Key Takeaways from Cricket to Ace the Investing Game

Posted On Friday, May 19, 2023

In a country like India, cricket is viewed as a religion, and cricket players as Gods, you can feel the adrenaline rush in the stadium, homes, and the streets. Every single game of your favourite cricket league transports you into the world of uncertainty. Even the comatose WhatsApp keeps buzzing with messages when cricket season starts at full steam. The constant commentary on television is an endless reminder that cricket can take precedence over everything. It makes you wonder if you can draw several parallels between investing and the game.

As an investor, you have to play the game of investing like a versatile cricket player, observing your opponent- that is the market volatility and macroeconomic challenges like high inflation rates. Both can influence your next move to create a winning portfolio.

Explore how a quick game of cricket can offer you plenty of ideas on how to invest your hard-earned money wisely and watch it grow:

1. Get Ahead of the Game - Start investing early

The initial few overs are crucial in every cricket match. It can decide the fate of the game. The same rule is applicable when it comes to investing -STARTing EARLY. It is one of the best and most important investment lessons to follow. The earlier you invest, the greater is your potential to achieve your financial goals. You just have to use right strategy to invest in the right investment avenues. Also keep in mind the power of compounding -the longer you stay invested, the higher is the likelihood for growth in your investment portfolio. With Quantum Mutual fund, you have the flexibility to start small using an SIP of Rs. 500 per month in all Quantum Funds or daily SIP of Rs. 100 in these funds – suitable for every wallet size.

| Fund | Daily SIP |

| Quantum India ESG Equity Fund | ✓ |

| Quantum Long Term Equity Value Fund | ✓ |

| Quantum Equity Fund of Funds | ✓ |

| Quantum Dynamic Bond Fund | ✓ |

| Quantum Gold Savings Fund | ✓ |

| Quantum Multi Asset Fund of Funds | ✓ |

2. Captain your financial goals

A team captain has the goal to win the match. The same lesson applies to the financial game. It is important to set short-term and long-term goals to achieve your dreams. It will help you pave the way for winning the game with every investment move and decision. It can help you strategically plan your portfolio and accomplish your life goals. Tie in a relevant mutual fund that is matching to your goals. For instance, equity mutual funds for your long term goals or liquid funds for short term or emergency needs.

| Tenure | Funds | Characteristics |

| Short term | Quantum Liquid Fund | Provide Liquidity and stability |

| Short/Long term | Quantum Gold Savings Fund/Gold Fund ETF | Portfolio Diversification |

| Long Term | Quantum Long Term Equity Value Fund | Potential for growth and risk adjusted returns |

| Quantum India ESG Equity Fund | ||

| Quantum Equity Fund of Funds | ||

| Quantum Nifty 50 ETF Fund of Fund |

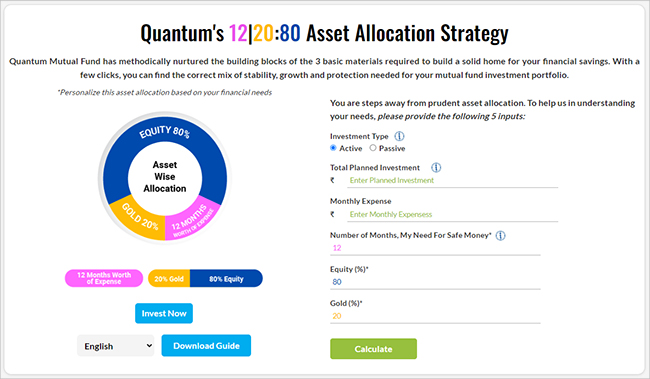

3. Create a winning team

To win a game, the right players need to be selected. There must be a perfect amalgamation of players to form a strong team. A team cannot just have good batsmen or good bowlers, there needs to be a mix. The same rule applies to your portfolio. When you allocate your money to different types of assets, you diversify and create a balance between risks and returns. You can use Quantum’s tried and tested 12|20:80 Asset Allocation Calculator to help you create a winning portfolio mix using three asset classes of equity, debt and gold.

#Please note the above is a suggested fund allocation and not to be considered as an investment advice / recommendation.

4. Master the strategy

Depending on the different cricket formats there are different game strategies. A single or general strategy may not work across various cricket formats. Each one requires a different strategy. Likewise, when you make investments, it is good to always identify your investment objective, the corpus you want to create, your risk appetite, and other goals that you might want to achieve. Consider all these factors before you draw a strategy and invest in various assets. For example, you can take higher risks and be aggressive in the initial years of your age investment. During the initial years, you can have greater exposure to equity-mutual funds. When you are older and have dependents, have a greater allocation to moderately high-risk funds such as Multi Asset Fund of Funds which provides exposure to equity, debt and gold. Depending on your preference you may also choose to diversify your investment using a DIY strategy based on Quantum’s 12| 20:80 Asset Allocation Approach or choose to invest in a readymade diversified portfolio using Quantum Multi Asset Fund of Funds.

5. Stay calm under pressure

Staying calm and focused is imperative while playing a cricket match, especially during a tough situation. A good cricketer knows that he needs to focus and ignore the chaos and the pressure that builds up when there is a major crisis. Similarly, as an investor, you must maintain your cool during difficult market situations/swings. You should stay calm during times of instability in the market such as geopolitical crises or market crashes.

6. Don’t rely on past performance

An intelligent franchise owner never selects players based on their past performance alone. Similarly historical returns of a mutual fund are just a reflection of past performance – they do not assure you of the fund’s performance in the future. Dig deeper to determine the fund's potential to meet your future goals.

Factors to consider before investing:

- Market Phases

- Investment Style

- Risk Exposure

- Governance Practices

7. Eye on the ball

In the game of cricket, keeping a keen eye on the ball’s movement is crucial for the outcome. Similarly, to successfully navigate the investing landscape, keep an eye on factors such as interest rates, geopolitical events, and industry-specific developments. To strengthen your portfolio, use a prudent asset allocation strategy to diversify with three asset classes of Equity, Debt and Gold.

8. Track your score to transform your game

As a captain, you must check your score and track the run rates to win the game. To win the game, the captain must make decisions to guide his teammates and alter his strategy as per the turn of events. In the same way as an investor, you must review your investment portfolio regularly and track your investments. Developing a habit of regularly reviewing your portfolio will help you check the health of your investments and make alterations at the right time.

9. Key Takeaways from Cricket to Ace the Investing Game

A coach serves as a guiding force in the game of cricket acting as a mentor to help players in their journey to success. Similarly, Quantum Mutual Fund aims to provide insights and a one-stop investing solution to simplify the investing game.

A game of cricket and investing are similar in many ways. A match is played with a passion to win and succeed. As an investor, you should be passionate and driven to achieve your dreams and goals- personal or financial by relying on a sound investment strategy.

|

|

Related Articles

World Health Day 2023: Assess Impact on your Financial Health

How to Structure Your Portfolio Given an Imminent Global Economic Slowdown

Kickstart the New Year with a 12:20:80 Mutual Fund Portfolio Review

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity, debt / money market instruments and gold |  Investors understand that their principal will be at Moderately High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Nifty 50 ETF Fund of Fund An Open ended Fund of Fund Scheme investing in units of Quantum Nifty 50 ETF | • Long term capital appreciation • Investments in units of Quantum Nifty 50 ETF - Exchange Traded Fund |  Investors understand that their principal will be at Very High Risk |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Low to Moderate Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The investors of Quantum Equity Fund of Funds, Quantum Gold Savings Fund, Quantum Nifty 50 ETF Fund of Fund will bear the Scheme expenses in addition to the expenses of other schemes in which Fund of Funds scheme makes investment (subject to regulatory limits).

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Potential Risk Class Matrix - Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Overcome Market Uncertainties: The Power of Multi-Asset Investing

Posted On Tuesday, Sep 03, 2024

As we step into September, Indian stock markets may face increased fluctuations, influenced by global and domestic factors.

Read More -

Getting Financial Freedom on Track

Posted On Friday, Aug 26, 2022

On Aug 15, 2022, India celebrated 75 years of independence. As in the past, India has displayed resilience and the potential to overcome challenges..

Read More