ESG Investing to Build Sustainable Portfolio

Posted On Wednesday, Apr 06, 2022

If you are concerned about whether your investments are not just about meeting bottom lines but also identifying certain values or ethics that are important to you, then it may be time to embrace responsible investing. Responsible investing is calling attention to how corporations respond to climate change, water management, treatment of minority workers and how its corporate culture builds trust and fosters innovation.

Responsible or sustainable investing is now popularly known as ESG investing (environmental, social and governance parameters). It is redefining the future earnings potential of a company - it looks at the integration of the triple bottom-line of people, planet and profits. But is India ready to drive forward its sustainability initiatives?

Scope of Sustainability in India

The Budget 2022 seems to pushing India into the right direction and has given a strong foundation for sustainable growth. Measures include:

• Government’s Green bond issuance: While the modalities of the Green Bond are yet to be finalized, in the long run, it is likely to bring a lot of traction and channelize sustainable capital in India.

• PLI (Production-Linked Incentives) Scheme: for solar module manufacturing will help reduce our reliance on imports.

• Battery swapping could provide EV (Electric Vehicles) the big push with right policies and execution.

However, there are certain crucial factors missing in private sector inclusion:

• Incentives for companies to increase their share of renewable energy production

• CSR investments channelised towards sustainability initiatives,

• Incentives for technology and investments towards sustainability.

It is now the responsibility of corporate India and thoughtful investors like you to take the sustainability landscape to the next level.

Rise of the Responsible Investor furthered by the Pandemic

ESG funds may be often be underestimated because of their non - financial nature. However, they can have a material impact on the firm’s earnings and valuation over the long term, making them important considerations for your long-term investments.

The COVID-19 Pandemic of 2020 has been a wake-up call for investors to prioritize a more sustainable approach – companies that adopted sustainability exhibited resilience during the equity market sell-offs. It is important to weigh both financial and non-financial metrics while making investment decisions. Moreover, you need to understand that a lack of foresight on risk and responsibility management eventually translates into lower profitability and valuation.

Several companies are recalibrating their business to encourage sustainable initiatives.

However, how do you as investors assess whether the funds that invest in these companies are true to label? It would be challenging to determine the transparency of the sustainability reports. Therefore, there is the need to take the research beyond the desk to a more comprehensive approach.

ESG Screening - Taking a detective lens’ approach

Quantum is one of the first AMCs to introduce ESG as a fund in India. What's unique about Quantum is that it banks on its own proprietary research, which has evolved through the years going through our own learning curve in the ESG space.

We can trace the evolution of our unique scoring system way back in 1996 at Quantum Group level, where we came up with what we called an "Integrity Screen". And to date, the ‘G’ part of ESG - Governance sits at the heart of our evaluation of any company.

If a company/Board does not meet our integrity checks, it will not be included in the portfolio, irrespective of how large its weight is in the benchmark. So, while we always had some of the 'Social' aspects in-built in our research process (we avoided companies with questionable business practices), we started adopting a formal approach to ESG from 2015 in terms of an actual score.

How does Quantum India ESG Equity Fund calculate an ESG score?

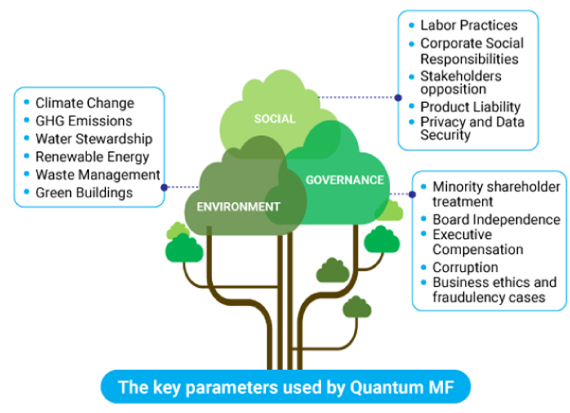

While screening companies, we subjectively evaluate more than 200 parameters across the Environment, Social and Governance domains. What you get is the result of a thorough & on-ground 360-degree view of the companies we invest in. Apart from company disclosures, we also use:

True to Label ESG Fund

Our fund portfolio is purely based on ESG principles, irrespective of the valuation metric like PE ratio or any other. Instead, we look at the stocks ESG score to determine its weightage in our fund subject to the company meeting our financial soundness assessment and the liquidity criteria.

Low Score → Low Weight, High Score → High Weight.

Companies that score positive and are above the minimum threshold ESG score are generally included in the portfolio.

How should you allocate to ESG funds to your portfolio?

You can take advantage of the globally emerging investment opportunity to enable your portfolio to capture maximum benefits from the market cycles.

So far, the track record of the ESG index has been encouraging. We believe that in the long term, ESG funds has the potential to deliver good long-term risk-adjusted returns. But considering that ESG is a relatively new concept, it’s advisable that you completely understand it before investing. You can start by allocating 15% of your equity portfolio to Quantum India ESG Equity funds. As you get more comfortable with ESG investing, you could increase your exposure if desired.

See how it forms part of your diversified portfolio as part of Quantum’s Proprietary Asset Allocation Strategy.

|

|

|---|

To ensure your investments are in a ‘True-to-label’ fund, look for a fund that goes one step beyond disclosure norms and integrates on-ground and beyond-the-desk research to help you benefit from responsible investing. It’s time to understand the value of ESG investing and make investment decisions that are well-aligned with your overall asset allocation strategy.

Are you ready to build a sustainable future together?

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on March 31, 2022.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More -

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More