Here are 3 more reasons to invest in gold

Posted On Friday, Oct 11, 2019

With gold prices soaring and interest in gold getting revived, the investment community is extensively talking and writing about the potential impact of trade wars, a global slowdown and looming dollar weakness on gold. These factors meaningfully impact the metal and deserve the investor’s attention. However here we attempt to explore other interesting, subtle economic indicators that could potentially impact gold, and give investors insight into where gold could be headed. Read on.

1) 70% of sovereign debt in developed markets is now negative yielding in real terms

It’s becoming a widely known fact that $15 trillion or 25% of sovereign debt is negatively yielding. However, not many are aware, on a real interest rate basis – what really matters for investors- a staggering 70% of it are negative.

There is a good chance that the global economy may enter into a recession within the next 1-2 years. Major economies like China and United States are showing signs of slowing down, and the trade war between them is accelerating this.

Lowering interest rates has historically been the first line of defense for global policy makers when staring at a recession. Lower interest rates encourage economic activity as the cost of borrowing funds falls for consumers and industries, thus pushing up spending and kick starting the economy. Typically, rates have been lowered by approximately 3-5% in response to prior recessions. But current rates are not high enough to drop, without going negative, since the time they were significantly reduced after the Global Financial Crisis of 2008-09. Thus the amount of negative-yielding debt globally is on the rise.

Countries with negative interest rates include Sweden, Denmark, Switzerland, Austria, Germany, Netherlands, Japan, and very recently even France. Belgium with a 10-year rate of 0.08% and Spain with a rate of 0.39% are expected to follow soon.

The gold connection:

Gold prices are expected to increase during this period of negative real interest rates. This is because negative real interest rates, i.e. the situation when the inflation rate is higher than the nominal interest rate (the rate which is actually paid), means that creditors will be losing money, therefore they are more prone to buy gold, even though it does not bear interest or dividends.

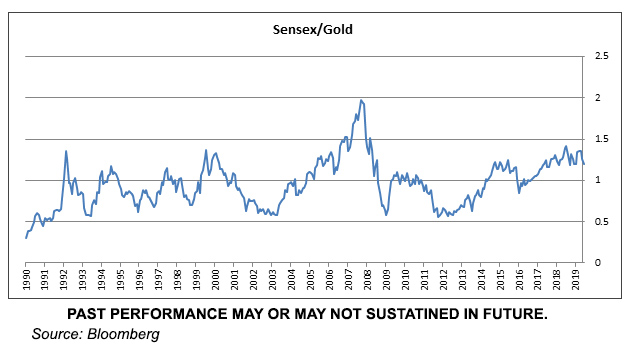

2) In other words, gold will reclaim its traditional role as money and a store of wealth, which will at least keep pace with inflation to preserve the purchasing power of the capital, at a time when bonds guarantee a real loss at negative real interest rates. The Sensex to Gold ratio is moving lower

The Sensex to Gold Ratio is a number that tells us how much of the Sensex can ten grams of gold buy at a given point in time. The calculation is made by dividing the value of the Sensex to the spot price for gold.

When the Sensex to Gold Ratio has high values, it means that stocks are valued higher than gold. These are times when investors are optimistic about the economic activity in general. They expect the companies to sell more, to increase revenues and profits, therefore they buy stocks. In these times, investors are willing to take risks. When more buyers come in, stock prices are moving higher. Gold is less attractive. Sensex increases and the gold price stagnates or even decreases, leading to a higher Sensex to Gold ratio.

When investors start losing optimism or when they feel that the stocks are overvalued, they start moving their money out of the stock market. More sellers lead to lower stock prices. As this process accelerates, the investors’ main focus is preservation; therefore, they look for stores of value – and gold has been the ideal asset in this category. More gold buyers lead to higher gold prices. With lower stock prices and higher gold prices, the Sensex to Gold Ratio decreases.

The gold connection:

As of July 2019, the Sensex to Gold ratio is at 1.2. It has moved down from 1.4 levels a year back on account of lower stock prices and gold moving higher, indicating a slowdown or loss of investor sentiment. Thus, gold prices can be expected to increase because:

a) Investors are expected to move to “” gold in times of muted economic growth b) Stock markets are elevated and gold needs to catch up in order for the ratio to move to the long term average

of 0.96. And usually, when this indicator moves, it moves towards the range low of 0.55. A combination of rising gold price and falling Sensex will tend to take the Sensex Gold ratio lower.

3) Less Gold underlying per unit of currency in circulation

With no gold required to back the currency since 1971, there is no longer any restriction on the creation of new money.

Central banks worldwide, led by the U.S. Federal Reserve, mint new money to artificially prop up slowing economies and endlessly bail out insolvent governments, banks and corporations.

The economy of the United States, for example, has been continuously supported by money printing or Quantitative Easing and near zero interest rates ever since the financial crisis of 2008-09. The result being that now there are only 4.9 tonnes of gold per billion dollars in circulation, compared to 9.9 in 2008, 15.3 in 2000, 33 in 1990 and 141.2 in 1973.

The gold connection:

Just like the value of a stock in a company is diluted when more stock is issued, insertion of unlimited amounts of money by the Federal Reserve is leading to devaluation of global currency dollar.

At some point, this devaluation will eventually lead to a loss of faith in the dollar and people will no more want to hold the paper as it is unable to preserve their purchasing power. As a result, people will want to convert their cash / wealth to something that they believe in, something that has intrinsic value, something that cannot be created at will by the central bankers, something that is free from any counter party risk and retains its value in the long term – gold.

This trend of dollar devaluation-resulting preference for gold can be expected to push up gold prices over the long term.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More -

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More