ISEC Merger with ICICI Bank, Why Quantum voted against the Resolution

Posted On Friday, Mar 22, 2024

Since its Inception in March 2006, Quantum Long Term Equity Value Fund has been focused on generating sensible, steady long term returns for investors while minimising the risks associated with investing in companies whose managements who do not respect the economic interests and rights of minority shareholders. In 1996 our Sponsor, Quantum Advisors, had pioneered the introduction of an Integrity Screen to exclude managements with poor corporate governance.

The Quantum Long Term Equity Value Fund and the Quantum ELSS Tax Saver Fund are shareholders of both companies, ICICI Bank and ISEC.

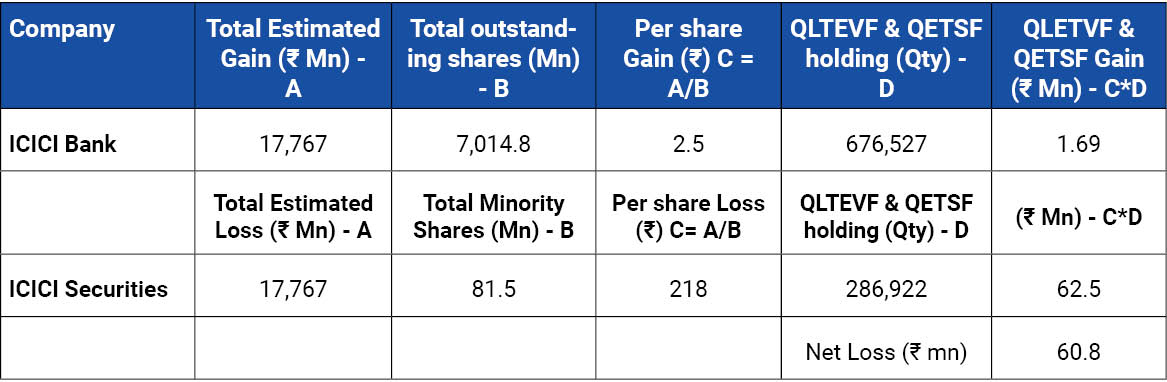

It is our opinion that the recent proposal by ICICI Bank to merge with ISEC (ICICI Bank owns a 75% equity stake in ISEC) is detrimental to the interests of our unit holders as we believe it undervalues ISEC and gives ICICI Bank access to the full business of ISEC at a less than fair market price. Our estimates of the true value of ISEC indicate that this low valuation proposed by ICICI Bank will result in a net loss of approximately Rs 61 million to the unit holders of the Fund.

Hence, we have voted against the Resolution.

The Calculations.

ICICI Bank wants to merge its 75% subsidiary ICICI securities (ISEC) with itself, offering investors 0.67 shares of ICICI Bank for every one share in ISEC.

ISEC listed on April 4, 2018 at Rs 432, which was a 17% discount to its IPO price of Rs 520. Had a reverse merger swap ratio set on the day of its listing, the ratio would have been set at 1.65 ICICI Bank shares for every 1 share of ICICI securities (a 146% premium to the current offer) based on the closing price for both the companies.

Had the ISEC IPO price been used as a benchmark then the share swap ratio would have been 1.9 shares of ICICI Bank for every 1 share of ICICI securities (a 183 % premium to the current offer) on the day of its listing.

The current swap ratio values ICICI securities at a 30% -77% discount to its other listed peers based on consensus earnings forecast for fiscal year ending March 2024.

| Company | FY24 Consensus EPS (₹/share) | PE multiple |

| ICICI securities | 46.1 | 15.7x |

| Angel One | 130.7 | 20.4x |

| 360 One | 20.7 | 34.2x |

| Anand Rathi Wealth | 54.9 | 70.1x |

Source: Bloomberg, Data as on March 11, 2024, ISEC valued at swap ratio

Even if the company was valued at the lowest PE multiple reflected in its peer set (20.4x for Angel One) the merger offer would have been at least 30% higher.

The current proposed merger ratio transfers at a minimum Rs 17.8 bln to ICICI Bank shareholders from ISEC Minority shareholders.

| ISEC Derived share price based on Swap Ratio | ₹722/share |

| ISEC derived share price if valued at 20.4x FY24E Earnings (lowest multiple for peer) | ₹940/share |

| Loss at current swap ratio | ₹218/share |

| Total No of minority shares | 81.5 Mln |

| Total loss for ISEC Minority shareholders | ₹17, 767 Mln |

Source: NSE, Data as on March 11, 2024

Quantum Long Term Equity Value Fund (QLTEVF) and Quantum ELSS Tax Saver Fund (QETSF) owns shares in ICICI Bank and ICICI Securities. We estimate the merger will result in a net loss of at least Rs 60.8 Mn to our unit holders.

Based on the above to protect interests of our unit holders, Quantum Mutual Fund has decided to vote against the resolution.

Quantum Mutual Fund was the first direct-to-investor fund house and is focused solely on working for the interests of our investors.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More -

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More