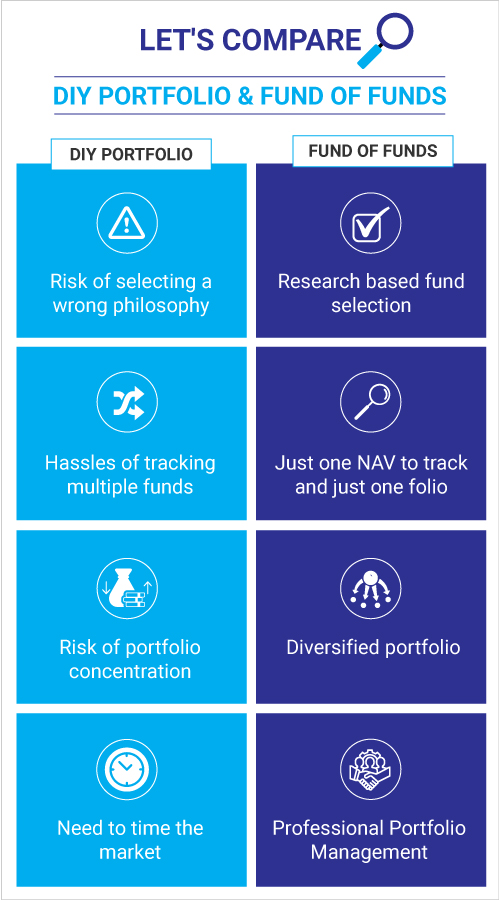

For DIY (Do-It-Yourself) investors, some of the biggest risks when it comes to equity mutual fund portfolio construction are:

• Risk of choosing the wrong philosophy: For instance, it would suit you best to invest in a mutual fund scheme that sticks to its investment mandate instead of frequently changing the fund objective to suit the market conditions.

• Skewed or Concentrated Portfolio: Additionally, there is also the risk of portfolio concentration or selecting only a particular sector or theme.

• Hassles of Tracking Multiple Portfolio and Rebalancing – You need to spend time reviewing multiple investments & their performance and rebalance as required.

In contrast, an Equity Fund of Funds scheme helps simplify the equity mutual fund selection, portfolio construction and tracking. You effectively track just one NAV and one fund. Your portfolio is managed by a professional fund manager, who will periodically balance the portfolio depending on the market conditions.

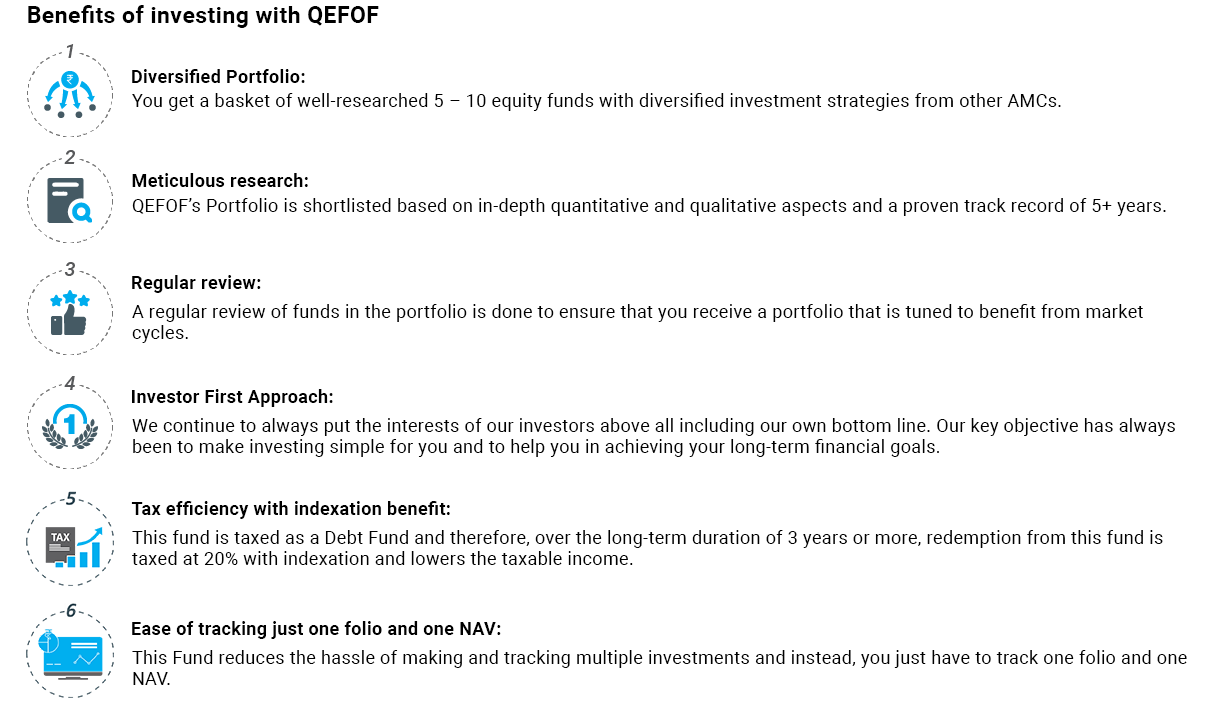

Diversified & Well-Researched – Quantum Equity Fund of Funds (QEFOF)

Quantum Equity Fund of Funds currently comprises 9 carefully selected equity mutual funds of other Fund Houses on the basis of various inhouse research parameters and with a proven track record. This fund offers you the opportunity to rebalance your equity portfolio adequately using the well-researched large & mid-cap schemes with a 5-year track record selected by the research team.

Note: A “Leading Fund” is a fund with a proven track record of 5 years+ selected after adequate quantitative and qualitative research.

How does QEFOF Complete Your Portfolio?

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

You can build your portfolio using the proven, time-tested, and Diversified 12-20-80 Asset Allocation Strategy that incorporates building blocks of the three asset classes of Equity, Debt and Gold. It offers the potential to help minimize downside risks while helping to achieve long-term goals.

Within this strategy, you invest a greater proportion (70% of your equity portfolio) into the Quantum Equity Fund of Funds. The higher weightage gives your portfolio a mix of the different equity funds with underlying varying investment styles and market capitalization. Over a longer duration of 7-10 years, this fund has potential for better risk-adjusted performance.

To know more download our simple guide.

Do away with the hassle of tracking multiple investments and simplify your equity investing with Quantum Equity Fund of Funds.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments. |  Investors understand that their principal will be at Low Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on November 30, 2021.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More -

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More