Investing in 2025: Say No to concentration and Yes to diversification

Posted On Monday, Jan 06, 2025

Welcome, dear investor, to 2025!

2024 was a gentle reminder that unlike the commonly held perception, equities don't always go up. As you digest that fact and prepare your portfolios for the new year, let’s talk about some of the major macroeconomic and geopolitical themes that can influence markets and may create impact on investment portfolio outcomes in 2025.

The extended bull run of domestic equity markets has been interrupted by foreign institutional selling in the final months of CY2024. Aggregate level corporate earnings for the first half of FY2025 have fallen short of expectations, even as valuations remain elevated close to long-term average price-earnings multiples.

Uncertainty on the food inflation and currency fronts has deterred the Reserve Bank of India from actioning rate cuts, even as higher interest rates weigh on economic activity.

GDP growth for the July-September period has decelerated to 5.4%, a seven-quarter low. All eyes are on government spending and the upcoming Union Budget to perk up slowing consumption and investment demand.

A resilient US economy and expectations of higher US inflation fuelled by Trump 2.0’s tariff hikes have led the Federal Reserve to halve the rate cuts previously indicated for CY2025. A resulting stronger US Dollar and higher US treasury yields have hurt India’s attractiveness as an investment destination, diverting foreign flows.

With stimulus announced to support the economy on the one hand, and the threat of US tariffs on the other, the growth trajectory of the Chinese economy may weigh on foreign flows to India.

A conflict-ridden world which is increasingly becoming protectionist and vulnerable to climate-related disruptions is potentially staring at higher inflation and thus higher interest rates.

All in all, even as the long-term India growth story remains intact, slowing domestic economic momentum, elevated market valuations and unfavourable external factors mean equity markets will remain volatile in the near to medium term.

While equities remain indispensable for long -term wealth creation, current market uncertainty requires proactive risk management.

Asset allocation is a tried and tested and easy to execute risk management strategy. Here, the investor divides his or her portfolio among different asset classes. In the current scenario, that would entail not being only concentrated in ‘wealth-creating’ equities and instead invest some money into other asset classes like ‘stabilizing’ debt and ‘diversifying’ gold that can balance out volatility in the equity markets – reducing the sudden impact on investment portfolio and manage downside risk.

This approach works because equity, debt and gold have different macroeconomic drivers which makes them outperform or underperform at different times. The result is a more resilient portfolio which is not vulnerable to the volatilities of only one asset class.

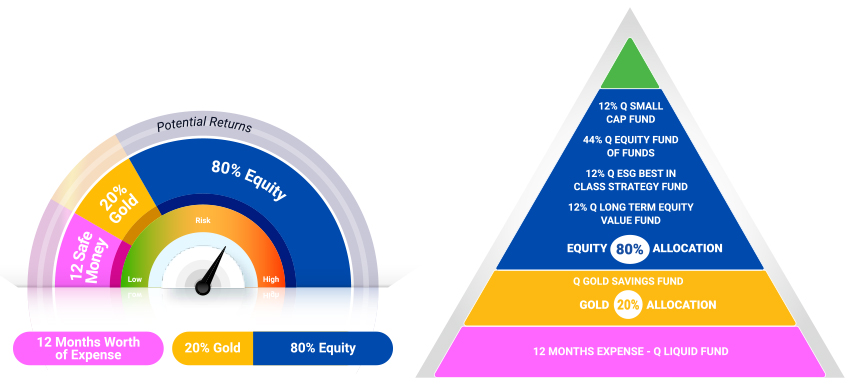

Quantum's 12|20:80 (Barah-Bees-Assi) Asset Allocation Approach can help you achieve that.

*Please note the above is a suggested Asset allocation and not to be considered as an investment advice / recommendation.

Safety Block: This approach suggests keeping 12 months of living expenses aside in an avenue like Quantum Liquid fund. The fund aims to earn slightly higher returns than interest on a bank savings account. It is an ideal parking spot for your emergency corpus which one can fall back on in times of need without disturbing their long-term equity investments. It prioritizes safety and liquidity over returns by investing pre-dominantly in AAA-rated debt papers issued by Govt authorities, and not taking on private corporate credit risk. By investing in debt upto 91 days, the interest rate risk is minimized.

Next, the investor can divide his or her portfolio between gold and equities in an approximately 20: 80 proportion which can be tweaked based on the investors investment objectives, investment horizon and risk-taking ability.

Diversifying Block: The approach suggests to keep 20% of the investable corpus in the Quantum Gold Savings Fund. Backed by 24 carat gold, the fund enables investors to invest in gold through the mutual fund route. This fund is an efficient and convenient way to take exposure to gold and do away with purity and storage concerns associated with investing in physical gold. Given that gold and equities generally have a low corelation, this 20% allocation to gold acts as a diversifier, balancing out the volatility in the equity component of the portfolio.

Growth Block: 80% of the investable corpus can be aimed at portfolio growth and can be built using the Quantum Equity Fund of Funds, the Quantum Long Term Equity Value Fund, the Quantum ESG Best In Class Strategy Fund and the Quantum Small Cap Fund. These funds offer an all-rounded equity exposure with a basket of well-researched, growth-oriented third-party equity schemes, value style of investing, investing with a sustainable theme and investing in high-potential and under-researched smaller businesses, respectively.

Thus, a diversified and disciplined portfolio built using Quantum’s 12|20:80 (Barah-Bees-Assi) Approach can give investors the ability to stay invested through the equity market volatility in 2025, and in turn benefit from India’s long-term growth potential.

|

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

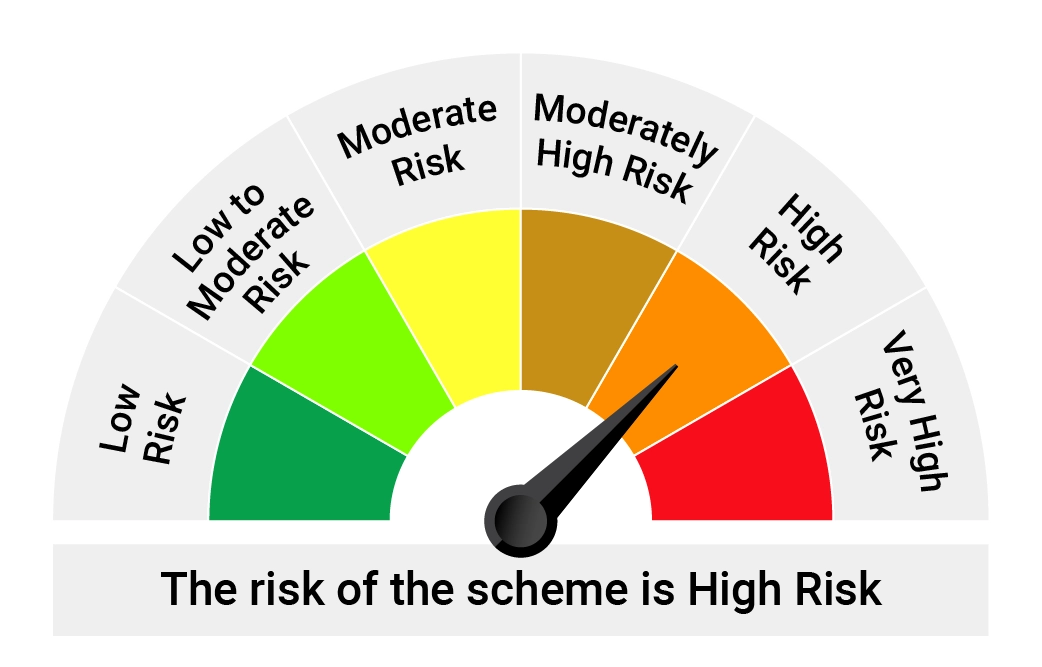

Quantum Small Cap Fund An Open Ended-Equity Scheme Predominantly Investing in Small Cap Stocks Tier I Benchmark: BSE 250 SmallCap TRI | • Long term capital appreciation • Investment in Small Cap Stock |  |

Quantum ESG Best In Class Strategy Fund An Open-ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme assessed through a Best In Class Strategy | • Long term capital appreciation • Invests in shares of companies following Environment, Social and Governance (ESG) theme assessed through a Best In Class Strategy |  |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in BSE 200 index |  |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  |

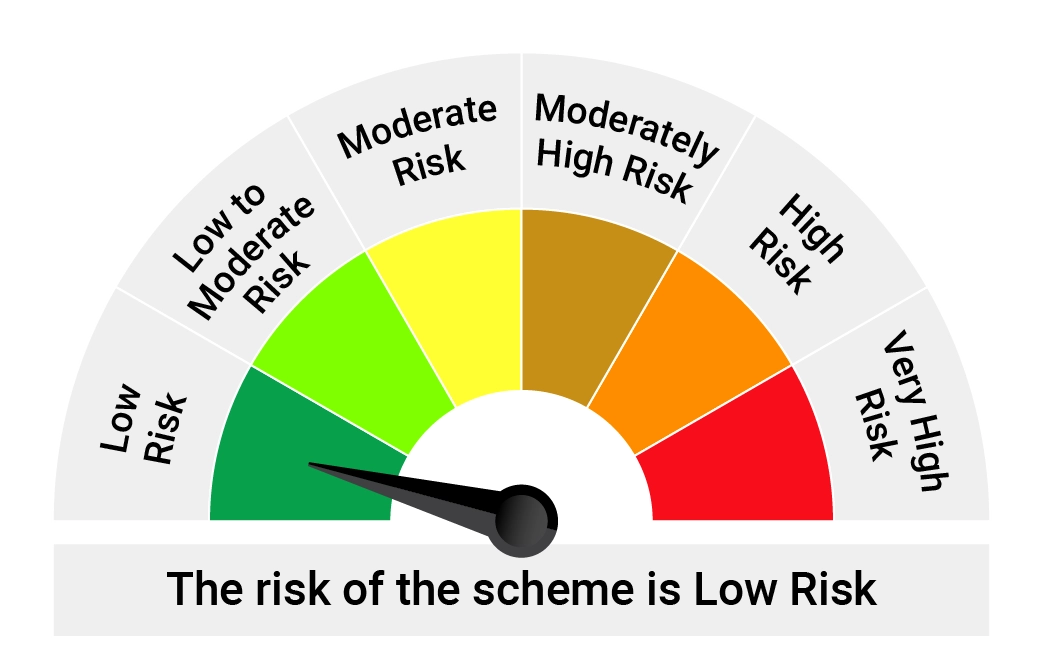

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk | • Income over the short term • Investments in debt / money market instruments |  |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  |

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Investors may please note that they will be bearing the recurring expenses of this Scheme in addition to the expenses of the underlying Schemes.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Overcome Market Uncertainties: The Power of Multi-Asset Investing

Posted On Tuesday, Sep 03, 2024

As we step into September, Indian stock markets may face increased fluctuations, influenced by global and domestic factors.

Read More -

Getting Financial Freedom on Track

Posted On Friday, Aug 26, 2022

On Aug 15, 2022, India celebrated 75 years of independence. As in the past, India has displayed resilience and the potential to overcome challenges..

Read More