How Thoughtful Investors Don't Get Affected by Market Crashes

Posted On Monday, May 23, 2022

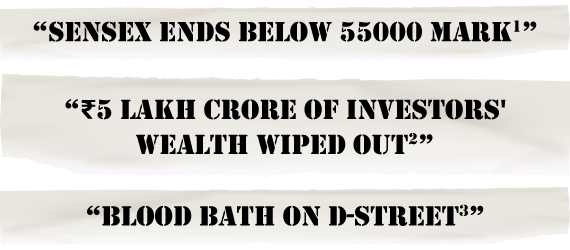

1Stock market - Sensex dives 867 points to close below 55,000-mark - Telegraph India, May 06, 2022

2Rs 5 Lakh Crore Of Investors' Wealth Wiped Out On Early Thursday Market Crash (ndtv.com), May 19, 2022)

3Bloodbath on D-Street: Factors behind Sensex crash today – BusinessToday, May 12, 2022

News portals have been flooded with headlines the past couple of weeks that have brought investors on the edge of their seats worried about the weakening cues in India and the world.

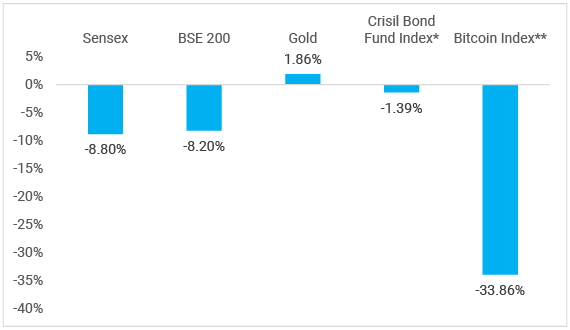

Investments in high risk asset classes like Equity and Bitcoin have fallen sharply by 8% approx. and 33% respectively this CY as of May 16, 2022. However, the High to Moderate risky asset classes such as short term bonds or gold have relatively performed better. Investors who have tried to follow trends and invested only in high-risk assets have witnessed losses in their portfolio.

Fig 1: Asset Classes Performance: An Overview

YTD Data for the period between Jan 01, 2022- May 16, 2022. Crisil composite Bond Index Data as of May 13, 2022. Past performance may or may not be sustained in the future. All figures in INR except bitcoin in US$

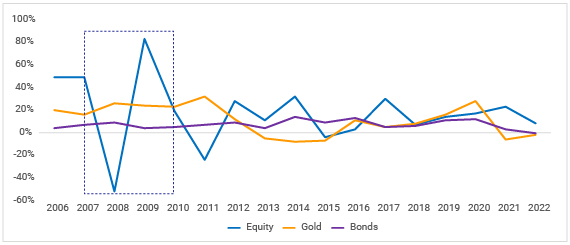

However, as seen historically, generally asset classes move in cycles and are not predictable. For instance, when equities rose to 23% in Dec 21, Gold prices fell by 6%. Conversely, from the start of this CY, as equities corrected by ~2%, Gold prices rose by 8%. There’s no clear winning asset class. It is this knowledge that makes a Thoughtful Investor unrattled.

Fig 2: Asset classes moves in cycles

Source: Bloomberg. Data as of April 2022. Past performance may or may not be sustained in the future. Indices Used: S&P BSE Sensex; MCX Gold Commodity Index and CRISIL Composite Bond Fund Index

Thoughtful investing is allocating money to different asset classes so that it can help you achieve risk adjusted returns. Instead of blindly following trends and suffering portfolio declines, a thoughtful investor sustains through market losses through a well-defined diversification strategy.

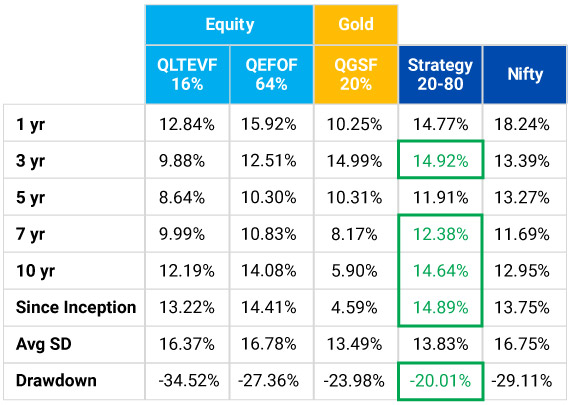

Quantum Mutual Fund has time and again advocated the Simple 12:20:80 Asset Allocation Solution - to help investors build a balanced portfolio with either active or passive fund options.

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

Let’s see how this asset allocation strategy would have performed in comparison with the Nifty. The following table indicates how a diversification strategy would potentially give you similar returns with limited drawdowns.

Fig 3: Asset Allocation Strategy vs Nifty Performance

Data from Jan 2012 to April 30, 2021 *QLTEVF – (Quantum Long Term Equity Value Fund, QEFOF (Quantum Equity Fund of Funds), QGSF (Quantum Gold Savings Fund). The above represent hypothetical return of a 20-80 Gold- Equity portfolio started on December 31st 2011, rebalanced over a period of time. The Equity portfolio is split between QEFOF and QLTEVG in 64% & 16%. Since these funds were launched prior to ESG, the Equity portfolio was split in QEFOF and QLTEVF in a proportion of 80:20.

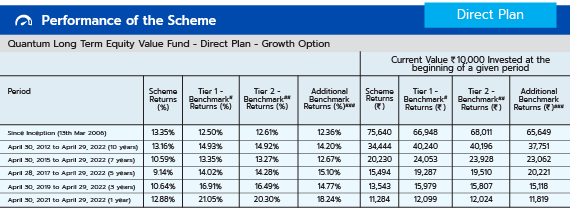

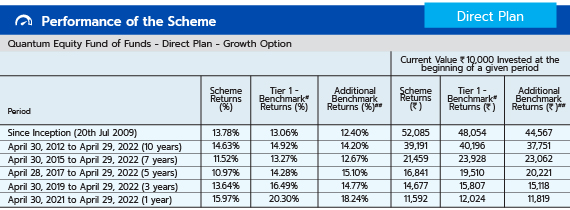

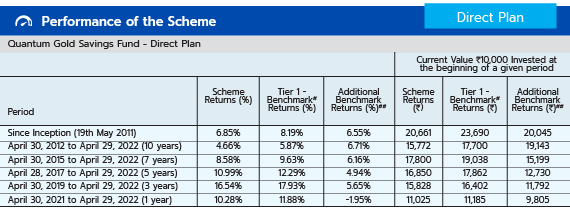

Since Inception Date: QLTEVF (March 13, 2006) QEFOF (July 20, 2009) QGSF (May 19, 2011). The performance shown in the table above should be reviewed in conjunction with detailed performance of the scheme provided below.

Past performance may or may not be sustained in the future.

Let’s understand the performance better using an example. Consider a Rs 1 lakh investment in the equity-gold portion of the 12-20-80 strategy vs. Nifty from the pre-COVID peak (17th January 2020) to the COVID market crash (23rd March 2020) period.

Fig 4: Evaluating drawdowns – Asset Allocation Strategy vs S&P Sensex

| Fund | 12-20-80 Allocation | S&P Sensex TRI |

| Investment Value | 100,000 | 100,000 |

| Quantum Equity Fund of Funds | 56,000 | - |

| Quantum Long Term Equity Value Fund | 12,000 | - |

| Quantum India ESG Equity Fund | 12,000 | - |

| Quantum Gold Savings Fund | 20,000 | - |

| Market Value | 71,937.78 | 61,220.86 |

| Correction | -28% | -38% |

Notes: 1. Market value of the portfolio as on Mar 23, 2020. Past performance may or may not be sustained in the future.

As you can see that the 12-20-80 strategy limited the downside risk and provided better portfolio stability during uncertain market conditions to the extent of 10%.

It’s never too late to safeguard your investments from the next downturn. Instead of looking for the next winning asset class or worrying about the next crash, diversify your portfolio for long term risk adjusted returns.

The markets may experience a further correction due to interest rate hikes rising commodity prices and other challenges confronting the economy. Looking at the macroeconomic parameters globally and in India, here’s how the asset classes are poised to perform:

Fig 5: Asset Outlook

| Asset Class | Outlook |

| Equity | As interest rates rise, share prices will fall. Overvalued or high PE multiple stocks likely to be more sensitive. |

| Debt | Aggressive rate hikes have been applying upward pressure on bond yields |

| Gold | Gold prices to moderate in response to interest rate hiking cycle. On the other hand, worries about growth, geopolitics, and inflation will keep demand supported |

Do not get lured by latest trends or market swings, instead safeguard your investments with prudent asset allocation, to generate wealth in the long term.

So, are you ready to become a thoughtful investor?

#S&P BSE 500 TRI, ##S&P BSE 200 TRI, ###S&P BSE Sensex.

Data as of April 30, 2022.

Past performance may or may not be sustained in future.

Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#with effect from December 01, 2021 Tier 1 benchmark has been updated as S&P BSE 500 TRI. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR S&P BSE 500 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

##TRI data is not available since inception of the scheme, Tier 2 benchmark performance is calculated using composite CAGR S&P BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006

The Fund is managed by Mr. Sorbh Gupta and Mr. George Thomas. Mr. Sorbh Gupta has been managing the fund since Dec 01, 2016. Mr. George Thomas has been managing the fund since April 01, 2022 Click here to view other funds managed by Mr. Sorbh Gupta and Mr. George Thomas.

#S&P BSE 200 TRI, ##S&P BSE Sensex TRI.

Data as of April 30, 2022.

Past performance may or may not be sustained in future.

Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated based on Compounded Annualized Growth Rate (CAGR).

The fund is managed by Mr. Chirag Mehta since Nov 1, 2013. Mr. Chirag Mehta manages 4 Schemes of Quantum Mutual Fund. For other schemes managed by him, please Click here.

#Domestic Price of Physical Gold, ##CRISIL 10 Year Gilt Index.

Data as of April 30, 2022.

Past performance may or may not be sustained in future.

Different Plans shall have a different expense structure.

The fund is managed by Mr. Chirag Mehta. Mr. Chirag Mehta is handing the fund since May 19, 2011. For other funds managed by Mr. Chirag Mehta, please Click here.

Product Labeling

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Riskometer of Tier 1 Benchmark |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |  |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns •Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |  |

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Tier 1 Benchmark | Tier 2 Benchmark |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Moderate Risk |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on April 30, 2022.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Overcome Market Uncertainties: The Power of Multi-Asset Investing

Posted On Tuesday, Sep 03, 2024

As we step into September, Indian stock markets may face increased fluctuations, influenced by global and domestic factors.

Read More -

Getting Financial Freedom on Track

Posted On Friday, Aug 26, 2022

On Aug 15, 2022, India celebrated 75 years of independence. As in the past, India has displayed resilience and the potential to overcome challenges..

Read More