Navratri - Nine Nights, Infinite Insights to Shape Your Portfolio

Posted On Wednesday, Oct 09, 2024

"Ya Devi Sarva Bhuteshu Shakti Rupena Samsthita" – Translates to, the Goddess who resides in all beings as shakti. Indian mythology is known for its teachings on life and evolution. Each God or Goddess and their forms have a unique significance.

We have to take several decisions through the course of life and investing for our finances is an important goal. During Navratri, we honour the divine power in its many forms much like various human mindsets in investing. Just as each form of the Goddess embodies a unique strength, investing too draws on different powers.

The Power of Rooted Beginnings

Goddess Shailputri, the first form of Durga, teaches us that strong beginnings require patience and thoughtful action.

In investing, starting with a balance between risk and reward is key. Take some time to understand one’s financial position, set clear goals, and identify risks. A well-laid foundation gives an investment strategy the opportunity to remain grounded, even when markets are uncertain.

The Power of Resolve

Goddess Brahmacharini reflects the spirit of self-discipline and quiet perseverance.

Investing calls for a steady, deliberate approach. Systematic and thoughtful investments, like SIPs or Systematic Investment Plans, echo this spirit. In times of market uncertainty, it’s this resolve that keeps your financial strategy on course, giving growth the opportunity to unfold naturally.

The Power of Calm

Goddess Chandraghanta, with her crescent moon, radiates a sense of quiet strength. She teaches us to remain steady, even when turmoil surrounds us.

In investing, a calm vigilance is crucial.

Market uncertainties come and go, but reacting impulsively can derail long-term goals. True composure is built through preparation, giving one the opportunity to face turbulence with confidence rather than fear.

The Power of Clarity

Goddess Kushmanda, the harbinger of light, reveals the strength in illuminating hidden possibilities.

In investing, clarity is also about understanding market movements, and refining your investment approach with sharp focus. Wealth grows with clear intent and a vision that cuts through the noise. Getting frayed by investing in the recent IPO over subscription is a case in point.

The Power of Vigilance

Goddess Skandamata embodies nurturing vigilance. As a mother, she protects her child while preparing him to face challenges.

Investors need to balance growth with active oversight and fostering a portfolio that is resilient yet adaptable.

True financial stewardship is about nurturing growth while staying prepared to navigate uncertainties.

The Power of Precision

Goddess Katyayani embodies sharp focus and the courage to strike at exactly the right moment.

In investing, precision isn’t about endless preparation, it's the art of discerning when to take action.

Markets shift, trends emerge, and opportunities appear briefly. The key is in recognising these windows and situations that align with your goal. Precision isn’t passive-it’s the quiet strength to make deliberate, timely moves that shape a stronger financial future.

The Power of Transformation

Goddess Kaalratri, fierce and unyielding, embodies the raw force needed for radical change. She urges us to face uncomfortable truths head-on, to confront what’s holding us back.

In investing, this might mean reconfiguring a stagnant portfolio, decisively cutting off losses, or taking a bold turn when market conditions demand it.

Transformation here is decisive-a reset that paves the way for renewed growth.

The Power of Simplicity

Goddess Maha Gauri radiates elegance of simplicity. Her grace reminds us that complexity is not always the path to success.

In investing, simplicity often holds the key-cutting back on over-complicated portfolios and focusing on what truly drives growth. It’s about decluttering: shedding redundant investments, refining asset choices, and aligning with core objectives.

The Power of a Holistic Approach

Goddess Siddhidatri represents the wisdom that comes from recognising completeness.

The importance of a well-considered asset allocation strategy in investing-one that blends stability, growth, and protection to achieve financial harmony.

This approach is not about favouring one asset over another. Despite equities being the most preferred asset class, it is equally important to understand the advantages of other asset types. There is a season for each of the asset classes to be utilised, hence ensuring that there is stability and growth in a well-diversified portfolio. By rationally participating in a variety of asset classes according to your risk profile, you can reap the advantages of a balanced Multi Asset Investing strategy.

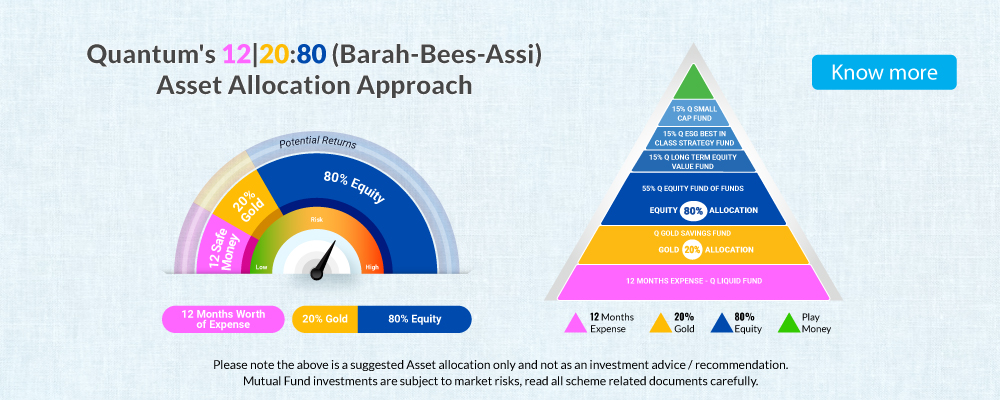

And we at Quantum Mutual Funds have been exhorting investors to focus on asset allocation with our Asset Allocation Approach of of 12|20:80 (Barah-Bees-Assi*).

Bottomline

Navratri celebrates the shakti within, the power to overcome obstacles and stay grounded.

In investing, tapping into this investment approach enables you with resilience, balance, and aligning with your long-term vision.

|

If you prefer a DIY (Do-It-Yourself) approach:

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More