From Tradition to Investment: Why Gold Shines Brightly This Dhanteras?

Posted On Thursday, Oct 24, 2024

India's widely celebrated festival Diwali begins with the cherished tradition of buying gold on Dhanteras to welcome the Goddess of Wealth, Lakshmi into the home. As we prepare to welcome wealth and prosperity into our homes, the allure of gold shines brighter than ever especially amid today's fluctuating market conditions. With global economic uncertainties and rising inflation, gold emerges as a dual symbol of wealth and a prudent investment choice. Gold is not just a timeless symbol of wealth and prosperity; it is a versatile asset that helps bridge the gap between ancient traditions and modern investment principles.

From the ritual of buying gold on Dhanteras to the contemporary practice of diversifying portfolios, gold holds a unique position in our financial landscape. This Dhanteras, as we light diyas and celebrate with loved ones, let’s also explore how investing in gold can honor our heritage while enhancing our financial well-being during economic uncertainties.

The investment case for gold

A compact, tangible and enduring asset, gold has historically been and still is the best way to park savings and secure the family’s future for many Indians.

Gold has been a store of value by keeping up with monetary inflation and maintaining its value in terms of real purchasing power over long periods of time. Inflation in India has averaged close to 6% over the last decade as per data from Ministry of Statistics and Programme Implementation. Gold as represented by MCX Gold Index has yielded a 10.9% CAGR in the 10-year period ending September 2024, offering positive real returns.

Gold has a large market with World Gold Council data showing that in 2023 gold was the second most liquid asset in the world after S&P 500 stocks. It is thus liquid and easily convertible to cash when required. This makes it a preferred choice for economic uncertainties and emergencies.

As an investment, gold’s utility is its generally low to negative correlation with equities. As per data from World Gold Council, for the 10-year period ending September 2024, the correlation of MCX Gold Index to the BSE Sensex was -0.077 indicating negative correlation. For the 5-year period ending September 2024 the correlation stood at 0.066 indicating low correlation. Gold when added to an equity portfolio may thus limit volatility and downside risk in times of market uncertainties.

In CY2008 when Indian equities as represented by the BSE Sensex was down 52% in response to the Global Financial Crisis, domestic gold as represented by the MCX Gold Index was up 23%.

More recently, when the pandemic hit in March 2020, our stock markets were down 21% but gold’s downside was limited to 7.5%.

Similarly, at the time of the European Debt crisis in 2011, the NPA crisis and Demonetization drive in 2016 and the aggressive rate hikes by global central banks in 2022, domestic equities were either in the red or flattish while gold yielded better returns.

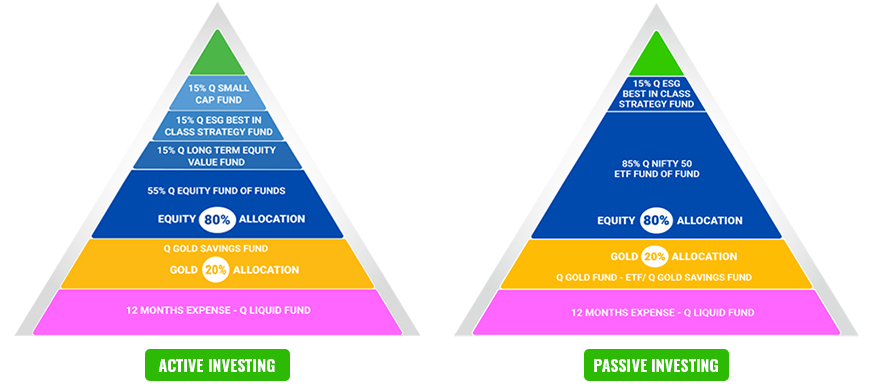

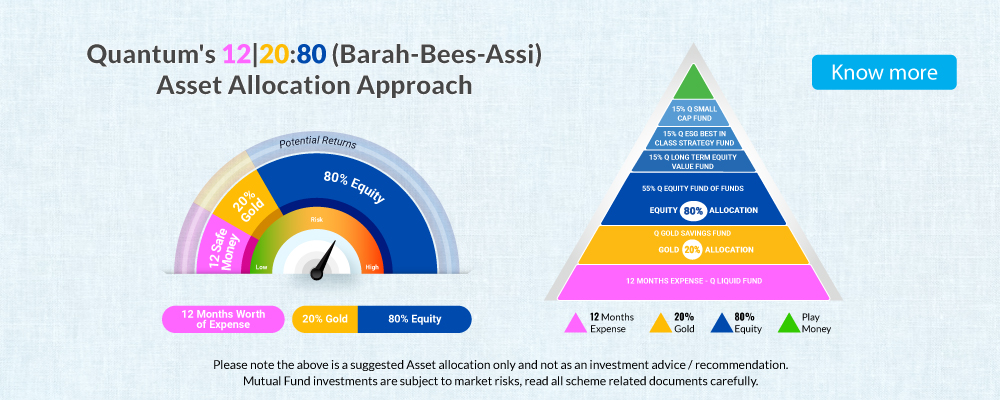

Gold may therefore be an effective complement to equity investments. Quantum’s 12|20:80** (Barah-Bees-Assi) Asset Allocation Approach builds on this time-tested relationship between gold and equity and suggests a 20% allocation to gold to balance out the 80% equity component of a portfolio. Whether you choose Active or Passive Investing – Gold is a vital component to build a resilient portfolio.

Aim to achieve your Financial Objectives with Quantum’s 12|20:80** (Barah-Bees-Assi) Asset Allocation Approach

**Please note the above is a suggested Asset allocation and not to be considered as an investment advice / recommendation.

Upgrade your gold investments

Just like many of us have limited the use of firecrackers for environmental reasons and replaced sugary sweets with healthier alternatives, the tradition of buying gold on Diwali can be revamped to reflect modern choices and sensibilities.

Investing in gold should not require one to step into multiple jewelry stores, negotiate prices and making charges, worry about purity of the coins or bars or arrange for their safe storage. Instead, one should be able to invest in gold from the convenience of their homes, at the click of a button, at close to market prices, assured of purity and relieved of storage concerns. This is where Gold Exchange Traded Funds come in.

The Quantum Gold Exchange Traded Fund invests in the physical gold and generate returns in line with the gold prices subject to expenses and tracking error.

Units of the ETF are backed by gold of the highest purity and trade on NSE and BSE like shares, facilitating fair price discovery, liquidity and tactical buying and selling. By investing in the Quantum Gold Fund - ETF, investors can manage their equity and gold investments from their Demat account, enabling efficient portfolio tracking and rebalancing. Quantum Gold Fund - ETF has a shorter holding period of 12 months to qualify for Long Term Capital Gains Tax.

If one wishes to invest in the Quantum Gold Fund - ETF without a Demat account, they can invest in the Quantum Gold Savings Fund which in turn invests in the Quantum Gold Fund - ETF. This fund extends almost all the benefits of the Gold ETF to the investor. The Fund also offers investors the option to invest via SIPs.

So, this Dhanteras, as traditions and investment merits nudge us to buy gold, one must consider moving on from gold coins and bars and upgrading to smarter alternatives.

|

If you prefer a DIY (Do-It-Yourself) approach:

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Small Cap Fund An Open Ended-Equity Scheme Predominantly Investing in Small Cap Stocks Tier I Benchmark: BSE 250 SmallCap TRI | • Long term capital appreciation • Investment in Small Cap Stock |  Investors understand that their principal will be at Very High Risk |

Quantum ESG Best In Class Strategy Fund An Open-ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme assessed through a Best In Class Strategy Tier I Benchmark : NIFTY100 ESG TRI | • Long term capital appreciation • Invests in shares of companies following Environment, Social and Governance (ESG) theme assessed through a Best In Class Strategy |  Investors understand that their principal will be at Very High Risk |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy Tier I Benchmark : BSE 500 TRI | Tier II Benchmark : BSE 200 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds Tier I Benchmark : BSE 200 TRI | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold Tier I Benchmark : Domestic Price of physical gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund Tier I Benchmark : Domestic Price of Physical Gold | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Nifty 50 ETF Fund of Fund An Open-ended fund of fund investing in units of Quantum Nifty 50 ETF Tier I Benchmark : Nifty 50 TRI | • Long term capital appreciation • Investments in units of Quantum Nifty 50 ETF – Exchange Traded Fund |  Investors understand that their principal will be at Very High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk Tier I Benchmark : CRISIL Liquid Debt A-I Index | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on September 30, 2024

Investors may please note that they will be bearing the recurring expenses of this Scheme in addition to the expenses of the underlying Schemes.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Waiting for Gold to Correct? Some Moments Are Too Auspicious to Wait!

Posted On Tuesday, Apr 29, 2025

It’s that time of the year again when prosperity is welcomed with open arms—and gold takes centre stage in celebrations across the country.

Read More -

From Tradition to Investment: Why Gold Shines Brightly This Dhanteras?

Posted On Thursday, Oct 24, 2024

India's widely celebrated festival Diwali begins with the cherished tradition of buying gold on Dhanteras to welcome the Goddess of Wealth, Lakshmi into the home.

Read More