Interest Rate Hikes: Is your Equity Portfolio Geared for Growth?

Posted On Wednesday, Mar 23, 2022

Since the Covid-19 fueled self-offs in March 2020, financial markets have risen to the challenge. However, recently we have seen corrections amid the Russia-Ukraine war, rising crude oil prices and increasing global inflationary pressures. Inflation in the US, which was expected to be ‘transitory’, had touched a record high of 7.5% in January 2022 (the highest since February 1982). This has led to the US Federal Reserve’s hiking of rates after more than 3 years. The US Central Bank has increased interest rates by 25 bps and indicated more rate hikes can be expected in the near future.

How have markets responded to interest rate hikes historically?

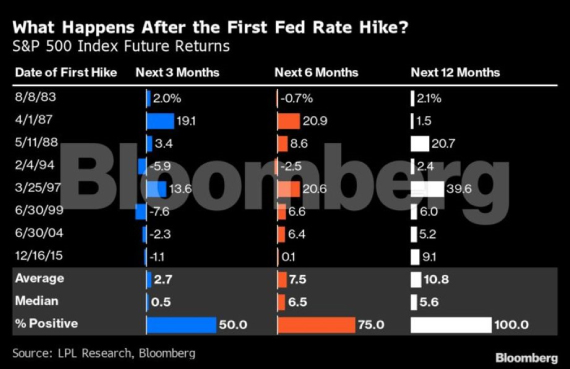

Historically, equity markets have experienced sharper swings following the rise in rates. Even this time, markets ended in green after the announcement. However, this does not necessarily mean that the upside potential is over. In fact, in the previous eight rate hiking cycles, the S&P 500 has risen higher after a year from the first increase every single time, according to LPL Research, Bloomberg. If you look further into the past, out of the 12 rate-rising cycles since the 1950s, the S&P 500 Index has gone up on 11 occasions. None of the rate hikes have been detrimental to equity markets over the long term. It is therefore very important to continue to keep a long-term horizon to weather the market uncertainty and benefit from the compounding of your investment corpus.

(Source: Bloomberg Finance L.P) Past performance may or may not be sustained in the future.

Challenges for equity investors over the short term:

• Sustained increase in Crude Oil Prices

• Prolonged geopolitical unrest between Russia and Ukraine

• State Elections in India and US-mid-term elections

• FPI Outflows

In the light of these challenges, what are the parameters that will help sustain equity markets?

Returns may be muted as long as uncertainty prevails on the macroeconomic front. Nevertheless, India’s long term growth story stays intact. A point here is that rate hikes are usually done when economic recovery indicators are evident such as – GDP growth, higher corporate earnings, increased employment, etc. This again reinforces that equity markets will be able to generate wealth over the long term.

Positive indicators of the Indian Economy

1. FPI investments: Foreigners were large investors in 2020-21 and given the run-up in the market, they are booking profits. However, it is not always true that interest rate hikes and equity markets demonstrate an inverse relationship.

From India’s standpoint, the conflict has very little direct impact on the economy and India has the potential to be an attractive market among emerging markets and will attract inflows once the war subsides.

Illustration 2: Russia-Ukraine war: Downside Impact on Financial markets in India vs. other indices

| Index | Returns (%) |

| S&P BSE SENSEX | -2.9% |

| S&P 500 | -1.8% |

| Dow Jones Industrial Average Index | -2.1% |

| MSCI Emerging Market Index | -1.8% |

Data as of Feb 28, 2022. Past performance may or may not be sustained in the future.

Other parameters that may work in favour of India’s economy and growth in financial markets are:

2. Strong forex currency reserves close to US$ 600 bn giving adequate cushion against any oil shock.

3. Over 50% of India’s CPI basket is food where India is self-sufficient (excluding edible oil & pulses).

4. Exports growth for both services and products should contain fiscal deficit

5. Buoyant tax collection

6. Strong retail investor participation:

• The AUM of the MF industry doubled and grew by over 70% in the last two years as of February 2022, aided by NFOs (New Fund Offers)

• Equity-oriented funds witnessed robust net inflow of Rs 1,21,698 crore during this period.

• ETF investing has gained momentum.

• More than two crore new SIP accounts were added reinforcing investor sentiment

Source: AMFI

Considering these strong future prospects, you can invest in equity mutual funds with a long-term view to take advantage of the market opportunities and minimize risks, using a diversified equity basket with varying investing styles and market cap.

How do you build a Diversified Equity Basket

After setting aside 12 months of expenses in a safe place such as a liquid fund scheme or bank savings account, you can invest 20% of your investment in portfolio diversifying asset of gold and the balance of 80% on a diversified equity bucket. The funds get allocated across three different equity funds - Quantum Equity Fund of Funds, (70%) Quantum India ESG Equity Fund (15%) and the Quantum Long Term Equity Value Fund (15%).

Please note the above is a suggested fund allocation and not to be considered as an investment advice or recommendation

The 70% - Quantum Equity Fund of Funds Features

With over 350+ equity schemes out there, how do you effectively build your equity portfolio to capture opportunities and minimize downside risks? Understanding your need for diversification and simplifying the fund selection process, the Quantum Equity Fund of Funds was launched.

|

|

|

|

|---|

Quantum Equity Fund of Funds - well positioned to benefit from capex and resulting consumption from high economic growth

The following table highlights the portfolio holdings of underlying equity schemes of Quantum Equity Fund of Funds.

| Sector | BSE 200 Index | Quantum Equity Fund of Funds |

| Communication Services | 2.70% | 2.77% |

| Consumer Disc. | 7.60% | 11.18% |

| Consumer Staples | 7.7% | 4.77% |

| Energy | 10.40% | 3.87% |

| Financials | 31.30% | 28.79% |

| Healthcare | 5.10% | 6.55% |

| Industrials | 6.00% | 10.59% |

| Information Technology | 14.5% | 12.95% |

| Materials | 9.6% | 8.76% |

| Real Estate | 0.6% | 0.31% |

| Utilities | 4.5% | 1.4% |

| Cash | 0.0% | 8.06% |

| Total | 100.0% | 100.0% |

Data as of Feb 28, 2022 | Past performance may or may not be sustained in the future.

The 15% - Quantum Long Term Equity Value Fund

You need to be cautious of new fund offers comprising of stocks with high valuations and those that are sensitive to the increases in the cost of capital. Here’s when buying into the idea of value investing may work for you.

A reasonably valued portfolio of quality stocks is expected to outperform compared to an expensive portfolio in a rising interest rate environment.

|

|

|

|

|---|

• A reasonably valued portfolio: The QLTEVF portfolio is valued at 11.9x as compared to 17.4x as of Mar 2024E.

PORTFOLIO VALUATIONS: 33% AT A DISCOUNT TO THE INDEX ON T12M AND 38% LESS EXPENSIVE FY2023e

| QLTEVF | As % of S&P BSE-30 Index | S&P BSE-30 Index** | |

| Analysts views expressed FY2023 | 508 | 74% | 687 |

| Analysts views expressed FY2024 | 433 | 70% | 615 |

| Number of Stocks | 29 | 97% | 30 |

| Median market cap. (USD mn) | 9,905 | 29% | 34,582 |

| Wtd. dividend yield | 1.94% | 162% | 1.20% |

| Historical PER of portfolio (T12M) | 19.0 | 67% | 28.5036053 |

| Wt of stocks with PER < 20, hist | 37% | 346% | 11% |

| % Wt of stocks with PER > 20, hist | 63% | 71% | 89% |

| % Wt of stocks with PER > 30, hist | 20% | 35% | 56% |

| ESTIMATES FOR FY2023 | |||

| Analysts polled | 508 | 74% | 687 |

| Wtd. PER: March 2023E | 13.4 | 65% | 20.5 |

| Wtd. EPS Growth: March 2023E | 25.5% | 105% | 24.3% |

| PEG Ratio (excludes cash) 2023E | 0.5 | 62% | 0.8 |

| ESTIMATES FOR FY2024 | |||

| Analysts polled | 433 | 70% | 615 |

| Wtd. PER: March 2024E | 11.9 | 68% | 17.4 |

| Wtd. EPS Growth: March 2024E | 11.9% | 65% | 18.2% |

| PEG Ratio (excludes cash) 2024E | 1.0 | 105% | 1.0 |

Source: Quantum Asset Management Company Pvt Ltd; As of Feb 28, 2022, | cash weight excluded | ** S&P BSE-30 Index weight is based on free-float. % S&P BSE 30 Index column depicts the Fund fundamentals as a percentage of S&P BSE 30 Index fundamentals. The figures mentioned in WTD PER, WTD EPS and PEG ratio are calculated on the basis of Bloomberg consensus estimates for companies owned by the Fund as well as the companies in the S&P BSE 30 as of the reporting date i.e. February 28, 2022. Past performance may or may not be sustained in the future.

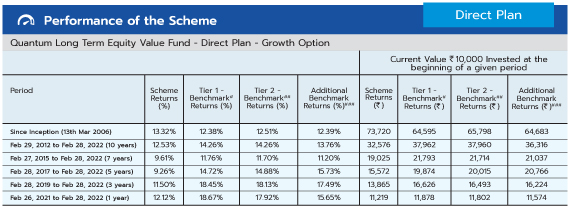

• 16-year Track record: The Quantum Long Term Equity Value Fund has completed 16 years on Mar 13, 2022 and has given since inception CAGR return of 13.32%.

| Fund/Index | Return |

| Quantum Long Term Equity Value Fund | 13.32% |

| BSE 30 | 12.51% |

| SP 500 | 12.38% |

| World | 11.2% |

| Emerging Markets | 8.9% |

| Gold | 11.7% |

Data since QLTEVF inception in Mar 2006 for period ending Feb 28, 2022. Past performance may or may not be sustained in the future. The performance to be read in conjunction with the complete performance given below.

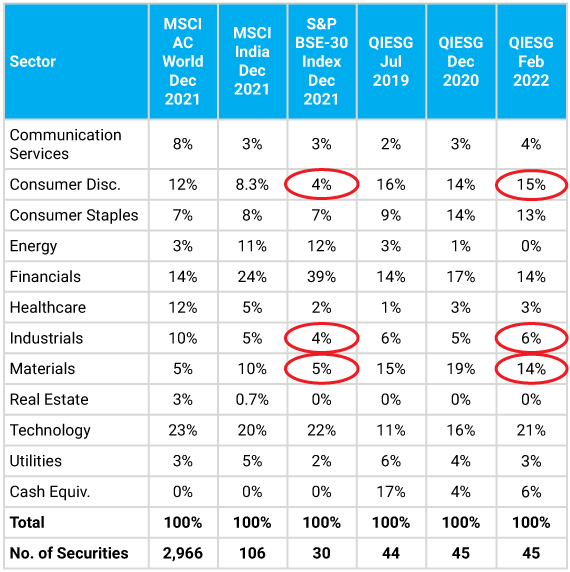

The 15% - Quantum India ESG Equity Fund

The true to label ESG fund uses in-house proprietary ESG scoring metrics comprising of qualitative and quantitative parameters. We subjectively evaluate over 200 parameters and go beyond the desk to give a comprehensively researched portfolio.

|

|

|

|

|---|

ESG stands for the environmental, social, and governance factors that has started playing a significant role in investment processes and decision-making. They can have a material impact on the firm’s earnings and valuation over the long term, making them important considerations for long-term investors. The COVID-19 Pandemic of 2020 has not only brought a great recession, but investors are also calling it the 21st century's first "sustainability crisis". It has been a wake-up call for investors to prioritize a more sustainable approach.

Let’s understand how the portfolio is positioned to capture the opportunities.

Quantum India ESG Fund - well positioned to benefit from capex, thrust on sustainability and resulting consumption from high economic growth

Data as of February 28, 2022. Past performance may or may not sustained in future.

You can use this market correction as an opportunity to increase allocation to equity mutual funds & align it to your long-term financial goals. Take calculated risks and select the right equity mutual fund schemes to build your equity allocation.

#S&P BSE 500 TRI, ##S&P BSE 200 TRI, ###S&P BSE Sensex.

Data as of February 28, 2022.

Past performance may or may not be sustained in the future.

Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#with effect from December 01, 2021 Tier 1 benchmark has been updated as S&P BSE 500 TRI. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR S&P BSE 500 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

##TRI data is not available since inception of the scheme, Tier 2 benchmark performance is calculated using composite CAGR S&P BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

The Fund is managed by Mr. Sorbh Gupta and Mr. Nilesh Shetty. Mr. Sorbh Gupta has been managing the fund since Dec 01, 2016. Mr. Nilesh Shetty has been managing the fund since Mar 28, 2011.

Click here to view other funds managed by them.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies. |  Investors understand that their principal will be at Very High Risk |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  Investors understand that their principal will be at Very High Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on February 28, 2022.

Product Labeling

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Tier 1 Benchmark | Tier 2 Benchmark |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy Primary Benchmark: S&P BSE 500 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |  |  |

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on February 28, 2022.

The Risk Level of the Tier 1 Benchmark & Tier 2 Benchmark in the Risk O Meter is basis it's constituents as on February 28, 2022.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More -

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More