From Dice to Diversification: Make the Thoughtful Shift to Asset Allocation

Posted On Tuesday, Sep 24, 2024

The allure of quick profits in the stock market has enticed many individual investors. A recent study by the Securities and Exchange Board of India (SEBI)1 sheds light on a stark reality: most individual F&O traders are not just failing to make profits but are incurring losses.

However, mutual funds, and asset allocation through mutual funds are more effective and prudent investment approach. By focusing on a balanced mix of assets, investors are less exposed to the fluctuations of any single investment or asset class. Moreover, mutual funds promote disciplined investing, encouraging long-term perspective over the short-term, and enhancing the potential for long-term risk adjusted returns.

For investors seeking to safeguard their financial future, making the shift to an asset allocation approach via mutual funds, can be a better choice than the chase for quick profits.

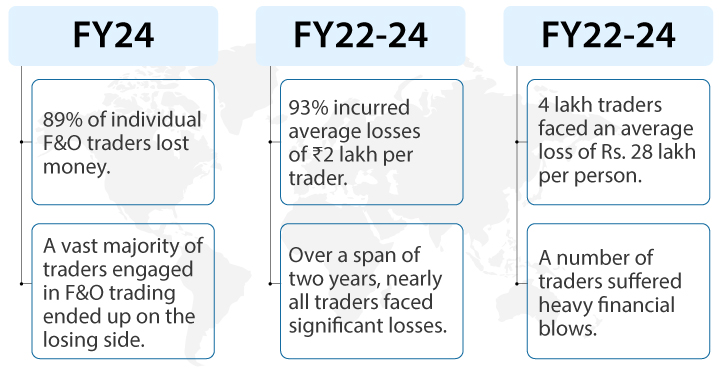

The Alarming Findings of the SEBI Study

Aggregate losses exceeded ₹1.8 lakh crore in equity F&O Trade. This colossal sum reflects the cumulative financial setback faced by individual traders. These statistics paint a sobering picture of the risks associated with trading. For the 89% who chose to participate in the stock markets, it's evident that the “roll the dice” approach often leads to financial distress rather than prosperity.

What Should Thoughtful Investors Not Do?

- Consider rating / rankings alone

- Be influenced solely by returns

- Attempt timing the markets

Trading while it offers the allure of high returns, it comes with equally high risks. Given these risks, it's important for investors to consider alternative investment approach that focus on long-term growth and capital preservation, like mutual funds. Therefore, an Asset Allocation Approach may be among the alternatives that can help in the long run.

Why the Asset Allocation Approach Makes Sense?

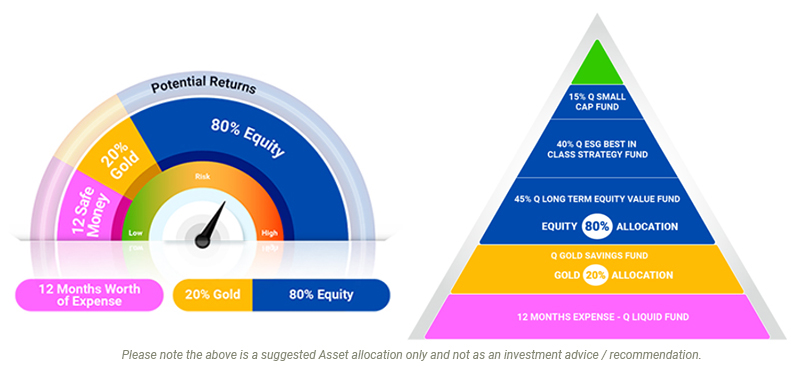

The 12|20:80 (Barah-Bees-Assi) Asset Allocation Approach offers a structured pathway toward financial stability and growth. This method emphasises diversification and disciplined investing.

What is the 12|20:80 (Barah-Bees-Assi) Asset Allocation Approach?

12 Months of Emergency Funds: Allocate funds equivalent to 12 months of essential expenses into a liquid fund. This is like a financial cushion against unforeseen circumstances.

20% Investment in Gold: Allocate 20% of your investment portfolio to gold. It generally performs well during market fluctuations, providing stability to the portfolio.

80% Investment in Equity Mutual Funds: The remaining 80% is invested in a mix of equity Mutual Funds.

Be Thoughtful Today to Be Secure Tomorrow

The journey to financial security is a marathon, not a sprint. While quick gains through trading may seem tempting, but as the SEBI study highlights, it often leads to losses for the majority.

By adopting the 12|20:80 (Barah-Bees-Assi) Asset Allocation Approach, you replace uncertainty with a strategic asset allocation grounded in financial principles. This approach empowers you to take control of your financial future thoughtfully.

Wrapping Up

Replace the uncertainty with a structured asset allocation aimed at financial security and growth. Build a weatherproof portfolio by exploring the 12|20:80 (Barah-Bees-Assi) Asset Allocation Calculator, here. By being thoughtful today - understanding risks, planning strategically, and investing wisely - you can build a secure tomorrow.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Overcome Market Uncertainties: The Power of Multi-Asset Investing

Posted On Tuesday, Sep 03, 2024

As we step into September, Indian stock markets may face increased fluctuations, influenced by global and domestic factors.

Read More -

Getting Financial Freedom on Track

Posted On Friday, Aug 26, 2022

On Aug 15, 2022, India celebrated 75 years of independence. As in the past, India has displayed resilience and the potential to overcome challenges..

Read More